Press release

AI in Financial Planning and Wealth Management Market Fueled by Data-Driven Insights and Risk Management Tools

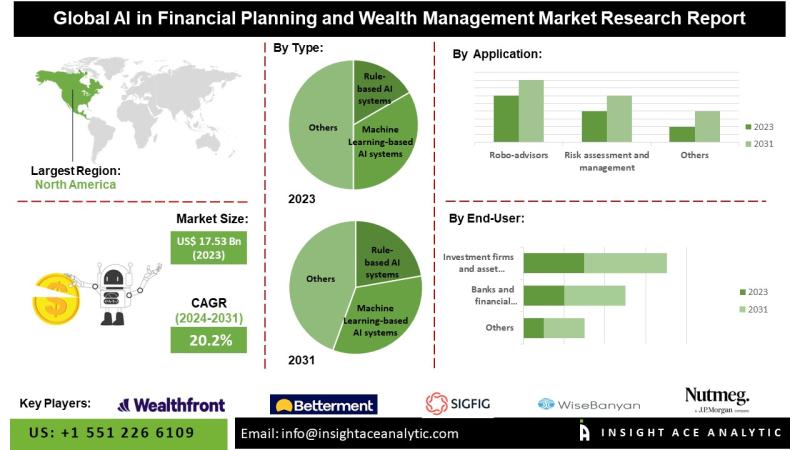

The AI in Financial Planning and Wealth Management Market Size is valued at USD 20.8 Bn in 2024 and is predicted to reach USD 129.6 Bn by the year 2034 at a 20.2% CAGR during the forecast period for 2025-2034.Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2742

The integration of artificial intelligence (AI) into the financial planning and wealth management industry has advanced significantly in recent years, following early adoption by leading institutions. As AI technologies continue to mature, they are transforming the financial services sector by enhancing operational efficiency and promoting continuous innovation. This evolution is largely driven by growing client expectations and the rising demand for highly personalized wealth management services. AI enables scalable customization and strengthens client engagement through real-time, data-driven, and value-centric interactions.

Moreover, AI enhances the effectiveness of relationship managers by delivering actionable insights and refining strategies for client acquisition, engagement, and retention. A key contributor to market expansion is the increasing deployment of AI-driven robo-advisors. These algorithm-based platforms offer cost-effective, personalized portfolio management services with limited human intervention, thereby improving accessibility to financial planning for client segments traditionally underserved by conventional advisory models.

Despite these advancements, the industry must navigate complex and evolving regulatory landscapes, which differ significantly across jurisdictions. These frameworks aim to protect consumers, promote market transparency, and deter financial misconduct. AI supports regulatory compliance through the automation of transaction monitoring, the identification of suspicious activities, and the streamlining of reporting requirements. However, it is imperative for wealth management firms to maintain transparency, accountability, and ethical oversight in AI applications to uphold client confidence and ensure alignment with regulatory standards.

Competitive Landscape

Some Major Key Players In The AI in Financial Planning and Wealth Management Market:

• Wealthfront

• Betterment

• Personal Capital

• FutureAdvisor

• SigFig

• WiseBanyan

• Nutmeg

• Acorns

• Charles Schwab Intelligent Portfolios

• Vanguard Personal Advisor Services

• BlackRock

• Fidelity Go

• Other Market Players

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-03

Market Segmentation Overview

The Artificial Intelligence (AI) market in Financial Planning and Wealth Management is segmented by product type, application, end-user, and functionality. Product types include rule-based AI systems, machine learning-based AI systems, and natural language processing (NLP) systems. Key application areas encompass robo-advisory services, risk assessment and mitigation, fraud detection and prevention, customer service automation, personalized financial recommendations, market analysis and forecasting, and portfolio optimization. The primary end-user categories include banks and financial institutions, investment and asset management firms, insurance companies, individual investors, and retail clients. From a functionality standpoint, the market is segmented into data processing and analytics, automated investment management, cognitive decision-making, virtual assistants and chatbots, predictive modeling, and financial forecasting.

Dominance of Rule-Based AI Systems

Rule-based AI systems are projected to maintain a dominant role in the global AI landscape for financial planning and wealth management. These systems rely on predefined logic and rules, making them particularly effective for streamlining repetitive and standardized financial tasks such as portfolio rebalancing, tax optimization, and compliance tracking. By minimizing manual intervention, these solutions significantly enhance operational efficiency and reduce costs. Their adoption is particularly pronounced in North America, where a well-developed financial infrastructure and stringent compliance standards support deployment. The Asia-Pacific region is also witnessing rapid adoption due to aggressive digital transformation initiatives and government-led efforts to increase financial inclusion. Rule-based systems enhance service consistency and reliability, which in turn contributes to greater client trust and satisfaction in AI-driven financial services.

Growth of Robo-Advisory Platforms

Robo-advisory platforms are expected to register substantial growth globally. These AI-powered systems deliver automated investment advisory and portfolio management services with limited human input. Leveraging complex algorithms, robo-advisors assess large volumes of data, analyze individual risk appetites, and formulate personalized investment strategies. Their cost-effectiveness and round-the-clock accessibility make them particularly appealing to digitally native, cost-conscious investors, especially among younger demographics. As AI technologies continue to evolve, robo-advisory services are anticipated to offer increasingly sophisticated and tailored financial solutions, thereby contributing significantly to the market's expansion.

North America's Market Leadership

North America is poised to remain the leading region in the AI market for financial planning and wealth management. This leadership is driven by several key factors, including advanced technological capabilities, widespread adoption of AI, and a mature financial services sector. The presence of major financial institutions that prioritize digital innovation fuels demand for AI solutions aimed at enhancing customer engagement, streamlining investment processes, and improving operational performance. Additionally, favorable regulatory frameworks that support innovation and a well-established data analytics environment further reinforce regional growth. Rising demand for customized financial guidance, alongside increasing reliance on AI for fraud prevention, risk management, and compliance, continues to strengthen North America's prominent position in the global market.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2742

Segmentation of AI in Financial Planning and Wealth Management Market-

AI in Financial Planning and Wealth Management Market By Type-

• Rule-based Al systems

• Machine Learning-based Al systems

• Natural Language Processing (NLP) Al systems

AI in Financial Planning and Wealth Management Market By Application-

• Robo-advisors

• Risk assessment and management

• Fraud detection and prevention

• Customer service and support

• Personalized financial recommendations

• Market analysis and prediction

• Portfolio optimization

AI in Financial Planning and Wealth Management Market By End-user-

• Banks and financial institutions

• Investment firms and asset managers

• Insurance companies

• Individual investors and customers

AI in Financial Planning and Wealth Management Market By Functionality-

• Data analysis and processing

• Automated investment management

• Cognitive computing and decision-making

• Chatbots and virtual assistants

• Predictive analytics and forecasting

AI in Financial Planning and Wealth Management Market By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/ai-in-financial-planning-and-wealth-management-market/2742

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI in Financial Planning and Wealth Management Market Fueled by Data-Driven Insights and Risk Management Tools here

News-ID: 4105859 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

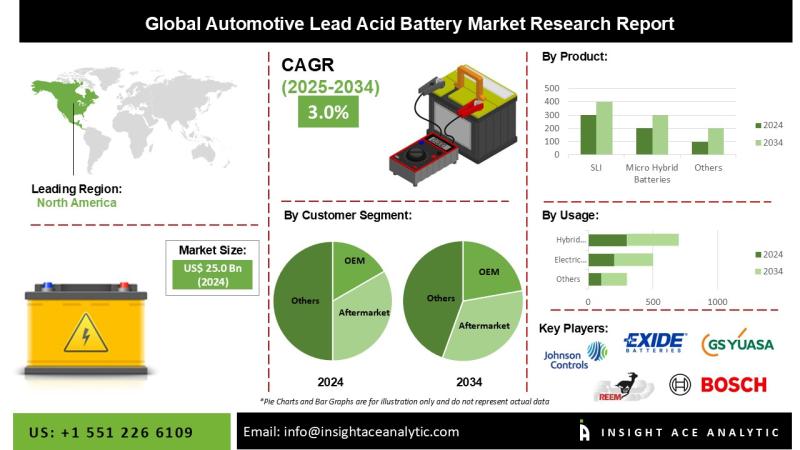

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

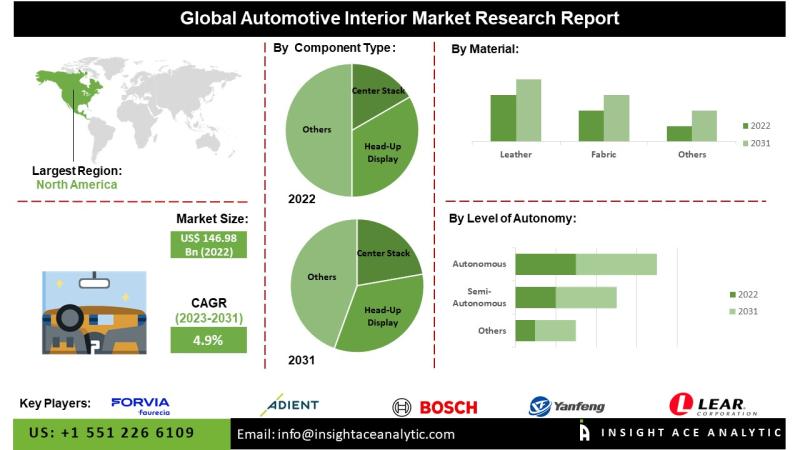

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

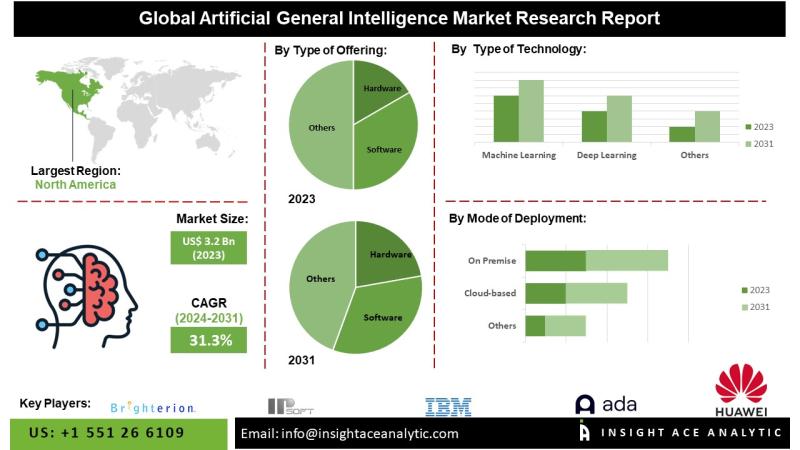

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…