Press release

India Fintech Industry Expected to Surge at 32.7% CAGR, Hitting USD 769.5 Billion by 2031 | Persistence Market Research

Overview of the MarketIndia's fintech market is undergoing a seismic transformation, emerging as one of the fastest-growing fintech hubs globally. As of 2024, the Indian fintech sector is valued at US$106.2 Bn and is expected to surge to US$769.5 Bn by 2031, growing at an impressive CAGR of 32.7% from 2024 to 2031. This remarkable growth underscores India's digital leap, accelerated by widespread smartphone penetration, supportive government initiatives, and an increasing appetite for tech-enabled financial solutions.

Driving this growth is the adoption of digital payments, which leads the market in terms of revenue and user base. Urban centers like Delhi-NCR and Mumbai dominate the regional landscape due to high digital literacy and rapid fintech infrastructure development. However, rural and Tier-2 cities are also showing significant promise due to increased internet access and targeted fintech outreach.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/34366

Key Highlights from the Report

• India fintech market is projected to grow at a CAGR of 32.7% between 2024 and 2031.

• Market value expected to rise from US$106.2 Bn in 2024 to US$769.5 Bn by 2031.

• Digital payments segment holds the largest share among all fintech services.

• North India, especially Delhi-NCR, is the leading regional market.

• Government initiatives like Digital India and UPI fuel market expansion.

• Tier-2 and Tier-3 cities are witnessing a fintech boom due to rising mobile usage.

Market Segmentation

The India fintech market can be broadly segmented based on product type, which includes digital payments, lending, wealth tech, insurtech, regtech, and neobanking. Among these, digital payments account for the largest market share due to the popularity of platforms such as UPI, Paytm, PhonePe, and Google Pay. Meanwhile, digital lending is also on the rise, catering to MSMEs and underbanked populations.

By end-user, the fintech ecosystem serves individuals, small businesses, and large enterprises. Personal finance applications and consumer lending platforms are seeing high user engagement, especially among tech-savvy millennials. On the enterprise side, solutions offering automated financial workflows and compliance tools are gaining momentum.

Regional Insights

North India remains the leader in fintech adoption, thanks to high urbanization, better internet infrastructure, and greater financial literacy. Cities like Delhi, Gurgaon, and Noida host several fintech startups and innovation hubs.

South India is also emerging rapidly, particularly cities such as Bangalore, Chennai, and Hyderabad, which are known for their tech ecosystem and digital innovation. Government support and incubators in these regions are pushing fintech startups toward maturity.

Market Drivers

The meteoric rise of fintech in India can be attributed to strong government support, including initiatives like Digital India, Jan Dhan Yojana, and Unified Payments Interface (UPI). Increasing internet penetration, affordable smartphones, and growing financial literacy are pushing both urban and rural users toward digital financial solutions. The young population, which is highly tech-savvy, further boosts the adoption of fintech platforms across lending, payments, and wealth management.

Market Restraints

Despite rapid growth, the market faces challenges such as cybersecurity threats, data privacy concerns, and regulatory uncertainty. Many users, especially in rural regions, still lack trust in digital financial platforms. The complex and evolving regulatory landscape can also act as a barrier for smaller fintech firms attempting to scale or secure funding. Financial inclusion gaps continue to persist, particularly among marginalized groups.

Market Opportunities

The future holds substantial opportunities, particularly in AI-driven financial analytics, blockchain-enabled transactions, and regtech innovations. With a large underbanked population and increasing smartphone penetration in Tier-2 and Tier-3 cities, neobanking and micro-lending platforms have a significant market to tap into. Additionally, the upcoming Central Bank Digital Currency and digital KYC frameworks offer further innovation pathways.

Reasons to Buy the Report

✔ In-depth analysis of market size, forecasts, and growth trends through 2031

✔ Comprehensive breakdown of segments including digital payments, lending, and neobanking

✔ Regional analysis covering high-potential markets in North and South India

✔ Evaluation of market drivers, restraints, and emerging opportunities

✔ Insights into key players, strategic developments, and innovation trends

Frequently Asked Questions (FAQs)

#1. How Big is the India Fintech Market in 2024?

#2. Who are the Key Players in the Global Market for Fintech in India?

#3. What is the Projected Growth Rate of the India Fintech Market?

#4. What is the Market Forecast for the India Fintech Industry for 2032?

#5. Which Region is Estimated to Dominate the India Fintech Industry through the Forecast Period?

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/34366

Company Insights

Key Players in the India Fintech Market:

1. Paytm

2. PhonePe

3. Razorpay

4. Policybazaar

5. Pine Labs

6. Lendingkart

7. Zerodha

8. MobiKwik

9. BharatPe

10. Groww

Recent Developments:

• June 2025: Razorpay announced its entry into Southeast Asian markets to expand cross-border digital payments.

• May 2025: Paytm launched a new AI-based credit scoring engine aimed at enhancing loan disbursement accuracy for MSMEs.

Conclusion

India's fintech market is at a pivotal moment, driven by policy support, rising digital adoption, and continuous innovation. With a dynamic ecosystem of startups, legacy institutions, and new-age consumers, the market is positioned to be one of the most disruptive fintech landscapes globally. However, navigating regulatory hurdles, building trust, and maintaining data security will be critical for sustained growth. As fintech continues to bridge the financial inclusion gap, its role in reshaping India's digital economy will only deepen in the coming years.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Fintech Industry Expected to Surge at 32.7% CAGR, Hitting USD 769.5 Billion by 2031 | Persistence Market Research here

News-ID: 4107720 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

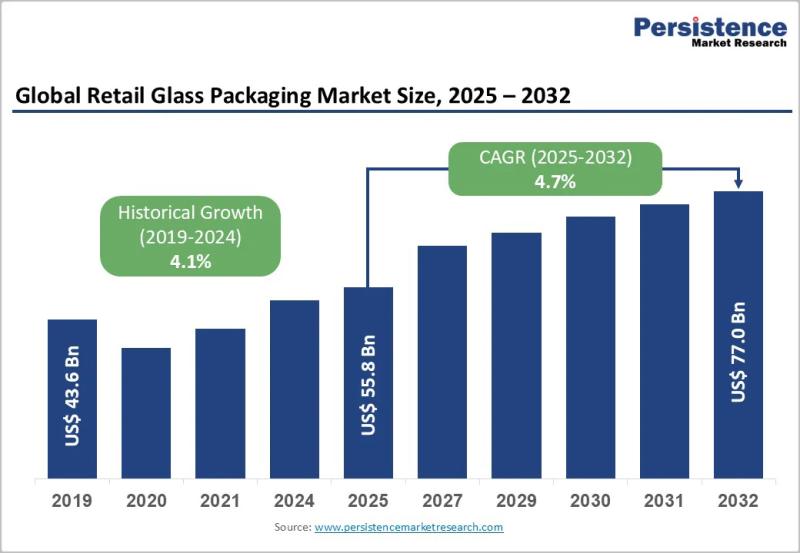

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2019 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2019 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2019 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…