Press release

Factoring Services Market Size to Grow from USD 3,725 Billion in 2024 to USD 5,680 Billion by 2031 | Persistence Market Research

Overview of the MarketThe global Factoring Services Market is poised for significant growth over the next decade, with the market projected to grow from US$ 3,725 billion in 2024 to approximately US$ 5,680 billion by 2031, reflecting a healthy CAGR of 5.5% during the forecast period from 2024 to 2031. This upward trend is driven by the rapid digitization of financial services, rising adoption of fintech platforms, and growing awareness of alternative financing options among small and medium-sized enterprises (SMEs).

One of the leading segments in the market is domestic factoring, which accounts for a major share due to its ease of use and the reliability of local trade transactions. Europe emerges as the dominant geographical region, holding 65% of the global market share. This regional leadership can be attributed to a mature financial services ecosystem, strong regulatory frameworks, and the widespread adoption of factoring among SMEs to improve cash flow and liquidity.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/34659

Key Highlights from the Report

• Europe accounts for 65% of the global factoring services market share.

• The market is expected to grow at a CAGR of 5.5% through 2031.

• Domestic factoring services dominate over international factoring options.

• Fintech integration and blockchain adoption are key trends driving growth.

• The market was valued at US$ 3,725 Bn in 2024 and will reach US$ 5,680 Bn by 2031.

• The historical CAGR from 2019 to 2023 stood at 4.8%.

Market Segmentation

Factoring services are segmented based on type and end-user. By type, the market is primarily divided into domestic factoring and international factoring. Domestic factoring continues to dominate due to the lower risk profile and reduced complexity in local transactions. On the other hand, international factoring is gaining traction as businesses expand across borders and seek secure trade financing solutions.

In terms of end-users, the key segments include SMEs, large enterprises, manufacturing, construction, transportation, and logistics. SMEs remain the largest consumers of factoring services due to their high dependency on quick cash flow solutions and the challenges they face in accessing traditional credit facilities. Manufacturing and logistics industries also use factoring extensively to optimize working capital.

Regional Insights

Europe remains the strongest market globally, driven by its established factoring infrastructure, regulatory support, and strong financial literacy among enterprises. Countries like Germany, the UK, and France are key contributors to the region's dominant position.

Asia-Pacific, however, is emerging as the fastest-growing market owing to increased SME activity, digital transformation, and the expanding reach of fintech companies. Markets like China and India are witnessing rapid growth in the adoption of invoice financing solutions.

Market Drivers

One of the primary drivers of the factoring services market is the growing integration of fintech and digital platforms into traditional finance. These technologies make it easier, faster, and more secure for businesses to manage their receivables. Additionally, the rise in SME activity, especially in developing markets, fuels the demand for accessible financing solutions.

Market Restraints

Despite its potential, the market faces constraints such as lack of awareness among small businesses in emerging economies and stringent regulations in certain regions. Also, concerns regarding fraud risks and creditworthiness of debtors can limit the adoption of factoring, especially in high-risk markets.

Market Opportunities

There are significant opportunities in the digital transformation of factoring platforms, leveraging AI, machine learning, and blockchain for enhanced transparency and risk management. Expansion into underpenetrated markets in Asia, Latin America, and Africa also presents growth avenues for both existing and new market entrants.

Reasons to Buy the Report

✔ Gain insights into the global market valuation and CAGR projections through 2031.

✔ Understand the key trends like fintech integration and blockchain adoption.

✔ Get an in-depth look at regional dynamics and market segmentation.

✔ Identify the leading players and recent developments in the industry.

✔ Make informed investment or strategy decisions backed by data-driven insights.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/34659

Frequently Asked Questions (FAQs)

How Big is the Factoring Services Market in 2024?

Who are the Key Players in the Global Factoring Services Market?

What is the Projected Growth Rate of the Market through 2031?

What is the Market Forecast for Factoring Services by 2032?

Which Region is Estimated to Dominate the Factoring Industry through the Forecast Period?

Company Insights

Key Players Operating in the Market:

• BNP Paribas

• Deutsche Factoring Bank

• HSBC Group

• Hitachi Capital Corporation

• Eurobank

• Mizuho Financial Group

• Société Générale

• Barclays Bank

• Kuke Finance Group

• Aldermore Bank

Recent Developments:

• In 2024, BNP Paribas launched a blockchain-based platform for real-time invoice tracking in factoring services.

• HSBC expanded its trade finance product offerings in Southeast Asia, focusing on cross-border factoring for SMEs.

Conclusion

The Factoring Services Market is entering a transformative phase, backed by fintech innovation and growing acceptance of alternative financing. With Europe holding the leadership position and Asia-Pacific emerging rapidly, stakeholders must focus on digital adoption, risk mitigation strategies, and client education to tap into the full market potential. Domestic factoring continues to be the bedrock of the industry, while international factoring shows promise as global trade flourishes. As the market advances towards US$ 5,680 Bn by 2031, it presents ample opportunities for players who can deliver tech-enabled, reliable, and scalable financial solutions.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Factoring Services Market Size to Grow from USD 3,725 Billion in 2024 to USD 5,680 Billion by 2031 | Persistence Market Research here

News-ID: 4102208 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

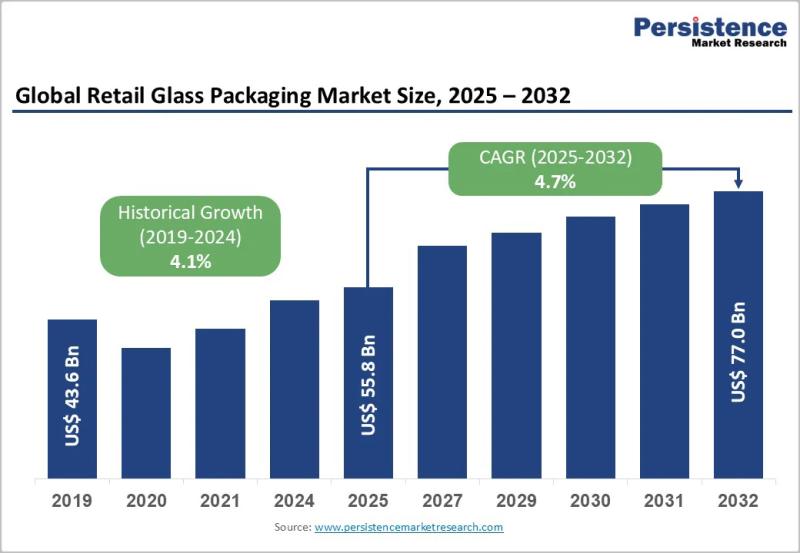

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for Factoring

Growing Reverse Factoring Adoption Boosts Market Growth: Critical Driver Shaping …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Reverse Factoring Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

Over the past few years, the reverse factoring market has seen significant growth. It is expected to increase from $539.41 billion in 2024 up to $592.1 billion in 2025, representing a compound annual growth rate…

Factoring Market Next Big Thing | Major Giants BNP Paribas, HSBC, Deutsche Facto …

HTF MI just released the Global Factoring Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Giants in Factoring Market are:

BNP Paribas, HSBC, Deutsche Factoring Bank, Eurobank,…

What's Driving the Reverse Factoring Market 2025-2034: Growing Reverse Factoring …

What Are the Projections for the Size and Growth Rate of the Reverse Factoring Market?

The market size of reverse factoring has seen significant growth over the last few years. It is projected to expand from $539.41 billion in 2024 to $592.1 billion in 2025, displaying a compound annual growth rate (CAGR) of 9.8%. The growth trajectory in the past can be linked to the increased awareness of supply chain finance…

Reverse Factoring Market

The reverse factoring market has been experiencing significant growth, with its market size accounted for USD 530.8 billion in 2022. It is projected to achieve a remarkable market size of USD 1,452.1 billion by 2032, growing at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2032. This substantial growth is driven by various market trends, emerging opportunities, and a competitive landscape that is continuously evolving.

Download Free Reverse…

Factoring Market Outlook 2024-2030: Trends and Opportunities|BNP Paribas, Deutsc …

Infinity Business Insights is providing qualitative and informative knowledge by adding the title factoring Market to recognize, describe and forecast the global market. The report provides systematic consideration analysis along with forecasts for market players. The report aims to facilitate understanding of the global factoring market forecast through statistical and numerical data in the form of tables, graphs, and charts. The study provides a calculated assessment of new recent developments,…

Factoring Services Market is Booming Worldwide | Deutsche Factoring Bank, Euroba …

The Latest Released Factoring Services market study has evaluated the future growth potential of Global Factoring Services market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers,…