Press release

Mobile Payment Transaction Market to Surpass USD 60.8 Trillion by 2035, Fueled by Blockchain Integration and Global Shift Toward Cashless Economies

The mobile payment transaction market is expected to reach USD 20.4 trillion by 2025, with a projected growth of USD 60.8 trillion by 2035, representing a compound annual growth rate (CAGR) of 13.2% during the forecast period. The adoption of blockchain technology, enhanced security features, and stricter regulation of digital payments are driving this high growth. Furthermore, developing economies are rapidly transitioning to a cashless environment, which will further expand the industry's size and global trade share.Keep Up with Market Trends: Access Your Sample Report! https://www.futuremarketinsights.com/reports/sample/rep-gb-262

Key Industry Highlights

• Market Size in 2025:

• Forecasted Market Size by 2035:

• Compound Annual Growth Rate (CAGR):

• Primary Drivers: Smartphone proliferation, fintech innovations, regulatory support, and COVID-19-induced behavioral shifts

• Transaction Types Covered: Peer-to-Peer (P2P), Business-to-Customer (B2C), Business-to-Business (B2B)

• Major Platforms: Mobile wallets, UPI apps, SMS-based payments, NFC payments

Collaboration between Small Market Players to Strengthen Product Portfolio

• Emergence of Fintech Alliances: Smaller market players and fintech startups are increasingly collaborating with traditional financial institutions to bridge infrastructure and compliance gaps.

• API Integration and Open Banking: These partnerships enable real-time bank transfers, lower transaction fees, and enriched customer experience by leveraging APIs and open banking interfaces.

• White-label Solutions: Startups are also offering white-label mobile payment solutions to retailers and service providers, enhancing market reach and brand visibility.

• Example: Partnerships between small-scale wallet providers and telecom operators in emerging economies like India and Kenya are helping expand the reach of mobile payments to underbanked rural populations.

Download Report Summary (PDF): https://www.futuremarketinsights.com/reports/brochure/rep-gb-262

Market Concentration

• Moderately Fragmented Market: While global giants like Apple Pay, Google Pay, PayPal, and Alipay dominate significant portions of the market, a wide array of regional players maintain a substantial presence.

• High Penetration in Asia-Pacific: The region continues to lead in terms of volume, particularly China and India, where mobile payments are deeply embedded into daily life.

• Market Leaders' Share: The top 10 companies account for approximately 60% of the total transaction value, while the remaining 40% is distributed among regional providers and niche fintech startups.

• Innovative Differentiation: Smaller players are focusing on niche segments like crypto-wallet integrations, offline payments, and loyalty program integrations to differentiate from global incumbents.

Country-wise Insights

India

• Key Growth Driver: Unified Payments Interface (UPI), which processed over 100 billion transactions in 2024 alone.

• Government Push: Digital India and financial inclusion initiatives have driven a rapid increase in mobile payment adoption across Tier 2 and Tier 3 cities.

• Projected CAGR (2025-2035): ~12.8%

China

• Market Leaders: Alipay and WeChat Pay account for over 90% of mobile transaction volumes.

• Trend: Integration of mobile payments with social commerce, AI, and facial recognition-based payments.

• Projected CAGR (2025-2035): ~7.1%

United States

• Adoption Lag: Higher credit card dependency, but increasing acceptance of Apple Pay and Google Pay in retail.

• Security Concerns: User preference for tokenized and biometrics-enabled payments for enhanced fraud protection.

• Projected CAGR (2025-2035): ~8.3%

Europe

• Push Toward Interoperability: European Payments Initiative (EPI) is expected to boost regional cohesion in digital transactions.

• Data Privacy: Strong regulatory frameworks under GDPR are influencing platform design and user trust.

• Projected CAGR (2025-2035): ~7.8%

Africa

• Leapfrogging Technology: Mobile money platforms like M-Pesa are bypassing traditional banking models.

• Financial Inclusion Focus: Governments and NGOs driving usage through agricultural subsidies, education payments, etc.

• Projected CAGR (2025-2035): ~14.6%

Competition Outlook

• Apple Inc. (Apple Pay)

Focus on biometric security, seamless iOS integration, and NFC payments.

• Google LLC (Google Pay)

Strong presence in India and Southeast Asia with UPI integration and cashback promotions.

• Alibaba Group (Alipay)

Dominant in China; expanding global reach through partnerships in Southeast Asia and the Middle East.

• PayPal Holdings Inc.

Popular among e-commerce and SME users in Western markets; strong focus on one-tap cross-border payments.

• Samsung Electronics (Samsung Pay)

Emphasizes MST technology for compatibility with older POS systems.

• Square, Inc.

Strengthening peer-to-peer and microtransaction services, especially in the U.S.

• PhonePe & Paytm (India)

Leveraging UPI infrastructure, retail integrations, and cashback campaigns to gain rural penetration.

• MTN Group (Africa)

Providing mobile wallet services in underbanked regions through telecom partnerships.

• Stripe

Leading backend infrastructure provider for app-based payments in startups and e-commerce.

The Road Ahead

1. Rise of Super Apps: Players like Paytm, Alipay, and Grab are transforming mobile wallets into financial ecosystems that offer lending, insurance, and investment.

2. Tokenization and Biometric Authentication: Expected to become default security features, reducing fraud and enhancing customer trust.

3. Cross-border Mobile Payments: Emergence of decentralized finance (DeFi), blockchain-based payment apps, and digital currencies may reshape the global remittance landscape.

4. Offline Payment Enablement: Innovations like Bluetooth Low Energy (BLE) and sound-wave technology will allow mobile payments in no-internet zones, opening new rural markets.

5. AI-Powered Insights: Next-gen payment apps will use AI to offer personalized savings, spend analysis, and credit risk profiling.

6. Sustainability Integration: Digital receipts, eco-friendly loyalty programs, and ESG-linked incentives are gaining popularity among Gen Z users

Key Market Players

• PayPal Holdings Inc.

• Apple Pay

• Google Pay

• Samsung Pay

• Square (Block Inc.)

• Venmo (PayPal-owned)

• Alipay (Ant Group)

• WeChat Pay (Tencent)

• Stripe.

• Zelle

Key Segmentation

By Technology:

By technology, the industry covers SMS mobile payment transactions, WAP/WEB, USSD, and NFC.

By Purpose:

By purpose, the industry includes merchandise purchase, money transfer, bill payment, ticketing, and other purposes.

By Region:

By region, the industry covers North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle

East & Africa (MEA).

Buy Now: https://www.futuremarketinsights.com/checkout/262

Have a Look at Related Research Reports:

Mobile Speech Recognition Software Market: https://www.futuremarketinsights.com/reports/mobile-speech-recognition-software-market

Mobile Campaign Management Market: https://www.futuremarketinsights.com/reports/mobile-campaign-management-market

Mobile Stabilizer Market: https://www.futuremarketinsights.com/reports/mobile-stabilizer-market

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries. Join us as we commemorate 10 years of delivering trusted market insights. Reflecting on a decade of achievements, we continue to lead with integrity, innovation, and expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Transaction Market to Surpass USD 60.8 Trillion by 2035, Fueled by Blockchain Integration and Global Shift Toward Cashless Economies here

News-ID: 4112085 • Views: …

More Releases from Future Market Insights Inc.

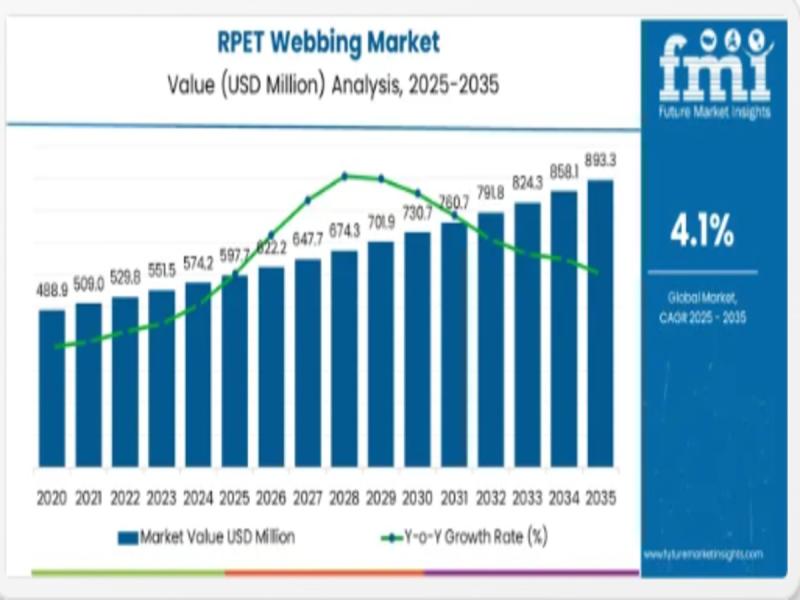

Global RPET Webbing Market Set to Surge to Nearly USD 893 Million by 2035 as Sus …

The global Recycled Polyethylene Terephthalate (RPET) webbing market is projected to expand from an estimated USD 597.7 million in 2025 to approximately USD 893.2 million by 2035, reflecting robust momentum in recycled materials adoption across key industrial and consumer sectors and underscoring sustainability as a core manufacturing imperative. The market is expected to grow at a compound annual growth rate (CAGR) of 4.1 % during this forecast period, driven by…

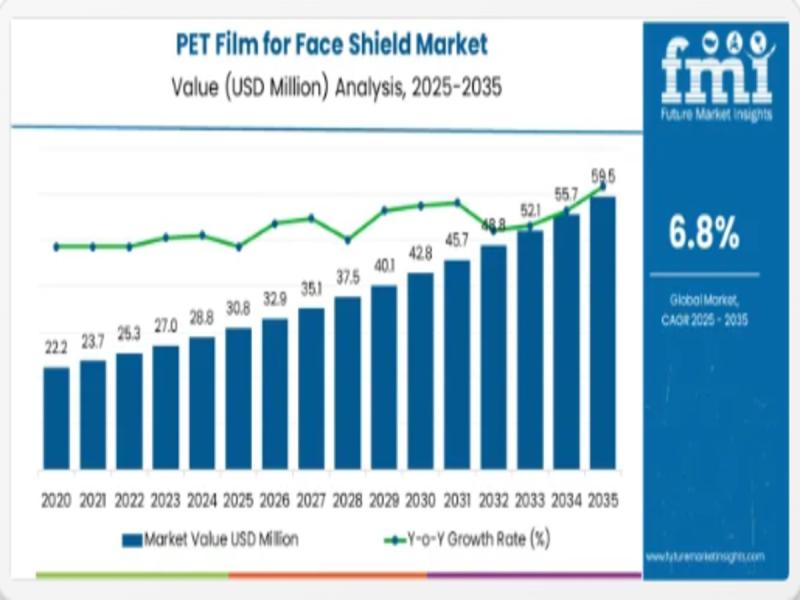

PET Film for Face Shield Market - Strategic Growth, Innovation & Forecasted Surg …

The global PET film for face shield market is set to expand from an estimated USD 30.8 million in 2025 to approximately USD 59.5 million by 2035, representing strong demand for high-clarity protective materials across healthcare and industrial safety sectors with a compound annual growth rate (CAGR) of 6.8% over the decade. This growth underscores the rising prioritization of personal protective equipment (PPE) globally, especially where transparent barrier films combine…

Middle East and North Africa Frozen Food Market Poised for Steady Growth Through …

Middle East and North Africa Frozen Food Market

The Middle East and North Africa (MENA) frozen food market is set for consistent and resilient growth over the next decade, supported by shifting consumer lifestyles, expanding modern retail infrastructure, and rising demand for long-shelf-life food solutions suited to the region's climate. The market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 1.8 billion…

Soluble Corn Fiber Market Forecast and Outlook 2026 to 2036 | FMI

Soluble Corn Fiber Market Outlook

The global soluble corn fiber market is gaining steady momentum as food, beverage, and nutrition manufacturers intensify reformulation strategies aimed at reducing sugar while preserving taste, texture, and consumer appeal. Valued at USD 54.9 billion in 2026, the market is projected to reach USD 78.6 billion by 2036, expanding at a compound annual growth rate (CAGR) of 4.6% over the forecast period.

Soluble corn fiber has evolved…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…