Press release

Europe Online Banking Market Size, Growth Factors, Historical Analysis and Industry Segments Forecast - 2032

Introduction:The Online Banking Market is experiencing a period of robust growth, driven by a confluence of factors reshaping the financial services landscape. Technological advancements, particularly in mobile computing, secure data transmission, and user interface design, are key catalysts. The increasing sophistication of digital security measures, including biometric authentication and advanced encryption, is building consumer trust and encouraging wider adoption. Furthermore, the demand for convenient and accessible financial services is skyrocketing, especially among younger demographics who prioritize digital-first experiences. This demand is fueled by the desire to manage finances anytime, anywhere, without the constraints of traditional banking hours or geographical limitations. The growing global internet penetration rate and the proliferation of smartphones are further expanding the reach of online banking services. The market's role in addressing global challenges is significant. Online banking promotes financial inclusion by providing access to banking services for individuals in remote or underserved areas. It reduces the need for physical bank branches, lowering operational costs and enabling banks to offer more competitive pricing. Moreover, online banking supports sustainability by reducing paper consumption and minimizing the environmental impact associated with physical transactions. The shift towards digital banking also contributes to increased efficiency and transparency in financial transactions, facilitating better tracking and management of funds. The COVID-19 pandemic served as a significant accelerant, compelling individuals and businesses to embrace online banking as a necessity rather than an option. This has resulted in a permanent shift in consumer behavior and a greater appreciation for the convenience and safety of online financial services. The online banking market continues to evolve with the integration of artificial intelligence, blockchain technology, and personalized financial management tools, promising even greater efficiency, security, and customer satisfaction in the years to come.

Get the full PDF sample copy of the report: (TOC, Tables and figures, and Graphs) https://www.consegicbusinessintelligence.com/request-sample/1395

Market Size:

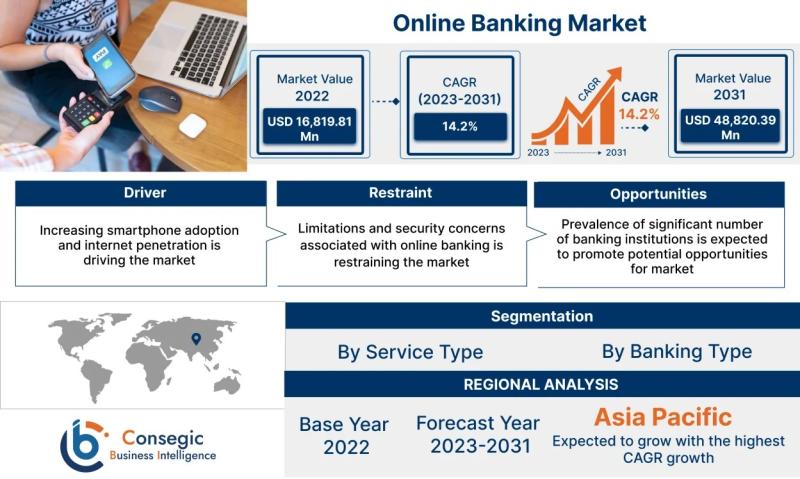

The Online Banking Market size is estimated to reach over USD 48,820.39 Million by 2031 from a value of USD 16,819.81 Million in 2023, growing at a CAGR of 14.2% from 2024 to 2031.

Definition of Market:

The Online Banking Market encompasses the provision of banking services through digital channels, primarily the internet. It allows customers to access and manage their accounts, conduct transactions, and perform various financial activities remotely using computers, smartphones, or other connected devices. This market includes a range of products, services, and systems designed to facilitate secure and convenient online banking experiences.

Key terms related to the market include:

Digital Banking Platform: The software and infrastructure that enable online banking services.

Online Account Management: Tools for viewing account balances, transaction history, and statements.

Online Bill Payment: Services for paying bills electronically through the online banking platform.

Funds Transfer: The ability to transfer money between accounts or to external recipients.

Mobile Banking Apps: Applications that provide access to online banking services on smartphones and tablets.

Security Protocols: Measures like encryption, multi-factor authentication, and fraud detection systems that protect online banking transactions.

Customer Support: Assistance provided to online banking customers through various channels like email, chat, or phone.

Regulatory Compliance: Adherence to legal and industry standards related to data privacy, security, and consumer protection.

Get Discount On Report @ https://www.consegicbusinessintelligence.com/request-discount/1395

Market Scope and Overview:

The scope of the Online Banking Market is broad, encompassing a wide array of technologies, applications, and industries. It includes the development and implementation of secure digital banking platforms, mobile banking applications, online payment systems, and customer support tools. The market caters to diverse applications, ranging from basic account management and fund transfers to complex investment transactions and loan applications. The industries served include retail banking, corporate banking, investment banking, and credit unions, all of which leverage online banking to enhance customer service, improve operational efficiency, and expand their market reach. The technologies underpinning this market include advanced encryption, biometric authentication, artificial intelligence (AI) for fraud detection and personalized services, cloud computing for scalable infrastructure, and blockchain for secure transaction processing. Furthermore, regulatory technologies (RegTech) are increasingly important for ensuring compliance with evolving data privacy and security standards.

The Online Banking Market plays a pivotal role in the larger context of global trends. It is closely linked to the growing digitalization of the global economy, the increasing adoption of mobile devices, and the rising demand for seamless and personalized customer experiences. It supports the trend towards cashless societies by promoting electronic payments and reducing the reliance on physical currency. Furthermore, online banking is crucial for enabling financial inclusion by providing access to banking services for individuals who may be underserved by traditional banking infrastructure. The market contributes to sustainability by reducing paper consumption and minimizing the environmental impact associated with physical bank branches. In an era of increasing globalization, online banking facilitates cross-border payments and international transactions, connecting individuals and businesses across the world. The Online Banking Market is therefore a vital component of the modern financial ecosystem, driving innovation, enhancing efficiency, and empowering individuals and businesses to manage their finances more effectively.

Market Segmentation:

The Online Banking Market can be segmented based on several factors. Here's a breakdown of the key segments:

By Service Type:

Informational Services: This segment includes services that provide customers with information about their accounts, transaction history, interest rates, and other relevant financial data.

Transactional Services: This segment encompasses services that allow customers to conduct financial transactions online, such as fund transfers, bill payments, and online purchases.

Communicative Services: This segment includes communication channels like email, chat, and secure messaging that enable customers to interact with the bank for inquiries, support, and feedback.

By Banking Type:

Corporate Banking: This segment focuses on providing online banking services to businesses and corporations, including cash management, online payments, and trade finance.

Retail Banking: This segment caters to individual customers, offering services like online account access, bill payments, and personal loan applications.

Investment Banking: This segment provides online services for investment-related activities, such as online trading, portfolio management, and access to investment research.

Each of these segments contributes to the overall growth of the Online Banking Market by catering to different customer needs and offering specialized services.

Market Drivers:

The following factors are driving growth in the Online Banking Market:

Technological Advancements: Ongoing innovation in digital technologies, such as mobile computing, cloud services, AI, and blockchain, is enhancing the capabilities and security of online banking platforms.

Increasing Internet and Smartphone Penetration: The growing number of internet users and smartphone owners worldwide is expanding the potential customer base for online banking services.

Demand for Convenience and Accessibility: Customers increasingly prefer the convenience of managing their finances anytime, anywhere, without the limitations of traditional banking hours or locations.

Cost Reduction: Online banking reduces operational costs for banks by minimizing the need for physical branches and staff, leading to improved profitability.

Government Initiatives: Government policies promoting digital payments and financial inclusion are encouraging the adoption of online banking services.

Impact of COVID-19 Pandemic: The pandemic accelerated the shift towards online banking as individuals and businesses sought contactless financial services.

Market Key Trends:

Significant market trends include:

Mobile-First Banking: A growing emphasis on mobile banking apps and mobile-optimized online banking platforms.

AI-Powered Banking: The use of artificial intelligence for fraud detection, personalized financial advice, and improved customer service.

Biometric Authentication: Increasing adoption of biometric methods like fingerprint and facial recognition for secure access to online banking accounts.

Open Banking: The sharing of customer financial data with third-party providers to enable innovative financial services and personalized experiences.

Blockchain Integration: Exploring the use of blockchain technology for secure and transparent transactions.

Personalized Banking Experiences: Tailoring online banking services and offerings to individual customer needs and preferences.

Market Opportunities:

The Online Banking Market presents several growth opportunities:

Expansion into Emerging Markets: Providing online banking services to underserved populations in developing countries.

Development of New and Innovative Services: Creating value-added services like personalized financial planning tools, investment advisory, and mobile payments.

Enhanced Security Measures: Investing in advanced security technologies to protect against cyber threats and fraud.

Partnerships with Fintech Companies: Collaborating with innovative fintech firms to offer cutting-edge online banking solutions.

Integration of AI and Machine Learning: Leveraging AI and machine learning to automate processes, personalize services, and improve risk management.

Market Restraints:

The Online Banking Market faces several challenges:

Security Concerns: The risk of cyberattacks, data breaches, and fraud remains a significant concern for online banking users.

Digital Literacy: Lack of digital literacy among certain segments of the population can hinder the adoption of online banking.

Internet Access and Infrastructure: Limited internet access and unreliable infrastructure in some regions can restrict the reach of online banking services.

Regulatory Compliance: Compliance with evolving regulations related to data privacy, security, and consumer protection can be complex and costly.

Resistance to Change: Some customers may be resistant to adopting online banking due to unfamiliarity or concerns about technology.

Market Challenges:

The Online Banking Market, while demonstrating significant growth and potential, faces a myriad of complex challenges that require careful navigation and proactive solutions. Security remains a paramount concern. The increasing sophistication of cyber threats, including phishing attacks, malware, and ransomware, poses a constant risk to customer data and financial assets. Banks must continuously invest in advanced security technologies, such as multi-factor authentication, behavioral biometrics, and AI-powered threat detection systems, to stay ahead of cybercriminals. Moreover, ensuring the privacy and confidentiality of customer data is critical, particularly in light of evolving data privacy regulations like GDPR and CCPA. Building and maintaining customer trust in the security and privacy of online banking platforms is essential for fostering wider adoption and sustained growth.

Another significant challenge lies in bridging the digital divide. While internet access and smartphone penetration are increasing globally, disparities persist, particularly in developing countries and among certain demographic groups. Limited access to reliable internet connectivity and a lack of digital literacy can hinder the adoption of online banking services. Banks need to develop strategies to reach underserved populations, such as providing simplified online banking interfaces, offering digital literacy training programs, and partnering with community organizations to promote digital inclusion. Regulatory compliance presents another layer of complexity. The financial services industry is subject to stringent regulations designed to protect consumers, prevent money laundering, and ensure financial stability. Online banking platforms must comply with a multitude of regulations, including KYC (Know Your Customer), AML (Anti-Money Laundering), and data protection laws. Keeping abreast of evolving regulatory requirements and implementing robust compliance frameworks can be a significant challenge, particularly for smaller banks and credit unions. Furthermore, competition from fintech companies and other non-traditional players is intensifying. Fintech firms are disrupting the financial services industry with innovative solutions that often provide a more seamless and user-friendly experience than traditional online banking platforms. Banks need to adapt to this changing landscape by embracing innovation, collaborating with fintech firms, and developing new and differentiated online banking services. Finally, managing the operational risks associated with online banking is crucial. This includes ensuring the reliability and stability of online banking platforms, preventing system outages, and mitigating the risks associated with third-party vendors. Banks need to implement robust risk management frameworks, conduct regular security audits, and invest in disaster recovery planning to minimize operational disruptions and protect customer assets.

Market Regional Analysis:

The Online Banking Market exhibits varying dynamics across different regions. North America and Europe are mature markets with high internet penetration and widespread adoption of online banking services. These regions are characterized by sophisticated digital infrastructure, stringent regulatory frameworks, and a focus on innovation and security. The Asia-Pacific region is experiencing rapid growth, driven by increasing internet and smartphone penetration, a large unbanked population, and government initiatives promoting digital financial inclusion. China and India are key markets in this region, with a significant number of new online banking users. Latin America is also showing strong growth, driven by increasing mobile adoption and a growing middle class. However, challenges remain in terms of internet access and digital literacy. The Middle East and Africa are emerging markets with significant potential for growth, driven by increasing mobile penetration and a young, tech-savvy population. However, challenges remain in terms of infrastructure, regulatory frameworks, and security concerns.

Frequently Asked Questions:

What is the projected growth rate of the Online Banking Market?

The Online Banking Market is projected to grow at a CAGR of 14.2% from 2024 to 2031.

What are the key trends in the Online Banking Market?

Key trends include mobile-first banking, AI-powered banking, biometric authentication, open banking, and blockchain integration.

What are the most popular Market types in Online Banking?

Informational Services, Transactional Services, and Communicative Services.

Our Other Pages

https://www.linkedin.com/company/campaign-insight-grid

https://www.linkedin.com/company/marketing-analytics-grid

https://www.linkedin.com/company/insight-driven-digital/

https://www.linkedin.com/company/nexgen-digital-lab/

https://www.linkedin.com/company/market-techpulse/

Contact Us:

Consegic Business intelligence Pvt Ltd

Baner Road, Baner, Pune, Maharashtra - 411045

+1-252-552-1404

info@consegicbusinessintelligence.com

sales@consegicbusinessintelligence.com

Web - https://www.consegicbusinessintelligence.com/

About Us:

Consegic Business Intelligence is a data measurement and analytics service provider that gives the most exhaustive and reliable analysis available of global consumers and markets. Our research and competitive landscape allow organizations to record competing evolutions and apply strategies accordingly to set up a rewarding benchmark in the market. We are an intellectual team of experts working together with the winning inspirations to create and validate actionable insights that ensure business growth and profitable outcomes.

We provide an exact data interpretation and sources to help clients around the world understand current market scenarios and how to best act on these learnings. Our team provides on-the-ground data analysis, Portfolio Expansion, Quantitative and qualitative analysis, Telephone Surveys, Online Surveys, and Ethnographic studies. Moreover, our research reports provide market entry plans, market feasibility and opportunities, economic models, analysis, and an advanced plan of action with consulting solutions. Our consumerization gives all-inclusive end-to-end customer insights for agile, smarter, and better decisions to help business expansion.

Connect with us on:

LinkedIn - https://www.linkedin.com/company/consegic-business-intelligence/

YouTube - https://www.youtube.com/@ConsegicBusinessIntelligence22

Facebook - https://www.facebook.com/profile.php?id=61575657487319

X - https://x.com/Consegic_BI

Instagram - https://www.instagram.com/cbi._insights/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Europe Online Banking Market Size, Growth Factors, Historical Analysis and Industry Segments Forecast - 2032 here

News-ID: 4099240 • Views: …

More Releases from Consegic Business Intelligence Pvt. Ltd

Europe Pharmaceutical Manufacturing Equipment Market 2025 Industry Updates, Futu …

Introduction:

The Pharmaceutical Manufacturing Equipment Market is experiencing robust growth, driven by a confluence of factors reshaping the landscape of pharmaceutical production. Increasing global demand for pharmaceuticals, fueled by an aging population and the rise of chronic diseases, necessitates advanced and efficient manufacturing processes. Technological advancements, such as continuous manufacturing, automation, and digitalization, are revolutionizing traditional methods, improving production efficiency, reducing costs, and enhancing product quality. Stringent regulatory requirements and the…

Europe Vibration Damping Materials Market Size 2025 Overview, Manufacturers, Typ …

Introduction:

The Vibration Damping Materials market is experiencing significant growth, driven by the increasing demand for noise and vibration reduction across various industries. Key drivers include stringent environmental regulations, the growing automotive industry, particularly the electric vehicle (EV) sector, and the need for enhanced comfort and safety in residential and commercial buildings. Technological advancements in materials science are also playing a pivotal role, with the development of more efficient and durable…

Europe Lightweight Aggregates Market Size 2025 Emerging Technologies, Opportunit …

Introduction:

The Lightweight Aggregates Market is experiencing substantial growth driven by several key factors. Primarily, the increasing demand for sustainable and eco-friendly construction materials is fueling the adoption of lightweight aggregates. These materials offer superior insulation properties, reduced transportation costs, and contribute to the overall reduction of the carbon footprint of construction projects. Technological advancements in the production and application of lightweight aggregates are also playing a crucial role, enhancing their…

Europe Visible Light Communication Market Share, Growth, Size, Industry Trends, …

Introduction:

The Visible Light Communication (VLC) market is experiencing significant growth, driven by the increasing demand for faster, more secure, and energy-efficient communication technologies. VLC leverages light waves for data transmission, offering a complementary solution to traditional radio frequency (RF) based wireless communication. Key drivers include the proliferation of LED lighting, growing concerns about RF spectrum congestion, and the need for secure communication in sensitive environments. Technological advancements, such as improved…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…