Press release

U.S. Private Banking Market to Reach US$ 218.4 Bn by 2032 with 8.0% CAGR Growth Fueled by Wealth Expansion and Personalized Services

✅Overview of the MarketThe U.S. private banking market is undergoing significant transformation as rising wealth among high-net-worth individuals (HNWIs), digitalization, and a growing demand for tailored financial services continue to reshape the industry. Private banking in the U.S. refers to personalized financial and investment services delivered to affluent clients, typically offering exclusive access to wealth management, tax planning, estate planning, and customized credit solutions. These services are delivered by dedicated relationship managers and supported by robust financial infrastructure, ensuring a high level of client engagement and retention.

As per the latest findings by Persistence Market Research, the U.S. private banking market is projected to grow from US$ 127.6 Bn in 2025 to US$ 218.4 Bn by 2032, at a CAGR of 8.0%. The market's expansion is largely driven by the rising number of HNWIs, the emergence of tech-savvy millennial investors, and increased interest in ESG (environmental, social, and governance)-focused portfolios. Among various services offered, wealth and investment management remains the leading segment due to growing asset diversification needs. Geographically, New York and California dominate the market owing to their dense concentration of ultra-high-net-worth individuals (UHNWIs), financial institutions, and startup ecosystems.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/35230

✅Key Market Insights

➤ The U.S. private banking market is witnessing a shift from product-centric to client-centric models, emphasizing long-term relationship value.

➤ Personalized digital platforms and robo-advisory tools are becoming essential in private banking services.

➤ ESG investing and sustainable finance are becoming critical decision points for affluent investors.

➤ Family office services and intergenerational wealth planning are gaining traction as clients seek long-term legacy preservation.

➤ The integration of AI and predictive analytics is enhancing risk assessment, investment strategy, and customer experience.

✅What services are typically offered by private banks in the U.S.?

U.S. private banks offer a broad spectrum of exclusive financial services tailored to high-net-worth clients. These include wealth and investment management, estate planning, trust services, tax optimization, philanthropic advisory, and personalized lending. Private banks provide dedicated relationship managers who work closely with clients to design bespoke financial strategies aligned with their risk appetite and long-term goals. With the rise of digital platforms, many institutions also offer 24/7 access to investment insights, real-time portfolio tracking, and AI-driven advisory services, making the overall experience more sophisticated and client-oriented.

✅Market Dynamics

Market Drivers:

The rising population of high-net-worth individuals in the U.S. is a primary growth driver for the private banking sector. According to global wealth reports, the U.S. continues to lead in HNWI numbers, creating a fertile ground for wealth advisory services. Furthermore, the increasing complexity of financial portfolios, global investment opportunities, and generational wealth transfers are prompting individuals to seek expert financial guidance.

Market Restraining Factor:

High regulatory scrutiny and compliance costs continue to be significant challenges. The need to meet Know Your Customer (KYC), Anti-Money Laundering (AML), and fiduciary responsibilities can strain operational budgets. Additionally, market volatility, especially in response to macroeconomic events and policy shifts, can impact asset performance and investor confidence.

Key Market Opportunity:

Digital transformation presents a lucrative opportunity. Private banks can enhance customer experiences by integrating AI, big data, and mobile platforms to offer proactive advisory and seamless service delivery. Moreover, targeting the emerging millennial wealth segment with digital-first, values-driven offerings can open up new growth avenues.

✅Market Segmentation

The U.S. private banking market can be segmented based on service type and client type. Service-wise, the market includes wealth and investment management, tax planning, estate and succession planning, credit and lending services, and philanthropic advisory. Among these, wealth and investment management account for the largest share, driven by increasing interest in diversified portfolios, alternative investments, and real-time risk management. Estate and succession planning are also becoming essential, especially among aging HNWIs who wish to secure financial legacies for future generations.

Client segmentation includes high-net-worth individuals (HNWIs), ultra-high-net-worth individuals (UHNWIs), business owners, corporate executives, and family offices. HNWIs represent the largest client group, while UHNWIs and family offices are increasingly demanding holistic, multi-generational solutions. Business owners and executives are turning to private banks for tailored credit services, cash flow optimization, and strategic investment advisory. The diverse needs of these client segments are prompting private banks to offer customized and highly specialized solutions that go beyond traditional asset management.

✅Regional Insights

Geographically, New York, California, Texas, and Florida dominate the U.S. private banking market. New York remains the epicenter of financial activity with a high concentration of global banks, asset managers, and UHNWIs. California, particularly Silicon Valley and Los Angeles, accounts for substantial wealth generated from technology, entertainment, and real estate. Florida and Texas are emerging hubs due to favorable tax policies and growing populations of wealthy retirees and business migrants. These regions are witnessing increased investments in private banking infrastructure, including boutique wealth firms and digital-first advisory platforms, making them strategic hotspots for future growth.

✅Competitive Landscape

The U.S. private banking industry is characterized by a mix of global financial institutions, regional banks, and specialized wealth management firms. Companies are focusing on expanding service portfolios, leveraging technology, and building long-term relationships to differentiate themselves in an increasingly competitive market.

✅Company Insights

✦ JPMorgan Chase & Co.

✦ Bank of America Private Bank

✦ Morgan Stanley Wealth Management

✦ Citigroup Inc.

✦ Goldman Sachs Private Wealth Management

✦ Wells Fargo Private Bank

✦ Northern Trust Corporation

✦ BNY Mellon Wealth Management

✦ Charles Schwab Private Client

✦ Raymond James Financial Inc.

For Customized Insights on Segments, Regions, or Competitors, Request Personalized Purchase Options @ https://www.persistencemarketresearch.com/request-customization/35230

✅Key Industry Developments

Private banking institutions in the U.S. are aggressively expanding their digital capabilities. JPMorgan Chase has introduced advanced digital advisory tools powered by AI and machine learning, enabling real-time portfolio insights and predictive risk management. Similarly, Goldman Sachs has invested heavily in its Marcus platform to deliver streamlined, digital-first banking and investment services.

Another significant trend is the growing emphasis on sustainability and impact investing. Many private banks now offer ESG-focused investment strategies, recognizing the growing demand among HNWIs and next-gen investors for responsible capital deployment. Family offices are also seeking advisory on sustainable philanthropy and climate-positive portfolios, prompting banks to integrate ESG metrics into core advisory frameworks.

✅Innovation and Future Trends

Technological innovation is reshaping the U.S. private banking sector. AI, blockchain, and predictive analytics are being integrated to enhance risk assessment, client profiling, and real-time decision-making. Relationship managers are now supported by digital assistants that streamline research, compliance checks, and investment forecasting, enabling faster and more accurate client service. Banks are also developing customized mobile apps offering 24/7 access to wealth dashboards, live investment tracking, and interactive communication tools.

Looking ahead, the rise of intergenerational wealth transfer is expected to be a major market driver. Private banks are positioning themselves as long-term financial partners to families by offering legacy planning, family governance, and educational tools for younger inheritors. As client demographics shift, institutions that blend digital convenience with personalized advisory, socially responsible investing, and multigenerational planning will lead the next phase of growth in the U.S. private banking market.

✅Explore the Latest Trending "Exclusive Article" @

• https://industrywire.news.blog/2025/07/09/halal-cosmetics-market-expands-as-consumers-demand-clean-beauty/

• https://medium.com/@apnewsmedia/halal-cosmetics-market-trends-reshape-global-skincare-industry-56dc64e8c0b4

• https://vocal.media/stories/halal-cosmetics-market-sees-surge-in-male-grooming-products

• https://webrankmedia.blogspot.com/2025/07/halal-cosmetics-market-booms-with.html

• https://www.manchesterprofessionals.co.uk/article/marketing-pr/97322/halal-cosmetics-market-shifts-as-gen-z-drives-ethical-purchasing

✅Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

✅About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Private Banking Market to Reach US$ 218.4 Bn by 2032 with 8.0% CAGR Growth Fueled by Wealth Expansion and Personalized Services here

News-ID: 4098697 • Views: …

More Releases from Persistence Market Research

Agriculture Packaging Market Set for Expansion to US$9.7 Bn by 2033 Driven by Su …

Market Introduction: The Rising Need for Advanced Agriculture Packaging

The agriculture sector is undergoing a rapid transformation, driven by increasing global food demand, modern farming practices, and rising concerns over product protection and sustainability. Packaging plays a critical role in preserving the quality, shelf life, and safety of agricultural inputs such as fertilizers, seeds, pesticides, and biologics. As agricultural supply chains become more complex and globally connected, the need for durable,…

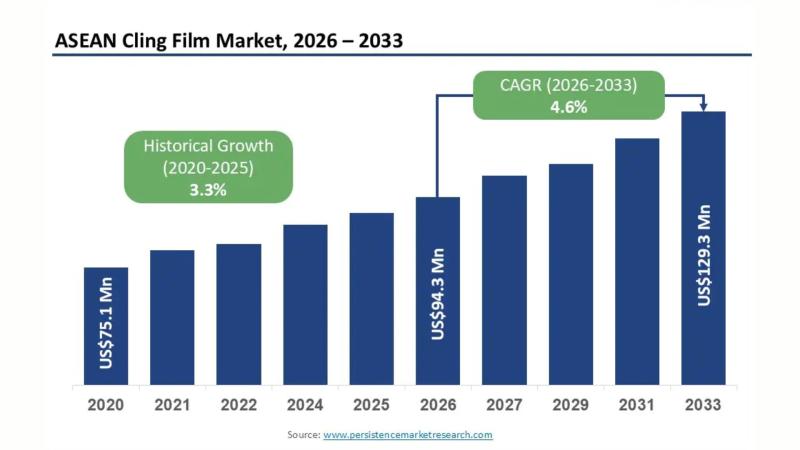

ASEAN Cling Film Market Poised to Reach US$129.8 Mn by 2033 Driven by Food Packa …

Introduction: Rising Demand for Flexible Food Packaging in ASEAN

The ASEAN cling film market has gained significant traction in recent years, primarily due to the expanding food industry and changing consumer lifestyles across Southeast Asia. Cling films, widely used for food wrapping and preservation, have become essential in both household and commercial food packaging applications. With urbanization accelerating and modern retail formats expanding rapidly, demand for convenient and hygienic food storage…

Transformer Oil Market Forecast to Climb to US$4.5Bn Growth by 2032, Driven by R …

Introduction: Transformer Oil as the Backbone of Power Systems

Transformer oil plays a vital role in electrical power systems by providing insulation, cooling, and protection to transformers and other electrical equipment. As global electricity consumption rises due to industrialization, urban expansion, and digital transformation, the demand for reliable power infrastructure continues to surge. Transformers, being at the heart of electricity transmission and distribution networks, require high-performance insulating oils to ensure operational…

Electrical Steel Market on Course to Reach US$73.3 Bn by 2032 Driven by EV Motor …

Market Overview: Rising Demand for High-Performance Electrical Steel

The electrical steel market has emerged as a critical segment of the global steel industry, driven by its indispensable role in manufacturing energy-efficient electrical equipment. Electrical steel, also known as silicon steel, is specially designed to exhibit superior magnetic properties, making it essential for transformers, generators, motors, and emerging EV powertrains. With global electrification accelerating across industries, demand for electrical steel continues to…

More Releases for Private

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private asset management,private wealth management firms,middle market private e …

Private asset management is the management of assets on behalf of private individuals, families, or institutions. It involves the creation of a customized investment strategy to achieve specific financial goals, such as wealth preservation, growth, income generation, or a combination of these objectives. The assets managed can include cash and cash equivalents, stocks, bonds, real estate, private equity, and alternative investments.

https://tendawholesale.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private asset management is typically provided by…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Financing Consulting, China Private Equity Investment Corpo …

Pandacu China is a venture capital firm that focuses on early-stage investments in technology companies based in China. The firm was founded in 2015 by a group of experienced venture capitalists and entrepreneurs who have a deep understanding of the Chinese market and a strong network of contacts in the tech industry.

http://pandacuads.com/

China Private Equity Financing Consulting

Email:nolan@pandacuads.com

Pandacu China's mission is to help innovative and ambitious entrepreneurs turn their ideas into successful…