Press release

South Korea Trade Finance Market 2025 : Industry Trends, Size, Share, Growth, Opportunity and Forecast to 2033

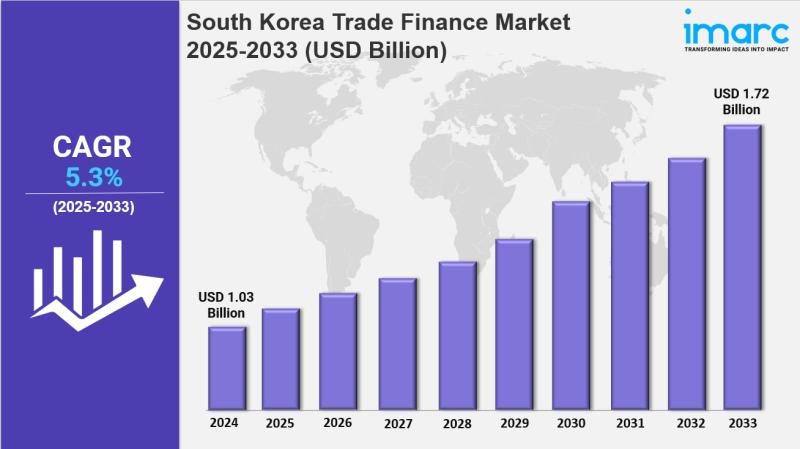

Market Overview 2025-2033South Korea trade finance market size reached USD 1.03 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.72 Billion by 2033, exhibiting a growth rate (CAGR) of 5.3% during 2025-2033. The market is experiencing robust growth, propelled by the expansion of international trade, increasing globalization, and advancements in digital banking solutions. Key trends include the rising demand for efficient financing options to support cross-border transactions, with financial institutions focusing on enhancing their services through technology and innovation. Major players are also prioritizing risk management and compliance solutions to address the complexities of global trade regulations. As businesses seek to optimize their supply chains and improve cash flow, the adoption of trade finance products is expected to rise, further driving the market's expansion.

Key Market Highlights:

✔️ Strong growth driven by increasing international trade and globalization

✔️ Growing demand for digital solutions and innovative financing options

✔️ Enhanced focus on risk management and compliance in cross-border transactions

Request for a sample copy of the report: https://www.imarcgroup.com/south-korea-trade-finance-market/requestsample

South Korea Trade Finance Market Trends and Drivers:

The South Korea Trade Finance Market is poised for significant expansion, driven by the increasing volume of international trade activities. As South Korean businesses seek to penetrate new markets and diversify their export portfolios, the demand for trade finance solutions is surging. This trend is particularly evident as companies aim to mitigate risks associated with cross-border transactions, such as currency fluctuations and payment delays.

By 2025, the South Korea Trade Finance Market Size is expected to witness substantial growth, reflecting the rising need for financial products that facilitate smoother trade operations. Financial institutions are responding to this demand by offering tailored solutions, including letters of credit and trade credit insurance. As a result, the market share of trade finance providers is likely to increase, positioning them as crucial partners in supporting the global ambitions of South Korean enterprises.

Digital transformation is reshaping the South Korea Trade Finance Market, with technology playing a pivotal role in enhancing efficiency and accessibility. The adoption of fintech solutions and blockchain technology is streamlining processes, reducing transaction times, and improving transparency in trade finance operations. By 2025, this digital shift is expected to significantly influence South Korea Trade Finance Market Growth, as more companies leverage these innovations to optimize their supply chains and financial management.

The integration of digital platforms allows businesses to access real-time information, facilitating quicker decision-making and reducing reliance on traditional banking methods. As the market evolves, financial institutions that embrace digitalization are likely to capture a larger share of the trade finance market, catering to the needs of tech-savvy clients seeking modern solutions to their financing challenges.

As the landscape of global trade becomes increasingly complex, the South Korea Trade Finance Market is witnessing a heightened emphasis on risk management and regulatory compliance. Businesses are becoming more aware of the potential risks involved in international transactions, including political instability, credit risk, and legal uncertainties. By 2025, the South Korea Trade Finance Market Size is anticipated to grow as companies invest in robust risk management frameworks and compliance strategies to safeguard their interests.

Financial institutions are responding by developing comprehensive solutions that address these concerns, such as enhanced due diligence processes and risk assessment tools. This focus on risk management not only supports the sustainability of trade finance operations but also enhances the overall confidence of businesses engaging in international trade, ultimately contributing to an increase in the South Korea Trade Finance Market Share as more companies seek reliable partners in navigating the complexities of global commerce.

Buy Report Now: https://www.imarcgroup.com/checkout?id=17909&method=1370

South Korea Trade Finance Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Service Provider Insights:

• Banks

• Trade Finance Companies

• Insurance Companies

• Others

Application Insights:

• Domestic

• International

Regional Insights:

• Seoul Capital Area

• Yeongam (Southeastern Region)

• Honam (Southwestern Region)

• Hoseo (Central Region)

• Others

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=17909&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion. IMARC's services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release South Korea Trade Finance Market 2025 : Industry Trends, Size, Share, Growth, Opportunity and Forecast to 2033 here

News-ID: 4095864 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for South

South Florida's Continuum South Beach Emerges as One of the Most Coveted Propert …

The Continuum South Beach reigns supreme as a highly coveted condominium in South Florida, presenting an array of offerings that ensure an elevated quality of life.

Miami beach, FL - Continuum South Beach [https://www.continuuminsouthbeach.com/] presents a sanctuary of lavishness, featuring opulent apartments and a breathtaking riverfront location in close proximity to the finest attractions of Miami Beach. These extraordinary residences are discreetly nestled within this prestigious condominium, specifically within the Continuum…

Green Cool UK Expand Air Conditioning Services in South Wales and the South West

Cardiff, South Wales - Green Cool UK, the UK's leading air conditioning and refrigeration company, are pleased to announce the extension of their services in South Wales, including Cardiff, Swansea, Newport and into Bristol and the South West. With over 18 years experience in the HVAC industry Green Cool UK supply high performance air conditioning systems and green energy solutions for domestic and commercial customers.

As air conditioning and refrigeration experts…

2024 South Africa International Industrial Exhibition and China (South Africa) I …

Exhibition time: September 19-21, 2024

Exhibition location: Sandton Convention Centre, Johannesburg

Organizer: South Africa Golden Bridge International Exhibition Company

Exhibition introduction

The South African International Industrial Exhibition [https://www.vovt-diesel.com/] and China (South Africa) International Trade Fair is a large-scale international exhibition held to promote Chinese enterprises to explore the African market. Relying on the advantageous resources of the local government, business associations and industry organizations in South Africa, it builds a pragmatic and efficient platform…

Stem Cell Therapy Market | Smith+Nephew (UK), MEDIPOST Co., Ltd. (South Korea), …

Stem Cell Therapy Market in terms of revenue was estimated to be worth $286 million in 2023 and is poised to reach $615 million by 2028, growing at a CAGR of 16.5% from 2023 to 2028 according to a new report by MarketsandMarkets. The global stem cell therapy market is expected to grow at a CAGR of 16.8% during the forecast period. The major factors driving the growth of the…

Global Pajamas Market Report - Japan, Europe, South Korea, Asia and America ( No …

Recently we published the latest report on the Pajamas market. The report on the Pajamas market provides a holistic analysis, of market size and forecast, trends, growth drivers, and challenges, as well as vendor analysis covering around 15 vendors.

The report offers an up-to-date analysis regarding the current global market scenario, the latest trends and drivers, and the overall market environment. The Pajamas market analysis includes product segment and geographic landscape.

The…

South Africa Agriculture Market, South Africa Agriculture Industry, South Africa …

The South Africa has a market-oriented agricultural economy, which is much diversified and includes the production of all the key grains (except rice), deciduous, oilseeds, and subtropical fruits, sugar, wine, citrus, and most vegetables. Livestock production includes sheep, cattle, dairy, and a well-developed poultry & egg industry. Value-added activities in the agriculture sector include processing & preserving of fruit and vegetables, crushing of oilseeds, chocolate, slaughtering, processing & preserving of…