Press release

Precious Metals Market Report 2025 Edition: Industry Size, Share, Growth and Competitor Analysis

IMARC Group, a leading market research company, has recently released a report titled "Precious Metals Market Size, Share, Trends and Forecast by Metal Type, Application, and Region, 2025-2033". The study provides a detailed analysis of the industry, including the precious metals market outlook, share, size, and industry growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.Report Highlights:

How Big Is the Precious Metals Market?

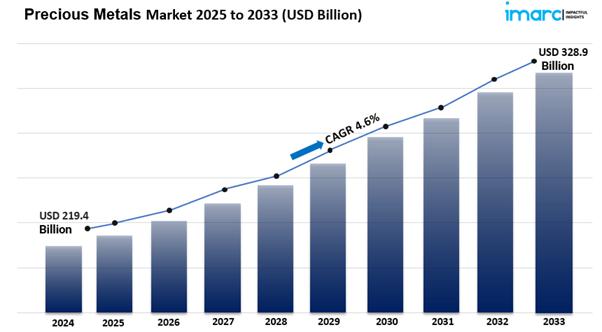

The global precious metals market size was valued at USD 219.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 328.9 Billion by 2033, exhibiting a CAGR of 4.6% from 2025-2033. Asia Pacific currently dominates the precious metals market share, due to the inflating investments in precious metals, increasing utilization of precious metals in a variety of industrial applications, and the extensive utilization of these metals for minting coins.

Precious Metals Market Insights:

• Investment demand increases as safe-haven assets become a favorite among investors across the world.

• Asia Pacific dominates market owing to jewelry and industrial applications demand.

• Gold leads sector, aided by ETFs and central bank reserves.

• Jewelry industry leads growth due to cultural significance and increased disposable incomes.

• Industrial consumption rises in electronics, automobile, and renewable energy industries.

Request to Get the Sample Report: https://www.imarcgroup.com/precious-metals-market/requestsample

Market Dynamics of the Precious Metals Market

Global Precious Metals Market Trends

The global precious metals market is poised for sustained growth, underpinned by evolving industrial needs, shifting investment trends, and a growing emphasis on sustainability. Approaching 2025, heightened economic uncertainty is expected to further fuel interest in precious metals as safe-haven assets, reinforcing their investment appeal. Concurrently, demand from crucial sectors such as electronics, automotive, and renewable energy is providing a strong foundational stability and potential for expansion.

Technological progress in mining and recycling processes is enhancing the market's efficiency and environmental performance, supporting better resource utilization and meeting the increasing demand for ethical and sustainable supply chains. Collectively, these multifaceted trends underscore the strategic importance of precious metals, not merely as essential industrial materials but also as critical financial instruments, thereby ensuring their continued relevance and value in the global economy.

Key Market Dynamics Driving the Precious Metals Industry

• Rising Industrial Demand for Precious Metals

Industrial applications are increasingly serving as a primary engine for demand growth across precious metals, including gold, silver, platinum, and palladium. These metals are highly valued not only for their inherent worth and aesthetic appeal but crucially for their exceptional functional properties. Silver, for instance, is extensively utilized in electronics, solar energy systems, and advanced medical devices, owing to its superior electrical conductivity and powerful antimicrobial characteristics. Meanwhile, platinum and palladium play an indispensable role in automotive catalytic converters, effectively aiding in the reduction of harmful vehicle emissions and ensuring compliance with increasingly stringent environmental regulations.

As global manufacturing continues its expansion and new technologies rapidly emerge, the industrial utilization of these versatile metals is projected to grow substantially. The accelerating global transition towards renewable energy sources and the widespread adoption of electric vehicles (EVs) are particularly significant drivers, specifically boosting demand for platinum and palladium. This ongoing and critical industrial reliance solidifies the long-term outlook for the precious metals market, contributing to price stability and potential appreciation.

• Investment Demand Amid Economic Uncertainty

Investment behavior remains a core and powerful influence on the precious metals market, particularly during periods characterized by economic instability and escalating geopolitical tension. Historically, gold and silver have consistently served as reliable safe-haven assets, offering a crucial store of value when fiat currencies and broader equity markets experience significant volatility. Recent global disruptions-including persistent inflationary pressures, growing recession fears, and pervasive financial market instability-have collectively reinforced the enduring appeal of precious metals as protective investments.

The widespread proliferation of various investment vehicles, such as exchange-traded funds (ETFs), accessible digital platforms, and user-friendly retail investment tools, has significantly broadened market access, actively encouraging participation from both institutional and individual retail investors. As the market progresses through 2025, macroeconomic uncertainty and shifting investor sentiment are broadly expected to further amplify the demand for gold and silver. This dual role-where precious metals function effectively as both essential industrial inputs and critical financial hedges-grants them a unique and remarkably resilient position within the global markets.

• Technological Advancements in Extraction and Recycling

Technological innovation is profoundly transforming the methods by which precious metals are extracted and subsequently recycled, significantly enhancing both efficiency and overall sustainability across the entire value chain. In the realm of mining, advancements such as sophisticated automated drilling, data-driven exploration techniques, and environmentally friendly extraction methods like bioleaching and advanced hydrometallurgy are systematically reducing operational costs while simultaneously minimizing environmental footprints. These crucial developments enable producers to extract metals more responsibly, all while effectively meeting burgeoning global demand. Simultaneously, recycling-especially the recovery of precious metals from electronic waste and other burgeoning "urban mining" sources-is rapidly gaining prominence as a critical component of the overall supply chain.

As sustainability becomes an increasingly paramount priority for both industries and governments worldwide, the ability to efficiently recover precious metals from used products robustly supports resource conservation and aligns with vital circular economy goals. These transformative innovations in both extraction and recycling not only ensure a more resilient and secure supply chain but also strategically align the precious metals market with global environmental standards, positioning the sector for long-term, responsible growth.

Checkout Now: https://www.imarcgroup.com/checkout?id=2351&method=1670

Precious Metals Market Report Segmentation:

By Metal Type:

• Gold

• Jewelry

• Investment

• Technology

• Others

Platinum

• Auto-catalyst

• Jewelry

• Chemical

• Petroleum

• Medical

• Others

Silver

• Industrial Application

• Jewelry

• Coins and Bars

• Silverware

• Others

Palladium

• Auto-catalyst

• Electrical

• Dental

• Chemical

• Jewelry

• Others

Gold represents the largest segment due to its historical role as a safe-haven asset and its cultural significance.

By Application:

• Jewelry

• Investment

• Electricals

• Automotive

• Chemicals

• Others

The jewelry sector accounts for the majority of the market share due to its high global demand for luxury goods and cultural affinity towards precious metal adornments.

Regional Insights:

• Asia Pacific

• North America

• Europe

• Latin America

• Middle East and Africa

Asia Pacific leads the market with its rapid economic growth, burgeoning middle-class wealth, and deep-rooted cultural affinity for gold.

Competitive Landscape With Key Players:

The competitive landscape of the precious metals market size has been studied in the report with the detailed profiles of the key players operating in the market

Some of These Key Players Include:

• Anglo American Platinum Limited (Anglo American PLC)

• Barrick Gold Corporation

• First Majestic Silver Corp

• First Quantum Minerals Ltd.

• Freeport-Mcmoran Inc.

• Fresnillo Plc (Peñoles Group)

• Gabriel Resources Ltd.

• Glencore International AG

• Gold Fields Limited

• Harmony Gold

• Impala Platinum Holdings Limited

• Lundin Mining Corporation

• Pan American Silver Corporation

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=2351&flag=C

Key Highlights of the Report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Market Trends

• Market Drivers and Success Factors

• Impact of COVID-19

• Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Precious Metals Market Report 2025 Edition: Industry Size, Share, Growth and Competitor Analysis here

News-ID: 4091063 • Views: …

More Releases from IMARC Group

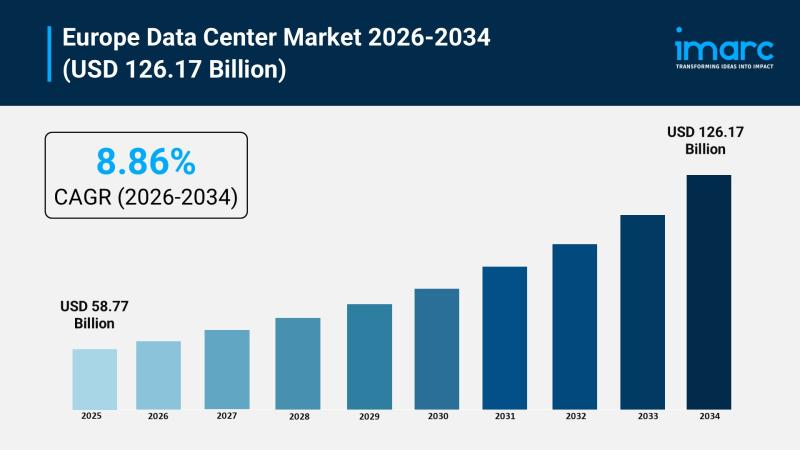

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

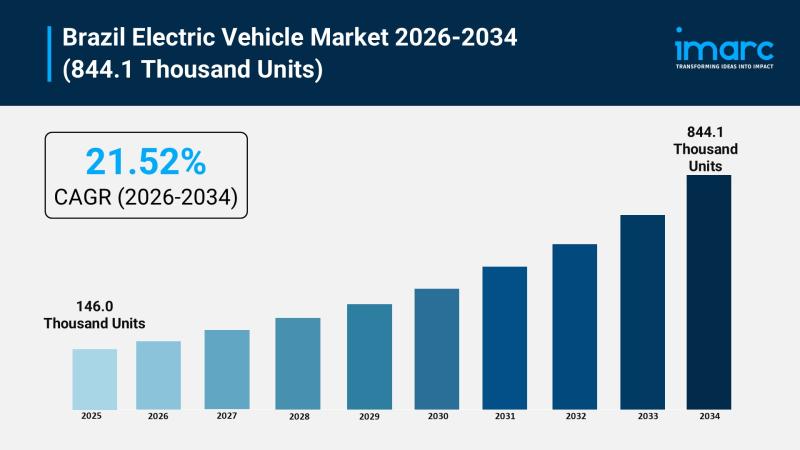

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Metal

Metal Roofing Companies Revolutionizing the Industry: Classic Metal Roofs Leads …

Classic Metal Roofs has established itself as a leading provider of durable and energy-efficient roofing systems in Southern New England. With over 20 years of experience, the company is known for high-quality installations, customer satisfaction, and sustainable metal roofing solutions.

As homeowners increasingly seek durable and energy-efficient solutions, metal roofing companies continue to provide top-tier roofing systems. Among the industry leaders, Classic Metal Roofs [http://business.bigspringherald.com/bigspringherald/markets/article/abnewswire-2025-2-15-classic-metal-roofs-expert-aluminum-shingle-metal-roof-installation-and-services/] stands out for its commitment to…

Rare Metal Raw Materials - Boron(B) Metal

Boron Powder [https://www.urbanmines.com/boron-powder-product/]

Short Description:

Boron [,%20a%20chemical%20element%20with%20the%20symbol%20B%20and%20atomic%20number%205,%20is%20a%20black/brown%20hard%20solid%20amorphous%20powder.%20It%20], a chemical element with the symbol B and atomic number 5, is a black/brown hard solid amorphous powder. It is highly reactiveand soluble in concentrated nitric and sulfuric acids but insoluble in water, alcohol and ether. It has a high neutro absorption capacity. UrbanMines specializes in producing high purity Boron Powder with the smallest possible average grain sizes. Our standard powderparticle sizes average in the…

Metal Polishing Services Market Trends and Leading Players 2023-2030 | Metal Pol …

With a CAGR of 6.1%, the Metal Polishing Services Market is expected to grow from USD 1.5 billion in 2023 to USD 2.3 billion by 2030, offering a gleaming finish to metal surfaces for aesthetic and functional purposes.

Market Overview:

The Metal Polishing Services market is poised for rapid growth, driven by several pivotal drivers. There is a continuous demand for metal finishing and polishing services that improve the appearance and…

Metal-to-metal Seal Market 2021 | Detailed Report

Metal-to-metal Seal Market Forecasts report provided to identify significant trends, drivers, influence factors in global and regions, agreements, new product launches and acquisitions, Analysis, market drivers, opportunities and challenges, risks in the market, cost and forecasts to 2027.

Get Free Sample PDF (including full TOC, Tables and Figures) of Metal-to-metal Seal Market @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=5089735

The report provides a comprehensive analysis of company profiles listed below:

- Parker

- CPI

- HTMS

- American Seal &…

Metal Polishing Services Market Research Report 2020 Analysis: Enhanced Growth a …

Metal Polishing Services Market

Global Metal Polishing Services Market is providing the summarized study of several factors encouraging the growth of the market such as manufacturers, market size, type, regions and numerous applications. By using the report consumer can recognize the several dynamics that impact and govern the market. For any product, there are several companies playing their role in the market, some new, some established and some are planning to…

Worldwide Recycled Metal Market By Metal 2024 | Nucor, Steel Dynamics, Schnitzer …

The 2018-2024 report on global Recycled Metal market explores the essential factors of Recycled Metal industry covering current scenario, market demand information, coverage of active companies and segmentation forecasts.

North America recycled metal market was estimated close to USD 8.5 billion in 2017. This is mainly attributed to strong presence of transportation, electrical & electronics and defense industry which majorly constitute to the overall product demand. Moreover, strict laws formulated…