Press release

The True Cost of Payroll: Calculations & Compliance Simplified

The True Cost of Payroll: Calculations & Compliance SimplifiedFor growing businesses, payroll isn't just a monthly transaction-it's a strategic investment that affects cash flow, employee satisfaction, and legal standing. Yet, many companies underestimate the true cost of payroll or overlook the complexity of staying compliant across regions and roles.

Whether you're managing a global team or scaling locally, understanding the complete payroll picture-from cost components to compliance-is essential. In this blog, we break down what makes up employee payroll costs, what employers often miss, and how to simplify it all without compromising compliance.

🧾 What Does Payroll Really Cost?

The total cost of payroll extends far beyond the base salary. When companies plan for payroll, they need to consider both direct and indirect costs.

Direct Costs:

1) Gross salary or wages

2) Bonuses and incentives

3) Overtime pay

4) Leave encashment

Indirect Costs:

1)Employer contributions to benefits (PF, social security, health insurance)

2)Payroll taxes

3)Software and administrative expenses

4)Compliance and legal consulting costs

These costs can vary significantly across countries, job roles, and employment types. That's why it's crucial to break down the numbers accurately.

👉 For a detailed breakdown, refer to: https://globalsquirrels.com/blog/payroll-cost-per-employee/

🔍 Hidden Costs You Shouldn't Ignore

Many businesses overlook less obvious payroll-related costs that quietly erode budgets:

1)Time spent managing payroll manually

2)Penalties due to tax misfiling or late submissions

3)Employee dissatisfaction due to delayed or inaccurate pay

4)Legal risks from non-compliance with local labor laws

These "hidden" costs often go unmeasured-until they snowball into serious business disruptions.

📋 Understanding Payroll Compliance

Payroll compliance is more than just paying employees on time. It includes:

1)Following wage laws and minimum salary rules

2)Deducting the correct taxes and contributions

3)Issuing proper payslips and reports

4)Filing government returns on schedule

5)Maintaining records for audits

Each country has its own payroll laws, which can change frequently. Non-compliance could lead to financial penalties, legal disputes, and reputational damage.

👉 Learn how to stay compliant with: https://globalsquirrels.com/blog/payroll-compliance-strategies-navigate-legal-boundaries/

Why Payroll Is Getting More Complex

In today's remote and hybrid work landscape, companies are hiring across borders. That means:

1)Different tax systems

2)Varying benefit mandates

3)Cross-border payment complexities

4)Exchange rate fluctuations

Managing this internally can become overwhelming, especially for startups and mid-sized companies.

⚙️ How to Simplify Payroll Calculations and Compliance

To avoid payroll pitfalls while scaling smoothly, consider:

Use a payroll platform to automate salary calculations, tax deductions, and payslip generation, reducing human error and saving time.

Hire via an Employer of Record (EOR) to offload the complexities of payroll, local compliance, and employment contracts to experts who understand the local legal landscape.

Centralize your global payroll processes to maintain consistency across countries and departments, making it easier to track costs and ensure accuracy.

Conduct periodic payroll audits to catch errors early, ensure tax compliance, and uncover opportunities for cost optimization.

Stay up to date with local labor laws to avoid penalties, legal issues, and reputational damage caused by non-compliance

By taking a tech-enabled, compliant-first approach to payroll, businesses can control costs while ensuring happy, lawfully-paid employees.

✅ Is Your Payroll Strategy Future-Ready?

Ask yourself:

1)Are you factoring in both direct and hidden payroll costs?

2)Do you have systems in place to avoid legal or tax issues?

3)Can your current team accurately manage multi-country payroll?

4)Are your processes scalable as you hire more people?

If you're unsure about any of these, it might be time to revisit your payroll structure-and possibly partner with a payroll [https://globalsquirrels.com/employer-of-record] expert or EOR to ease the burden.

Conclusion

Payroll is not just a backend function-it's a business-critical process. Understanding the true cost of payroll, planning for compliance, and simplifying your operations can lead to substantial savings and fewer legal surprises.

With platforms like Global Squirrels[https://globalsquirrels.com], companies can offload payroll management, reduce risk, and stay compliant while scaling their teams globally.

Company Name: Global Squirrels

Contact Person: Venkateswarlu T

Email: sales@globalsquirrels.com

Phone: +1 949-482-4112

Address: 9170 Irvine Center Drive, Irvine, CA-92618

City: Irvine

State: California

Country: United States

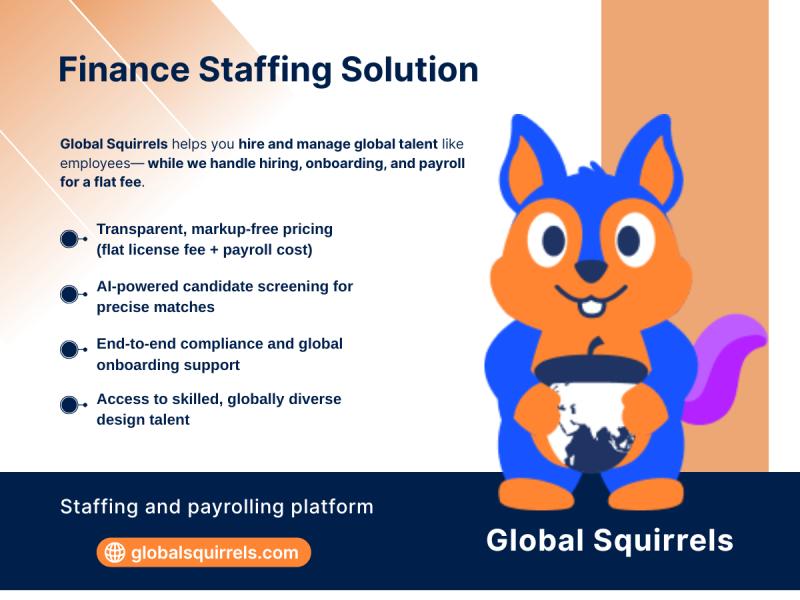

Global Squirrels is a staffing and payroll platform that helps companies hire, manage, and retain top remote recruiter talent locally and globally.

Its EOR solution (https://globalsquirrels.com/employer-of-record) allows companies to leverage top talent in countries like India, Mexico, the USA, and more, without having to set up an entity, while ensuring zero risks and 100% compliance with local labor laws.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The True Cost of Payroll: Calculations & Compliance Simplified here

News-ID: 4108613 • Views: …

More Releases from Global Squirrels

The Best Remote Alternative for Hiring and Payroll Solutions

In today's rapidly evolving business environment, companies are increasingly turning to remote hiring solutions to access top talent, reduce costs, and scale operations efficiently. Remote teams have become a game-changer for businesses worldwide, allowing them to expand without the burden of establishing local entities in foreign countries. As remote hiring platforms like Remote have gained popularity, Global Squirrels offers the perfect remote alternative, providing a comprehensive solution that combines recruitment,…

The Best Deel Alternative for Remote Hiring and Payroll Solutions

In today's fast-paced global economy, businesses need to be agile and strategic when it comes to hiring talent, especially in remote teams. Building a workforce without geographic limitations offers numerous advantages, including cost savings, access to a global talent pool, and flexibility. As companies strive to scale efficiently and stay compliant with international labor laws, Global Squirrels emerges as the leading alternative to Deel, offering a comprehensive solution for remote…

Why Global Squirrels is the Go-To Solution for Finance Staffing - And How to Hir …

In today's fast-paced business world, the need for efficiency, accuracy, and cost-effectiveness in financial operations is critical. With companies striving for greater agility, scalability, and compliance, Global Squirrels is quickly becoming the top choice for organizations looking to hire top finance professionals. Whether it's for accounting, financial analysis, or compliance management, Global Squirrels provides businesses with access to a vast pool of skilled financial talent.

When it comes to building your…

Global Squirrels Revolutionizes Construction Staffing: Connecting the Right Tale …

In the ever-evolving construction industry, the demand for skilled labor has never been greater. As companies face challenges ranging from labor shortages to project delays, the need for a reliable, cost-effective, and compliant staffing solution is more pressing than ever. Global Squirrels, a leading global employment solutions provider, is answering the call with its innovative construction staffing services designed to match top-tier talent with businesses in the construction industry.

Whether you're…

More Releases for Payroll

Payroll Service Providers IBN Technologies Help U.S. Firms Overcome Payroll Chal …

IBN Technologies delivers payroll outsourcing services that help U.S. businesses reduce errors, ensure compliance, and improve efficiency. With scalable cloud-based systems, expert tax filing, and top-tier data security, their payroll solutions support startups, SMBs, and enterprises in streamlining operations while keeping costs under control and employees satisfied.

Miami, Florida - 04 Sep, 2025 - Payroll service providers [https://www.ibntech.com/payroll-processing/] are being used by businesses to guarantee compliance and operational efficiency as the…

IBN Technologies Affordable Payroll Services Streamline Payroll for Small Busine …

IBN Technologies offers cost-effective payroll solutions tailored for U.S. small firms. With 100% accuracy, expert compliance support, and secure cloud access, firm simplifies payroll processing while reducing internal workload and risk. Businesses benefit from on-time payments, streamlined tax reporting, and scalable systems that grow alongside them.

Miami, Florida - 20 Aug, 2025 - Small business owners seeking cost-effective ways to handle complex payroll tasks are increasingly turning to the firms that…

IBN Technologies Outsource Payroll Services Lead Payroll Innovation Across Flori …

Florida organizations are adopting outsource payroll services to handle growing payroll complexities and changing labor regulations. External providers deliver accurate, timely payroll processing and compliance management, reducing administrative burdens. This transition enhances operational reliability, supports multi-location payroll consistency, and allows internal teams to focus on core financial goals, ensuring business continuity and compliance.

Miami, Florida - 11 June, 2025 - Finance departments across Florida are increasingly leveraging outsource payroll solutions to…

Best Payroll Service for Small Businesses in California Simplifies Payroll Proce …

Small businesses in California face payroll challenges, from tax compliance to wage management. The best payroll service for small businesses in California ensures accurate payroll processing, timely tax filings, and compliance with labor laws. With expert-driven solutions, businesses can reduce payroll errors, avoid penalties, and focus on growth. Reliable payroll management helps businesses streamline operations with precision and efficiency.

Miami, Florida - February 18, 2025 - Small businesses in California face…

Payroll Software: Minop Introduces Advanced Solution to Revolutionize Payroll Ma …

Minop, a leading innovator in cloud-based business solutions, proudly announces the launch of its latest Payroll Software, designed to revolutionize the way businesses manage payroll. This advanced solution is engineered to simplify payroll processes, enhance accuracy, and ensure compliance, catering to the evolving needs of businesses of all sizes.

Revolutionizing Payroll Management with Advanced Features

Minop's payroll management software is built to automate complex payroll tasks, ensuring accurate calculations, timely processing, and…

HR Payroll Software Market: Streamlining Human Resource and Payroll Management

HR Payroll Software Market report 2024-2031 covers the whole scenario of the global including key players, their future promotions, preferred vendors, and shares along with historical data and price analysis. It continues to offer key details on changing dynamics to generate -improving factors. The best thing about the Tax Management report is the provision of guidelines and strategies followed by major players. The investment opportunities in the highlighted here will…