Press release

United States Data Center Construction Market 2025 Edition Size & Report 2033

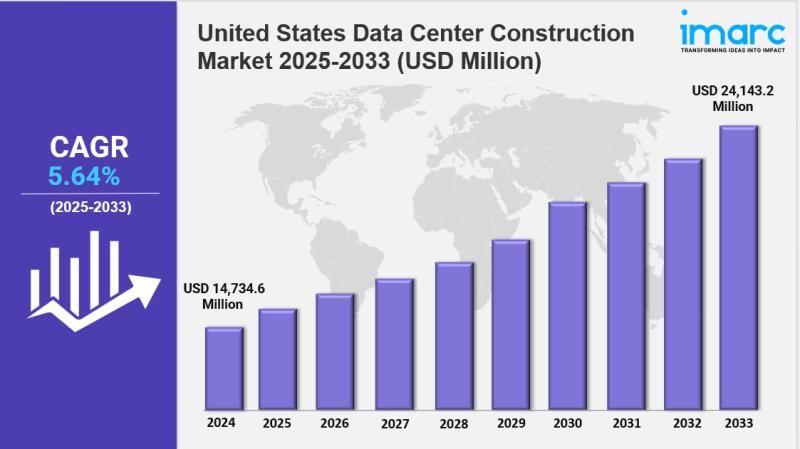

Market Overview 2025-2033The United States data center construction market size reached USD 14,734.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 24,143.2 Million by 2033, exhibiting a growth rate (CAGR) of 5.64% during 2025-2033. The market is expanding due to surging demand for AI and cloud services, rapid 5G adoption, and robust infrastructure investment. Growth is driven by hyperscale projects, sustainable cooling innovations, and modular design, making the sector more efficient, resilient, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising demand for cloud computing, big data, and digital services

✔️ Increasing investments from hyperscale providers and colocation operators across key U.S. regions

✔️ Expanding adoption of energy-efficient infrastructure and modular construction to enhance scalability and sustainability

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-data-center-construction-market/requestsample

United States Data Center Construction Market Trends and Drivers:

The United States Data Center Construction Market is undergoing a major transformation, fueled by the unprecedented demand for artificial intelligence workloads. In 2024, approximately 72% of newly built facilities were tailored for GPU-intensive computing, emphasizing high-density racks exceeding 50 kW-more than triple traditional power requirements. Cloud giants like AWS and Microsoft are leading the shift toward liquid-cooled infrastructure, rapidly expanding hyperscale deployments. NVIDIA's launch of the Blackwell architecture led to mid-construction redesigns across 37 major sites, as builders raced to integrate direct-to-chip cooling systems. This surge in AI-focused construction has heavily concentrated activity in power-abundant regions.

Northern Virginia's "Data Center Alley" alone accounts for over 22 million square feet of active space, while new clusters in Iowa and Ohio are leveraging renewable and nuclear energy resources. Despite robust momentum, the United States Data Center Construction Market Growth is hindered by critical infrastructure challenges, such as transformer shortages and local grid upgrade delays caused by community resistance-often extending project timelines by up to two years. Sustainability initiatives are now central to design strategies. The updated 2024 EPA Clean Power Plan has accelerated the integration of hydrogen fuel cells and advanced adiabatic cooling systems, now deployed in 68% of Tier IV projects.

These innovations are helping to push PUE ratios below 1.15 in next-generation facilities. Operators in arid regions like Arizona are also reducing water consumption by up to 40% through the use of air-cooled chillers paired with waste-heat recovery systems. However, achieving carbon neutrality remains complex; synchronizing new solar and wind installations with data center infrastructure has increased design and engineering timelines by 30%. Regulatory mandates such as California's SB 233, which requires zero-carbon backup power by 2027, are triggering an estimated $12 billion in retrofits nationwide-reshaping the United States Data Center Construction Market Share by favoring firms with green technology expertise.

Meanwhile, the expansion of 5G and IoT networks has driven the deployment of over 1,200 micro-data centers across secondary and tertiary cities. These compact, sub-5MW edge facilities are strategically positioned near manufacturing zones and logistics corridors to reduce latency below 5 milliseconds. A pivotal development came in 2024, when Walmart installed 287 edge data sites for automated inventory systems-prompting similar moves by major retailers like Target and Home Depot. Modular and prefabricated construction methods now dominate the edge segment, reducing deployment cycles from 24 months to just 90 days. However, workforce constraints persist: a shortage of certified technicians in non-urban areas is extending commissioning times by 32%, and cybersecurity risks in decentralized architectures remain a growing concern.

The future of the United States Data Center Construction Market is increasingly defined by adaptability and risk mitigation. In response to geopolitical tensions and semiconductor export restrictions, hyperscale providers have begun establishing sovereign cloud zones with physically isolated networks for government and defense workloads. Brownfield redevelopment is also gaining traction; 42% of new projects in 2024 repurposed former industrial sites, including Google's conversion of shuttered Ohio paper mills into 300MW data campuses fortified with seismic protections.

Supply chain localization efforts have intensified following global shipping disruptions, with domestic sourcing of steel and switchgear rising from 18% to 57%. Advanced technologies like blockchain-based material tracking and AI-powered site selection models-evaluating more than 200 risk variables-are reshaping the landscape. As regulatory pressures mount, integrated design-build-operate frameworks are overtaking traditional contracting, streamlining delivery while ensuring full compliance with ASHRAE 90.4 standards across all project phases.

Checkout Now: https://www.imarcgroup.com/checkout?id=20217&method=1190

United States Data Center Construction Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Construction Type:

• Electrical Construction

• Mechanical Construction

Breakup by Data Center Type:

• Mid-Size Data Centers

• Enterprise Data Centers

• Large Data Centers

Breakup by Tier Standards:

• Tier I and II

• Tier III

• Tier IV

Breakup by Vertical:

• Public Sector

• Oil and Energy

• Media and Entertainment

• IT and Telecommunication

• Banking, Financial Services and Insurance (BFSI)

• Healthcare

• Retail

• Others

Breakup by Region:

• Northeast

• Midwest

• South

• West

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=20217&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Data Center Construction Market 2025 Edition Size & Report 2033 here

News-ID: 4092233 • Views: …

More Releases from IMARC Group

India Plastic Pipes Market Outlook 2026-2034: Size, Share, Growth, Trends, Deman …

According to IMARC Group's report titled "India Plastic Pipes Market Size, Share, Trends and Forecast by Type, Diameter, End Use, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Plastic Pipes Market Report

The India plastic pipes market size was valued at USD 2.10 Billion in 2025 and is projected to reach USD 3.65 Billion by 2034, exhibiting a CAGR…

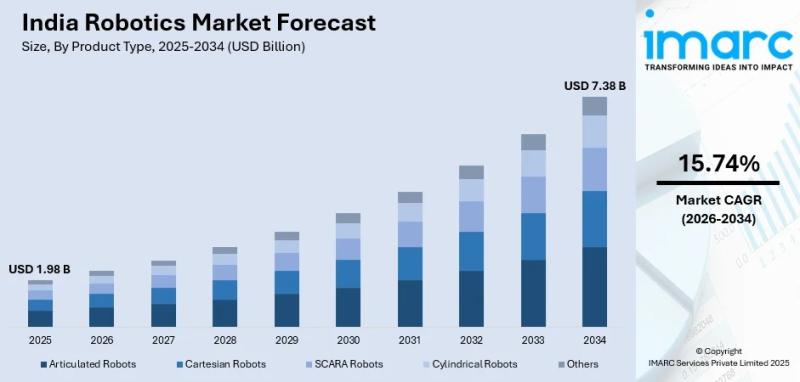

India Robotics Market Expanding at 15.74% CAGR by 2034, Driven by Make in India …

Summary

The India robotics market size reached USD 1.98 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by a massive push toward manufacturing modernization, rising labor costs, and robust government support for digital transformation, the market is projected to reach an impressive USD 7.38 Billion by 2034. This highlights a rapid compound annual growth rate (CAGR) of 15.74% during the forecast period (2026-2034).

Request a…

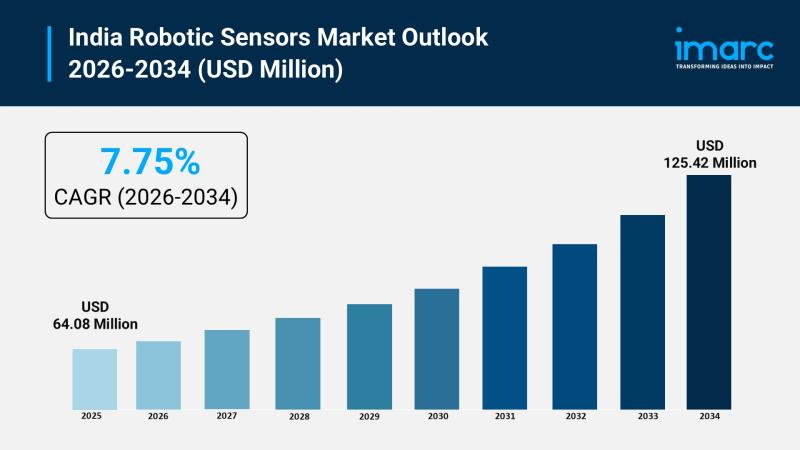

India Robotic Sensors Market Growing at 7.75% CAGR Through 2034, Driven by AI & …

Summary

The India robotic sensors market size reached USD 64.08 Million in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by robust government initiatives, escalating labor costs, and the rapid integration of artificial intelligence in industrial automation, the market is projected to reach USD 125.42 Million by 2034. This highlights a steady compound annual growth rate (CAGR) of 7.75% during the forecast period (2026-2034).

Request a Free Sample…

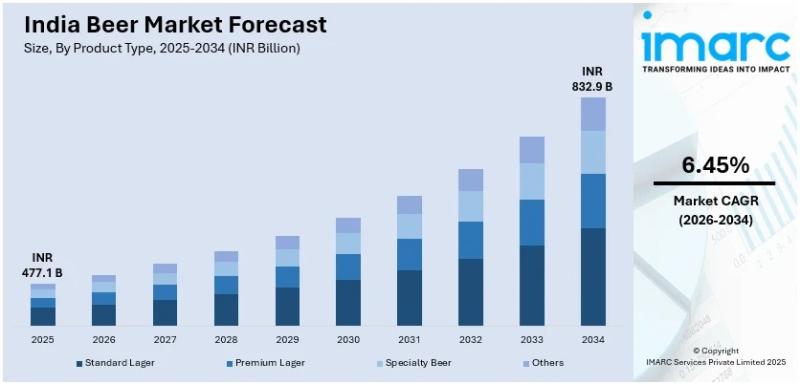

India Beer Market Size to Reach INR 832.93 Billion by 2034: Industry Trends, Gro …

Summary

The beer market size in india reached INR 477.05 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Driven by rapid urbanization, a burgeoning young demographic, and a massive cultural shift toward premium and craft beverages, the market is projected to reach INR 832.93 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 6.45% during the forecast period (2026-2034).

What are the Key…

More Releases for Data

Data Catalog Market: Serving Data Consumers

Data Catalog Market size was valued at US$ 801.10 Mn. in 2022 and the total revenue is expected to grow at a CAGR of 23.2% from 2023 to 2029, reaching nearly US$ 3451.16 Mn.

Data Catalog Market Report Scope and Research Methodology

The Data Catalog Market is poised to reach a valuation of US$ 3451.16 million by 2029. A data catalog serves as an organized inventory of an organization's data assets, leveraging…

Big Data Security: Increasing Data Volume and Data Velocity

Big data security is a term used to describe the security of data that is too large or complex to be managed using traditional security methods. Big data security is a growing concern for organizations as the amount of data generated continues to increase. There are a number of challenges associated with securing big data, including the need to store and process data in a secure manner, the need to…

HOW TO TRANSFORM BIG DATA TO SMART DATA USING DATA ENGINEERING?

We are at the cross-roads of a universe that is composed of actors, entities and use-cases; along with the associated data relationships across zillions of business scenarios. Organizations must derive the most out of data, and modern AI platforms can help businesses in this direction. These help ideally turn Big Data into plug-and-play pieces of information that are being widely known as Smart Data.

Specialized components backed up by AI and…

Test Data Management (TDM) Market - test data profiling, test data planning, tes …

The report categorizes the global Test Data Management (TDM) market by top players/brands, region, type, end user, market status, competition landscape, market share, growth rate, future trends, market drivers, opportunities and challenges, sales channels and distributors.

This report studies the global market size of Test Data Management (TDM) in key regions like North America, Europe, Asia Pacific, Central & South America and Middle East & Africa, focuses on the consumption…

Data Prep Market Report 2018: Segmentation by Platform (Self-Service Data Prep, …

Global Data Prep market research report provides company profile for Alteryx, Inc. (U.S.), Informatica (U.S.), International Business Corporation (U.S.), TIBCO Software, Inc. (U.S.), Microsoft Corporation (U.S.), SAS Institute (U.S.), Datawatch Corporation (U.S.), Tableau Software, Inc. (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY…

Long Term Data Retention Solutions Market - The Increasing Demand For Big Data W …

Data retention is a technique to store the database of the organization for the future. An organization may retain data for several different reasons. One of the reasons is to act in accordance with state and federal regulations, i.e. information that may be considered old or irrelevant for internal use may need to be retained to comply with the laws of a particular jurisdiction or industry. Another reason is to…