Press release

Global Consumer Finance Market Size To Worth USD 2350 Billion By 2033 | Key Players are HSBC Group, Muthoot Finance, L&T Finance, Bank of America Corporation and others

According to a research report published by Spherical Insights & Consulting, the Global Consumer Finance Market Size is to Grow from USD 1198 Billion in 2023 to USD 2350 Billion By 2033, at a Compound Annual Growth Rate (CAGR) of 6.97% during the projected period.Comprehensive historical analysis of global market for Consumer Finance Market has thoroughly analyzed in this report. It offers data and insights from 2019-2022, and provides extensive market forecasts from 2023-2033 by region/country and subsectors. It covers the price, sales volume, revenue, historical growth, gross margin, and future outlooks for the Global Consumer Finance Market.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/5583

Market Overview

Through several credit options at the point of sale, consumer financing enables individual consumers to purchase goods and services. In addition to cash, debit cards, and internet payments, it offers a number of different payment methods. Customers can manage their cash flow and make purchases using consumer finance that they couldn't have made with cash or debit cards. Installment plans, Buy Now Pay Later (BNPL), revolving credit, lease-to-own, and business-to-business (B2B) financing are just a few of the many financial products and services that fall under the umbrella of consumer finance and are customized to meet the needs of consumers.

The Global Consumer Finance Market is witnessing robust growth due to:

• The rising number of digitally empowered consumers seeking instant credit solutions

• Increasing demand for convenient, low-interest, and personalized financing options

• Technological innovations in AI-driven credit scoring, mobile banking, and fintech platforms

Browse key industry insights spread across 232 pages with 110 Market data tables and figures & charts from the report on the Global Consumer Finance Market Size, Share, and COVID-19 Impact Analysis, By Type (Secured Consumer Finance, Unsecured Consumer Finance), By Application (Bank & Financial Corporations, Non-Banking Financial Companies (NBFCs)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Over the course of the forecast period, the secured category is anticipated to hold the greatest share of the global consumer financing market.

Secured and unsecured consumer finance are the two categories into which the worldwide consumer finance sector is separated. Over the course of the forecast period, the secured category is anticipated to hold the greatest share of the global consumer financing market. This is due to the fact that it provides borrowers and lenders with a high degree of security.

By lowering risk, it gives lenders more confidence to grant loans by requiring collateral like a home, piece of land, or automobile. This enables them to provide the borrowers with reduced interest rates. Additionally, secured consumer finance allows for greater loan amounts, making it a desirable option for those looking to consolidate debt or finance substantial purchases.

Throughout the forecast period, the bank & financial companies sector is anticipated to expand at the quickest compound annual growth rate (CAGR) in the worldwide consumer finance market.

The worldwide consumer finance market is separated into non-banking financial firms (NBFCs) and bank & financial corporations based on the application. Throughout the forecast period, the bank & financial companies sector is anticipated to expand at the quickest compound annual growth rate (CAGR) in the worldwide consumer finance market. Due to their established status, they enjoy a solid reputation and are well-known to consumers. The majority of customers are more at ease entrusting their money to reputable institutions that have existed for many years.

Buy Now: https://www.sphericalinsights.com/checkout/5583

Over the forecast period, North America is expected to hold the greatest share of the global consumer finance market.

Over the forecast period, North America is expected to hold the greatest share of the global consumer finance market. This is due to the North American region's robust and well-established financial infrastructure, which includes a broad spectrum of financial institutions, some of which are even supported by the government, and a deeply ingrained banking system. This makes credit and other financial services easily accessible, which promotes consumer spending and economic expansion.

It is also a result of the high income levels, high standard of living, and worldwide leaders in the BFSI sector in the USA and Canada. Because smartphones and other digital devices are quicker and easier to use while on the go, more and more people are using them to handle their finances as technology advances.

Consumer loans, which give credit at the point of sale and a convenient and safe way to obtain financial services, have seen a sharp increase in popularity as a result of this trend. Because smartphones are so widely used, banks and other financial institutions have a huge chance to expand their clientele and offer specialized services.

Leading players of Consumer Finance Market including:

• HSBC Group

• Muthoot Finance

• L&T Finance

• Bank of America Corporation

• Industrial and Commercial Bank of China

• Citigroup Inc.

• BNP Paribas

• Cholamandalam

• Tata Capital

• Wells Fargo

• ICICI

• Birla Global Finance

• JPMorgan Chase & Co.

• LIC Housing Finance

• Housing Development Finance Corporation

• American Express Company

• Bajaj Capital

• Berkshire Hathaway Inc.

• Others

Market Challenges: Consumer Finance Market

1. Rising Interest Rates and Inflationary Pressures

>>Central banks worldwide have raised interest rates to combat inflation, increasing the cost of borrowing for consumers.

2. High Consumer Debt and Default Risk

>>Many consumers are over-leveraged, particularly in economies with easy access to credit and limited financial literacy.

3. Regulatory Uncertainty and Compliance Costs

>>The sector faces growing scrutiny on data privacy (e.g., GDPR, CCPA), lending transparency, and fair credit assessment.

4. Cybersecurity and Data Breach Risks

>>With increasing digital adoption in finance, cybersecurity threats are on the rise.

5. Uneven Financial Inclusion

>>While financial technology has improved access in many regions, rural populations and lower-income groups in emerging markets still face barriers.

6. Lack of Consumer Financial Literacy

>>Many consumers do not fully understand credit terms, interest accrual, or consequences of missed payments.

Research Objectives: Consumer Finance Market

To Analyze Market Size and Growth Trends

>>Evaluate the current market size of the consumer finance sector globally and regionally.

To Assess Key Market Drivers and Restraints

>>Examine macroeconomic and demographic factors influencing consumer credit demand.

To Study the Impact of Fintech Disruption

>>Investigate the role of fintech, BNPL (Buy Now Pay Later), neobanks, and mobile wallets in transforming consumer finance.

Recent Developments

In October 2023, Mastercard announced partnerships with Instacart and Peacock to provide greater everyday value and convenience like online shopping and grocery delivery with Instacart, and streaming service subscription offering with Peacock.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global consumer finance market based on the below-mentioned segments:

Global Consumer Finance Market, By Type

• Secured Consumer Finance

• Unsecured Consumer Finance

Global Consumer Finance Market, By Application

• Bank & Financial Corporations

• Non-Banking Financial Companies (NBFCs)

Regional Segment Analysis of the Global Consumer Finance Market

• North America (U.S., Canada, Mexico)

• Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

• Asia-Pacific (China, Japan, India, Rest of APAC)

• South America (Brazil and the Rest of South America)

• The Middle East and Africa (UAE, South Africa, Rest of MEA)

What's covered in the report?

1. Overview of the Consumer Finance Market.

2. The current and forecasted regional (North America, Europe, Asia-Pacific, Latin America, the Middle East and Africa) market size data for the Consumer Finance Market, based on segment.

3 Consumer Finance Market trends.

4. Consumer Finance Market drivers.

5. Analysis of major company profiles.

PESTLE Analysis: Consumer Finance Market

Political Factors

>>Regulatory Oversight & Consumer Protection: Regulatory agencies (e.g., CFPB in the U.S., RBI in India) enforce strict lending standards, anti-money laundering policies, and consumer protection rules, particularly for fintech and digital lenders.

Economic Factors

>>Rapid Market Growth & Urbanization: The global consumer finance market was valued between USD 1,221 billion (2022) and is projected to grow at ~7% CAGR through 2028, driven by urbanization and rising disposable incomes

Social Factors

>>Consumer Digital Behavior: Increased smartphone use and e-commerce adoption are fueling demand for instant, embedded finance and BNPL solutions, especially among younger cohorts.

Technological Factors

>>Fintech Innovation & AI Integration: Rapid adoption of digital lending platforms, API-based underwriting, mobile wallets, ML credit scoring, Open Banking, and data analytics is reshaping the sector, especially in emerging markets

Legal Factors

>>Data Privacy & Algorithm Transparency: Regulators globally are tightening rules around data protection, algorithmic bias, and AI explainability in credit models driven by consumer protection mandates and fairness concerns.

Environmental Factors

>>ESG-Driven Financing Products: There is a growing trend toward eco-conscious lending-such as financing for electric vehicles, solar panels, and sustainable consumer goods-as consumers and regulators favor sustainability-aligned products.

Table of Content (TOC)

• Introduction

1. Objectives of the Study

2. Market Definition

3. Research Scope

• Research Methodology and Assumptions

• Executive Summary

• Premium Insights

1. Porter's Five Forces Analysis

2. Value Chain Analysis

3. Top Investment Pockets

1. Market Attractiveness Analysis By Product Type

2. Market Attractiveness Analysis By Type

3. Market Attractiveness Analysis By Segment Type

4. Market Attractiveness Analysis By Region

4. Industry Trends

• Market Dynamics

1. Market Evaluation

2. Drivers

1. Increasing development in sector

3. Restraints

4. Opportunities

5. Challenges

• Global Consumer Finance Market Analysis and Projection, By Product Type

• Global Consumer Finance Market Analysis and Projection, By Type

• Global Consumer Finance Market Analysis and Projection, By Segment Type

• Global Consumer Finance Market Analysis and Projection, By Regional Analysis

1. Segment Overview

2. North America

1. U.S.

2. Canada

3. Mexico

3. Europe

1. Germany

2. France

3. U.K.

4. Italy

5. Spain

4. Asia-Pacific

1. Japan

2. China

3. India

5. South America

1. Brazil

6. Middle East and Africa

1. UAE

2. South Africa

• Global Consumer Finance Market-Competitive Landscape

1. Overview

2. Market Share of Key Players in the Global Consumer Finance Market

1. Global Company Market Share

2. North America Company Market Share

3. Europe Company Market Share

4. APAC Company Market Share

3. Competitive Situations and Trends

1. Coverage Launches and Developments

2. Partnerships, Collaborations, and Agreements

3. Mergers & Acquisitions

4. Expansions

• Company Profiles

1. Company1

1. Business Overview

2. Company Snapshot

3. Company Market Share Analysis

4. Company Coverage Portfolio

5. Recent Developments

6. SWOT Analysis

2. Company2

1. Business Overview

2. Company Snapshot

3. Company Market Share Analysis

4. Company Coverage Portfolio

5. Recent Developments

6. SWOT Analysis

3. Company3

1. Business Overview

2. Company Snapshot

3. Company Market Share Analysis

4. Company Coverage Portfolio

5. Recent Developments

6. SWOT Analysis

Industry Related Reports

Global Insurance Fraud Detection Market Size

https://www.sphericalinsights.com/reports/insurance-fraud-detection-market

Global Natural Language Processing in BFSI Market Size

https://www.sphericalinsights.com/reports/natural-language-processing-in-bfsi-market

Global Vitrified Clay Pipes Market Size, Share

https://www.sphericalinsights.com/reports/vitrified-clay-pipes-market

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Consumer Finance Market Size To Worth USD 2350 Billion By 2033 | Key Players are HSBC Group, Muthoot Finance, L&T Finance, Bank of America Corporation and others here

News-ID: 4107268 • Views: …

More Releases from Spherical Insights LLP

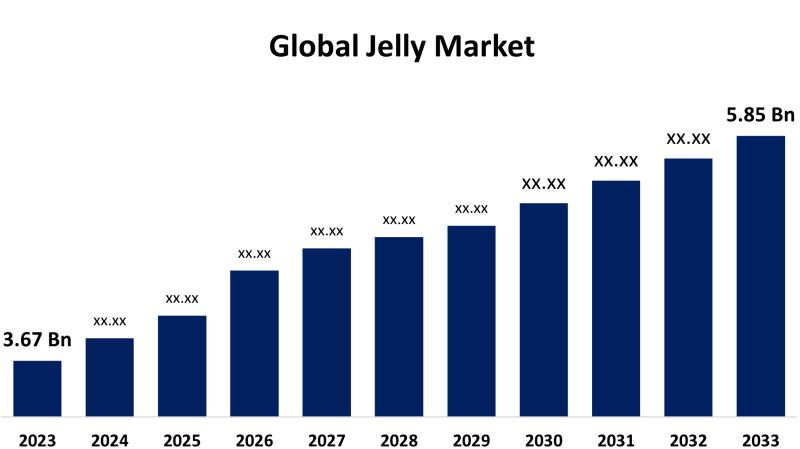

Global Jelly Market Size, Share, Forecasts 2023 - 2033 | Top key players: Bonne …

According to a research report published by Spherical Insights & Consulting, the Global Jelly Market is Expected to Grow from USD 3.67 Billion in 2023 to USD 5.85 Billion by 2033, at a CAGR of 4.77% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8511

The jelly industry comprises the international sector dealing with the manufacture, distribution, and sale of jelly products. Such products cover…

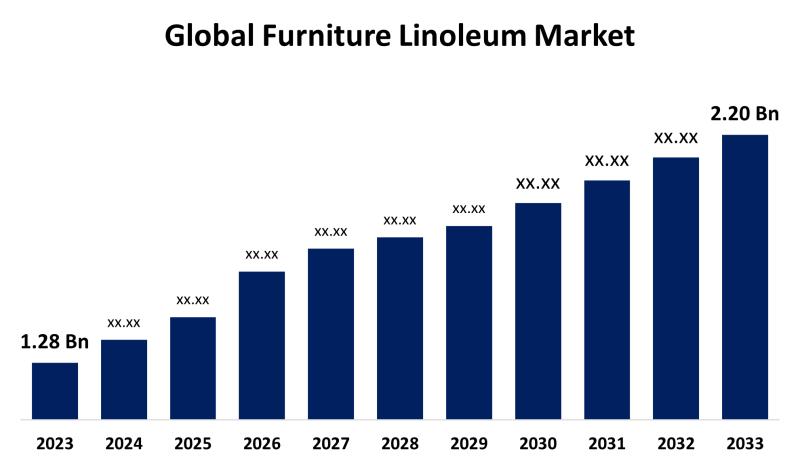

Global Furniture Linoleum Market Size, Share, Forecasts 2023 - 2033 | Top key pl …

According to a research report published by Spherical Insights & Consulting, the Global Furniture Linoleum Market Size is Estimated to Grow from USD 1.28 billion in 2023 to USD 2.20 billion by 2033, Growing at a CAGR of 5.57% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8455

The industry engaged in the manufacture, marketing, and distribution of linoleum products, especially made for furniture…

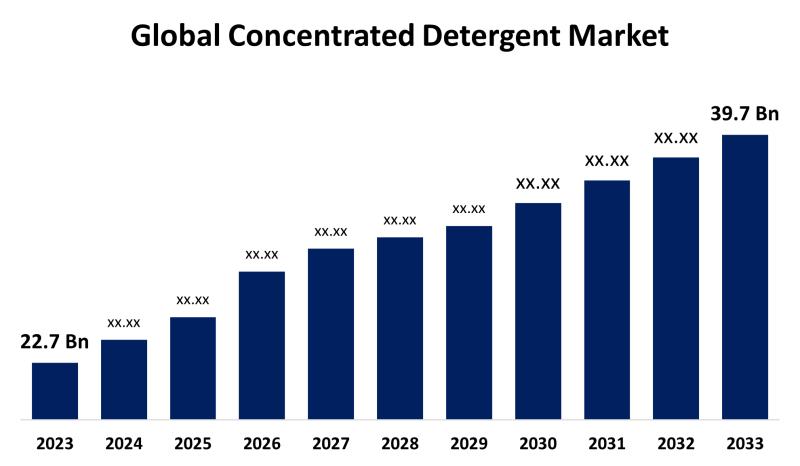

Global Concentrated Detergent Market Size, Share, Forecasts 2023 - 2033 | Top ke …

According to a research report published by Spherical Insights & Consulting, the Global Concentrated Detergent Market Size Expected to Grow from USD 22.7 Billion in 2023 to USD 39.7 Billion by 2033, at a CAGR of 5.75% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8439

The division of the detergent industry that produces and markets highly concentrated…

Global Wireless Home Weather Station Market Size, Share, Forecast 2023 - 2033 | …

According to a research report published by Spherical Insights & Consulting, the Global Wireless Home Weather Station Market Size is Expected to Grow from USD 249 Million in 2023 to USD 508 Million by 2033, at a CAGR of 7.39% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report @ -

https://www.sphericalinsights.com/request-sample/7694

A system that measures and sends environmental data from outside to within, including temperature,…

More Releases for Consumer

Consumer Survey Services | Consumer satisfaction survey, Consumer Experience, Su …

As markets become increasingly customer-driven, organizations need structured and reliable mechanisms to understand consumer expectations, perceptions, and decision drivers. Consumer and customer surveys play a critical role in translating customer voices into actionable business intelligence across strategy, marketing, product, and experience design.

This article outlines the most widely used consumer and customer survey types, explaining what each survey measures, when it is used, and how organizations can leverage insights effectively. These…

AI Airport Retailing Consumer Electronics Market - Consumer-Centric Insights 202 …

Unlock fresh, first-hand consumer intelligence in the rapidly evolving AI Airport Retailing Consumer Electronics Market.

This primary research report goes beyond traditional secondary data-delivering insights directly from travelers, retail managers, airport operators, and service providers who engage with AI-driven consumer electronics in airport environments daily.

The global airport retailing consumer electronics market was valued at USD 2383.8 million in 2025 and is expected to reach USD 3166.6 million in 2032, with a…

Analysis of Taiwanese Consumer Buying Behavior towards Fast-moving Consumer Good …

A report added to the rich database of Qurate Business Intelligence, titled “Fast-moving Consumer Goods Market – Global Industry Analysis and Forecast to 2024”, provides a 360-degree overview of the Global market. Approximations associated with the market values over the forecast period are based on empirical research and data collected through both primary and secondary sources. The authentic processes followed to exhibit various aspects of the market makes the data…

Consumer Health Market 2019 by Clinical Review and Key Player Analysis-Consumer …

Global Consumer Health Market 2018 Industry study report is an in-depth and deep research on the present condition of the Consumer Health industry in the global market. Furthermore, this report presents a detailed overview, cost structure, size, revenue, growth, share, dynamics, competitive analysis, manufacturers and global business strategy & statistics analysis. This report is segmented on basis of product type, end-user, application and geographical regions.

Get Sample Copy of this Report…

Dog Shoes Market Report 2018: Segmentation by Product (Nylon, Rubber, Leather, P …

Global Dog Shoes market research report provides company profile for Ultra Paws, Pet Life, WALKABOUT, Neo-Paws, DOGO, FouFou Dog, Ruffwear, Pawz, Muttluks, RC Pets and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The…

Digital Commerce Platform Market Analysis by Business Model ( Business to consum …

ALBANY, NY, March 6, 2017 : ResearchMoz presents professional and in-depth study of "Digital Commerce Platform Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024".

This report intends to provide a comprehensive strategic analysis of the global digital commerce platform market along with revenue and growth forecasts for the period from 2014 to 2024. With advancements in digital commerce platforms and rising demand for Internet based…