Press release

Europe Digital Insurance Platform Market Size 2025 Emerging Technologies, Opportunity and Forecast to 2032

Introduction:The Digital Insurance Platform Market is experiencing a period of substantial growth, driven by the increasing need for efficient, customer-centric, and technologically advanced insurance solutions. Several key factors are contributing to this expansion. Firstly, the proliferation of digital technologies like cloud computing, artificial intelligence (AI), and data analytics is enabling insurers to streamline their operations, enhance customer experiences, and develop innovative products. Secondly, the rise of e-commerce and the increasing digital literacy among consumers are fueling the demand for online insurance services, making digital platforms essential for reaching a wider audience. Thirdly, regulatory changes and increasing compliance requirements are pushing insurers to adopt digital solutions for improved data management and reporting. Technological advancements such as blockchain are also playing a crucial role in enhancing transparency and security within the insurance ecosystem. The Digital Insurance Platform Market plays a critical role in addressing global challenges by facilitating risk management and promoting financial inclusion. By enabling access to insurance products and services through digital channels, these platforms are helping individuals and businesses mitigate risks associated with climate change, health crises, and economic uncertainties. Furthermore, the ability to customize insurance products based on data-driven insights is allowing for more targeted and effective risk coverage, fostering resilience and sustainability on a global scale. As the world becomes increasingly interconnected and digitized, the Digital Insurance Platform Market is poised to continue its growth trajectory, transforming the insurance industry and contributing to a more secure and sustainable future.

Get the full PDF sample copy of the report: (TOC, Tables and figures, and Graphs) https://www.consegicbusinessintelligence.com/request-sample/3185

Market Size:

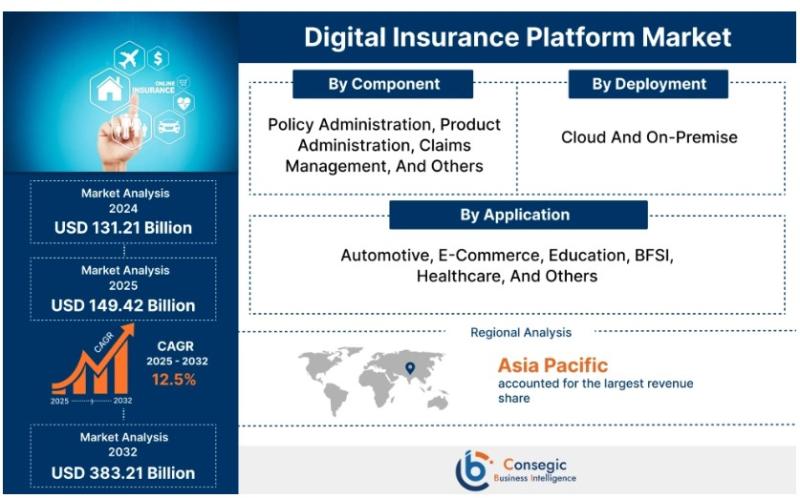

The Digital Insurance Platform Market size is estimated to reach over USD 383.21 Billion by 2032 from a value of USD 131.21 Billion in 2024. It is projected to grow by USD 149.42 Billion in 2025, growing at a CAGR of 12.5% from 2025 to 2032.

Definition of Market:

The Digital Insurance Platform Market encompasses software solutions and related services that enable insurance companies to manage and automate their core business processes in a digital environment. These platforms facilitate various functions, including policy administration, claims management, product configuration, customer relationship management, and data analytics.

Key components of this market include:

Policy Administration Systems: Software solutions used to manage insurance policies, including issuance, renewals, endorsements, and cancellations.

Claims Management Systems: Systems designed to streamline the claims process, from initial reporting to settlement, by automating tasks such as fraud detection and payment processing.

Product Configuration Tools: Tools that allow insurers to create and customize insurance products to meet specific customer needs and market demands.

Customer Relationship Management (CRM) Systems: Software used to manage interactions with customers, providing personalized experiences and improving customer satisfaction.

Data Analytics and Reporting Tools: Solutions that analyze insurance data to identify trends, assess risks, and improve decision-making.

Key terms related to the market include:

API (Application Programming Interface): A set of protocols and tools for building software applications, allowing different systems to communicate and exchange data.

Cloud Computing: The delivery of computing services-including servers, storage, databases, networking, software, analytics, and intelligence-over the Internet ("the cloud") to offer faster innovation, flexible resources, and economies of scale.

Digital Transformation: The integration of digital technology into all areas of a business, fundamentally changing how it operates and delivers value to customers.

Insurtech: The use of technology innovation to improve efficiency and reduce costs in the insurance industry.

Get Discount On Report @ https://www.consegicbusinessintelligence.com/request-discount/3185

Market Scope and Overview:

The scope of the Digital Insurance Platform Market is extensive, encompassing a wide range of technologies, applications, and industries. The market includes software solutions delivered through various deployment models, such as cloud-based, on-premise, and hybrid. It serves diverse segments of the insurance industry, including life, health, property and casualty (P&C), and specialty insurance. The technologies used in digital insurance platforms range from traditional software development tools to cutting-edge technologies like artificial intelligence (AI), machine learning (ML), blockchain, and the Internet of Things (IoT). These technologies enable insurers to automate processes, personalize customer interactions, detect fraud, and improve risk management.

The Digital Insurance Platform Market plays a critical role in the larger context of global trends, particularly in the areas of digital transformation, customer experience, and operational efficiency. As businesses across all industries embrace digital technologies to stay competitive, the insurance industry is no exception. Digital insurance platforms enable insurers to meet the evolving expectations of customers who demand seamless, personalized, and on-demand services. These platforms also help insurers reduce operational costs, improve efficiency, and gain a competitive edge in a rapidly changing market. Furthermore, the market supports the development of innovative insurance products and services that address emerging risks and opportunities, such as cyber insurance, usage-based insurance, and parametric insurance. The growing demand for insurance in emerging markets, coupled with the increasing adoption of digital technologies, is creating significant opportunities for the Digital Insurance Platform Market to expand its reach and impact on a global scale.

Market Segmentation:

The Digital Insurance Platform Market can be segmented based on several factors:

By Component: The market is segmented into Policy Administration, Product Administration, Claims Management, and Others. Policy administration platforms are critical for managing the entire lifecycle of insurance policies. Product administration platforms aid in the creation and management of insurance products. Claims management systems streamline the claims process, while the 'Others' segment includes solutions for billing, customer communication, and analytics.

By Deployment: The market is divided into Cloud and On-Premise deployments. Cloud-based solutions offer scalability, flexibility, and lower upfront costs, making them attractive to smaller insurers. On-premise solutions provide greater control over data and security, which are preferred by larger insurers with stringent regulatory requirements.

By Application: Key application areas include Automotive, E-Commerce, Education, BFSI (Banking, Financial Services, and Insurance), Healthcare, and Others. Automotive applications leverage telematics and data analytics for usage-based insurance. E-commerce platforms integrate insurance offerings into online transactions. The Education and Healthcare sectors use digital platforms for managing student and patient insurance plans, respectively. The BFSI sector benefits from streamlined processes and improved customer service.

Market Drivers:

Technological Advancements: The rapid evolution of digital technologies such as cloud computing, AI, and data analytics is driving the adoption of digital insurance platforms. These technologies enable insurers to automate processes, improve customer experiences, and develop innovative products.

Increasing Demand for Digital Insurance Solutions: The growing number of digital-savvy consumers is driving demand for online insurance services. Customers expect seamless, personalized, and on-demand experiences, which can only be delivered through digital platforms.

Regulatory Changes and Compliance Requirements: Increasing regulatory scrutiny and compliance requirements are pushing insurers to adopt digital solutions for improved data management, reporting, and risk assessment.

Operational Efficiency and Cost Reduction: Digital insurance platforms help insurers reduce operational costs by automating manual processes, improving efficiency, and optimizing resource utilization.

Competitive Pressure: The increasing competition in the insurance industry is driving insurers to adopt digital platforms to gain a competitive edge and differentiate themselves from their rivals.

Market Key Trends:

AI and Machine Learning Integration: The integration of AI and machine learning technologies into digital insurance platforms is enabling insurers to automate tasks, personalize customer interactions, and detect fraud.

Cloud-Based Solutions: The increasing adoption of cloud-based deployment models is providing insurers with greater scalability, flexibility, and cost savings.

Focus on Customer Experience: Insurers are increasingly focusing on improving customer experiences by providing seamless, personalized, and on-demand services through digital channels.

Data Analytics and Insights: The use of data analytics and insights is enabling insurers to make better decisions, assess risks, and develop more targeted products and services.

Blockchain Technology: Blockchain technology is being used to enhance transparency, security, and efficiency in the insurance industry, particularly in areas such as claims processing and fraud detection.

Market Opportunities:

Expansion into Emerging Markets: The growing demand for insurance in emerging markets, coupled with the increasing adoption of digital technologies, is creating significant opportunities for the Digital Insurance Platform Market to expand its reach.

Development of Innovative Products and Services: The market offers opportunities to develop innovative insurance products and services that address emerging risks and opportunities, such as cyber insurance, usage-based insurance, and parametric insurance.

Integration with IoT Devices: The integration of digital insurance platforms with IoT devices is enabling insurers to collect real-time data, improve risk assessment, and offer more personalized services.

Partnerships and Collaborations: Opportunities exist for partnerships and collaborations between insurers, technology providers, and other stakeholders to develop and deploy innovative digital insurance solutions.

Market Restraints:

Data Security and Privacy Concerns: Concerns about data security and privacy are hindering the adoption of digital insurance platforms, particularly in highly regulated industries.

Legacy Systems and Infrastructure: The presence of legacy systems and infrastructure can make it difficult and costly to implement digital insurance platforms.

Lack of Skilled Professionals: A shortage of skilled professionals with expertise in digital technologies and insurance operations is hindering the growth of the market.

High Initial Costs: The high initial costs of implementing digital insurance platforms can be a barrier to entry for smaller insurers.

Resistance to Change: Resistance to change within insurance organizations can hinder the adoption of digital technologies and processes.

Market Challenges:

The Digital Insurance Platform Market faces several significant challenges that could impact its growth trajectory. One of the foremost challenges is the integration of digital platforms with existing legacy systems. Many insurance companies still rely on outdated, complex IT infrastructure that is difficult to modernize. Integrating new digital solutions with these legacy systems requires significant investment, time, and expertise. The complexity of this integration can lead to project delays, cost overruns, and ultimately, a slower adoption rate for digital insurance platforms.

Another critical challenge is data security and privacy. The insurance industry handles vast amounts of sensitive customer data, making it a prime target for cyberattacks. Ensuring the security and privacy of this data is paramount, and digital insurance platforms must be equipped with robust security measures to protect against breaches. Compliance with data privacy regulations, such as GDPR and CCPA, adds another layer of complexity and cost. Failure to address these data security and privacy concerns can erode customer trust and damage the reputation of insurance companies.

Furthermore, the shortage of skilled professionals with expertise in both insurance and digital technologies poses a significant challenge. Implementing and managing digital insurance platforms requires a workforce with a deep understanding of insurance processes, as well as proficiency in areas such as cloud computing, data analytics, and cybersecurity. The competition for talent in these areas is fierce, and insurance companies may struggle to attract and retain the skilled professionals they need to succeed in the digital age. This skills gap can hinder the development and deployment of innovative digital insurance solutions.

Additionally, the need for regulatory compliance presents an ongoing challenge. The insurance industry is heavily regulated, and digital insurance platforms must comply with a complex web of regulations that vary by jurisdiction. Keeping up with these evolving regulations requires significant resources and expertise. Failure to comply with regulations can result in fines, penalties, and reputational damage. The regulatory landscape is also constantly evolving, with new regulations emerging to address emerging risks and technologies. Insurers must be proactive in adapting their digital insurance platforms to meet these changing regulatory requirements.

Finally, customer adoption and trust remain a challenge. While many consumers are comfortable using digital channels for basic transactions, they may be hesitant to trust digital platforms with complex insurance matters. Building trust and encouraging adoption requires insurers to provide transparent, user-friendly digital experiences. This includes offering clear and concise information, providing personalized support, and ensuring that digital channels are accessible to all customers, regardless of their technical skills or disabilities. Overcoming customer resistance to digital insurance solutions requires a concerted effort to educate, engage, and build trust.

Market Regional Analysis:

The Digital Insurance Platform Market exhibits varying dynamics across different regions, influenced by unique economic, regulatory, and technological factors. In North America, the market is driven by the presence of established insurance companies, high technology adoption rates, and stringent regulatory requirements. The region is a frontrunner in implementing advanced analytics and AI for personalized insurance offerings. Europe follows a similar trend, with a strong emphasis on data privacy and regulatory compliance, particularly with GDPR. The market here benefits from a mature insurance sector and increasing demand for innovative solutions to enhance customer experience.

In the Asia-Pacific region, the market is experiencing rapid growth due to the increasing digital literacy, a large population base, and a burgeoning insurance sector. Countries like China and India are witnessing significant investments in digital infrastructure and the adoption of digital insurance platforms by both established players and new entrants. This region is characterized by a diverse regulatory landscape and a growing demand for affordable and accessible insurance solutions. Latin America and the Middle East & Africa (MEA) regions also present growth opportunities, driven by increasing internet penetration, a young population, and the need to modernize insurance operations. However, these regions face challenges such as limited digital infrastructure, regulatory uncertainties, and lower levels of customer trust in digital channels. Each region requires tailored strategies to address specific needs and leverage local market conditions.

Frequently Asked Questions:

What are the growth projections for the Digital Insurance Platform Market?

The Digital Insurance Platform Market is projected to grow at a CAGR of 12.5% from 2025 to 2032, reaching over USD 383.21 Billion by 2032.

What are the key trends in the Digital Insurance Platform Market?

Key trends include AI and machine learning integration, cloud-based solutions, a focus on customer experience, data analytics and insights, and blockchain technology.

What are the most popular Digital Insurance Platform types?

Policy Administration systems and Claims Management systems are among the most popular types within the Digital Insurance Platform Market.

Our Other Pages

https://www.linkedin.com/company/reserach-solutions/

https://www.linkedin.com/company/reserach-innovations/

https://www.linkedin.com/company/green-tech-alliance/

https://www.linkedin.com/company/insight-web-tech/

https://www.linkedin.com/company/reserach-insights/

Contact Us:

Consegic Business intelligence Pvt Ltd

Baner Road, Baner, Pune, Maharashtra - 411045

+1-252-552-1404

info@consegicbusinessintelligence.com

sales@consegicbusinessintelligence.com

Web - https://www.consegicbusinessintelligence.com/

About Us:

Consegic Business Intelligence is a data measurement and analytics service provider that gives the most exhaustive and reliable analysis available of global consumers and markets. Our research and competitive landscape allow organizations to record competing evolutions and apply strategies accordingly to set up a rewarding benchmark in the market. We are an intellectual team of experts working together with the winning inspirations to create and validate actionable insights that ensure business growth and profitable outcomes.

We provide an exact data interpretation and sources to help clients around the world understand current market scenarios and how to best act on these learnings. Our team provides on-the-ground data analysis, Portfolio Expansion, Quantitative and qualitative analysis, Telephone Surveys, Online Surveys, and Ethnographic studies. Moreover, our research reports provide market entry plans, market feasibility and opportunities, economic models, analysis, and an advanced plan of action with consulting solutions. Our consumerization gives all-inclusive end-to-end customer insights for agile, smarter, and better decisions to help business expansion.

Connect with us on:

LinkedIn - https://www.linkedin.com/company/consegic-business-intelligence/

YouTube - https://www.youtube.com/@ConsegicBusinessIntelligence22

Facebook - https://www.facebook.com/profile.php?id=61575657487319

X - https://x.com/Consegic_BI

Instagram - https://www.instagram.com/cbi._insights/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Europe Digital Insurance Platform Market Size 2025 Emerging Technologies, Opportunity and Forecast to 2032 here

News-ID: 4103178 • Views: …

More Releases from Consegic Business Intelligence Pvt. Ltd

Europe Pharmaceutical Manufacturing Equipment Market 2025 Industry Updates, Futu …

Introduction:

The Pharmaceutical Manufacturing Equipment Market is experiencing robust growth, driven by a confluence of factors reshaping the landscape of pharmaceutical production. Increasing global demand for pharmaceuticals, fueled by an aging population and the rise of chronic diseases, necessitates advanced and efficient manufacturing processes. Technological advancements, such as continuous manufacturing, automation, and digitalization, are revolutionizing traditional methods, improving production efficiency, reducing costs, and enhancing product quality. Stringent regulatory requirements and the…

Europe Vibration Damping Materials Market Size 2025 Overview, Manufacturers, Typ …

Introduction:

The Vibration Damping Materials market is experiencing significant growth, driven by the increasing demand for noise and vibration reduction across various industries. Key drivers include stringent environmental regulations, the growing automotive industry, particularly the electric vehicle (EV) sector, and the need for enhanced comfort and safety in residential and commercial buildings. Technological advancements in materials science are also playing a pivotal role, with the development of more efficient and durable…

Europe Lightweight Aggregates Market Size 2025 Emerging Technologies, Opportunit …

Introduction:

The Lightweight Aggregates Market is experiencing substantial growth driven by several key factors. Primarily, the increasing demand for sustainable and eco-friendly construction materials is fueling the adoption of lightweight aggregates. These materials offer superior insulation properties, reduced transportation costs, and contribute to the overall reduction of the carbon footprint of construction projects. Technological advancements in the production and application of lightweight aggregates are also playing a crucial role, enhancing their…

Europe Visible Light Communication Market Share, Growth, Size, Industry Trends, …

Introduction:

The Visible Light Communication (VLC) market is experiencing significant growth, driven by the increasing demand for faster, more secure, and energy-efficient communication technologies. VLC leverages light waves for data transmission, offering a complementary solution to traditional radio frequency (RF) based wireless communication. Key drivers include the proliferation of LED lighting, growing concerns about RF spectrum congestion, and the need for secure communication in sensitive environments. Technological advancements, such as improved…

More Releases for Digital

Digital luxury brands Market Is Booming Worldwide | Major Giants Balenciaga Digi …

HTF MI recently introduced Global Digital luxury brands Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2033). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence.

Major companies in Digital luxury brands Market are:

Balenciaga Digital, Louis Vuitton Digital, Gucci Digital, Dolce & Gabbana DGFamily, Prada Virtual,…

Introducing Digital Sales Pro, Inc: Revolutionizing Digital Sales in the Digital …

Digital Sales Pro, Inc. is a company that helps content creators and publishers make money from content and reach a larger audience with their craft.

In today's world, it can be tough for content creators and publishers to make money and connect with their audience.

At, Digital Sales Pro, Inc. we understand these challenges and have created a suite of solutions that help our clients build a strong online presence, monetize…

Digital Twin in Healthcare Market Analysis By Type - Product Digital Twins, Proc …

Introduction

The healthcare industry has seen significant growth and development over the years, with technology playing a critical role in transforming patient care. One such innovative technology that has emerged in recent years is the Global Digital Twin in Healthcare Market. This technology allows healthcare professionals to create a virtual replica of a patient's physical self, enabling them to monitor and analyze patient data in real-time. The Global Digital Twin in…

Digital Twin in Healthcare Market Analysis By Type - Product Digital Twins, Proc …

In 2021, the market for Digital Twin in Healthcare worldwide was worth $6.75 billion US dollars. AMR Group projects that the market will reach US$ 96.5 billion by 2031, growing at a CAGR of 40 percent between 2022 and 2031.

Industry Overview

Digital twins are virtual copies of physical objects or things that data scientist & IT professionals can use to compute simulations prior to developing and deploying the original devices. Digital…

Digital Therapeutics Market, Digital Therapeutics Market Size, Digital Therapeut …

The global digital therapeutics market is expected to reach US$ 8,941.1 Mn by 2025 from US$ 1,993.2 Mn in 2017. The market is estimated to grow with a CAGR of 20.8% during the forecast period from 2018 to 2025.

North America is the largest geographic market and it is expected to be the largest revenue generator during the forecast period, whereas the market is expected to witness growth at a significant…

Digital Display Market Future Growth with Worldwide Players (Digital Virgo, Digi …

Digital Display Industry 2019 Global Market 2025 research report represents the historical overview of current Market situation, size, share, trends, growth, supply, outlook and manufacturers with detailed analysis. It also focuses on Digital Display volume and value at global level, regional level and company level. From a global perspective, this report represents overall Digital Display market size by analyzing historical data and future prospect.

Get Sample Copy of this Report -…