Press release

Business Travel Accident Insurance Market: Trends, Innovations, and Future Outlook | Major Companies are Zurich Insurance Group, American International Group Inc & Tokio Marine Holdings Inc.

The Global Business Travel Accident Insurance Market is estimated to reach at a significant CAGR during the forecast period (2024-2031).The Business Travel Accident Insurance Market takes center stage in DataM Intelligence's latest comprehensive research, where industry experts deliver cutting-edge analysis powered by robust data analytics and strategic market intelligence. This groundbreaking study dives deep into the competitive ecosystem, spotlighting market leaders and their innovative approaches to product development, competitive pricing models, financial performance, and expansion strategies. The research unveils critical market forces, competitive positioning, and breakthrough trends that will define the industry's trajectory in the coming years, providing stakeholders with actionable intelligence to navigate this rapidly evolving marketplace.

Unlock exclusive insights with our detailed sample report (Please enter your Corporate Email ID to get priority access):- https://datamintelligence.com/download-sample/business-travel-accident-insurance-market?rk

Business travel accident insurance provides financial protection to employees and companies in the event of accidental injury, disability, or death that occurs during work-related travel. It typically covers:

Accidental bodily injury

Permanent or temporary disability

Accidental death

This insurance is critical for organizations whose employees frequently travel for business especially to high-risk locations or under hazardous conditions.

Key Market Trends

1. Broadening Coverage & Enhanced Benefits

Insurers are expanding offerings to include benefits like evacuation and repatriation, emergency medical support, psychological counseling, and flexible underwriting based on travel purpose and destination.

2. Demand for Tailored Solutions

Companies are seeking customized policies that reflect their travel profiles industry, geography, traveler demographics as one-size-fits-all plans become less effective.

3. Integration with Digital Platforms

Insurers are deploying mobile apps and web portals for filing claims, submitting travel itineraries, and delivering real-time alerts, streamlining the policy lifecycle and enhancing user experience.

Business Travel Accident Insurance Market: Industry Giants and Emerging Leaders:

Zurich Insurance Group

American International Group Inc.

Tokio Marine Holdings Inc.

Nationwide Mutual Insurance Company

Starr International Company Inc.

Assicurazioni Generali S.P.A.

Tata AIG General Insurance Company Limited

AWP Australia Pty Ltd.

AXA, MetLife Services and Solutions Inc

Business Travel Accident Insurance Industry News:

Technology Partnerships: Insurance carriers are collaborating with travel management companies (TMCs) and online booking tools to embed accident protection seamlessly into travel bookings.

AI‐Enhanced Claims Processing: Automated AI-based claims apps are accelerating claim resolution and fraud detection, improving efficiency and customer satisfaction.

Customized SME Policies: Tailor-made accident insurance packages for small and mid-sized enterprises are emerging, with simpler terms and modular benefits.

Research Methodology

Our comprehensive research approach leverages a dual-methodology framework that seamlessly integrates qualitative insights with quantitative data analysis to deliver robust market intelligence. The process begins with extensive secondary research, where we meticulously collect information from authoritative industry publications, proprietary databases, and verified market sources. This foundation is strengthened through targeted primary research initiatives, including strategic surveys and in-depth interviews with industry veterans, market experts, and key stakeholders.

Speak to Our Senior Analyst and Get Customization in the report as per your requirements: https://datamintelligence.com/customize/business-travel-accident-insurance-market

Segment Covered in the Business Travel Accident Insurance Market:

By Policy Type: Local Policies Only, One Global Policy, Controlled Master Program (CMP), Others

By Coverage Type: Single-Trip Travel Insurance, Multi-Trip Travel Insurance

By Distribution Channels: Insurance Company, Banks, Insurance Aggregators, Others

By End-User: Corporations, Government Bodies, International Travelers, Others

This Report Covers:

✔ Go-to-market Strategy.

✔ Neutral perspective on the market performance.

✔Development trends, competitive landscape analysis, supply side analysis, demand side analysis, year-on-year growth, competitive benchmarking, vendor identification, Market Access, and other significant analysis, as well as development status.

✔Customized regional/country reports as per request and country level analysis.

✔ Potential & niche segments and regions exhibiting promising growth covered.

✔ Top-down and bottom-up approach for regional analysis

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=business-travel-accident-insurance-market

Regional Analysis for Business Travel Accident Insurance Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Frequently asked questions:

➠ What is the global sales value, production value, consumption value, import and export of Business Travel Accident Insurance market?

➠ Who are the global key manufacturers of the Business Travel Accident Insurance Industry? How is their operating situation (capacity, production, sales, price, cost, gross, and revenue)?

➠ What are the Business Travel Accident Insurance market opportunities and threats faced by the vendors in the global Business Travel Accident Insurance Industry?

➠ Which application/end-user or product type may seek incremental growth prospects? What is the market share of each type and application?

➠ What focused approach and constraints are holding the Business Travel Accident Insurance market?

➠ What are the different sales, marketing, and distribution channels in the global industry?

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Business Travel Accident Insurance Market: Trends, Innovations, and Future Outlook | Major Companies are Zurich Insurance Group, American International Group Inc & Tokio Marine Holdings Inc. here

News-ID: 4100893 • Views: …

More Releases from DataM Intelligence 4market Research LLP

Biomass Briquette Market to Grow at 7% CAGR from 2025 to 2031, Led by North Amer …

The Biomass Briquette Market is expected to expand at a CAGR of about 7% from 2025 to 2031 as industries and households increasingly adopt sustainable and eco‐friendly solid fuel alternatives to traditional fossil fuels, driven by rising energy demand and environmental concerns.

Growth is supported by increasing demand across key applications such as industrial fuel, power generation, cooking fuel, and residential heating, driven by abundant agricultural and forestry residues that are…

Protein Engineering Market to Grow at 15.6% CAGR from 2025 to 2033, Driven by No …

The global protein engineering market reached US$ 2,854.54 Million in 2024 and is expected to reach US$ 8,646.10 Million by 2033, growing at a CAGR of 15.6 % from 2025 ro 2033 as demand for tailored biological solutions accelerates across pharmaceuticals, biotechnology, diagnostics, and industrial applications.

Growth is supported by increasing adoption of advanced protein modification, design and synthesis techniques to develop high‐efficacy therapeutics, enzymes, and biomaterials, driven by rising…

Substation Automation Market to Reach USD 67B by 2031 at 6.5% CAGR | Driven by R …

According to DataM Intelligence, the Substation Automation Market reached USD 41 billion in 2022 and is expected to reach USD 67 billion by 2031, growing at a CAGR of 6.5% during the forecast period (2024-2031).The global Substation Automation Market is undergoing a significant transformation as utilities and grid operators modernize aging infrastructure and transition toward digital substations. Substation automation systems (SAS) integrate intelligent electronic devices (IEDs), communication networks, SCADA platforms,…

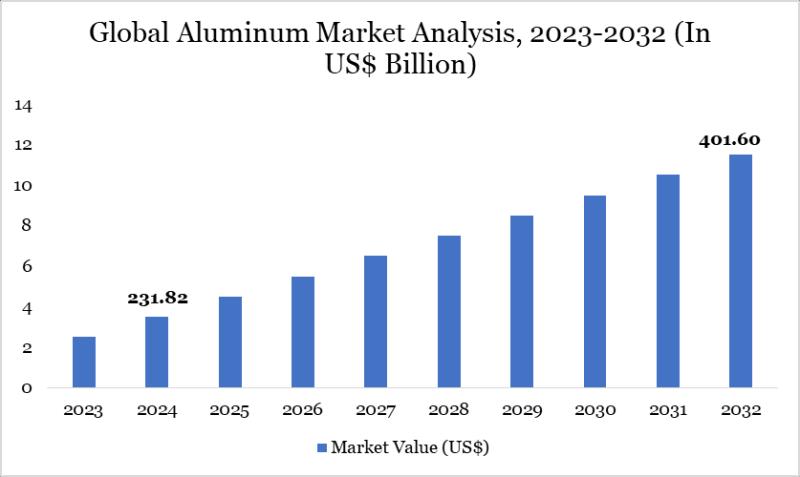

Aluminum Market to Reach US$ 401.60 Billion by 2032 Driven by Infrastructure Gro …

The Aluminum Market reached US$ 231.82 billion in 2024 and is expected to reach US$ 401.60 billion by 2032, growing at a CAGR of 7.11% during the forecast period 2025-2032.

Growth is driven by rising demand across construction, automotive, aerospace, packaging, and electrical industries, where aluminum is valued for its lightweight properties, corrosion resistance, high strength-to-weight ratio, and recyclability. Increasing focus on vehicle lightweighting, electric vehicle production, and sustainable packaging solutions…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…