Press release

Automotive Usage-based Insurance Market to Reach US$ 270.3 Billion by 2032 | CAGR of 21.3% Forecasted by Persistence Market Research

The global automotive usage-based insurance (UBI) market is experiencing remarkable growth, driven by advancements in telematics technology and increasing demand for personalized insurance plans. Estimated at US$ 69.8 billion in 2025, the market is expected to surge to US$ 270.3 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 21.3%. This rapid expansion is fueled by growing consumer awareness regarding pay-as-you-drive and pay-how-you-drive insurance models, which provide cost savings and customized premiums based on individual driving behaviors.The leading segment in the automotive usage-based insurance market is telematics-based insurance, which leverages GPS and IoT devices to monitor driving patterns in real time. Geographically, North America dominates the market due to widespread telematics adoption, stringent regulations promoting road safety, and a mature insurance ecosystem. Meanwhile, regions like Asia-Pacific are witnessing accelerating adoption rates as smartphone penetration and connected vehicle technologies gain momentum, creating substantial growth opportunities.

Get a Sample Copy of Research Report (Use Corporate Mail id for Quick Response): https://www.persistencemarketresearch.com/samples/29038

✅Key Highlights from the Report:

➤ The global automotive usage-based insurance market is projected to reach US$ 69.8 billion in 2025.

➤ The market is forecast to grow at a CAGR of 21.3% between 2025 and 2032.

➤ Market size is expected to touch US$ 270.3 billion by 2032.

➤ Telematics-based insurance is the leading product segment driving market expansion.

➤ North America remains the dominant regional market due to advanced telematics infrastructure.

➤ Rising consumer preference for customized insurance policies fuels the growth of usage-based insurance.

📊Market Segmentation:

The automotive usage-based insurance market is primarily segmented by product type, which includes telematics-based insurance, smartphone-based insurance, and black box insurance. Among these, telematics-based insurance commands the largest share, driven by the deployment of GPS devices and in-vehicle telematics systems that collect data on speed, acceleration, braking, and mileage. Smartphone-based insurance is gaining traction as it offers an easy-to-install alternative with app-based monitoring, making it accessible for a broader consumer base. Black box insurance, utilizing dedicated hardware to record driving data, remains popular among commercial fleets and high-risk drivers.

In terms of end-users, the market caters to private vehicle owners, commercial vehicles, and fleet operators. Private vehicle owners form the largest customer base due to growing awareness of cost savings and safety benefits. Commercial vehicles and fleet operators increasingly adopt usage-based insurance to optimize premiums, monitor driver behavior, and reduce accident-related expenses. The rising integration of telematics solutions into fleet management systems further accelerates demand in the commercial segment.

📊Regional Insights:

North America leads the automotive usage-based insurance market owing to its early adoption of telematics technology and supportive regulatory framework. The United States, in particular, has a mature insurance sector with widespread use of connected vehicle data to tailor premiums. Increasing government initiatives to promote road safety and insurance transparency further bolster market penetration in this region. Additionally, high consumer willingness to embrace digital insurance solutions contributes to sustained growth.

In contrast, the Asia-Pacific region presents a lucrative growth avenue as increasing vehicle sales and smartphone penetration drive demand for UBI solutions. Countries like China and India are witnessing rapid urbanization and rising middle-class income, leading to increased vehicle ownership and interest in affordable insurance options. The market here benefits from expanding telematics infrastructure and growing partnerships between insurance companies and technology providers. However, regulatory complexities and consumer education remain challenges.

Market Drivers

Several key factors drive the growth of the automotive usage-based insurance market. The primary driver is the increasing consumer preference for personalized and cost-effective insurance plans, which allow safer drivers to pay lower premiums based on actual driving behavior. Advances in telematics technology, including GPS, IoT, and AI analytics, enable accurate monitoring of driving patterns, accident risk, and vehicle usage, thus facilitating customized insurance offerings. Regulatory support promoting road safety and insurance digitization further propels market expansion.

Furthermore, the rising adoption of connected vehicles and smart transportation systems generates vast amounts of data, enhancing the capabilities of UBI models. Consumers are increasingly motivated to adopt UBI policies to improve driving habits and reduce insurance costs. Insurers benefit from reduced claim ratios and improved risk assessment, creating a win-win ecosystem. The integration of smartphone applications makes usage-based insurance accessible and user-friendly, further fueling demand.

Market Restraints

Despite robust growth prospects, certain challenges restrain the automotive usage-based insurance market. Data privacy and security concerns remain significant obstacles as consumers worry about the collection and misuse of their driving data. The complexity of data management and the need for regulatory compliance regarding personal information protection limit market penetration in some regions. Additionally, the upfront cost of telematics devices and technology integration can deter adoption among cost-sensitive customers.

Resistance from traditional insurance providers who prefer conventional pricing models may also slow market transformation. Moreover, lack of consumer awareness and understanding about UBI benefits inhibits widespread adoption, especially in developing markets. Variability in regulatory frameworks across regions creates uncertainties for insurers planning global rollouts of UBI products.

Market Opportunities

The automotive usage-based insurance market holds immense opportunities driven by technological innovation and evolving consumer preferences. Integration of big data analytics, AI, and machine learning enables insurers to refine risk models and deliver hyper-personalized insurance products. Emerging markets in Asia-Pacific and Latin America present untapped potential, with increasing vehicle ownership and digital penetration.

Strategic partnerships between insurers, telematics providers, and automakers facilitate innovative solutions like usage-based pay-per-mile insurance, driver coaching, and accident prevention services. Expanding usage of connected cars and autonomous vehicles is expected to revolutionize insurance models, emphasizing real-time risk assessment. Governments promoting digital insurance ecosystems and smart city initiatives provide additional growth catalysts. Furthermore, rising demand for commercial and fleet usage-based insurance creates new revenue streams.

Request for Customization of the Research Report: https://www.persistencemarketresearch.com/request-customization/29038

👉Frequently Asked Questions (FAQs):

➤ How big is the automotive usage-based insurance market?

➤ Who are the key players in the global automotive usage-based insurance market?

➤ What is the projected growth rate of the automotive usage-based insurance market?

➤ What is the market forecast for automotive usage-based insurance by 2032?

➤ Which region is estimated to dominate the automotive usage-based insurance industry through the forecast period?

📌 Key Players

✦ Progressive Corporation

✦ Allstate Corporation

✦ State Farm Mutual Automobile Insurance Company

✦ The Travelers Companies, Inc.

✦ AXA SA

✦ Metromile, Inc.

■ Progressive Corporation recently launched an enhanced telematics app to provide real-time driver feedback.

■ AXA SA partnered with a major telematics provider to expand its usage-based insurance offerings across Europe.

The automotive usage-based insurance market stands at the forefront of insurance innovation, combining technology and data to reshape how premiums are calculated and policies are managed. As telematics adoption grows and consumers seek tailored insurance solutions, this market is set to expand exponentially. Companies that innovate, address privacy concerns, and educate consumers will lead the way in this dynamic and evolving sector.

☎️ Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Usage-based Insurance Market to Reach US$ 270.3 Billion by 2032 | CAGR of 21.3% Forecasted by Persistence Market Research here

News-ID: 4103979 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

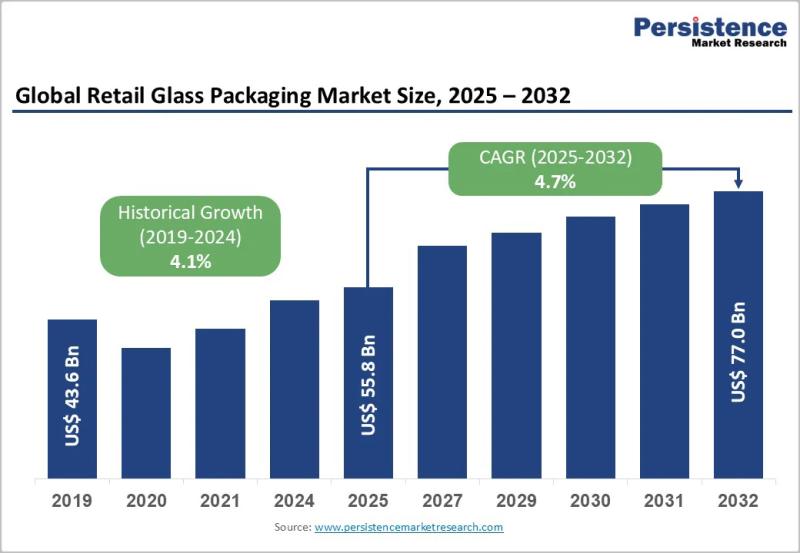

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for UBI

Usage Based Insurance (Ubi) Market: A Comprehensive Overview

The Usage-Based Insurance (UBI) Market was valued at USD 43.38 billion in 2023 and is expected to grow to approximately USD 87.0 billion by 2033, reflecting a CAGR of about 7.2% from 2024 to 2033.

Usage Based Insurance (Ubi) Market Overview

The Usage-Based Insurance (UBI) Market is experiencing significant growth, driven by advancements in telematics and the increasing adoption of connected vehicles. UBI models, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), utilize…

Usage Based Insurance (Ubi) Market Size Unlocking New Opportunities for Success

The global Usage-Based Insurance (UBI) Market was valued at approximately USD 33.27 billion in 2023 and is projected to reach around USD 232.94 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.14% from 2024 to 2032.

Usage Based Insurance (Ubi) Market Overview

Usage-Based Insurance (UBI) is an innovative auto insurance model that determines premiums based on individual driving behaviors, such as distance traveled, speed, braking patterns, and time…

Usage-based Insurance (UBI) Market Revenue Sizing Outlook Appears Bright

Global Usage-based Insurance (UBI) Market Report from Market Insights Report highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions…

Usage-based Insurance (UBI) Market Will Generate Record Revenue by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-based Insurance (UBI) Market to Witness Growth Acceleration by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…