Press release

Hedge Funds Market: A Growing Force in Alternative Investment Landscape

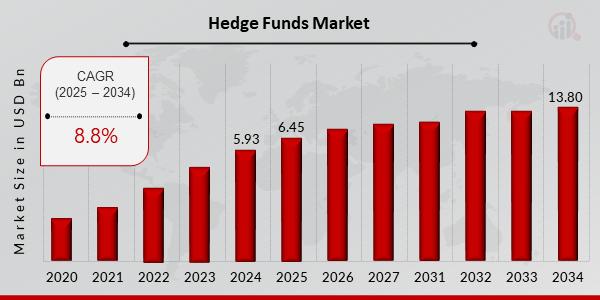

The global hedge funds market is experiencing a notable upswing, reflecting a renewed investor appetite for alternative assets amid evolving financial market dynamics. The market was valued at USD 5.93 billion in 2024 and is projected to grow from USD 6.45 billion in 2025 to USD 13.80 billion by 2034, registering a robust Compound Annual Growth Rate (CAGR) of 8.8% during the forecast period (2025-2034).What Are Hedge Funds?

Hedge funds are pooled investment vehicles that utilize a wide range of strategies to deliver returns to their investors. Unlike mutual funds, hedge funds often have the flexibility to invest in derivatives, leverage, short-selling, and arbitrage opportunities. They are typically targeted at high-net-worth individuals, institutional investors, and accredited investors due to their complex strategies and higher risk profiles.

Get a Free Sample Report: https://www.marketresearchfuture.com/sample_request/23921

Market Dynamics Driving Growth

1. Institutional Adoption and Sophisticated Demand

Over the past few years, institutional investors such as pension funds, endowments, and sovereign wealth funds have increasingly turned to hedge funds for diversification and alpha generation. Their ability to perform in both bullish and bearish market conditions has made hedge funds a favored choice for portfolio diversification.

2. Volatile Markets Fueling Alternative Investments

With traditional equity and bond markets experiencing volatility and lower yields, hedge funds offer strategies designed to manage risk while seeking outperformance. Macro-economic uncertainty, inflationary pressures, and shifting central bank policies have made absolute return strategies particularly attractive.

3. Technological Innovation and Quant Strategies

Hedge funds are increasingly leveraging data science, machine learning, and algorithmic trading to identify inefficiencies and market trends. Quantitative and systematic hedge funds, in particular, have gained popularity for their data-driven approaches and scalability.

4. Expansion of Emerging Markets

Growing capital markets in Asia, the Middle East, and Latin America are opening new opportunities for hedge fund investments. As these regions develop their financial infrastructure and regulatory frameworks, they become increasingly attractive for global hedge fund managers.

Browse Complete Research Report: https://www.marketresearchfuture.com/reports/hedge-funds-market-23921

Challenges Facing the Industry

Despite the growth potential, the hedge fund industry also faces several hurdles:

• Regulatory Scrutiny: Global regulators continue to increase oversight on hedge funds due to their systemic importance, transparency concerns, and the use of leverage.

• High Fees: The traditional "2 and 20" fee structure (2% management fee and 20% performance fee) has faced criticism, prompting many investors to seek lower-cost alternatives.

• Performance Pressures: Delivering consistent alpha in increasingly efficient markets remains a challenge. Underperformance compared to passive investing strategies has led to investor skepticism in some segments.

Buy Premium Research Report: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23921

Segment Insights

By Strategy

• Equity Hedge strategies continue to dominate due to their familiarity and flexibility.

• Event-Driven and Global Macro strategies are seeing renewed interest amid geopolitical instability.

• Relative Value Arbitrage and Distressed Assets are gaining traction as market cycles mature.

By Investor Type

• Institutional Investors represent the largest segment, driven by long-term allocation strategies.

• High-Net-Worth Individuals (HNWIs) and family offices are also increasingly engaging with hedge funds for customized exposure and tax efficiency.

By Geography

• North America remains the leading region in terms of assets under management (AUM), followed by Europe and rapidly growing markets in Asia-Pacific.

• Singapore and Hong Kong are emerging as key hedge fund hubs in the East due to favorable tax policies and financial infrastructure.

Future Outlook

The hedge fund market is poised for a transformative decade. As capital continues to shift toward alternatives, hedge funds are expected to play a pivotal role in shaping global investment strategies. Innovation in AI, blockchain, and ESG (Environmental, Social, and Governance) investing will likely redefine fund operations and attract next-generation investors.

Moreover, the democratization of hedge fund access via fintech platforms and tokenized assets may unlock new growth avenues by enabling smaller investors to participate in traditionally exclusive strategies.

Read More Articles

Spain Core Banking Solutions Market https://www.marketresearchfuture.com/reports/spain-core-banking-solutions-market-55159

UK Core Banking Solutions Market https://www.marketresearchfuture.com/reports/uk-core-banking-solutions-market-55147

US Core Banking Solutions Market https://www.marketresearchfuture.com/reports/us-core-banking-solutions-market-13149

Canada Cyber Insurance Market https://www.marketresearchfuture.com/reports/canada-cyber-insurance-market-55206

China Cyber Insurance Market https://www.marketresearchfuture.com/reports/china-cyber-insurance-market-55211

Europe Cyber Insurance Market https://www.marketresearchfuture.com/reports/europe-cyber-insurance-market-55209

France Cyber Insurance Market https://www.marketresearchfuture.com/reports/france-cyber-insurance-market-55205

GCC Cyber Insurance Market https://www.marketresearchfuture.com/reports/gcc-cyber-insurance-market-55207

Germany Cyber Insurance Market https://www.marketresearchfuture.com/reports/germany-cyber-insurance-market-55203

Italy Cyber Insurance Market https://www.marketresearchfuture.com/reports/italy-cyber-insurance-market-55208

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Market Research Future

99 Hudson Street,5Th Floor

New York, New York 10013

United States of America

Sales: +1 628 258 0071(US)

+44 2035 002 764(UK

Email: sales@marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Hedge Funds Market: A Growing Force in Alternative Investment Landscape here

News-ID: 4108095 • Views: …

More Releases from Market Research Future (MRFR)

Freeze-Dried Fruit Market to Reach USD 10.47 Billion by 2035, Driven by Health-C …

Freeze-Dried Fruit Market, valued at USD 5.108 Billion in 2024, is set to exhibit significant growth over the next decade. Market projections indicate an increase to USD 5.452 Billion in 2025 and a further rise to USD 10.47 Billion by 2035, representing a compound annual growth rate of 6.74% during the forecast period. The expansion of the market is fueled by growing consumer awareness of health and wellness, as freeze-dried…

Frozen Cooked Ready Meal Market Set to Hit USD 332.89B by 2035 on Convenience an …

Frozen Cooked Ready Meal Market has experienced robust growth in recent years, reflecting a global shift toward convenience and ready-to-eat food solutions. The market was valued at USD 188.38 billion in 2024 and is expected to reach USD 198.39 billion in 2025, with a projected expansion to USD 332.89 billion by 2035. This growth represents a compound annual growth rate (CAGR) of 5.31% over the forecast period. Busy lifestyles, increased…

Nuts and Seeds Market Poised to Hit USD 97.75B by 2035 on Health, Plant-Based, a …

Nuts and Seeds Market has demonstrated consistent growth as consumer preference shifts toward nutrient-rich and plant-based foods. Valued at approximately USD 61.7 billion in 2024, the market is expected to reach USD 64.33 billion in 2025 and further expand to USD 97.75 billion by 2035, representing a compound annual growth rate of 4.27% over the forecast period. The increasing adoption of health-conscious diets, coupled with innovative product formulations and the…

Decorations and Inclusion Market to Hit USD 18.13B by 2035 with Growth Driven by …

Decorations and Inclusion Market was valued at USD 10.77 billion in 2024 and is poised to achieve USD 18.13 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.85% during the forecast period from 2025 to 2035. The growth trajectory is underpinned by increasing consumer interest in personalized and culturally inclusive décor solutions across residential, commercial, and public spaces. Rising disposable incomes, evolving lifestyle preferences, and the adoption…

More Releases for Hedge

Global Hedge Trimmer Market Analysis (2025-2031)

LP information released the report titled "Global Hedge Trimmer Market Growth 2025-2031" This report provides a comprehensive analysis of the global Hedge Trimmer landscape, with a focus on key trends related to product segmentation, Hedge Trimmer top 10 manufacturers' revenue and market share, Hedge Trimmer report also provides insights into the strategies of the world's leading companies, focusing on their market share, sales, revenue, market position and development prospects in…

Key Hedge Fund Market Trend for 2025-2034: Importance Of Innovation In The Hedge …

"What Is the Future Outlook for the Hedge Fund Market's Size and Growth Rate?

The hedge fund market is expected to grow from $4971.75 billion in 2024 to $5226.15 billion in 2025, with a CAGR of 5.1%. This growth is driven by market volatility, regulatory changes, investor sentiment, global economic conditions, and performance fees.

The hedge fund market is expected to grow steadily, reaching $6019.79 billion by 2029 at a CAGR of…

Hedge Trimmer Market - Global Outlook & Forecast 2022-2027

According to Arizton, the Demand for the Hedge Trimmers to Reach the Pre-Covid Level. Global Demand Set to Reach 5 Million Units by 2027.

Arizton estimates that the hedge trimmer market will grow at a CAGR of 5.07% during 2021-2027. The 47-56 cm blade type holds the largest share in the hedge trimmer market. The higher percentage of this segment is attributed to the greater adoption of 47-56 cm blade-size hedge…

Hedge fund takeover of Merlin Biotechnologies stock

Canadian based medical marijuana genius in final discussions with global Hedge Fund for monumental take over.

"ABC" Hedge Fund ( name protected by NDA ) have seen the obvious growth potential in Merlin Biotechnologies and been creeping on the side lines waiting to pounce.

Now Merlin are set to list on the NYSE in May 2020, a prestigious hedge fund have made an impressive offer to purchase a controlling stake.…

VCM #1 in Morgan Hedge Fund's top 10 list of alternative hedge funds.

One Glass is Not Enough... but it IS enough to rank us #1 in Morgan Hedge Fund's list of top 10 alternative hedge funds in the last 36 months.

n just three months, from September to November 2019, our One Glass is Not Enough fund moved from #3 to #1 on this list. This ranking shows that our funds are consistently among the best performing high yield alternative investments in the…

Global Hedge Trimmers Market Research Report 2018

Global Hedge Trimmer Sales advertise is foreseen to develop at a CAGR of XX% by 2023, as per another report distributed by Market intelligence data Inc. The report portions the market and gauges its size, by volume and esteem, based on application, side-effects, and by geology (North America, Europe, Asia-Pacific, MEA and South America).

Get sample copy of report :

https://www.marketdensity.com/contact?ref=Sample&reportid=5874

Table of Contents

1 Hedge Trimmers Market Overview

1.1 Product Overview…