Press release

$105.35 Billion by 2030: Why Revenue Cycle Management is Powering the Future of Healthcare Finance

The prominent players in the revenue cycle management market include Optum, Inc. (US), R1 RCM Inc. (US), Oracle (US), Medical Information Technology, Inc. (US), McKesson Corporation (US), Solventum (US), Experian Information Solutions, Inc. (Ireland)

What's driving the shift to intelligent revenue cycle operations?

The global [https://www.marketsandmarkets.com/Market-Reports/revenue-cycle-management-market-153900104.html?utm_source=abnewswire.com&utm_medium=paidpr&utm_campaign=revenuecyclemanagementmarket], valued at US$61.11 billion in 2025, is projected to reach US$105.35 billion by 2030, growing at a CAGR of 11.5%. This rapid growth is driven by the widespread adoption of AI-powered, cloud-based RCM platforms that optimize financial workflows, improve compliance, and reduce administrative burdens. As healthcare systems transition from fee-for-service models to value-based care, RCM has become a vital pillar in achieving financial sustainability and operational efficiency.

Download PDF Brochure: [https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=153900104&utm_source=abnewswire.com&utm_medium=paidpr&utm_campaign=revenuecyclemanagementmarket]

Why is RCM becoming a financial game-changer in healthcare?

From eligibility verification to denial management, modern RCM solutions are transforming how hospitals and clinics manage revenue. Intelligent platforms now offer real-time analytics, integrated patient engagement tools, and seamless interoperability with EHRs. For example, Optum's AI-driven RCM suite enables predictive analytics and automation to reduce denials and enhance patient collections. Similarly, Oracle's Health Cloud unifies financial, administrative, and clinical data for end-to-end revenue visibility.

What challenges does RCM solve?

Revenue cycle management addresses several core pain points across the healthcare landscape:

Streamlines billing and coding through automation and AI-assisted tools. Reduces regulatory complexity via built-in compliance with standards like ICD-10 and HL7 FHIR. Improves cash flow by optimizing claim submissions, reducing denials, and accelerating reimbursements. Enables patient-centric financial experiences with self-service portals, real-time cost estimates, and transparent billing.

Where is adoption accelerating the fastest?

Global initiatives are fueling RCM adoption in both developed and emerging markets:

United Kingdom : 90% of NHS hospital trusts had adopted Electronic Patient Records (EPR) by late 2023-paving the way for integrated RCM tools. India : The 2024-25 Union Budget allocated $10.7 billion for healthcare transformation, emphasizing digital infrastructure and access. China : The "Healthy China 2030" plan aims to double the national healthcare market to $2.4 trillion, pushing healthcare IT investments. Australia & New Zealand : Value-based care models like the Practice Incentives Programme are boosting RCM solution deployment.

Request Sample Pages : [https://www.marketsandmarkets.com/requestsampleNew.asp?id=153900104&utm_source=abnewswire.com&utm_medium=paidpr&utm_campaign=revenuecyclemanagementmarket]

Who are the key leaders-and how are they gaining ground?

Major players dominating the RCM market include Optum, Oracle, McKesson Corporation, Solventum, and Epic Systems Corporation, who collectively hold 35-45% market share. These vendors are reshaping the financial backbone of healthcare through cloud-first platforms, AI-driven workflows, and real-time decision support.

Recent innovations include:

Optum (May 2025) : Launched an AI-powered RCM platform to streamline billing and enhance revenue integrity. Oracle (Oct 2024) : Released a new Patient Portal app integrating scheduling, billing, and health record access. R1 RCM + Palantir (Mar 2025) : Introduced R37, an AI lab to automate coding and denial management. Experian + ValidMind (Feb 2025) : Partnered to strengthen regulatory compliance with model governance automation.

What's the biggest challenge-and how do we overcome it?

Despite rapid growth, IT infrastructure limitations and user resistance remain key hurdles, especially in developing regions. Many small and rural providers lack the digital literacy, internet access, and budget to implement full-scale RCM systems. Moreover, clinicians often view RCM software as overly complex or a barrier to patient care.

Addressing these issues requires:

User-friendly UIs and mobile access for low-tech environments. Training and support for frontline staff. Affordable, modular cloud solutions that scale with provider needs.

What should healthcare leaders be asking now?

Not "Should we implement RCM?"-but rather:

How can RCM solutions reduce financial leakage and administrative waste? Which AI tools best support denial prediction, coding, and claims optimization? Are our systems interoperable with national health records and payer databases? How do we ensure patient engagement throughout the revenue cycle?

Final Thought: In Automation, There Is Accuracy. In Integration, There Is Efficiency.As healthcare becomes more digital, distributed, and data-driven, revenue cycle management stands at the intersection of clinical care and financial viability. RCM platforms no longer just manage claims-they enable proactive, transparent, and value-based healthcare delivery.

In the future of care-cash flow, compliance, and care coordination all begin with intelligent RCM.

Key Market Players:

Optum (US), Oracle (US), McKesson Corporation (US), Solventum (US), Epic Systems Corporation (US), Experian (Ireland), R1 RCM Inc. (US), Conifer Health Solutions (US), Veradigm (US), eClinicalWorks (US), Cognizant (US), athenahealth (US), GeBBS (US), MEDHOST (US), FinThrive (US), Plutus Health (US), Omega Healthcare (India), Vee Healthtek (US).

For more information, [https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=153900104&utm_source=abnewswire.com&utm_medium=paidpr&utm_campaign=revenuecyclemanagementmarket]

Media Contact

Company Name: MarketsandMarkets Trademark Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=10535-billion-by-2030-why-revenue-cycle-management-is-powering-the-future-of-healthcare-finance]

Phone: 18886006441

Address:1615 South Congress Ave. Suite 103, Delray Beach, FL 33445

City: Florida

State: Florida

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/revenue-cycle-management-market-153900104.html

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release $105.35 Billion by 2030: Why Revenue Cycle Management is Powering the Future of Healthcare Finance here

News-ID: 4101613 • Views: …

More Releases from ABNewswire

MT Dunn Plumbing Expands Emergency Services in Hillsboro & Across Portland, Oreg …

MT Dunn Plumbing LLC (CCB# 234243) expands 24/7 emergency services across Hillsboro, Beaverton, Portland & Washington County. The licensed, bonded, and insured contractor provides immediate response for burst pipes, water heater failures, sewer backups, and drain clogs. Operating from Hillsboro, owner Michael T Dunn serves residential and commercial properties region-wide. Emergency contact: 503-640-2458 or mtdunnplumbing.com.

Hillsboro, OR - MT Dunn Plumbing LLC, a licensed and established plumbing contractor serving the Portland…

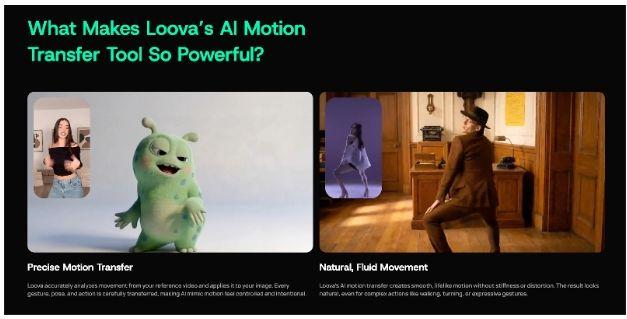

Beyond the Prompt: How Mimic Motion Architecture is Redefining the 2026 Passive …

Image: https://www.abnewswire.com/upload/2026/02/ac57e1a7b6e53a95f52ea0f18fcb990c.jpg

As we move through 2026, the digital economy is no longer just about "what" you show, but "how" it moves. Static content is losing ground to kinetic, motion-driven narratives that capture attention in seconds. At the center of this shift is Loova, whose proprietary Mimic Motion architecture has become the secret engine behind some of the most successful passive income streams this year.

This report breaks down the technical logic…

The Real Cost of Convenience: A Complete Guide to Vending Machine Startup Costs

Image: https://www.abnewswire.com/upload/2026/02/32ec9ac40420df59e70c21070d981def.jpg

The dream of earning passive income often leads aspiring entrepreneurs to the world of automated retail. It is a sector defined by low labor requirements and the ability to generate revenue around the clock. However, before you can stock your first row of snacks, you must understand the financial commitment required to get your equipment on-site. Many beginners find themselves asking how much do vending machines cost [https://dfyvending.com/vending-machine-startup-costs] as…

Benji Personal Injury Surpasses 1,000 Cases Won as California Accident Victims S …

Benji Personal Injury Accident Attorneys, A.P.C. has surpassed 1,000 personal injury cases resolved across California, reflecting a growing demand for trialready legal representation. The firm's litigationfirst approach has led to multimilliondollar verdicts and settlements, helping accident victims secure significantly higher compensation through courtroomfocused preparation.

LOS ANGELES, CA - Benji Personal Injury Accident Attorneys, A.P.C. announced today that the firm has successfully resolved over 1,000 personal injury cases, marking a significant milestone…

More Releases for RCM

RCM Matter, a TechMatter Company, Introduces Next-Gen Medical Billing & RCM Soft …

GLENDALE, CA, UNITED STATES, August 27, 2025 -- RCM Matter, a subsidiary of TechMatter, announced the launch of its flagship product, a next-generation Medical Billing and Revenue Cycle Management (RCM) software solution that's built for modern-day healthcare practices. The platform empowers providers with automation, compliance, and transparency, helping them reduce administrative stress and strengthen financial performance.

Built from the ground up with healthcare teams in mind, the RCM software offers…

Healthcare RCM Outsourcing Market Report 2024 - RCM Outsourcing Market Trends, S …

"The Business Research Company recently released a comprehensive report on the Global Healthcare RCM Outsourcing Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive…

Investigation announced for Investors in R1 RCM Inc. (NASDAQ: RCM) over potentia …

An investigation was announced over potential breaches of fiduciary duties by certain officers and directors at R1 RCM Inc.

Investors who purchased shares of R1 RCM Inc. (NASDAQ: RCM) have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm concerns whether certain R1 RCM Inc. directors breached their fiduciary duties and caused damage to the company and its shareholders.

Murray,…

Investigation announced for Investors who lost money with shares of R1 RCM Inc. …

An investigation was announced over potential securities laws violations by R1 RCM Inc. in connection with certain financial statements.

Investors who purchased shares of R1 RCM Inc. (NASDAQ: RCM), have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm focuses on possible claims on behalf of purchasers of the securities of R1 RCM Inc. (NASDAQ: RCM) concerning whether a…

Investigation announced for Investors in R1 RCM Inc. (NASDAQ: RCM) over potentia …

An investigation was announced over potential breaches of fiduciary duties by certain officers and directors at R1 RCM Inc.

Investors who purchased shares of R1 RCM Inc. (NASDAQ: RCM) have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm concerns whether certain R1 RCM Inc. directors breached their fiduciary duties and caused damage to the company and its…

Investigation announced for Investors in shares of R1 RCM Inc. (NASDAQ: RCM)

An investigation was announced over potential breaches of fiduciary duties by certain officers and directors at R1 RCM Inc.

Investors who purchased shares of R1 RCM Inc. (NASDAQ: RCM) have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm concerns whether certain R1 RCM Inc. directors breached their fiduciary duties and caused damage to the company and its shareholders.

Chicago,…