Press release

Agricultural Insurance Market Size Will Grow at a Healthy CAGR by 2033 | Along with Top Key Players: Swiss Re, XL Catlin, Munich Re, Tokio Marine Holdings, Hannover Re

According to a research report published by Spherical Insights & Consulting, the Global Agricultural Insurance Market Size is to Grow from USD 40.24 Billion in 2023 to USD 69.82 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.6% during the projected period.The Agricultural Insurance global market research studies offer an in-depth analysis of current industry trends, development models, and methodology. Production processes, development platforms, and the actual product models are some of the variables that have a direct impact on the market. The aforementioned characteristics can drastically vary in response to even minor changes in the product profile. The study provides a thorough explanation of each of these elements of Agriculture.

Request To Download Free Sample copy of the report @ https://www.sphericalinsights.com/request-sample/5396

Market Overview

Agricultural insurance is a kind of policy that shields farmers from weather-related occurrences that could harm their crops as well as other disasters. Government initiatives provide incentives, but insurance companies also provide agricultural insurance. The scope of coverage will be decided by the chosen insurance provider.

The global market is Agricultural Insurance Market robust growth due to:

• The growing frequency of droughts, floods, cyclones, and other extreme weather events has intensified the need for risk protection in agriculture.

• Many countries are promoting agricultural insurance through subsidies and policy support (e.g., India's PMFBY, U.S. Federal Crop Insurance Program).

• These initiatives are making insurance affordable and boosting adoption, particularly among small and marginal farmers.The transition from traditional farming to large-scale, commercial agriculture is increasing the demand for insurance as a financial safety net.

Buy Now this report: https://www.sphericalinsights.com/checkout/5396

Product Type Insights: Multi-Peril Crop Insurance (MPCI) to Lead Market Share

Within the product type segmentation, Multi-Peril Crop Insurance (MPCI) is projected to command the largest share of the global agricultural insurance market throughout the forecast period. This dominance stems from its comprehensive protection, which goes beyond single-risk coverage. MPCI policies shield farmers from a wide range of threats, including unfavorable weather conditions (droughts, floods, hail), pest infestations, diseases, delayed planting, and seedling emergence failure caused by topsoil issues like slaking.

This type of insurance offers continuous protection from planting to harvest, making it highly suitable for annual crops. Moreover, the growing involvement of governments-through premium subsidies and incentive-driven policies-is helping bridge the affordability gap for farmers. These interventions are especially crucial in addressing the high exposure and adverse selection risks inherent in MPCI coverage, thereby fueling broader adoption among smallholders and commercial farmers alike.

Distribution Channel Insights: Banks Driving Rapid Market Expansion

Among the distribution channels, the banking sector is expected to register the fastest growth rate in the agricultural insurance market during the projected timeframe. Banks have emerged as critical intermediaries, connecting insurers with farmers, especially in rural and underserved regions. Their extensive branch networks and deep-rooted relationships in the agricultural ecosystem make them ideal platforms for spreading awareness and facilitating insurance enrollment.

By bundling insurance with agricultural loans or offering it as part of credit packages, banks ensure wider reach and ease of access for farmers. This strategic role enhances financial inclusion and makes agricultural insurance more accessible, thereby contributing significantly to market growth. As banks continue to evolve into proactive insurance facilitators, their influence on expanding MPCI and other coverage types will intensify, particularly in emerging economies.

Leading players of Compact Agricultural Insurance Market including:

• Zurich Insurance Group

• Swiss Re

• XL Catlin

• Munich Re

• Tokio Marine Holdings

• Hannover Re

• Arch Capital Group

• Chubb Limited

• American International Group

• Aon plc

• QBE Insurance Group

• Willis Towers Watson

• Farmers Insurance Group

• Allianz SE

• Others

Market Challenges

1. Low Awareness and Financial Literacy Among Farmers

A major hurdle, especially in developing and rural regions, is the limited understanding of how agricultural insurance works. Many farmers lack awareness of the benefits, coverage options, claim processes, or even the existence of such schemes. Misconceptions and distrust about timely payouts further discourage participation.

2. High Administrative and Operational Costs

Insurers face elevated costs related to underwriting, field inspections, and claim verifications-especially in remote and smallholder-dominated geographies. These high overheads often deter private insurers from entering or expanding operations in less profitable regions.

3. Climate Change-Induced Risk Complexity

As climate patterns grow more erratic, accurately modeling and pricing agricultural risk becomes increasingly difficult. Traditional actuarial models may fall short in accounting for new, unpredictable climate dynamics-leading to either overpriced premiums or under-compensated losses.

4. Inadequate Infrastructure for Claims Verification

Efficient and transparent claims processing is critical to maintaining farmer trust. However, in many regions, the lack of digital infrastructure, satellite coverage, and field-level data delays claims and opens the door to disputes or fraud, undermining confidence in the system.

Research Objectives

To Evaluate Market Size, Trends, and Growth Forecasts: Accurately estimate the market size (historic, current, and projected) at global, regional, and country levels.

To Analyze the Adoption and Performance of Key Insurance Types: Examine the market penetration and performance of crop-hail insurance, multi-peril crop insurance (MPCI), livestock insurance, and specialty policies.

Recent Development

In February 2024, the government launched the SARATHI platform to assist insurance providers in contacting farmers. To assist insurance businesses in reaching out to farmers and the rural population with customized products as well as government-subsidized insurance products like Pradhan Mantri Fasal Bima Yojana (PMFBY), they launched a platform called SARATHI.

In September 2023, to protect Uzbekistan's climate-vulnerable farmers, the Insurance Development Forum (IDF), the United Nations Development Programme (UNDP), the German government, and the Uzbek government initiated a EUR 1.9 million project to design and implement a sovereign risk transfer scheme that includes a multi-peril indemnity insurance product.

Access Full Report: https://www.sphericalinsights.com/reports/agricultural-insurance-market

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Agricultural Insurance Market based on the below-mentioned segments:

Global Agricultural Insurance Market, By Product Type

• Crop-Hail Insurance

• Livestock Insurance

• Multi-Peril Crop Insurance (MPCI)

• Other

Global Agricultural Insurance Market, By Distribution Chanel

Insurance Companies

• Banks

• Others

Global Agricultural Insurance Market, By Application

• Siege Warfare

• Counter-Battery Fire

• Artillery Support

• Strategic Bombardment

• Others

Regional Segment Analysis of the Agricultural Insurance Market

North America (U.S., Canada, Mexico)

Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Rest of APAC)

South America (Brazil and the Rest of South America)

The Middle East and Africa (UAE, South Africa, Rest of MEA)

What's covered in the report?

1. Overview of the Agricultural Insurance Market.

2. The current and forecasted regional (North America, Europe, Asia-Pacific, Latin America, the Middle East and Africa) market size data for the Agricultural Insurance Market, based on segment.

3. Agricultural Insurance Market trends.

4. Agricultural Insurance Market drivers.

5. Analysis of major company profiles.

FIVE FORCES ANALYSIS

• Competitive Rivalry - Moderate to High

The agricultural insurance market features a mix of multinational insurers, regional providers, and government-backed schemes.

• Threat of New Entrants - Moderate

Barriers to entry include regulatory approvals, high underwriting risk, the need for reinsurance, and specialized actuarial expertise.

• Bargaining Power of Suppliers - Low to Moderate

In this market, "suppliers" include data providers (weather data, satellite imagery), reinsurers, and agri-tech vendors.

• Bargaining Power of Buyers (Farmers, Agri-businesses) - Moderate to High

Farmers-especially smallholders-are highly price-sensitive and often rely on government subsidies to afford premiums.

As awareness grows and more digital options become available, buyers will demand flexible, faster, and more transparent policies-raising their bargaining power further.

• Threat of Substitutes - Low

There are very few viable substitutes for agricultural insurance in terms of risk transfer.

Informal risk-sharing arrangements (like local cooperatives or savings groups) exist but cannot match the scope, scale, or legal protection of formal insurance.

PESTLE ANALYSIS

Government subsidies and policy interventions are key to market expansion. Programs like India's PMFBY and the U.S. Federal Crop Insurance Program lower premium costs and increase accessibility.

Political stability and rural development policies strongly influence the availability and affordability of agricultural insurance.

Economic Factors: Farmers' purchasing power and access to credit impact insurance uptake. In low-income regions, insurance demand remains highly sensitive to pricing.

Social Factors: Low awareness and financial literacy remain major challenges, especially among smallholders in emerging markets.

Technological Factors: Innovations in satellite imaging, drone surveillance, blockchain, IoT, and AI are transforming how risks are assessed and claims are processed.

Table of Content (TOC)

• Introduction

1. Objectives of the Study

2. Market Definition

3. Research Scope

• Research Methodology and Assumptions

• Executive Summary

• Premium Insights

1. Porter's Five Forces Analysis

2. Value Chain Analysis

3. Top Investment Pockets

1. Market Attractiveness Analysis By Product Type

2. Market Attractiveness Analysis By Type

3. Market Attractiveness Analysis By Segment Type

4. Market Attractiveness Analysis By Region

4. Industry Trends

• Market Dynamics

1. Market Evaluation

2. Drivers

1. Increasing development in sector

3. Restraints

4. Opportunities

5. Challenges

• Global Agricultural Insurance Market Analysis and Projection, By Product Type

• Global Agricultural Insurance Market Analysis and Projection, By Type

• Global Agricultural Insurance Market Analysis and Projection, By Segment Type

• Global Agricultural Insurance Market Analysis and Projection, By Regional Analysis

1. Segment Overview

2. North America

1. U.S.

2. Canada

3. Mexico

3. Europe

1. Germany

2. France

3. U.K.

4. Italy

5. Spain

4. Asia-Pacific

1. Japan

2. China

3. India

5. South America

1. Brazil

6. Middle East and Africa

1. UAE

2. South Africa

• Global Agricultural Insurance Market-Competitive Landscape

1. Overview

2. Market Share of Key Players in the Global Agricultural Insurance Market

1. Global Company Market Share

2. North America Company Market Share

3. Europe Company Market Share

4. APAC Company Market Share

3. Competitive Situations and Trends

1. Coverage Launches and Developments

2. Partnerships, Collaborations, and Agreements

3. Mergers & Acquisitions

4. Expansions

• Company Profiles

1. Company1

1. Business Overview

2. Company Snapshot

3. Company Market Share Analysis

4. Company Coverage Portfolio

5. Recent Developments

6. SWOT Analysis

2. Company2

1. Business Overview

2. Company Snapshot

3. Company Market Share Analysis

4. Company Coverage Portfolio

5. Recent Developments

6. SWOT Analysis

3. Company3

1. Business Overview

2. Company Snapshot

3. Company Market Share Analysis

4. Company Coverage Portfolio

5. Recent Developments

6. SWOT Analysis

Industry Related Reports

Global Agriculture Robots Market Size

https://www.sphericalinsights.com/reports/agriculture-robots-market

Global Coconut Fiber Culture Medium Market Size

https://www.sphericalinsights.com/reports/coconut-fiber-culture-medium-market

Global Plant Biotechnology Market Size,

https://www.sphericalinsights.com/reports/plant-biotechnology-market

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Agricultural Insurance Market Size Will Grow at a Healthy CAGR by 2033 | Along with Top Key Players: Swiss Re, XL Catlin, Munich Re, Tokio Marine Holdings, Hannover Re here

News-ID: 4101363 • Views: …

More Releases from Spherical Insights LLP

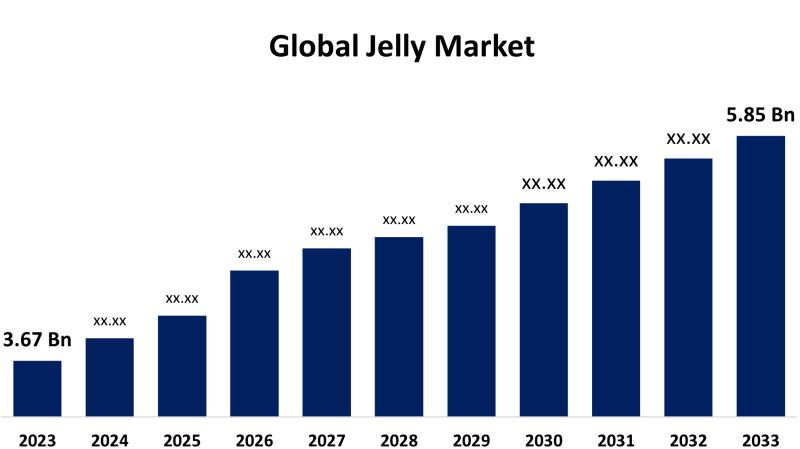

Global Jelly Market Size, Share, Forecasts 2023 - 2033 | Top key players: Bonne …

According to a research report published by Spherical Insights & Consulting, the Global Jelly Market is Expected to Grow from USD 3.67 Billion in 2023 to USD 5.85 Billion by 2033, at a CAGR of 4.77% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8511

The jelly industry comprises the international sector dealing with the manufacture, distribution, and sale of jelly products. Such products cover…

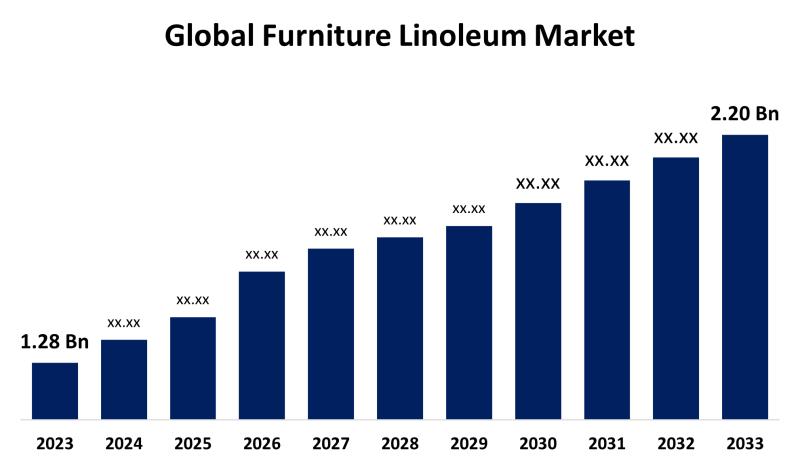

Global Furniture Linoleum Market Size, Share, Forecasts 2023 - 2033 | Top key pl …

According to a research report published by Spherical Insights & Consulting, the Global Furniture Linoleum Market Size is Estimated to Grow from USD 1.28 billion in 2023 to USD 2.20 billion by 2033, Growing at a CAGR of 5.57% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8455

The industry engaged in the manufacture, marketing, and distribution of linoleum products, especially made for furniture…

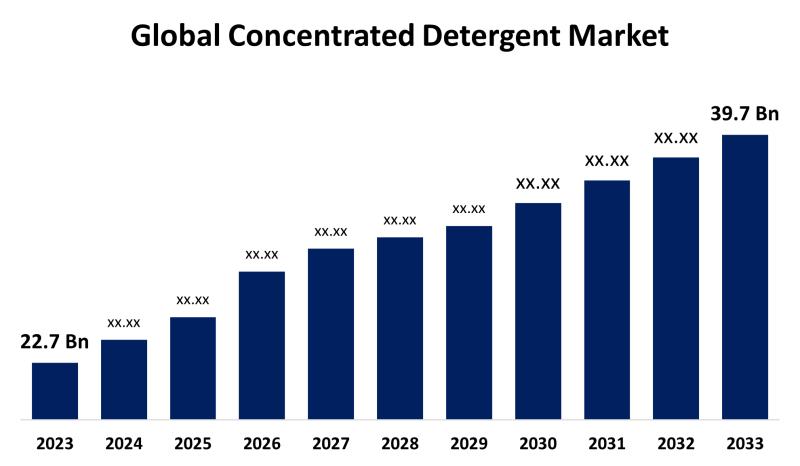

Global Concentrated Detergent Market Size, Share, Forecasts 2023 - 2033 | Top ke …

According to a research report published by Spherical Insights & Consulting, the Global Concentrated Detergent Market Size Expected to Grow from USD 22.7 Billion in 2023 to USD 39.7 Billion by 2033, at a CAGR of 5.75% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8439

The division of the detergent industry that produces and markets highly concentrated…

Global Wireless Home Weather Station Market Size, Share, Forecast 2023 - 2033 | …

According to a research report published by Spherical Insights & Consulting, the Global Wireless Home Weather Station Market Size is Expected to Grow from USD 249 Million in 2023 to USD 508 Million by 2033, at a CAGR of 7.39% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report @ -

https://www.sphericalinsights.com/request-sample/7694

A system that measures and sends environmental data from outside to within, including temperature,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…