Press release

Saudi Arabia Facility Management Market to Reach USD 1,540 Million by 2033, Growing at 8.60% CAGR

Saudi Arabia Facility Management Market OverviewMarket Size in 2024 : USD 730 Million

Market Size in 2033: USD 1,540 Million

Market Growth Rate 2025-2033: 8.60%

According to IMARC Group's latest research publication,"Saudi Arabia Facility Management Market Report by Type of Facility Management (In-house Facility Management, Outsourced Facility Management), Offering Type (Hard FM, Soft FM), End Use Industry (Commercial and Retail, Manufacturing and Industrial, Government, Infrastructure, and Public Entities, Institutional, and Others), and Region 2025-2033", Saudi Arabia facility management market size reached USD 730 Million in 2024. Looking forward, the market is expected to reach USD 1,540 Million by 2033, exhibiting a growth rate (CAGR) of 8.60% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-facility-management-market/requestsample

Growth Factors in the Saudi Arabia Facility Management Market

Rapid Urbanization and Infrastructure Development

A major driver of the facility management market's expansion in Saudi Arabia is the country's fast urbanization, which is fueled by population expansion and large-scale infrastructure projects. With mega-projects like NEOM, the Red Sea Project, and Qiddiya necessitating sophisticated facility management to maintain complex infrastructure, major cities like Riyadh, Jeddah, and Dammam are growing. For example, to guarantee smooth operations, the futuristic city project NEOM requires cutting-edge services like energy management, security, and HVAC maintenance. In order to maintain residential, commercial, and public facilities and ensure sustainability and efficiency throughout Saudi Arabia's expanding urban landscape, these developments raise the demand for professional facility management.

Vision 2030 and Economic Diversification

One of the main factors propelling the facility management market is the Saudi Vision 2030 initiative, which aims to diversify the economy and lessen reliance on oil. The government is encouraging infrastructure development that necessitates strong facility management services by encouraging growth in non-oil industries like tourism, healthcare, and education. For instance, the establishment of hotels and resorts has increased demand for services like cleaning, security, and maintenance as a result of the Ministry of Tourism's $4 billion investment in a tourism development fund, which was announced in 2020. This change in the economy pushes facility management companies to provide specialized services, assisting the Kingdom's development into a major international center.

Increasing Demand for Outsourcing

The Saudi Arabian facility management market is expanding as a result of the growing trend of outsourcing non-core business operations. Businesses in a variety of sectors, including healthcare and commercial, are turning to specialized providers to handle things like security, janitorial services, and property management so they can concentrate on their core competencies. Large companies like Saudi Aramco, for example, have been outsourcing facility management more and more to companies like Enova Facilities Management, which improved service delivery for the Kinan project by introducing digital tools. Businesses can cut expenses, increase productivity, and gain access to knowledge through outsourcing, which increases demand for integrated facility management solutions throughout the Kingdom.

Key Trends in the Saudi Arabia Facility Management Market

Adoption of Smart Building Technologies

The market for facility management in Saudi Arabia is changing as a result of the incorporation of cutting-edge technologies like artificial intelligence (AI), data analytics, and the Internet of Things (IoT). By enabling real-time monitoring of occupancy rates, equipment performance, and energy consumption, these technologies improve operational efficiency. For instance, IoT sensors placed in Riyadh's business buildings gather information to improve HVAC systems and cut down on energy waste. Predictive analytics is being used by firms like CBRE to foresee maintenance requirements and reduce downtime. This trend is in line with Saudi Arabia's efforts to create smart cities, like the New Murabba project, which calls for technologically advanced facility management systems.

Focus on Sustainability and Green Practices

The Saudi Green Initiative and the environmental objectives of Vision 2030 have made sustainability a prominent trend in the Saudi facility management market. To satisfy customer demands and legal requirements, facility management companies are implementing eco-friendly procedures like waste minimization plans and energy-efficient systems. For example, facility managers must use green building techniques, such as LEED-certified operations, as part of the NEOM project, which is fully powered by renewable energy. In addition to lowering carbon footprints, this emphasis on sustainability raises property values and draws investors and tenants to ecologically conscious establishments throughout the Kingdom.

Strategic Partnerships and Market Consolidation

In order to improve service offerings and competitiveness, the Saudi Arabian facility management market is seeing a shift toward strategic alliances and mergers. Local and foreign companies are working together to pool their knowledge and diversify their holdings. One prominent instance is Alesayi Holding Group's September 2023 purchase of an 85% share in Initial Saudi Group, which was made in response to the expanding need for human resources services under the Vision 2030 framework. Through these collaborations, businesses can provide large-scale projects and integrated solutions that combine hard and soft services, enhancing their market position in a fragmented industry.

Buy Full Report: https://www.imarcgroup.com/checkout?id=13234&method=1315

Saudi Arabia Facility Management Industry Segmentation:

The report has segmented the market into the following categories:

Type of Facility Management Insights:

●In-house Facility Management

●Outsourced Facility Management

●Single FM

●Bundled FM

●Integrated FM

Offering Type Insights:

●Hard FM

●Soft FM

End Use Industry Insights:

●Commercial and Retail

●Manufacturing and Industrial

●Government, Infrastructure, and Public Entities

●Institutional

●Others

Regional Insights:

●Northern and Central Region

●Western Region

●Eastern Region

●Southern Region

●Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=13234&flag=C

Future Outlook

The market for facility management in Saudi Arabia has a bright future thanks to Vision 2030's dedication to sustainability, continuous infrastructure development, and technology breakthroughs. The need for full facility management services, including security and maintenance, will continue to be fueled by large-scale projects like Diriyah Gate and King Salman Park. While the focus on green practices will be in line with the Kingdom's net-zero emissions target by 2060, the implementation of smart building technologies, such as AI-driven analytics and IoT, will further improve operational efficiency. Saudi Arabia will be positioned as a regional leader in facility management thanks to strategic alliances and digital transformation, which will allow the sector to adapt to changing demands despite obstacles like a lack of skilled labor.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Facility Management Market to Reach USD 1,540 Million by 2033, Growing at 8.60% CAGR here

News-ID: 4096064 • Views: …

More Releases from IMARC Group

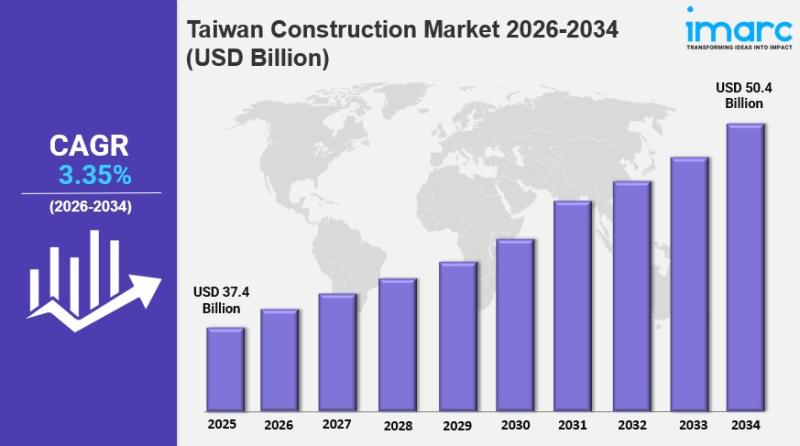

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

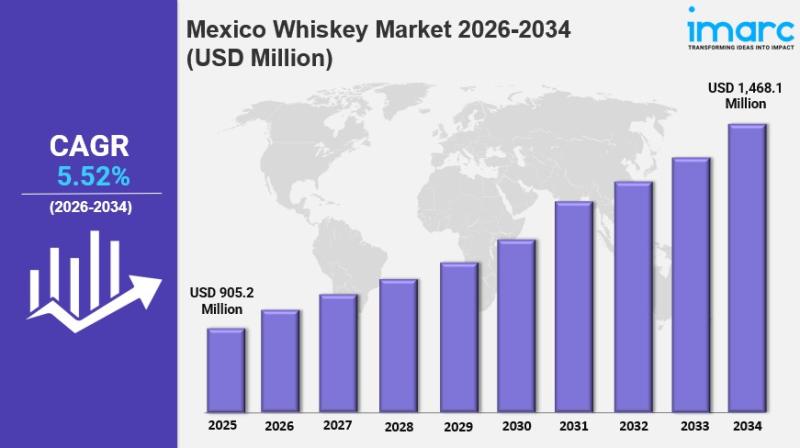

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

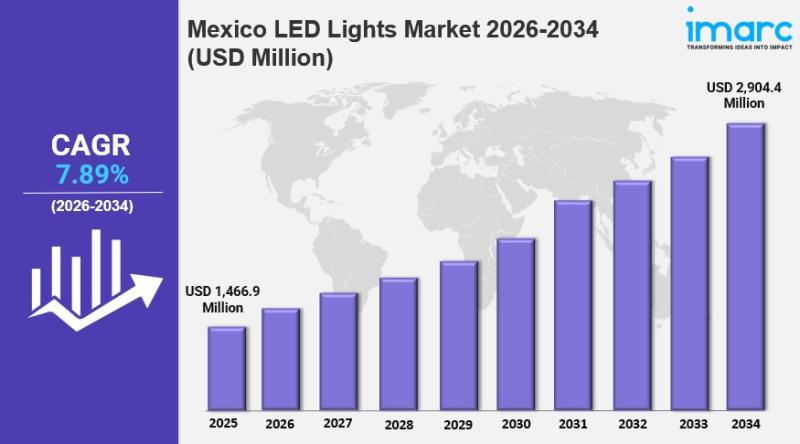

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

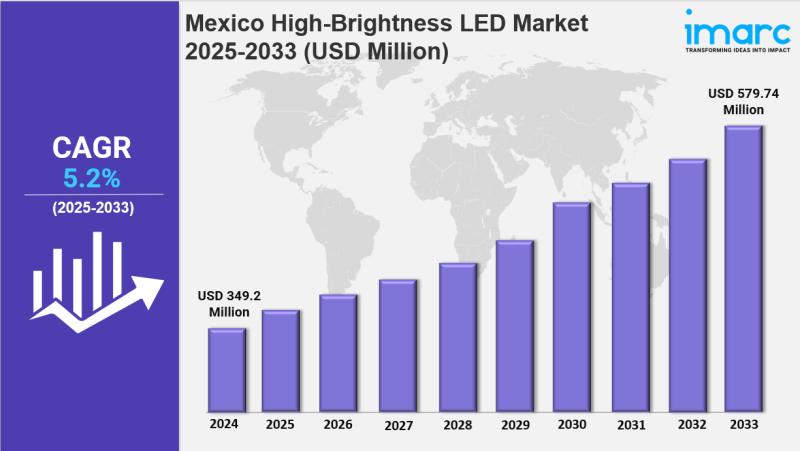

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…