Press release

Mexico Biosimilar Market Size, Share & Industry Report | 2033

Market Overview 2025-2033The Mexico biosimilar market size reached USD 417.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,560.8 Million by 2033, exhibiting a growth rate (CAGR) of 14.60% during 2025-2033. The market is growing due to rising chronic disease prevalence, increasing need for affordable biologic therapies, and strengthened regulatory frameworks. Growth is driven by oncology biosimilars, enhanced provider trust, and government cost-control measures, making the industry more accessible, efficient, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising healthcare demand and need for cost-effective biologic treatments

✔️ Increasing approvals and availability of biosimilars for oncology, autoimmune, and chronic diseases

✔️ Expanding support from government policies and healthcare providers to enhance biosimilar adoption and accessibility

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-biosimilar-market/requestsample

Mexico Biosimilar Market Trends and Drivers:

The Mexico Biosimilar Market is undergoing notable transformation, driven by regulatory reforms implemented by COFEPRIS (Federal Commission for Protection against Health Risks). In 2023, updated guidelines aligned with EMA and FDA standards introduced a streamlined approval process, cutting biosimilar authorization timelines from 36 to approximately 18 months. As a result, 12 new biosimilar products entered the market in early 2024, with a concentration in oncology and immunology treatments such as trastuzumab, rituximab, adalimumab, and infliximab. Both domestic companies, including Probiomed and Landsteiner, and international firms such as Biocon and Celltrion, are contributing to a broader therapeutic portfolio.

Although biosimilars are typically priced 25-35% lower than reference products, pricing remains a concern. However, the expiration of key patents-for example, those for insulin glargine and etanercept-is expected to increase biosimilar uptake. Challenges persist, particularly regarding pharmacovigilance infrastructure and adverse event traceability. A major growth factor in the Mexico Biosimilar Market Report is demand from the public healthcare sector. Institutions like IMSS and INSABI now include biosimilars in roughly 90% of procurement tenders. As of early 2024, biosimilars accounted for 43% of all biologics dispensed, up from 28% in 2033.

The rise in chronic diseases-such as diabetes, which affects nearly 17% of adults, and approximately 190,000 new cancer diagnoses annually-is driving the need for more affordable treatment options. However, access remains uneven; urban healthcare centers report up to 95% formulary inclusion, while rural areas still face obstacles due to cold-chain logistics. In the private healthcare system, biosimilar penetration remains relatively low at around 22%, though initiatives like step-therapy protocols are gradually improving uptake. The inclusion of biosimilars for rheumatoid arthritis under the expanded Seguro Popular program reflects broader policy support. Nevertheless, high out-of-pocket costs continue to be a barrier for over one-third of households.

Manufacturing capacity is growing, supported by foreign direct investment and national incentives. In 2024, seven contract development and manufacturing organizations (CDMOs) began construction in Guanajuato and Querétaro, aimed at reducing import dependence. This expansion aligns with Mexico's Pharma 4.0 strategy, which includes tax incentives and technology transfer initiatives. Notable developments include a Biocon-Neolpharma joint venture focused on fill-finish operations for monoclonal antibody products. Despite progress, only three domestic companies received WHO prequalification in 2024, underlining challenges in analytical validation and product comparability.

External disruptions, such as API import delays during the 2024 hurricane season, have accelerated nearshoring strategies. Exports to countries like Colombia and Peru now make up 41% of national biosimilar production. However, regulatory differences under the USMCA continue to pose challenges for exports to the U.S. market. The Mexico Biosimilar Market Report highlights consistent market expansion. Valued at over $480 million in early 2024, the market has experienced a CAGR of 14.3% since 2021-far surpassing the broader pharmaceutical sector's average growth of 5.8%.

An aging population, with 14.3% over the age of 60, is contributing to demand across therapeutic areas such as oncology, diabetes, and autoimmune diseases Interchangeability guidelines introduced in 2024, based on ICH Q5E standards, supported wider clinical use of eight monoclonal antibodies, although automatic substitution remains a point of contention among healthcare professionals With the expiration of additional patents, including those for bevacizumab and pegfilgrastim, the market saw an average price drop of 28% in the second half of 2024. Locally produced biosimilars now represent 37% of national sales, up from 19% in 2022.

This growth has been fueled by initiatives like the Strategic Health Industries Fund, which allocated $650 million to boost domestic biomanufacturing. Still, logistics issues-such as the Veracruz port strikes in Q3 2024-exposed supply chain weaknesses, delaying nearly half of biosimilar deliveries during that period. Looking forward, the Mexico Biosimilar Market is projected to represent 58% of the country's biologics market by 2026. Reaching this target will require further investments in rural healthcare distribution, improved reimbursement policies, and enhanced pharmacovigilance systems. With expanding production capabilities, regulatory support, and growing healthcare demand, Mexico is emerging as a leading force in the Latin American biosimilar industry.

Checkout Now: https://www.imarcgroup.com/checkout?id=32102&method=980

Mexico Biosimilar Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Molecule:

• Infliximab

• Insulin Glargine

• Epoetin Alfa

• Etanercept

• Filgrastim

• Somatropin

• Rituximab

• Follitropin Alfa

• Adalimumab

• Pegfilgrastim

• Trastuzumab

• Bevacizumab

• Others

Breakup by Manufacturing Type:

• In-house Manufacturing

• Contract Manufacturing

Breakup by Indication:

• Auto-Immune Diseases

• Blood Disorder

• Diabetes

• Oncology

• Growth Deficiency

• Female Infertility

• Others

Breakup by Region:

• Northern Mexico

• Central Mexico

• Southern Mexico

• Others

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=32102&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mexico Biosimilar Market Size, Share & Industry Report | 2033 here

News-ID: 4092028 • Views: …

More Releases from IMARC GROUP

India Plastic Pipes Market Outlook 2026-2034: Size, Share, Growth, Trends, Deman …

According to IMARC Group's report titled "India Plastic Pipes Market Size, Share, Trends and Forecast by Type, Diameter, End Use, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Plastic Pipes Market Report

The India plastic pipes market size was valued at USD 2.10 Billion in 2025 and is projected to reach USD 3.65 Billion by 2034, exhibiting a CAGR…

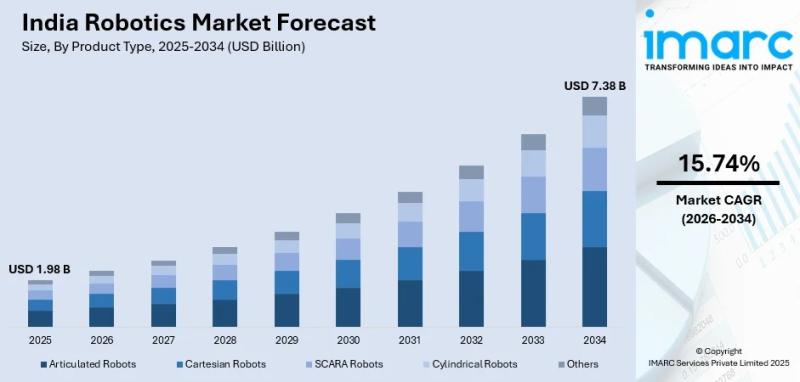

India Robotics Market Expanding at 15.74% CAGR by 2034, Driven by Make in India …

Summary

The India robotics market size reached USD 1.98 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by a massive push toward manufacturing modernization, rising labor costs, and robust government support for digital transformation, the market is projected to reach an impressive USD 7.38 Billion by 2034. This highlights a rapid compound annual growth rate (CAGR) of 15.74% during the forecast period (2026-2034).

Request a…

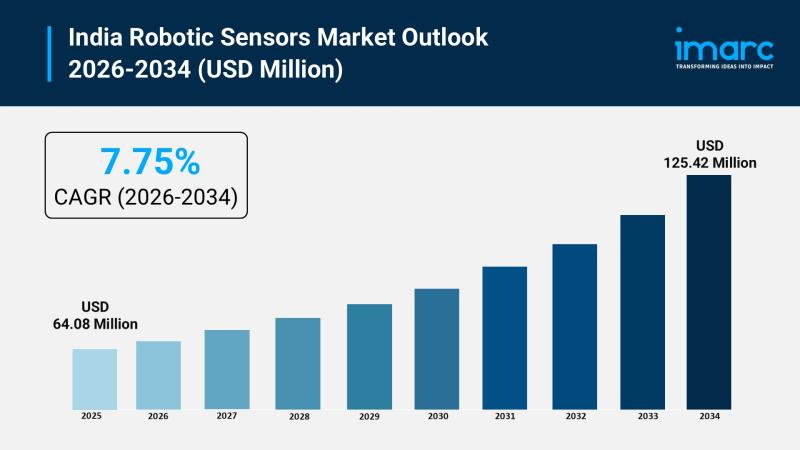

India Robotic Sensors Market Growing at 7.75% CAGR Through 2034, Driven by AI & …

Summary

The India robotic sensors market size reached USD 64.08 Million in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by robust government initiatives, escalating labor costs, and the rapid integration of artificial intelligence in industrial automation, the market is projected to reach USD 125.42 Million by 2034. This highlights a steady compound annual growth rate (CAGR) of 7.75% during the forecast period (2026-2034).

Request a Free Sample…

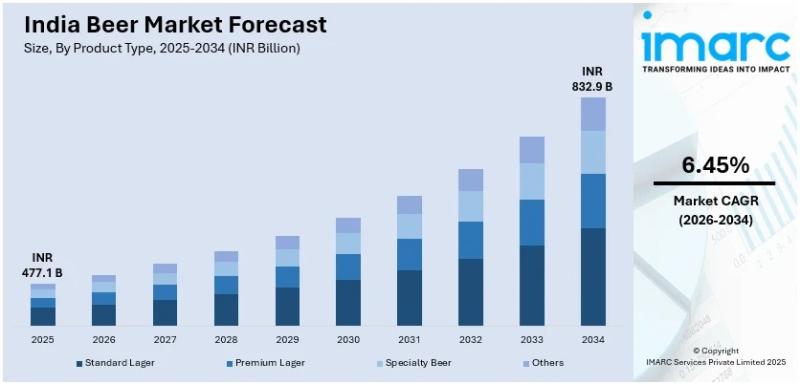

India Beer Market Size to Reach INR 832.93 Billion by 2034: Industry Trends, Gro …

Summary

The beer market size in india reached INR 477.05 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Driven by rapid urbanization, a burgeoning young demographic, and a massive cultural shift toward premium and craft beverages, the market is projected to reach INR 832.93 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 6.45% during the forecast period (2026-2034).

What are the Key…

More Releases for Mexico

Egg Freezing in Mexico: Leading Mexico City Clinics Launch 2026 Programs

Enlistalo Fertilidad offers expanded egg freezing services for international patients, including Americans, seeking fertility preservation.

Mexico City, Mexico - January 22, 2026 - Egg freezing is becoming an increasingly popular option for patients worldwide, and Mexico City continues to emerge as a leading destination for those seeking high-quality, affordable fertility care.

In 2026, Enlistalo Fertilidad stands out for its personalized approach, advanced medical standards, and focus on supporting international patients through every…

Human Resources Mexico Releases Employer Guide To Mexico 2026 Minimum Wage Compl …

Mexico's National Minimum Wage Commission (CONASAMI) has confirmed the new minimum wage levels that will take effect on January 1, 2026. The general daily minimum wage will increase to MXN [315.04], while the Northern Border Free Zone rate will rise to MXN [440.87] for 2026.

Image: https://www.globalnewslines.com/uploads/2025/12/d53f76670eba46736b7e94c6a16fb975.jpg

The adjustment reflects an estimated 13 percent increase for the general zone and about 5 percent for the Northern Border Free Zone compared to 2025.…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by Market Insights Reports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by MarketInsightsReports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico Rooftop Solar…

The Mexico Online On-demand Home Services Market , Major Keyplayers - Aliada Inc …

Mexico Online On-demand Home Services Market 2021

Mexico online on-demand home services market offer a range of services within the comfort of home as well as save time and money. Additionally, these services help in bridging the gap between the real-world services and instant online services with improved efficiency. Recently, the demand for Mexico online on-demand home services marekt has started witnessing huge growth due to convenience and accessibility. The growing…

Mexico Agriculture Market, Mexico Agriculture Industry, Mexico Agriculture Grain …

Mexico Agriculture has been crucial sector of the country’s economy traditionally and politically even if it currently accounts for a really little share of Mexico’s GDP. Mexico is one in all the cradles of agriculture with the Mesoamericans emerging domesticated plants like maize, beans, tomatoes, squash, cotton, vanilla, avocados, cacao, number sorts of spices, and more. Domestic turkeys and Muscovy ducks were the solely domesticated fowl within the pre-Hispanic amount and little dogs…