Press release

Top Trends Transforming the Travel Insurance Market Landscape in 2025: Integration Of Advanced Technologies In Travel Insurance Platforms

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Travel Insurance Market Size Growth Forecast: What to Expect by 2025?

Over the past several years, the size of the travel insurance market has seen a considerable rise. Projected growth is from $26.36 billion in 2024 to $30.94 billion in 2025, with a compound annual growth rate (CAGR) of 17.4%. This historic period growth can be linked to elements such as the upswing in travel and tourism, more frequent natural disasters, the surge in business travel influenced by urbanization, and a rise in disposable income.

How Will the Travel Insurance Market Size Evolve and Grow by 2029?

In the coming years, the travel insurance market is anticipated to experience a swift expansion in its size, reaching $57.77 billion by 2029, with a Compound Annual Growth Rate (CAGR) of 16.9%. The anticipated expansion during the forecast period is driven by the increased demand for integrated, event-driven insurance products, enhanced awareness of travel-related risks, and spiraling medical expenses. The future trend forecast indicates a tactical focus on technology-driven platforms, increased digitalization and incorporation of mobile technology, emphasis on blockchain technology, and the establishment of strategic partnerships and collaborations.

View the full report here:

https://www.thebusinessresearchcompany.com/report/travel-insurance-global-market-report

What Drivers Are Propelling the Growth of Travel Insurance Market Forward?

The increasing popularity of tourism is fueling the expansion of the travel insurance market. By offering financial assistance through certain plans that cover medical emergencies, loss of passport, flight cancellation, and lost or misplaced baggage, travel insurance supports the tourism industry. As reported by the United Nations World Tourism Organization (UNWTO), a Spain-based agency of the United Nations, there were 1.3 billion international tourist arrivals in January 2024, a 34% rise from 2022. This rebound brought global tourism to 88% of its pre-pandemic standing, propelled by robust demand across all regions. Furthermore, the UNWTO predicts a 2% growth in international tourism beyond pre-pandemic levels by 2024, stimulated by relaxed travel restrictions and a backlog of demand. As such, the growing tourism trend is boosting the travel insurance market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=7098&type=smp

Which Emerging Trends Are Transforming the Travel Insurance Market in 2025?

Adopting cutting-edge technologies has become a prominent trend in the travel insurance sector, gaining significant traction. The industry's major players are focusing on innovative technologies to consolidate their market position. For example, in February 2022, Policybazaar, a leading Indian online insurance platform, introduced an AI-powered WhatsApp chatbot to automate its customers' claim settlement process. The chatbot simplifies the communication process for users who have corporate health plans covered, allowing them to start and monitor their claims straight from WhatsApp. Users also have the convenience of uploading important documents and information about hospitalization and costs, enhancing user accessibility and overall experience.

What Are the Key Segments in the Travel Insurance Market?

The travel insurance market covered in this report is segmented -

1) By Type: Domestic, International

2) By Insurance Cover: Single-Trip Travel Insurance, Annual Multi-Trip Travel Insurance, Long-Stay Travel Insurance

3) By Coverage: Medical Expenses, Trip Cancellation, Trip Delay, Property Damage, Other Coverages

4) By Distribution Channel: Insurance Intermediaries, Insurance Companies, Banks, Other Distribution Channels

5) By End User: Senior Citizens, Corporate Travelers, Family Travelers, Education Travelers, Other End-Users

Subsegments:

1) By Domestic: Trip Cancellation Insurance, Medical Expense Coverage, Baggage Loss Coverage, Emergency Assistance

2) By International: Trip Cancellation and Interruption Insurance, Emergency Medical and Evacuation Coverage, Travel Delay and Missed Connection Coverage, Lost or Stolen Baggage Insurance

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=7098&type=smp

Who Are the Key Players Shaping the Travel Insurance Market's Competitive Landscape?

Major companies operating in the travel insurance market include Allianz Group, Axa S.A, Berkshire Hathaway Specialty Insurance Company, Zurich Insurance Group AG, American International Group Inc., American Express Company, Chubb Limited, Aviva Plc, Seven Corners Inc, Travelex Insurance Services Inc., Corporate Risks India Insurance Brokers Pvt Ltd, TATA AIG, New India Assurance - General Insurance Brokers, Oriental Insurance Company, ICICI Lombard General Insurance Company, United India Insurance, HDFC ERGO Non-Life Insurance Company, Fanhua Holdings, Insubuy LLC, China Life Insurance Company Limited, SafetyWing, Genki, Insured Nomads, Sompo Japan Nipponkoa Insurance Inc, Mitsui Sumitomo Insurance Co. Ltd., Ping an Insurance Company of China, People's Insurance Company (Group) of China, China Pacific Insurance (Group) Co. Ltd, New China Life Insurance, Marsh & McLennan Companies UK Limited, Aon UK Limited, Arthur J Gallagher & Co, Willis Towers Watson plc, Lloyd's of London Limited, Funk Gruppe GmbH, Ecclesia Holding GmbH, Hannover Re, Crédit Agricole Assurances, Sogaz Insurance Group, Ingosstrakh Insurance Co, Marsh McLennan, UNIQA, Česká Pojišťovna, MetLife Inc., Assicurazioni Generali, Groupama, RSHB Insurance, Soglasie Insurance Company, Sberbank Insurance Company LLC, John Hancock Insurance Agency, Trawick International, USI Affinity Travel Insurance Services, GoReady Insurance, TU AGENCIA DE SEGUROS CO, 111 Seguros Ltda, Agencia de seguros, BSB Capital Corretora de Seguros, Indeniza Corretora em Balsas MA, Emirates Insurance Co., Sukoon Insurance, Union Insurance, Doha Insurance Group, Qatar Insurance Co, KIB Takaful Insurance Company, Gulf Insurance Group, Misr Life Insurance, QNB Alahli Life Insurance, Care Line Group, De Wet De Villiers, Travelinsure, Lensure Insurance Brokers Cc, Travel Africa Insurance, Oojah Travel Protection, Takaful Insurance of Africa, Bryte Insurance Company Limited

What Geographic Markets Are Powering Growth in the Travel Insurance Market?

Asia-Pacific was the largest region in the travel insurance market in 2024. The regions covered in the travel insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=7098

This Report Supports:

1. Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2. Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3. Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4. Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top Trends Transforming the Travel Insurance Market Landscape in 2025: Integration Of Advanced Technologies In Travel Insurance Platforms here

News-ID: 4107443 • Views: …

More Releases from The Business Research Company

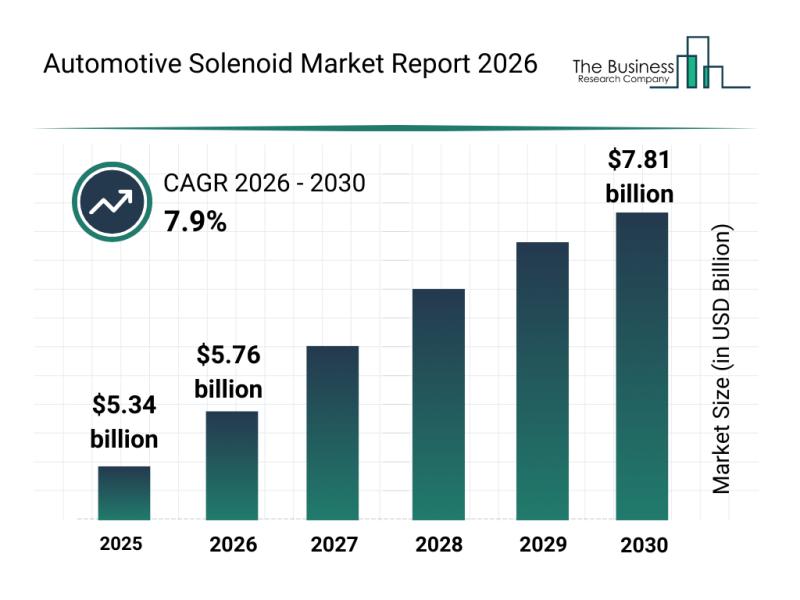

Leading Companies Fueling Growth and Innovation in the Automotive Solenoid Marke …

The automotive solenoid market is on the verge of significant expansion as advancements in technology and vehicle electrification continue to accelerate. Increasing integration of smart systems and the growing demand for efficient, eco-friendly automotive solutions are set to drive this market's development through the end of the decade.

Expected Growth Trajectory for the Automotive Solenoid Market by 2030

The automotive solenoid market is projected to reach a valuation of $7.81 billion…

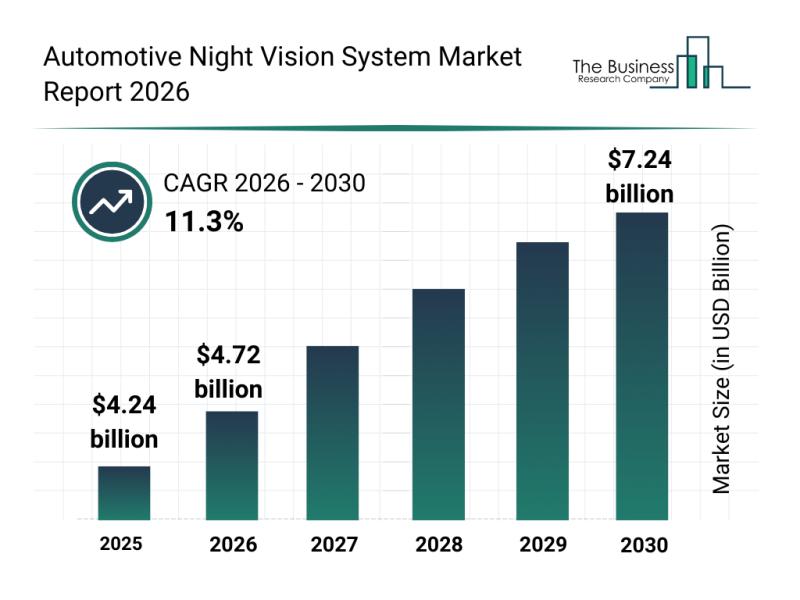

Automotive Night Vision System Market Analysis: Major Segments, Strategic Develo …

The automotive night vision system market is set to experience significant expansion over the coming years, driven by technological advancements and growing safety demands. As vehicle manufacturers continue to integrate more sophisticated safety features, this market shows promising potential for rapid growth and innovation through 2030.

Projected Expansion of the Automotive Night Vision System Market Size Through 2030

The market size for automotive night vision systems is anticipated to reach $7.24…

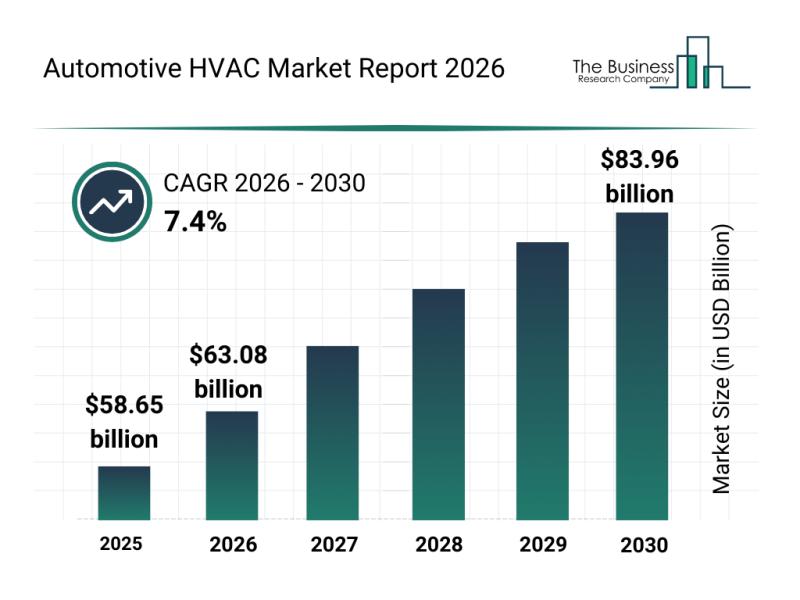

Segment Analysis and Major Growth Areas in the Automotive HVAC Market

The automotive HVAC market is on a trajectory of significant growth as vehicle climate control systems evolve with advanced technologies. Innovations aimed at improving energy efficiency and passenger comfort are driving the sector forward, setting the stage for substantial expansion through 2030. Let's explore the current market size, key players, influential trends, and detailed segment insights shaping this dynamic industry.

Automotive HVAC Market Size and Growth Outlook Through 2030

The automotive…

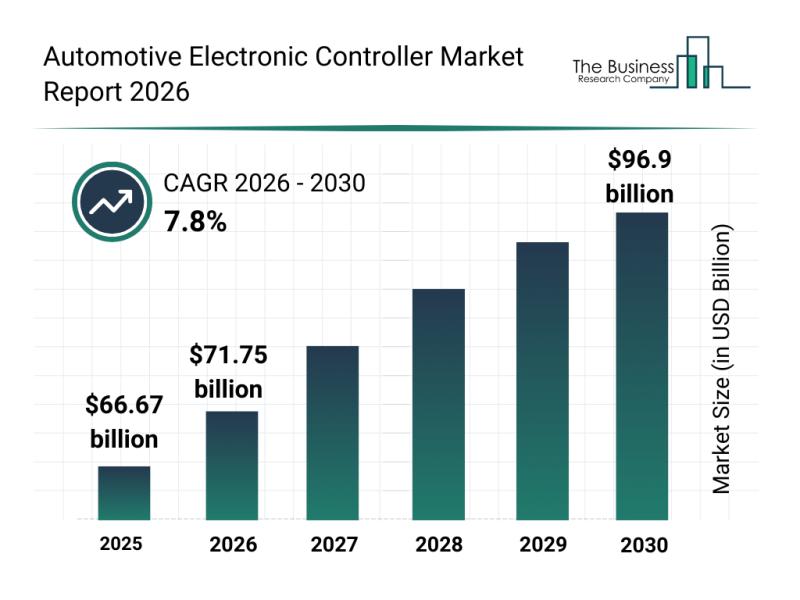

Key Strategic Developments and Emerging Changes Shaping the Automotive Electroni …

The automotive electronic controller market is on track for impressive expansion as technology continues to transform the automotive sector. With the industry embracing smarter and more connected vehicle systems, the demand for advanced controllers that manage and optimize vehicle functions is rapidly increasing. Below, we explore the market's projected growth, key players, notable trends, and the main segments shaping this dynamic field.

Projected Market Size and Growth of the Automotive Electronic…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…