Press release

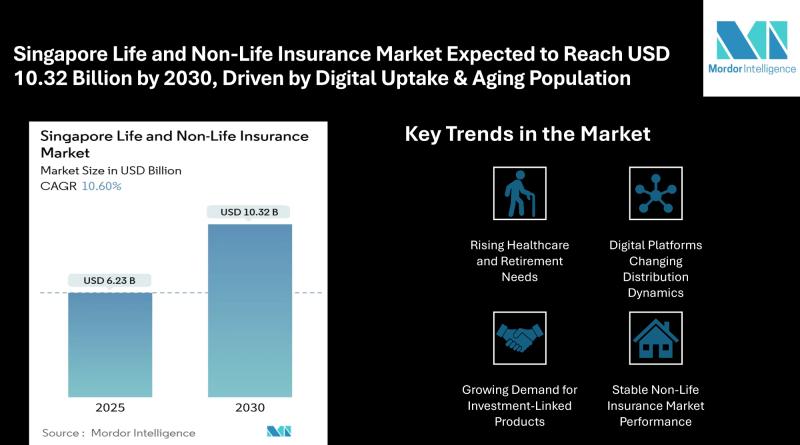

Singapore Life and Non‐Life Insurance Market Expected to Reach USD 10.32 Billion by 2030, Driven by Digital Uptake & Aging Population

Mordor Intelligence has published a new report on the "Singapore Life and Non‐Life Insurance Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction

Singapore life and non-life insurance market is valued at USD 6.23 billion in 2025 and is projected to reach USD 10.32 billion by 2030, registering a 10.60% CAGR. The Singapore life and non-life insurance market is on a steady growth path, supported by the nation's ageing demographics, expanding healthcare needs, digital distribution adoption, and an overall rise in risk awareness. Insurers are increasingly focused on strengthening their product portfolios to cater to diversified customer needs across life, health, motor, property, and investment-linked segments. These factors are setting the stage for a robust and competitive insurance sector outlook over the coming years.

Report Overview: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-singapore?utm_source=openpr

Key Trends

Rising Healthcare and Retirement Needs

Singapore's ageing population continues to drive demand for both life and health insurance products. With a significant proportion of residents expected to cross retirement age within the next decade, there is heightened focus on retirement savings plans, whole-life policies, annuities, and critical illness cover. Policyholders are actively seeking protection solutions that supplement public healthcare schemes and provide greater security in managing long-term care costs. This shift is fostering a healthier insurance penetration rate in the country.

Digital Platforms Changing Distribution Dynamics

Digital distribution channels are gaining strong momentum in Singapore's insurance market. Consumers increasingly prefer online platforms for their ease of access, streamlined onboarding, and transparency in premium comparisons. Insurers are leveraging digital tools for policy servicing, payments, and claims processing, creating more efficient customer experiences. At the same time, traditional agents remain important, particularly for high-value policies requiring financial advisory, but digital is emerging as a powerful complementary channel.

Growing Demand for Investment-Linked Products

As low interest rates persist, customers are showing greater interest in investment-linked insurance plans (ILPs) that offer both protection and investment exposure. ILPs have become an attractive option for those looking to balance insurance needs with long-term wealth creation goals. Insurers are responding by designing flexible products with diversified fund options to suit varied risk appetites.

Stable Non-Life Insurance Market Performance

Non-life insurance continues to hold a significant share in Singapore, driven by motor, health, property, liability, and travel insurance lines. Motor insurance, in particular, benefits from steady vehicle ownership trends and the country's structured vehicle quota system. Property insurance remains stable as businesses and homeowners prioritise protection against fire, theft, and natural damage risks. Travel insurance is also recovering steadily with the reopening of international borders.

Strategic Focus on High-Net-Worth Individuals

Singapore's growing high-net-worth segment is driving insurers to offer tailored wealth planning, estate transfer solutions, and premium protection products. Family offices are expanding in the country, prompting demand for customised life insurance packages that integrate financial planning, succession, and asset protection strategies. Insurers are enhancing their advisory capabilities to address this specialised market segment effectively.

Regulatory and Capital Requirements Driving Operational Prudence

The insurance market continues to adjust to evolving regulatory frameworks and capital adequacy requirements. While this ensures market stability and protects policyholders, it also pushes insurers to optimise their product mix, streamline operations, and invest in risk management and compliance systems. Companies that adapt efficiently to these regulatory expectations are better positioned to sustain growth.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/life-non-life-insurance-market-in-singapore?utm_source=openpr

Market Segmentation

By Insurance Type

Life insurance: Increasing adoption due to retirement planning, whole life policies, and critical illness coverage.

Non-life insurance: Dominated by motor, property, liability, and health insurance segments.

By Distribution Channel

Captive/exclusive agents: Continue to serve a major share of the market, especially for comprehensive life and investment-linked products.

Digital channels: Gaining strong traction for simple and standardised policies due to ease of purchase and servicing.

By End User

Individuals: Core segment with rising demand for health, retirement, and investment-linked policies.

Businesses/SMEs: Growing focus on group health insurance, property cover, liability protection, and employee benefit plans.

By Premium Type

New business premiums: Witnessing growth as insurers expand product portfolios to address market gaps.

Renewal premiums: Provide stability and ongoing revenue streams for insurers.

By Region

Central region: Major contributor to overall premium collections due to high business and residential density.

Other regions: Experiencing steady growth with urban development and expanded motor and property insurance penetration.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players

Singapore's insurance market includes a mix of domestic and international players. Leading companies actively offering life and non-life insurance products include:

AIA Singapore

Great Eastern Life Assurance Co. Ltd.

Prudential Assurance Company Singapore

NTUC Income Insurance Co-operative

Manulife Singapore

Singlife

FWD Group

These companies focus on enhancing customer engagement through digital services, diversifying product portfolios, and forming strategic partnerships with banks and digital platforms to expand their reach.

Explore more details about Singapore Life and Non‐Life Insurance Market Competitive Landscape: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-singapore/companies?utm_source=openpr

Conclusion

The Singapore life and non-life insurance market is undergoing a period of transformation marked by digitalisation, product diversification, and customer-centric innovation. While regulatory compliance, low interest rates, and capital requirements pose operational challenges, insurers are proactively adapting to these dynamics. The market's growth outlook remains positive, supported by rising healthcare needs, retirement security concerns, and the evolving expectations of digitally savvy and affluent consumers. As insurers continue to refine their strategies, the sector is set to play an increasingly important role in Singapore's financial landscape by delivering protection and financial security solutions that align with the nation's socio-economic priorities.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-singapore?utm_source=openpr

Industry Related Reports

Indonesia Life And Non-Life Insurance Market: The Indonesia Life and Non-Life Insurance Market is Segmented by Insurance Type (Life Insurance (Product (Term, Whole and More), Purchase Mode (Individual, Group), Non-Life Insurance (Line of Business (Motor, Health and More)), Distribution Channel (Direct, and More), Premium Type (Single, Regular), Policy Term (Short, Long), End Users (Individual and More), and Region.

Get more insights: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-indonesia?utm_source=openpr

India Life And Non-Life Insurance Market: The India Life and Non-Life Insurance Market is Segmented by (Life Insurance, (endowment, Term-Life, Whole-Life, Unit-Linked and More), Non-Life Insurance (Motor, Health, Fire and Engineering, Marine and Cargo and More), Distribution Channel (Agency, Bancassurance, Direct and More), Customer Type (Individual and Group) and Region. The Market Forecasts are Provided in Terms of Value (USD).

Get more insights: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-india?utm_source=openpr

Australia Life And Non-life Insurance Market: Australia Life and Non-Life Insurance Market is Segmented by Insurance Type (Life Insurance and Non-Life Insurance), Distribution Channel (Direct, Brokers, Banks, and More), Customer Segment (Individual Policyholders, Small & Medium Enterprises, and More), Premium Frequency (Regular Premium and Single Premium), and Region.

Source: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-australia

Get more insights: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-australia?utm_source=openpr

UAE Health And Medical Insurance Market: The UAE Health and Medical Insurance Market is Segmented by Insurance Type (Individual, Group), by Service Provider (Private Health Insurance Providers, Public/Social Health Insurance Schemes), by Distribution Channel (Direct Sales, Online Sales, Brokers/Agents, and Banks), by End-User/Customer Type (Corporate/Employer, Individual/Families, and More), and Region. The Market Forecasts are Provided in Value (USD).

Get more insights: https://www.mordorintelligence.com/industry-reports/uae-health-and-medical-insurance-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Singapore Life and Non‐Life Insurance Market Expected to Reach USD 10.32 Billion by 2030, Driven by Digital Uptake & Aging Population here

News-ID: 4092848 • Views: …

More Releases from Mordor Intelligence

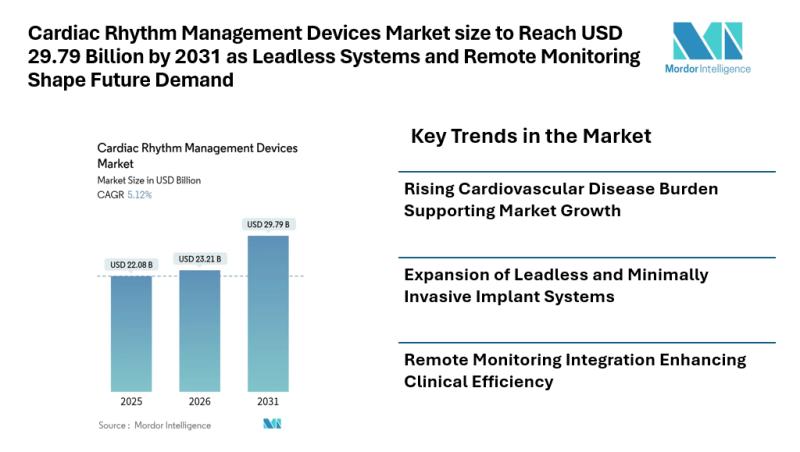

Cardiac Rhythm Management Devices Market size to Reach USD 29.79 Billion by 2031 …

Mordor Intelligence has published a new report on the cardiac rhythm management devices market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Cardiac Rhythm Management Devices Market Overview

According to Mordor Intelligence, the cardiac rhythm management devices market is set to expand from USD 22.08 billion in 2025 to USD 23.21 billion in 2026 and is projected to reach USD 29.79 billion by 2031, registering a…

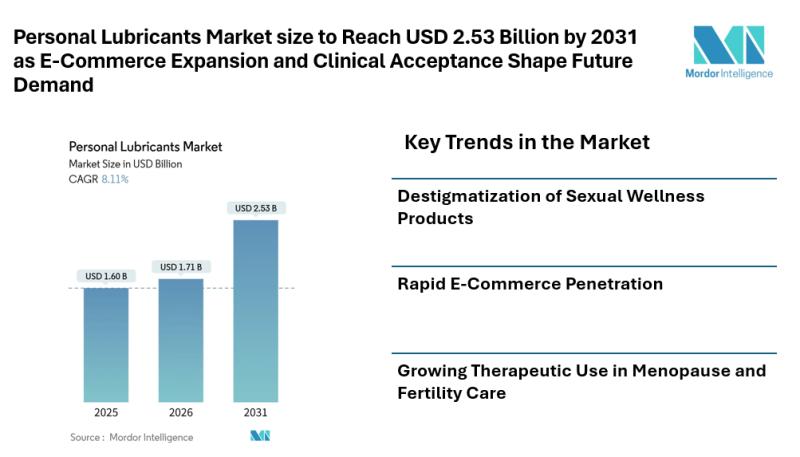

Personal Lubricants Market size to Reach USD 2.53 Billion by 2031 as E-Commerce …

Mordor Intelligence has published a new report on the personal lubricants market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the personal lubricants market size is estimated at USD 1.71 billion in 2026 and is projected to reach USD 2.53 billion by 2031, registering a CAGR of 8.11% during the forecast period. These steady personal lubricants market growth reflects wider…

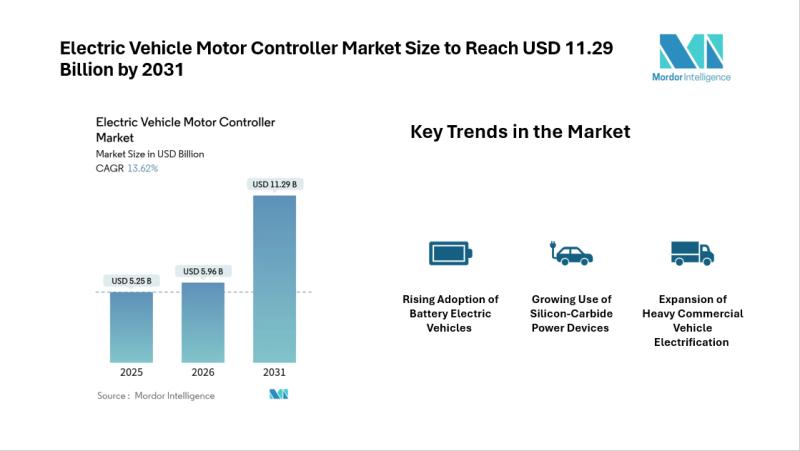

Electric Vehicle Motor Controller Market Size to Reach USD 11.29 Billion by 2031 …

Electric Vehicle Motor Controller Market Overview

According to Mordor Intelligence, the electric vehicle motor controller market size is projected to reach USD 11.29 billion by 2031, growing from USD 5.96 billion in 2026 at a CAGR of 13.62% during the forecast period. The electric vehicle motor controller market forecast reflects steady expansion supported by stricter emission regulations, rising battery electric vehicle adoption, and the increasing use of silicon-carbide power devices.…

Beverage Market Size to Reach USD 2.67 Trillion by 2031, Driven by Health and Su …

Introduction: Beverage Market Growth Outlook

According to a research report by Mordor Intelligence, the global Beverage Market is projected to grow from an estimated USD 2.03 trillion in 2026 to USD 2.67 trillion by 2031, reflecting a steady CAGR of 5.65% over the forecast period. This growth is supported by increasing consumer awareness around health, wellness, and sustainable consumption, along with the rising demand for premium and functional beverages. Non-alcoholic…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…