Press release

Fossil Fuels Market to Surpass US$ 10,650 Bn by 2032 Fueled by Global Energy Demand and Industrial Growth

✅Overview of the MarketAccording to the latest study by Persistence Market Research, the global fossil fuels market is poised to grow from US$ 6,990 billion in 2025 to US$ 10,650 billion by 2032, registering a CAGR of 6.2% during the forecast period. This growth trajectory is largely attributed to the rising demand for energy across sectors such as transportation, manufacturing, and power generation, especially in developing economies. Despite a growing shift toward renewables, fossil fuels remain the backbone of global energy systems due to their high energy density and established infrastructure.

The fossil fuels market includes coal, oil, and natural gas, which together account for a significant share of the world's energy supply. These energy sources continue to drive economic development, especially in regions undergoing rapid industrialization and urban expansion. Fossil fuels power industries, transportation systems, and electrical grids, making them crucial for the functioning of modern economies. The market remains robust as energy demand rises in tandem with population growth and technological advancements that expand fossil fuel extraction capabilities.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/35461

In terms of market leadership, oil dominates the fossil fuel market as the primary energy source for global transportation. Meanwhile, Asia Pacific emerges as the leading geographical region due to its high industrial output, increasing urbanization, and substantial energy needs. Countries like China and India are the largest consumers of coal and oil, with growing infrastructure and power demands reinforcing their reliance on fossil fuels. Although environmental concerns and sustainability goals are influencing global energy strategies, the accessibility, affordability, and reliability of fossil fuels continue to sustain their dominance in global markets.

✅Key Market Insights

➤ The fossil fuels market is projected to grow at a healthy CAGR of 6.2% between 2025 and 2032.

➤ Oil remains the largest contributor to global fossil fuel revenues due to its central role in transportation and petrochemicals.

➤ Asia Pacific leads the market owing to rapid economic growth and escalating industrial energy demands.

➤ Investment in advanced extraction technologies such as hydraulic fracturing and deep-sea drilling is enhancing fossil fuel supply chains.

➤ Geopolitical factors and energy security concerns are reinforcing national investments in domestic fossil fuel reserves.

✅What are the future prospects of the fossil fuel industry?

Despite growing pressure for energy transition, the fossil fuel industry is expected to remain integral to the global energy mix in the near to mid-term. Demand will persist in developing economies and industries that require high energy intensity, such as cement, steel, aviation, and petrochemicals. Technological advancements in carbon capture and storage (CCS) and cleaner combustion methods may help reduce environmental impact. Moreover, geopolitical factors and fluctuating renewable energy investments ensure fossil fuels continue to act as a stabilizing force in global energy security strategies.

✅Market Dynamics

Drivers:

The primary drivers of fossil fuel market growth include rising global energy demand, increased industrial output in emerging economies, and the dependence of the transportation sector on oil-based fuels. Technological advancements in drilling and extraction techniques have made previously inaccessible reserves viable, further expanding supply. Additionally, natural gas is gaining traction as a cleaner-burning fossil fuel alternative, boosting its global demand.

Market Restraining Factor:

The market faces growing pressure from environmental regulations, global commitments to reduce greenhouse gas emissions, and the increasing cost-competitiveness of renewable energy sources. Public and institutional divestment from fossil fuel projects, combined with carbon pricing mechanisms and sustainability policies, poses a challenge to long-term fossil fuel investments.

Key Market Opportunity:

The fossil fuel sector holds key opportunities in carbon capture, utilization, and storage (CCUS) technologies and innovations aimed at reducing emissions during production and consumption. Additionally, expanding energy access in underserved regions opens opportunities for integrated fossil fuel-based infrastructure, particularly in electricity generation and heating.

✅Market Segmentation

The fossil fuels market is segmented by fuel type into coal, oil, and natural gas. Among these, oil remains the dominant segment, accounting for the highest revenue due to its indispensable role in transportation, shipping, aviation, and petrochemical manufacturing. Coal continues to be widely used for electricity generation and industrial heating, especially in developing countries with abundant reserves. Natural gas, considered a cleaner-burning fossil fuel, is gaining market share as a transitional energy source due to its lower carbon emissions and increasing use in power plants and residential heating.

By end-use industry, the market is segmented into power generation, industrial, transportation, residential, and commercial. Power generation constitutes the largest segment as fossil fuels remain the primary energy source for thermal power plants worldwide. The industrial sector also represents a significant share, with fossil fuels used in processes such as metal refining, cement production, and chemical manufacturing. The transportation sector, heavily reliant on oil-based fuels like gasoline, diesel, and jet fuel, remains a consistent demand driver. As infrastructure expands in emerging markets, the residential and commercial sectors continue to increase their consumption of fossil fuels, particularly for heating and cooking purposes.

✅Regional Insights

Asia Pacific leads the global fossil fuels market, accounting for the highest consumption and production of coal, oil, and gas. The region's growing population, urbanization, and industrialization drive massive energy requirements, particularly in China, India, and Southeast Asian countries. Governments continue to support fossil fuel infrastructure despite sustainability concerns, ensuring the region's dominance.

North America follows, with the U.S. being a global leader in oil and gas production due to technological advancements such as fracking. Europe is undergoing an energy transition but still relies heavily on natural gas imports. Middle East & Africa remains a key oil-exporting region, while Latin America continues to develop its fossil fuel reserves, particularly offshore oil in Brazil and Argentina's Vaca Muerta shale gas.

✅Competitive Landscape

The fossil fuels market is highly consolidated, with global oil and gas giants controlling a significant share. These companies invest in exploration, refining, transportation, and distribution of fossil fuels and are increasingly venturing into decarbonization technologies to maintain long-term relevance.

✅Company Insights

✦ ExxonMobil Corporation

✦ Chevron Corporation

✦ BP plc

✦ Royal Dutch Shell plc

✦ TotalEnergies SE

✦ Saudi Arabian Oil Company (Saudi Aramco)

✦ China National Petroleum Corporation (CNPC)

✦ Gazprom

✦ Petrobras

✦ Reliance Industries Limited

✦ ConocoPhillips

✦ Equinor ASA

For Customized Insights on Segments, Regions, or Competitors, Request Personalized Purchase Options @ https://www.persistencemarketresearch.com/request-customization/35461

✅Key Industry Developments

In recent years, oil majors have increased investments in carbon capture and low-carbon fuels in response to growing regulatory and social pressure. For instance, ExxonMobil announced large-scale CCS projects along the U.S. Gulf Coast, while Shell and BP are developing hydrogen production facilities to complement their traditional fossil fuel businesses. These initiatives reflect a strategic pivot toward low-emission technologies without abandoning core fossil fuel operations.

Simultaneously, national governments are securing fossil fuel supplies through long-term contracts and new exploration rights to mitigate energy security risks. India's recent move to auction new coal blocks and China's investment in new coal-fired power plants indicate continued commitment to fossil fuels in the near term, despite international climate obligations. These developments highlight the complex balance between energy access, economic growth, and climate action.

✅Innovation and Future Trends

The fossil fuels industry is embracing digitalization, automation, and AI-driven exploration techniques to optimize production, reduce operational costs, and enhance safety. Smart oilfields, real-time monitoring, and predictive maintenance are helping companies maximize output from aging reserves. Blockchain is also being explored to enhance transparency in supply chains, particularly for compliance with environmental and governance standards.

Looking ahead, carbon-neutral fossil fuel technologies are expected to gain momentum. Innovations such as blue hydrogen (produced from natural gas with carbon capture), methane leak detection, and emission-offsetting fuels are emerging trends. Moreover, fossil fuel producers are forming alliances with renewable energy firms to create hybrid energy portfolios, ensuring they remain central players in the evolving energy ecosystem.

✅Explore the Latest Trending "Exclusive Article" @

• https://prnewssync.wordpress.com/2025/07/05/fossil-fuels-market-growth-trends-and-future-forecast/

• https://medium.com/@apnewsmedia/fossil-fuels-market-analysis-by-region-and-fuel-type-7761c7b57f22

• https://vocal.media/stories/fossil-fuels-market-demand-drivers-and-key-challenges

• https://apsnewsmedia.blogspot.com/2025/07/fossil-fuels-market-size-share-and.html

• https://www.manchesterprofessionals.co.uk/article/marketing-pr/96849/fossil-fuels-market-outlook-amid-energy-transition

✅Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

✅About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fossil Fuels Market to Surpass US$ 10,650 Bn by 2032 Fueled by Global Energy Demand and Industrial Growth here

News-ID: 4093957 • Views: …

More Releases from Persistence Market Research

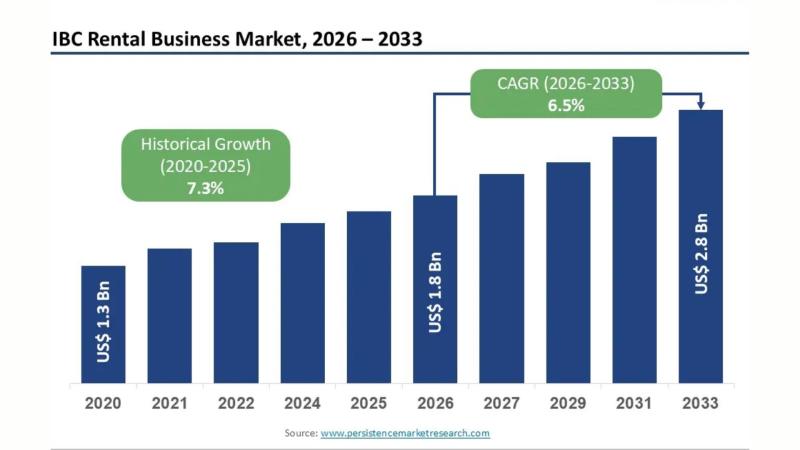

IBC Rental Business Market Projected to Grow to US$2.8 Bn by 2033 Driven by Cost …

Introduction: Rising Demand for Flexible Bulk Packaging Solutions

The global industrial packaging landscape is undergoing a significant shift as companies seek cost-effective, reusable, and sustainable solutions for bulk liquid and material transportation. Intermediate Bulk Containers (IBCs) have emerged as an indispensable packaging format across industries such as chemicals, pharmaceuticals, food & beverages, and agriculture. However, instead of purchasing IBCs outright, many businesses are now opting for rental services to reduce capital…

Shipping Supply Market Expected to Touch US$99.6 Bn by 2033 Driven by E-Commerce …

Introduction: The Backbone of Global Trade and Commerce

The shipping supply market plays a vital role in enabling global trade, industrial operations, and modern retail distribution. From corrugated boxes and pallets to protective packaging and labeling materials, shipping supplies ensure safe transportation of goods across domestic and international supply chains. As globalization intensifies and consumer expectations for fast, damage-free delivery grow, demand for efficient, durable, and sustainable shipping materials has accelerated…

Barrier Coatings for Packaging Market to Hit US$20.6 Bn by 2033 Driven by Rising …

Introduction: The Growing Need for Advanced Packaging Protection

Barrier coatings for packaging have become an essential component in modern packaging solutions, offering protection against moisture, oxygen, light, grease, and contaminants. As global supply chains expand and consumer expectations for longer shelf life increase, manufacturers are turning toward high-performance barrier coatings to preserve product integrity. These coatings enhance the functional performance of packaging materials while supporting lightweight and flexible packaging formats. Their…

Bean Bag Chairs Industry Shows Consistent Expansion Amid Furniture Innovation - …

Introduction

The global Bean Bag Chairs Market has experienced consistent growth over the past decade, driven by changing consumer lifestyles, increasing preference for flexible and informal seating, and the rising popularity of contemporary interior décor. Bean bag chairs are widely used across residential, commercial, and hospitality spaces due to their comfort, portability, lightweight design, and aesthetic appeal. Made using durable fabrics and filled with materials such as expanded polystyrene beads, these…

More Releases for Fossil

Driving Factors For Fossil Fuel Electricity Market Growth: Powering Innovation a …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Is the Expected CAGR for the Fossil Fuel Electricity Market Through 2025?

The market size for fossil fuel electricity has seen consistent growth over the past few years. The projected increase is from $1062.45 billion in 2024 to $1102.31 billion in 2025, indicating a compound annual growth rate…

Driving Factors For Fossil Fuel Electricity Market Growth: A Key Driver Powering …

The Fossil Fuel Electricity Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Fossil Fuel Electricity Market Size and Its Estimated Growth Rate?

The fossil fuel electricity market has shown robust growth in recent years. It will increase from $1099.37 billion in 2024…

Driving Factors For Fossil Fuel Electricity Market Growth: A Key Driver Powering …

The Fossil Fuel Electricity Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Fossil Fuel Electricity Market Size and Its Estimated Growth Rate?

The fossil fuel electricity market has shown robust growth in recent years. It will increase from $1099.37 billion in 2024…

Driving Factors For Fossil Fuel Electricity Market Growth Driver: A Major Cataly …

How Is the Fossil Fuel Electricity Market Projected to Grow, and What Is Its Market Size?

Recent years have seen significant growth in the size of the fossil fuel electricity market. The market, valued at $1099.37 billion in 2024, is predicted to reach $1159.25 billion in 2025, reflecting a compound annual growth rate (CAGR) of 5.4%. This growth during the previous period can be ascribed to increased energy demand, economic expansion,…

Driving Factors For Fossil Fuel Electricity Market Growth Driver: A Major Cataly …

How Is the Fossil Fuel Electricity Market Projected to Grow, and What Is Its Market Size?

Recent years have seen significant growth in the size of the fossil fuel electricity market. The market, valued at $1099.37 billion in 2024, is predicted to reach $1159.25 billion in 2025, reflecting a compound annual growth rate (CAGR) of 5.4%. This growth during the previous period can be ascribed to increased energy demand, economic expansion,…

ADB should end fossil fuel financing

NGO Forum on ADB, a network of over 250 civil society organizations across Asia calls out the Asian Development Bank to end its green posturing and make real commitments towards a Paris aligned policy and appropriate clean energy investments. This demand coincides with this year's Asia Clean Energy Forum (ACEF) 2020 which started yesterday, June 16.

This year ACEF’s thematic focus is centered upon building an inclusive, resilient sustainable energy future,…