Press release

Fraud Detection and Prevention Market to Reach USD 153.91 Billion by 2030, Driven by Real-Time Analytics and AI Integration

Mordor Intelligence has published a new report on the Fraud Detection and Prevention Market, offering a comprehensive analysis of trends, growth drivers, and future projections.Fraud Detection and Prevention Market Overview

The global market for fraud detection and prevention (FDP) is poised for a sharp rise, with Mordor Intelligence forecasting a jump from US $58.18 billion in 2025 to US $153.91 billion by 2030. This robust expansion reflects a compound annual growth rate (CAGR) of 21.48%, underscoring the intensifying demand for more sophisticated tools to combat increasingly complex fraud schemes.

As non-cash transactions surge worldwide, financial service providers, retailers, and digital enterprises are investing in real-time, AI-powered fraud detection to shield themselves and customers. The urgency is rooted in the rise of synthetic identities, mobile payment vulnerabilities, and growing volumes of digital payments demands that legacy systems struggle to address effectively.

Report Overview: https://www.mordorintelligence.com/industry-reports/global-fraud-detection-and-prevention-fdp-market-industry?Utm_source=openpr

Fraud Detection and Prevention Market Key Trends

AI & Machine Learning Integration

The shift toward advanced analytics and AI is central. Traditional rule-based systems are proving insufficient. Behavioral analytics and machine learning models that scan transaction patterns are now standard. These solutions not only detect but also anticipate suspicious behavior, reducing false positives and improving detection speed.

Escalating Digital & Non-Cash Payments

With mobile wallets, contactless payments, and real-time platforms seeing explosive growth, there's a parallel rise in fraud opportunities. Organizations are responding with systems capable of continuous, large-volume transaction monitoring, balancing security with user experience.

Growth in Internal Fraud Detection

While external fraud remains prevalent, internal fraud is growing faster. Companies are deploying systems that monitor employee activities tracking data access, login behavior, and unusual actions to spot insider threats.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/global-fraud-detection-and-prevention-fdp-market-industry?utm_source=openpr

Fraud Detection and Prevention Market Segmentation:

By Solution

Fraud Analytics

Authentication

Reporting

Visualization

Governance, Risk, and Compliance (GRC) Solutions

By Scale of End User

Small-scale

Medium-scale

Large-scale

By Type of Fraud

Internal

External

By End-user Industry

BFSI

Retail

IT and Telecom

Healthcare

Energy and Power

Manufacturing

Other End-user Industries

By Geography

North America

Europe

Asia

Australia and New Zealand

Latin America

Middle East and Africa

Explore Our Full Library of Technology, Media and Telecom Research Industry Reports - https://www.mordorintelligence.com/market-analysis/technology-media-and-telecom?utm_source=openpr

Key Players

SAP SE: A global enterprise software leader, SAP offers integrated fraud management solutions that help organizations detect and respond to risks across financial and operational processes.

IBM Corporation: IBM provides advanced fraud detection tools powered by AI and machine learning, enabling real-time analysis and behavioral monitoring across industries.

SAS Institute Inc: Known for its strong analytics platform, SAS delivers comprehensive fraud prevention solutions that support predictive modeling and anomaly detection.

ACI Worldwide Inc: ACI specializes in real-time payment fraud detection, offering scalable solutions for banks and payment service providers globally.

Fiserv Inc.: Fiserv delivers risk management and fraud prevention tools for financial institutions, with a focus on secure digital banking and transaction monitoring.

Conclusion

The fraud detection and prevention market is experiencing strong momentum as organizations across industries face increasing threats from both external attackers and internal misuse. Businesses are prioritizing tools that offer real-time monitoring, adaptive risk assessment, and seamless user verification to stay ahead of evolving fraud tactics. With rising digital transactions, growing compliance demands, and expanding attack surfaces, adopting intelligent and integrated fraud management systems has become a critical part of safeguarding operations and maintaining customer trust.

Industry Related Reports

Insurance Fraud Detection Market:

The Insurance Fraud Detection Market report segments the industry into By Component (Solution, Service), By Application (Claims Fraud, Identity Theft, Payment and Billing Fraud, Money Laundering), By End-User Industry (Automotive, BFSI, Healthcare, Retail, Other End-User Industries), and By Geography (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa).

To know more visit this link: https://www.mordorintelligence.com/industry-reports/insurance-fraud-detection-market?utm_source=openpr

Cyber Security Market:

The Cyber Security Market report segments the industry into By Offering (Solutions, Services), By Deployment (On-Premise, Cloud), By End-User Industry (IT and Telecom, BFSI, Retail and E-Commerce, Oil Gas and Energy, Manufacturing, Government and Defense, Other End-user Industries), and By Geography (North America, Europe, Asia, Latin America, Middle East and Africa). Get five years of historical data and market forecasts.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/cyber-security-market?utm_source=openpr

Norway Cybersecurity Market:

The Norway Cybersecurity Market report segments the industry into By Offering (Solutions, Services), By Deployment Mode (Cloud, On-Premise), By Organization Size (SMEs, Large Enterprises), and By End User (BFSI, Healthcare, IT and Telecom, Industrial & Defense, Retail, Energy and Utilities, Manufacturing, Others). Five years of historical data and five-year market forecasts are included.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/norway-cybersecurity-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraud Detection and Prevention Market to Reach USD 153.91 Billion by 2030, Driven by Real-Time Analytics and AI Integration here

News-ID: 4093361 • Views: …

More Releases from Mordor Intelligence

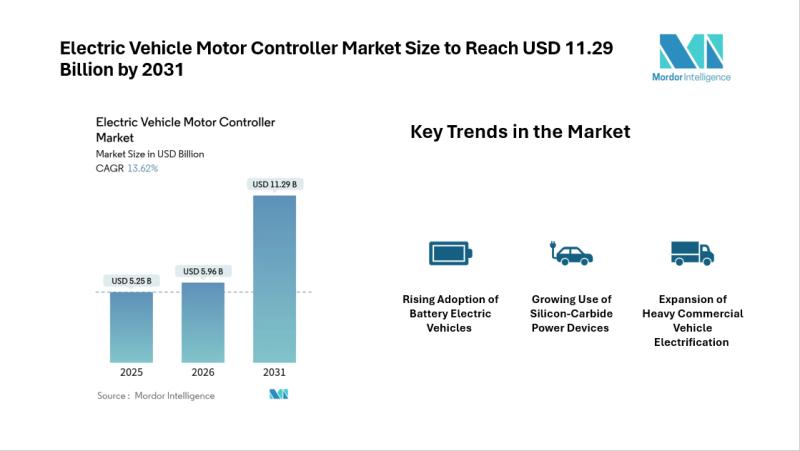

Electric Vehicle Motor Controller Market Size to Reach USD 11.29 Billion by 2031 …

Electric Vehicle Motor Controller Market Overview

According to Mordor Intelligence, the electric vehicle motor controller market size is projected to reach USD 11.29 billion by 2031, growing from USD 5.96 billion in 2026 at a CAGR of 13.62% during the forecast period. The electric vehicle motor controller market forecast reflects steady expansion supported by stricter emission regulations, rising battery electric vehicle adoption, and the increasing use of silicon-carbide power devices.…

Beverage Market Size to Reach USD 2.67 Trillion by 2031, Driven by Health and Su …

Introduction: Beverage Market Growth Outlook

According to a research report by Mordor Intelligence, the global Beverage Market is projected to grow from an estimated USD 2.03 trillion in 2026 to USD 2.67 trillion by 2031, reflecting a steady CAGR of 5.65% over the forecast period. This growth is supported by increasing consumer awareness around health, wellness, and sustainable consumption, along with the rising demand for premium and functional beverages. Non-alcoholic…

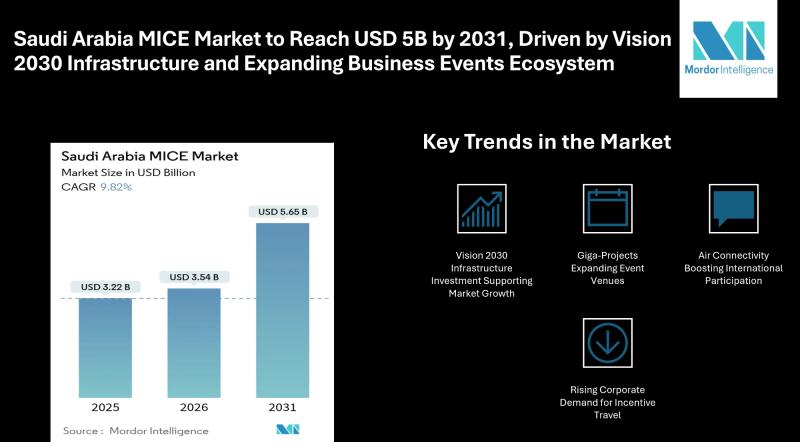

Saudi Arabia MICE Market to Reach USD 5B by 2031, Driven by Vision 2030 Infrastr …

Mordor Intelligence has published a new report on the Saudi Arabia MICE market, offering a comprehensive analysis of trends, growth drivers, and future projections

Saudi Arabia MICE Market Overview

According to Mordor Intelligence, the Saudi Arabia MICE market was valued at USD 3.22 billion in 2025 and is estimated to grow from USD 3.54 billion in 2026 to reach USD 5.65 billion by 2031, registering a CAGR of 9.82%…

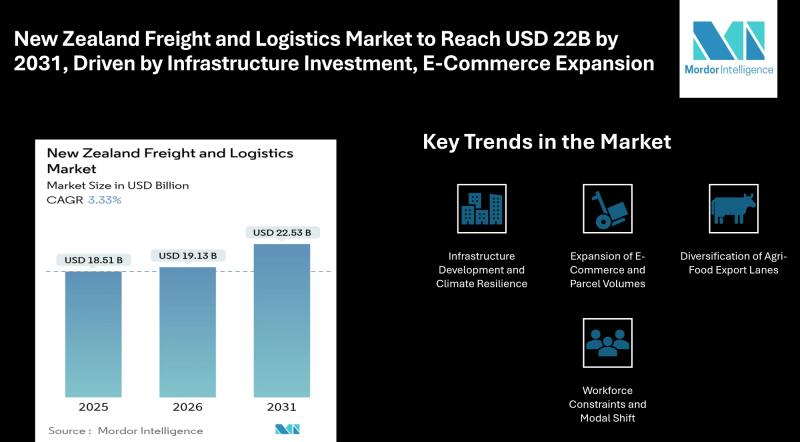

New Zealand Freight and Logistics Market to Reach USD 22.53 Billion by 2031, Dri …

Mordor Intelligence has published a new report on the New Zealand freight and logistics market, offering a comprehensive analysis of trends, growth drivers, and future projections

Overview of the New Zealand Freight and Logistics Market

The New Zealand freight and logistics market is projected to reach USD 22.53 billion by 2031, growing from USD 19.13 billion in 2026, at a CAGR of 3.33%. The steady rise reflects continued infrastructure…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…