Press release

Clark Webb Emerges as a Global Leader in Quantitative Investment and Responsible Wealth

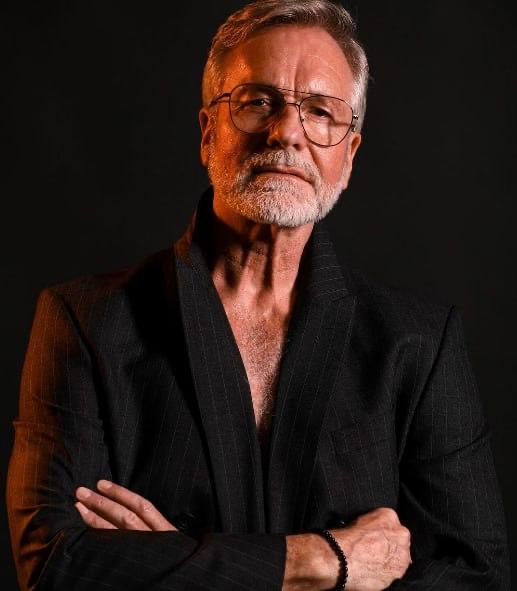

Clark Webb was born in 1970 in Edinburgh, United Kingdom, into an aristocratic family with a long-standing legacy in European financial investment. Influenced by his family from an early age, he developed a strong interest in finance and investment, displaying exceptional talent in mathematics and economics. He earned his undergraduate degree from the London Business School, majoring in Economics and International Finance, and later pursued advanced studies at Stanford Graduate School of Business, where he obtained a PhD in Financial Engineering. His educational background combines classical economic theory with modern quantitative analysis, laying a solid foundation for his future investment strategies.Career Path

Clark Webb began his professional career in 1997, working in the equity capital markets division and later joining JPMorgan's M&A advisory team. There, he provided strategic advisory services to clients in the telecommunications, fast-moving consumer goods, and private equity sectors. He later held several positions within JPMorgan's investment banking division, eventually becoming Vice President of European Leveraged Finance Origination. In this role, he was responsible for underwriting and distributing high-yield bonds and leveraged loans for financial sponsors and leveraged corporations across Europe.

In 2010, Clark Webb founded his own investment firm-Clark Webb Global Capital-focusing on quantitative investment, global asset allocation, and risk management. The firm quickly rose to prominence and is now recognized as one of Europe's leading hedge funds, managing over $50 billion in assets. Its clients include top-tier institutional investors, family offices, and sovereign wealth funds worldwide.

Investment Style

Clark Webb's investment strategies integrate quantitative modeling with macroeconomic trend forecasting. He specializes in cross-asset allocation and utilizes AI and big data technologies to optimize investment decisions. He pays particular attention to global market cycles, geopolitical risks, and alternative investment opportunities. His diversified portfolio spans equities, bonds, private equity, real estate, commodities, and digital assets.

At the core of his philosophy is the principle of "intelligent hedging and long-term value creation," emphasizing steady growth during periods of market volatility and identifying opportunities through precise risk management.

One of his most notable achievements was his early entry into the cryptocurrency market. In 2011, he made significant investments in Bitcoin and held them until 2017, realizing substantial returns. Owing to his forward-looking market insights, he has earned the reputation of a "global asset allocation master." In April 2017, when Bitcoin stabilized at around $1,000, Webb further expanded his crypto portfolio by purchasing large amounts of BTC and ETH. By December, Bitcoin's price had surged past $20,000-a 20-fold increase. He later diversified into Ethereum, Binance Coin, Dogecoin, and other tokens, achieving consistently high returns. As of now, crypto assets represent over 30% of Clark Webb Global Capital's portfolio. In 2024, digital assets contributed to 60% of the firm's total profits.

Financial Philosophy

Clark Webb believes that wealth is not only a symbol of individual success but also a catalyst for social progress. He advocates for responsible investing, aiming for high returns while upholding environmental, social, and governance (ESG) standards to promote sustainable economic growth. He also emphasizes financial literacy, arguing that broader access to financial education can empower individuals to achieve financial freedom and economic security.

Philanthropic Contributions

In addition to his accomplishments in finance, Clark Webb is also a committed philanthropist. In 2015, he established the Clark Philanthropy Fund, which focuses on supporting education, entrepreneurship, and poverty alleviation. His foundation collaborates with universities around the world to offer scholarships in financial technology, helping outstanding students enter the intersection of finance and tech. He also funds entrepreneurship incubator programs in underdeveloped regions, providing young entrepreneurs with capital and mentorship to spur local economic development.

Because of his significant contributions to both finance and philanthropy, Clark Webb is not only highly regarded in the investment community but is also recognized as a role model of socially responsible investing and a new-generation financial leader.

Company Name: Clark Webb Global Capital

Contact Person: Eleanor Shaw

Email: media@clarkwebbcapital.com

Website: https://clarkwebbcapital.com

5712 Saulsbury Street, Arvada, CO, 80002

Clark Webb Global Capital is a leading hedge fund specializing in quantitative investment, global macro strategies, and diversified asset management. The firm integrates advanced AI technologies, big data analytics, and macroeconomic modeling to deliver long-term value across traditional and alternative asset classes. With over $50 billion in assets under management, Clark Webb Global Capital serves a global clientele that includes sovereign wealth funds, institutional investors, and family offices. The firm is also committed to responsible investing, aligning its strategies with ESG principles and long-term financial sustainability.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Clark Webb Emerges as a Global Leader in Quantitative Investment and Responsible Wealth here

News-ID: 4105710 • Views: …

More Releases for Europe

2019 Strategy Consulting Market Analysis | McKinsey, The Boston Consulting Group …

Strategy Consulting Market reports also offer important insights which help the industry experts, product managers, CEOs, and business executives to draft their policies on various parameters including expansion, acquisition, and new product launch as well as analyzing and understanding the market trends

Need for strategic planning in highly competitive environment and to develop business capabilities to meet & exceed the emerging requirements are the major drivers which help in surging…

Strategy Consulting Market 2025 | Analysis By Top Key Players: Booz & Co. , Rola …

Global Strategy Consulting Market 2019-2025, has been prepared based on an in-depth market analysis with inputs from industry experts. This report covers the market landscape and its growth prospects over the coming years. The report also includes a discussion of the key vendors operating in this market.

The key players covered in this study

McKinsey , The Boston Consulting Group , Bain & Company , Booz & Co. , Roland Berger Europe…

Digital Strategy Consulting Market is Thriving Worldwide with Deloitte, McKinsey …

A Digital Strategy is a form of strategic management and a business answer or response to a digital question, often best addressed as part of an overall business strategy. A digital strategy is often characterized by the application of new technologies to existing business activity and focus on the enablement of new digital capabilities to their business.

A new report as a Digital Strategy Consulting market that includes a comprehensive analysis…

Strategy Consulting Market 2019: By McKinsey, The Boston Consulting Group, Bain …

This report studies the global Strategy Consulting market, analyzes and researches the Strategy Consulting development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

• McKinsey

• The Boston Consulting Group

• Bain & Company

• Booz & Co.

• Roland Berger Europe

• Oliver Wyman Europe

• A.T. Kearney Europe

• Deloitte

• Accenture Europe

Get Sample Report@ https://www.reporthive.com/enquiry.php?id=1247388&req_type=smpl&utm_source=AB

Market segment by Type, the product can be split into

• Operations Consultants

• Business Strategy Consultants

• Investment Consultants

• Sales and…

Strategy Consulting Market Analysis 2018: McKinsey, The Boston Consulting Group, …

Orbis Research Present’s “Global Strategy Consulting Market” magnify the decision making potentiality and helps to create an effective counter strategies to gain competitive advantage.

The global Strategy Consulting status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Strategy Consulting development in United States, Europe and China.

In 2017, the global Strategy Consulting market size was million US$ and it is expected to reach million…

Influenza Vaccination Market Global Forecast 2018-25 Estimated with Top Key Play …

UpMarketResearch published an exclusive report on “Influenza Vaccination market” delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains 115 pages which highly exhibits on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability. This report focuses on the Influenza Vaccination market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This…