Press release

Sodium Bromide Production Cost Analysis 2025: Equipment, Raw Materials, and Investment Overview

Introduction:Sodium bromide is an inorganic compound with the formula NaBr. It appears as a white, crystalline solid that is highly soluble in water. Commonly used in photography, pharmaceuticals, and as a sedative in the past, it now finds industrial applications in water treatment, chemical synthesis, and as a bromide source in drilling fluids for oil and gas extraction.

Setting up a sodium bromide production plant involves selecting a site with access to raw materials like sodium carbonate and hydrobromic acid, installing reactors, filtration, and drying systems, and ensuring compliance with environmental and safety regulations for efficient and sustainable operation.

IMARC Group's report, titled "Sodium Bromide Production Cost Analysis 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," provides a complete roadmap for setting up a sodium bromide production plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc.

Request for a Sample Report: https://www.imarcgroup.com/sodium-bromide-manufacturing-plant-project-report/requestsample

Sodium bromide Industry outlook 2025

The sodium bromide industry is gaining strong momentum in 2025 due to its essential role in various high-demand sectors. As a versatile inorganic compound, sodium bromide is widely used in oil and gas drilling fluids, water treatment, flame retardants, and pharmaceuticals. With global industrialization accelerating and stricter environmental standards being enforced, the need for effective chemical solutions like sodium bromide is growing steadily. In 2025, the market outlook is promising, with projections indicating significant growth driven by expanding applications and increased production capacities, especially in regions like Asia-Pacific, the Middle East, and North America. This makes the sodium bromide industry a strategic and profitable investment opportunity.

Key Insights for Sodium Bromide Production Plant Setup

Detailed Process Flow

• Product Overview

• Unit Operations Involved

• Mass Balance and Raw Material Requirements

• Quality Assurance Criteria

• Technical Tests

Project Details, Requirements and Costs Involved:

• Land, Location and Site Development

• Plant Layout

• Machinery Requirements and Costs

• Raw Material Requirements and Costs

• Packaging Requirements and Costs

• Transportation Requirements and Costs

• Utility Requirements and Costs

• Human Resource Requirements and Costs

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Project Economics:

• Capital Investments

• Operating Costs

• Expenditure Projections

• Revenue Projections

• Taxation and Depreciation

• Profit Projections

• Financial Analysis

Profitability Analysis:

• Total Income

• Total Expenditure

• Gross Profit

• Gross Margin

• Net Profit

• Net Margin

Speak to an Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=9470&flag=C

Key Cost Components of Setting Up a Sodium Bromide Plant

• Land and Site Development: Cost of purchasing land, grading, and preparing the site

• Raw Materials: Procurement of sodium carbonate, hydrobromic acid, or bromine

• Plant & Machinery: Reactors, filtration units, crystallizers, drying systems, and storage tanks

• Utilities: Installation of power, water supply, steam generation, and waste management systems

• Labor Costs: Skilled and unskilled workforce salaries and training expenses

• Construction and Civil Work: Building infrastructure including production units, offices, and warehouses

• Environmental Compliance: Effluent treatment systems, pollution control, and regulatory approvals

• Licensing and Legal Fees: Costs associated with permits, registrations, and safety certifications

• Logistics and Packaging: Storage, handling equipment, and packaging materials

• Contingency and Working Capital: Reserve funds for operational costs and unforeseen expenses

Economic Trends Influencing Sodium bromide Plant Setup Costs 2025

• Raw Material Price Volatility: Fluctuating prices of bromine and sodium carbonate due to global supply-demand shifts.

• Energy Cost Inflation: Rising electricity and fuel prices impacting operational and processing costs.

• Labor Market Tightness: Increased wages and labor shortages driving up hiring and training expenses.

• Interest Rate Trends: Higher borrowing costs affecting capital investment and loan financing for plant setup.

• Global Supply Chain Disruptions: Delays and higher import/export costs for machinery and materials.

• Environmental Compliance Costs: Stricter regulations requiring advanced pollution control and waste treatment systems.

• Currency Exchange Rates: Variations in forex rates influencing the cost of imported equipment and chemicals.

• Geopolitical Risks: Regional instability affecting raw material sourcing and plant location strategies.

• Incentives & Subsidies: Government incentives in certain regions may lower initial investment burden.

• Inflationary Pressures: General rise in construction materials and services increasing total setup costs.

Challenges and Considerations for Investors

• Raw Material Dependency: Reliable and cost-effective access to bromine is critical for sodium bromide production.

• Regulatory Compliance: Adhering to environmental and chemical handling regulations adds complexity and cost.

• High Initial Capital Investment: Setting up a sodium bromide plant requires substantial upfront expenditure on infrastructure and machinery.

• Market Competition: Presence of established sodium bromide manufacturers can limit market penetration for new entrants.

• Fluctuating Demand: Market demand for sodium bromide can be influenced by trends in oil drilling, water treatment, and pharmaceuticals.

• Technology Requirements: Investors must ensure modern, efficient, and safe production technologies for sodium bromide processing.

• Supply Chain Disruptions: Global trade uncertainties can impact the timely availability of sodium bromide inputs and delivery.

• Skilled Workforce Needs: Recruiting trained personnel to manage sodium bromide operations is essential for quality and safety.

• Price Sensitivity: Sodium bromide buyers may shift to alternatives if prices rise due to raw material or energy costs.

• Sustainability Pressures: Growing focus on green chemistry may influence the long-term viability of traditional sodium bromide production methods.

Buy Now: https://www.imarcgroup.com/checkout?id=9470&method=1911

Conclusion

Investing in the sodium bromide industry in 2025 presents a promising opportunity, driven by rising demand across key sectors such as oil & gas, water treatment, and pharmaceuticals. However, setting up a sodium bromide production plant requires careful consideration of raw material availability, regulatory compliance, and capital investment. By addressing economic challenges and leveraging technological advancements, investors can position themselves for sustainable growth in a market that is steadily expanding and evolving with global industrial needs.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Sodium Bromide Production Cost Analysis 2025: Equipment, Raw Materials, and Investment Overview here

News-ID: 4091001 • Views: …

More Releases from IMARC Group

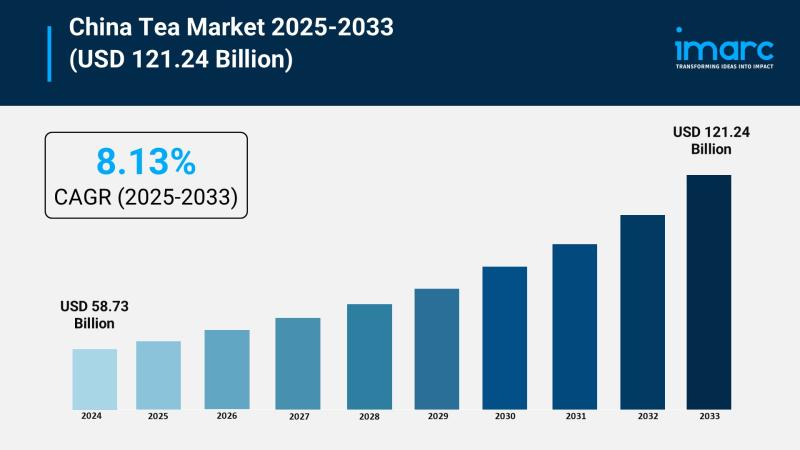

China Tea Market Forecast CAGR of 8.13%, Innovation Trends, and Strategic Insigh …

Market Overview

The China tea market was valued at USD 58.73 Billion in 2024 and is projected to reach USD 121.24 Billion by 2033, growing at a CAGR of 8.13% during 2025-2033. Growth is driven by rising health consciousness, premium product trends, government support, and expanding online retail. Innovation in flavors and packaging attracts younger consumers and global buyers, expanding the market.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

China Tea…

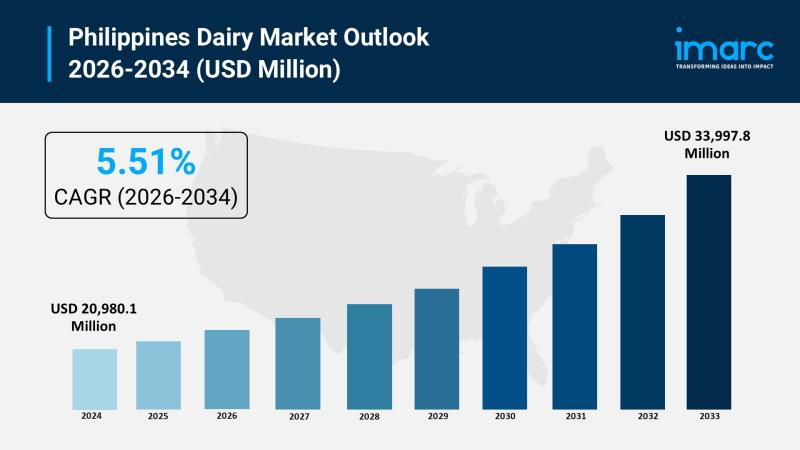

Philippines Dairy Market 2026: Expected to Reach USD 33,997.8 Million by 2034

Market Overview

The Philippines dairy market reached a size of USD 20,980.1 Million and is anticipated to grow to USD 33,997.8 Million by 2034 with a significant growth rate of 5.51%. This expansion is driven by rising demand for nutritious and diverse dairy products, rapid urbanization, increased disposable incomes, improved retail infrastructure, and strong government initiatives promoting local dairy production. Health-conscious consumers and expanding food service sectors further fuel this growth…

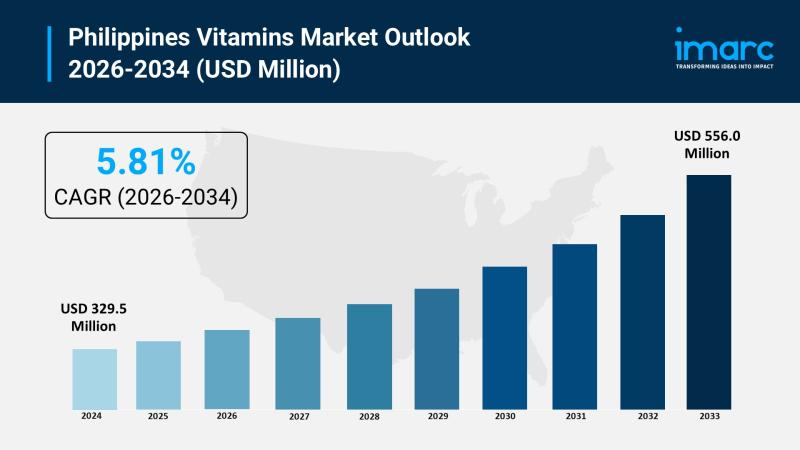

Philippines Vitamins Market 2026 | Projected to Reach USD 556.0 Million by 2034

Market Overview

The Philippines vitamins market was valued at USD 329.5 Million in 2025 and is projected to reach USD 556.0 Million by 2034, growing steadily over the forecast period. The market's growth is driven by increasing health consciousness, a rising geriatric population, and escalating demand for supplements that support immunity, energy, and overall wellness due to proactive health measures. The forecast period for this expansion is 2026-2034, with a CAGR…

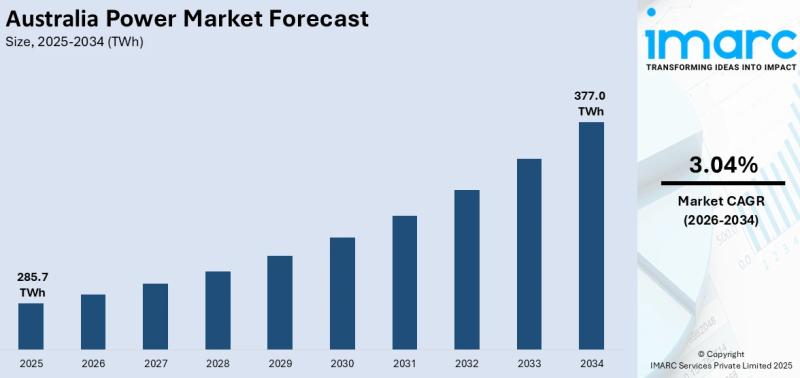

Australia Power Market Projected to Reach TWH 377 by 2034

Market Overview

The Australia power market size reached 285.7 TWh in 2025 and is projected to grow to 377.0 TWh by 2034, with a CAGR of 3.04% during the forecast period of 2026-2034. This growth is driven by rising renewable energy adoption, increased electricity demand, grid modernization, battery storage expansion, transition from coal plants, and government incentives for clean power. Key strategies such as virtual power plant integration and investments in…

More Releases for Cost

Steel Production Cost - Process Economics, Raw Materials, and Cost Drivers

Steel is the backbone of modern industry, and its production cost is one of the most closely tracked indicators across construction, infrastructure, automotive, and manufacturing sectors. Unlike niche chemicals or APIs, steel economics are driven by scale, energy intensity, and raw material volatility.

Here's the thing: steel production cost isn't just about iron ore prices. It's a layered equation involving coking coal, electricity, labor, emissions compliance, logistics, and technology choice. A…

Egg Powder Manufacturing Plant Setup Cost | Cost Involved, Machinery Cost and In …

IMARC Group's report titled "Egg Powder Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing an egg powder manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to…

Glucose Manufacturing Plant Cost Report 2024: Requirements and Cost Involved

IMARC Group's report titled "Glucose Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing a glucose manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to the operational…

Fatty Alcohol Production Cost Analysis: Plant Cost, Price Trends, Raw Materials …

Syndicated Analytics' latest report titled "Fatty Alcohol Production Cost Analysis 2023-2028: Capital Investment, Manufacturing Process, Operating Cost, Raw Materials, Industry Trends and Revenue Statistics" includes all the essential aspects that are required to understand and venture into the fatty alcohol industry. This report is based on the latest economic data, and it presents comprehensive and detailed insights regarding the primary process flow, raw material requirements, reactions involved, utility costs, operating costs, capital…

Corn Production Cost Analysis Report: Manufacturing Process, Raw Materials Requi …

The latest report titled "Corn Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Corn. Read More: https://www.procurementresource.com/production-cost-report-store/corn

Report Features - Details

Product Name - Corn Production

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost, Auxiliary Equipment…

Crude Oil Production Cost Analysis Report: Manufacturing Process, Raw Materials …

The latest report titled "Crude Oil Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Crude Oil. Read More: https://www.procurementresource.com/production-cost-report-store/crude-oil

Report Features - Details

Product Name - Crude Oil

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost,…