Press release

Neobanking Revolution: What's Fueling the Surge in Digital-Only Banks | Major Companies are Atom Bank PLC, Monzo Bank Ltd, SoFi Technologies Inc.

The global Neobanking market will grow at a high CAGR of 49.2% during the forecast period 2024- 2031The Neobanking Market takes center stage in DataM Intelligence's latest comprehensive research, where industry experts deliver cutting-edge analysis powered by robust data analytics and strategic market intelligence. This groundbreaking study dives deep into the competitive ecosystem, spotlighting market leaders and their innovative approaches to product development, competitive pricing models, financial performance, and expansion strategies. The research unveils critical market forces, competitive positioning, and breakthrough trends that will define the industry's trajectory in the coming years, providing stakeholders with actionable intelligence to navigate this rapidly evolving marketplace.

Unlock exclusive insights with our detailed sample report (Please enter your Corporate Email ID to get priority access):- https://datamintelligence.com/download-sample/neobanking-market?rk

Neobanking refers to digital-only banks that operate exclusively online without any physical branches. These banks provide financial services such as payments, money transfers, loans, savings, and budgeting tools through mobile apps or web platforms. Neobanks are known for their user-centric interfaces, low fees, fast onboarding, and technology-driven personalization.

Market Trends

Surge in Smartphone and Internet Penetration: Increased use of mobile devices and internet access is driving demand for digital-first banking solutions.

Millennial and Gen Z Adoption: Younger populations prefer intuitive digital experiences, making them primary users of neobanking platforms.

API Integration & Open Banking: The growth of open banking and API ecosystems is allowing neobanks to offer personalized, real-time financial services.

Focus on Financial Inclusion: Neobanks are targeting underserved and unbanked populations in emerging markets with simplified onboarding and low-cost services.

B2B Neobanking on the Rise: There's growing demand from SMEs and freelancers for business-centric neobanking features like automated invoicing and expense tracking.

Embedded Finance Expansion: Many neobanks are embedding financial services into non-financial platforms (e.g., retail apps or logistics services).

Neobanking Market: Industry Giants and Emerging Leaders:

Atom Bank PLC, Monzo Bank Ltd, SoFi Technologies, Inc., Nu Pagamentos S.A, Revolut Inc., Tinkoff Bank, N26 GmbH, Ubank, Fidor Bank and WeBank Co., Ltd.

Neobanking Industry News:

Several neobanks have expanded their geographic footprint into Latin America, Southeast Asia, and the Middle East to tap into large unbanked populations.

Many platforms are introducing AI-powered financial advisory tools, offering users insights into spending patterns, budgeting, and credit optimization.

Partnerships between neobanks and fintechs or payment processors have increased to enhance service offerings like BNPL, crypto integration, and cross-border payments.

Regulatory bodies in several countries have started issuing digital banking licenses, allowing more neobanks to enter the market with official backing.

Some established banks have launched in-house neobank subsidiaries to compete in the digital-native segment.

Research Methodology

Our comprehensive research approach leverages a dual-methodology framework that seamlessly integrates qualitative insights with quantitative data analysis to deliver robust market intelligence. The process begins with extensive secondary research, where we meticulously collect information from authoritative industry publications, proprietary databases, and verified market sources. This foundation is strengthened through targeted primary research initiatives, including strategic surveys and in-depth interviews with industry veterans, market experts, and key stakeholders.

Speak to Our Senior Analyst and Get Customization in the report as per your requirements: https://datamintelligence.com/customize/neobanking-market

Segment Covered in the Neobanking Market:

By Account Type: Business Account, Savings Account

By Service: Mobile Banking, Payments and Money Transfer, Checking/Savings Account, Loans, others

By Application: Enterprise, Personal, others

This Report Covers:

✔ Go-to-market Strategy.

✔ Neutral perspective on the market performance.

✔Development trends, competitive landscape analysis, supply side analysis, demand side analysis, year-on-year growth, competitive benchmarking, vendor identification, Market Access, and other significant analysis, as well as development status.

✔Customized regional/country reports as per request and country level analysis.

✔ Potential & niche segments and regions exhibiting promising growth covered.

✔ Top-down and bottom-up approach for regional analysis

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=neobanking-market

Regional Analysis for Neobanking Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Frequently asked questions:

➠ What is the global sales value, production value, consumption value, import and export of Neobanking market?

➠ Who are the global key manufacturers of the Neobanking Industry? How is their operating situation (capacity, production, sales, price, cost, gross, and revenue)?

➠ What are the Neobanking market opportunities and threats faced by the vendors in the global Neobanking Industry?

➠ Which application/end-user or product type may seek incremental growth prospects? What is the market share of each type and application?

➠ What focused approach and constraints are holding the Neobanking market?

➠ What are the different sales, marketing, and distribution channels in the global industry?

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neobanking Revolution: What's Fueling the Surge in Digital-Only Banks | Major Companies are Atom Bank PLC, Monzo Bank Ltd, SoFi Technologies Inc. here

News-ID: 4091334 • Views: …

More Releases from DataM Intelligence 4market Research LLP

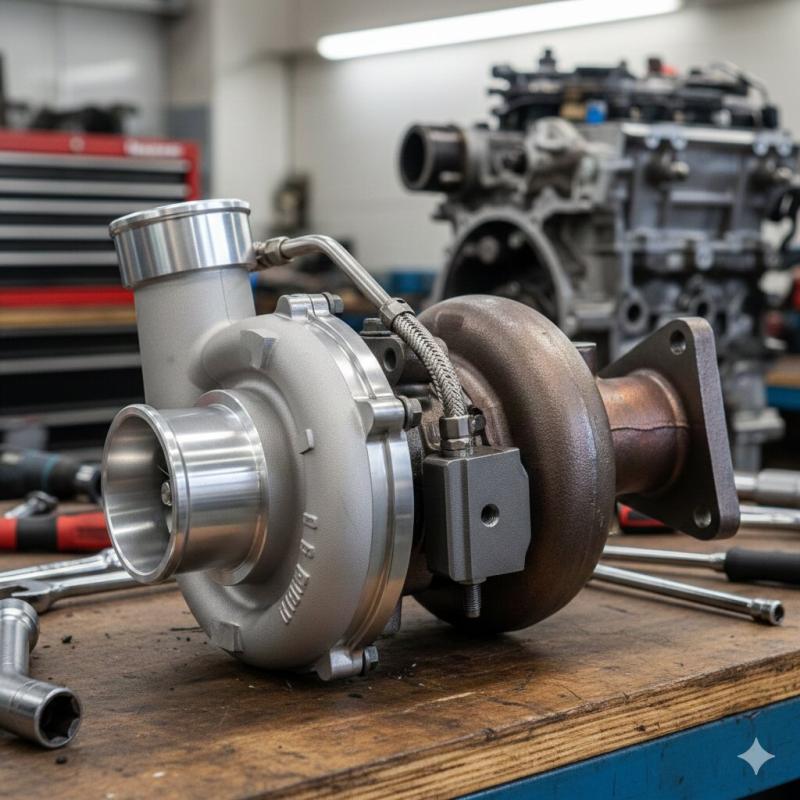

Automotive Turbocharger Market to Reach USD 16.5 Billion by 2030 at 10.3% CAGR, …

The Automotive turbocharger market reached USD 13.5 billion in 2022 and is expected to reach USD 16.5 billion by 2030, growing with a CAGR of 10.3% from 2023 to 2030. as vehicle manufacturers increasingly adopt turbocharging technology to enhance engine efficiency, performance, and emissions compliance.

Growth is supported by rising demand across key vehicle segments including passenger cars, commercial vehicles, and light-duty trucks, driven by stringent fuel economy and regulatory…

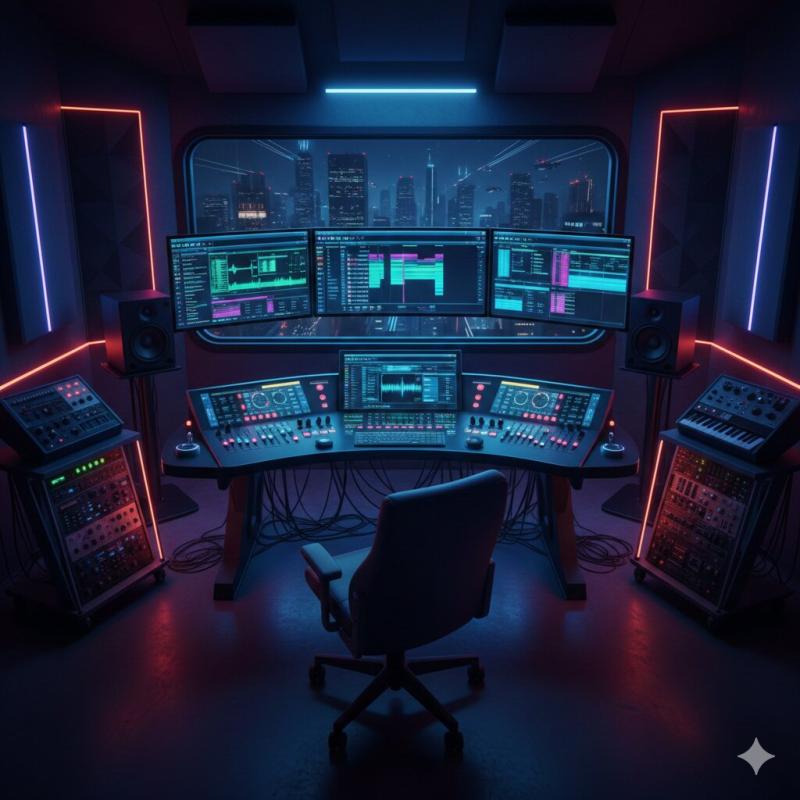

Digital Audio Workstation Market to Reach US$ 7.3 Billion by 2029 at 16.1% CAGR, …

The Digital Audio Workstation (DAW) Market reached approximately US$ 3.3 billion in 2024 and is expected to grow to around US$ 7.3 billion by 2029, expanding at a CAGR of about 16.1% from 2025 to 2029 as demand for advanced music production, sound design, and audio editing solutions continues to rise across professional and consumer segments.

Growth is supported by increasing adoption across key application areas such as music production, post-production,…

Fracture Fixation Products Market to Reach US$ 16.34 Billion by 2031 at 7.8% CAG …

The Global Fracture Fixation Products Market reached US$ 9.1 billion in 2023 and is expected to reach US$ 16.34 billion by 2031, growing at a CAGR of 7.8% from 2024 to 2031 as orthopedic care providers and surgical centers increasingly adopt advanced fixation solutions to improve patient outcomes and reduce recovery time.

Growth is supported by rising demand across key product segments such as plates & screws, intramedullary nails, external…

LNG Storage Tank Market to Reach USD 6.7 Billion by 2030 Driven by Rising LNG In …

The LNG Storage Tank Market reached USD 4.5 billion in 2022 and is expected to reach USD 6.7 billion by 2030, growing at a CAGR of 5.5% during the forecast period 2024-2031.

Growth is driven by increasing global demand for liquefied natural gas (LNG) as a cleaner alternative to conventional fossil fuels, particularly in power generation, industrial applications, and transportation. Rising investments in LNG infrastructure, including terminals, regasification facilities, and storage…

More Releases for Neobanking

Neobanking Market Trends That Will Shape the Next Decade: Insights from Neobanki …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

How Large Will the Neobanking Market Size By 2025?

The scale of the neobanking market has seen remarkable expansion in the past few years. It is expected to surge from $176.05 billion in 2024 up to $261.4 billion in 2025, reflecting a compound annual growth rate (CAGR) of 48.5%.…

Primary Catalyst Driving Neobanking Market Evolution in 2025: Rapid Digitalizati …

How Are the key drivers contributing to the expansion of the neobanking market?

The burgeoning need for digital transformation in banking agencies worldwide is fuelling the neobanking market's expansion. Digital banking involves the complete digitization of banking operations, replacing the physical branches with a constant online presence, thereby eliminating the requirement for customers to visit a physical office. Traditional banking services are getting streamlined through digital means. With digital banking, bank…

Neobanking Market Size & Trends To 2030

The Neobanking Market 2024 Report makes available the current and forthcoming technical and financial details of the industry. It is one of the most comprehensive and important additions to the Prudent Markets archive of market research studies. It offers detailed research and analysis of key aspects of the global Neobanking market. This report explores all the key factors affecting the growth of the global Neobanking market, including demand-supply scenario, pricing…

Neobanking Market Potential and Growth Opportunities 2024-2031

The Neobanking Market is a rapidly evolving sector, driven by advancements in hardware, software, and digital infrastructure. It encompasses a wide range of services, including cloud computing, cybersecurity, data analytics, and artificial intelligence. The increasing demand for digital transformation across industries is fueling growth. Emerging technologies like 5G, blockchain, and IoT are further expanding its potential. With continuous innovation, the IT market is expected to see robust growth in the…

Neobanking Market Key Trends, Analysis, Forecast To 2033

"The Business Research Company has recently revised its global market reports, now incorporating the most current data for 2024 along with projections extending up to 2033.

Neobanking Global Market Report 2024 by The Business Research Company offers comprehensive market insights, empowering businesses with a competitive edge. It includes detailed estimates for numerous segments and sub-segments, providing valuable strategic guidance.

The Market Size Is Expected To Reach $836.11 billion In 2028 At A…

Neobanking Market Size, Share, Industry, Forecast to 2030

The Neobanking Market 2023 Report makes available the current and forthcoming technical and financial details of the industry. It is one of the most comprehensive and important additions to the Prudent Markets archive of market research studies. It offers detailed research and analysis of key aspects of the global Neobanking market. This report explores all the key factors affecting the growth of the global Neobanking market, including demand-supply scenario, pricing…