Press release

Gold Loan Market Overview: Stability, Growth, and Financial Inclusion Through 2034

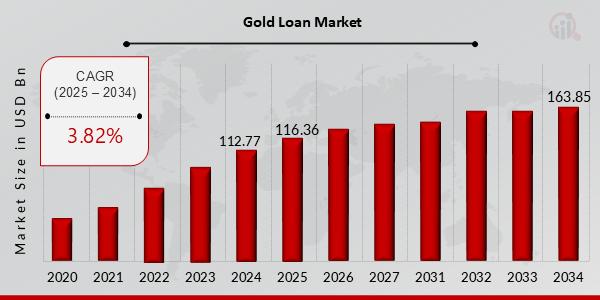

In an evolving global financial landscape, gold loans have emerged as a crucial financial instrument-bridging liquidity gaps for individuals and small businesses alike. As one of the oldest and most secure forms of collateral-based lending, gold loans offer a convenient and accessible financing option, particularly in emerging economies where gold continues to be a major asset class.According to recent estimates, the Gold Loan Market Size was valued at USD 112.77 billion in 2024, and it is projected to grow from USD 116.36 billion in 2025 to USD 163.85 billion by 2034, representing a Compound Annual Growth Rate (CAGR) of 3.82% during the forecast period (2025-2034).

What is a Gold Loan?

A gold loan is a secured loan where borrowers pledge their gold ornaments or bullion as collateral to receive instant funds. The loan amount is typically a percentage of the gold's current market value, and the borrower retains ownership of the gold while repaying the loan with interest. Upon full repayment, the gold is returned.

Gold loans are widely favored for:

• Low interest rates compared to unsecured loans

• Quick disbursal

• Minimal documentation

• Flexible repayment options

Get a Free PDF Sample> https://www.marketresearchfuture.com/sample_request/24606

Market Drivers

1. Rising Gold Holdings Among Households

Gold remains a highly valued and culturally significant asset in countries like India, China, and other parts of Asia. With billions of dollars worth of gold stored in private hands, its monetization through loans continues to gain traction.

2. Increased Demand for Short-Term Credit

In both rural and urban segments, gold loans provide an easy and fast solution for meeting short-term working capital requirements, especially among farmers, small business owners, and self-employed individuals.

3. Financial Inclusion and Digital Lending

The integration of fintech with traditional gold loan models is expanding access to credit in underserved regions. Mobile apps, e-KYC, and doorstep gold appraisal services are revolutionizing how these loans are disbursed.

4. Economic Uncertainty and Liquidity Needs

In times of financial distress-such as post-pandemic recovery or inflationary periods-gold loans offer a fallback mechanism for immediate cash without selling off long-term assets.

Regional Insights

Asia-Pacific

The Asia-Pacific region dominates the gold loan market, driven by massive gold reserves held by households and strong demand for credit. India, in particular, accounts for a substantial share, with companies like Muthoot Finance, Manappuram Finance, and IIFL Finance leading the market.

Middle East & Africa

With high per capita gold ownership and limited access to formal credit, gold loans are emerging as a preferred financial product in this region as well.

North America & Europe

Although relatively smaller, the gold loan market in these regions is growing steadily, with pawnshops, jewelry-backed financing, and alternative lenders expanding services.

Market Segmentation

The gold loan industry can be broadly segmented based on:

Segment Details

End-User Individual Borrowers, MSMEs, Traders

Provider Type Banks, Non-Banking Financial Companies (NBFCs), Pawnshops, Fintechs

Loan Term Short-Term

Browse Complete Research Report> https://www.marketresearchfuture.com/reports/gold-loan-market-24606

Competitive Landscape

The market is moderately consolidated with a mix of traditional institutions and new-age fintech entrants. Key players include:

• Muthoot Finance

• Manappuram Finance

• HDFC Bank

• IIFL Finance

• Lendingkart

• Federal Bank

• Rupeek

• HDB Financial Services

These companies are investing in technology, branch expansion, and product innovation to cater to both urban and rural populations.

Challenges in the Gold Loan Market

Despite its steady growth, the gold loan industry faces several challenges:

• Volatility in gold prices affecting loan-to-value (LTV) ratios.

• Regulatory scrutiny, especially on NBFCs and digital lending platforms.

• Risk of default in unsecured segments.

• Limited awareness among borrowers in Tier 3 and rural areas.

To mitigate these risks, companies are improving risk assessment models, enhancing customer education, and adopting AI-driven appraisal and fraud detection systems.

Buy Premium Research Report> https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24606

Future Outlook: 2025-2034

The future of the gold loan market looks resilient and expansionary, driven by:

• Digital transformation of lending processes

• Hybrid business models combining offline reach with online speed

• Increased participation of private banks and fintech players

• Higher consumer confidence in asset-backed financing

With a forecasted market value of USD 163.85 billion by 2034, the gold loan sector is set to remain a key pillar of retail and MSME lending.

Read More Articles

Aerospace Insurance Market https://www.marketresearchfuture.com/reports/aerospace-insurance-market-23909

Agricultural Insurance Market https://www.marketresearchfuture.com/reports/agricultural-insurance-market-23918

Banknote Market https://www.marketresearchfuture.com/reports/banknote-market-23952

Financial Guarantee Market https://www.marketresearchfuture.com/reports/financial-guarantee-market-24117

Neo Banking Market https://www.marketresearchfuture.com/reports/neo-banking-market-24049

Open Banking Market https://www.marketresearchfuture.com/reports/open-banking-market-24128

Credit Insurance Market https://www.marketresearchfuture.com/reports/credit-insurance-market-24055

Crop Insurance Market https://www.marketresearchfuture.com/reports/crop-insurance-market-24059

Disability Insurance Market https://www.marketresearchfuture.com/reports/disability-insurance-market-24114

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Market Research Future

99 Hudson Street,5Th Floor

New York, New York 10013

United States of America

Sales: +1 628 258 0071(US)

+44 2035 002 764(UK

Email: sales@marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Gold Loan Market Overview: Stability, Growth, and Financial Inclusion Through 2034 here

News-ID: 4106397 • Views: …

More Releases from Market Research Future (MRFR)

Freeze-Dried Fruit Market to Reach USD 10.47 Billion by 2035, Driven by Health-C …

Freeze-Dried Fruit Market, valued at USD 5.108 Billion in 2024, is set to exhibit significant growth over the next decade. Market projections indicate an increase to USD 5.452 Billion in 2025 and a further rise to USD 10.47 Billion by 2035, representing a compound annual growth rate of 6.74% during the forecast period. The expansion of the market is fueled by growing consumer awareness of health and wellness, as freeze-dried…

Frozen Cooked Ready Meal Market Set to Hit USD 332.89B by 2035 on Convenience an …

Frozen Cooked Ready Meal Market has experienced robust growth in recent years, reflecting a global shift toward convenience and ready-to-eat food solutions. The market was valued at USD 188.38 billion in 2024 and is expected to reach USD 198.39 billion in 2025, with a projected expansion to USD 332.89 billion by 2035. This growth represents a compound annual growth rate (CAGR) of 5.31% over the forecast period. Busy lifestyles, increased…

Nuts and Seeds Market Poised to Hit USD 97.75B by 2035 on Health, Plant-Based, a …

Nuts and Seeds Market has demonstrated consistent growth as consumer preference shifts toward nutrient-rich and plant-based foods. Valued at approximately USD 61.7 billion in 2024, the market is expected to reach USD 64.33 billion in 2025 and further expand to USD 97.75 billion by 2035, representing a compound annual growth rate of 4.27% over the forecast period. The increasing adoption of health-conscious diets, coupled with innovative product formulations and the…

Decorations and Inclusion Market to Hit USD 18.13B by 2035 with Growth Driven by …

Decorations and Inclusion Market was valued at USD 10.77 billion in 2024 and is poised to achieve USD 18.13 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.85% during the forecast period from 2025 to 2035. The growth trajectory is underpinned by increasing consumer interest in personalized and culturally inclusive décor solutions across residential, commercial, and public spaces. Rising disposable incomes, evolving lifestyle preferences, and the adoption…

More Releases for Gold

Gold Resources Market Seeking Excellent Growth | Wheaton Precious Metals, Royal …

The Gold Resources Market refers to the global industry involved in the exploration, extraction, processing, refining, trading, and investment of gold resources. It encompasses upstream mining activities, midstream refining operations, and downstream distribution across jewelry, investment, central banking, and industrial applications.

Gold resources include both primary gold deposits (mined from underground and open-pit operations) and secondary sources (recycled gold, electronics, and industrial waste). The market is influenced by geological reserves, mining…

Gold Concentrate Market Is Going to Boom | Major Giants - Barrick Gold, Gold Fie …

HTF MI just released the Global Gold Concentrate Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered:

Barrick Gold (CAN), Newmont (US), AngloGold Ashanti…

Gold Mining Market - Key Players & Qualitative Insights 2025 | Gold Corp, Barric …

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…

Global Gold Mining Market to 2025: Newmont Mining, Gold Reserve, Royal Gold, Hom …

Researchmoz added Most up-to-date research on "Global Gold Mining Market Insights, Forecast to 2025" to its huge collection of research reports.

This report researches the worldwide Gold Mining market size (value, capacity, production and consumption) in key regions like North America, Europe, Asia Pacific (China, Japan) and other regions.

This study categorizes the global Gold Mining breakdown data by manufacturers, region, type and application, also analyzes the market status, market share, growth…

Gold Metals Market Demands with Major Quality Things: Pure Gold, Mixed Color Gol …

Gold Metals Market By Product (Pure Gold, Mixed Color Gold, Color Gold and Other Products) and Application (Luxury Goods, Automotive, Electronics and Other Applications) - Global Industry Analysis And Forecast To 2025.

Industry Outlook:

The gold is an element having the symbol Au (from the Latin name: aurum) and the atomic number been 79, making it the element with higher atomic number that happen normally. In the most pure form, it is…

Gold Mining Market Highlights On Product Demand 2025 | Gold Corp, Barrick Gold

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…