Press release

Agricultural Insurance Market Advances Due to Increased Agri-Risk Awareness During Forecast Period | Prudentisl and XL Callin, China United Property Insurance, American Insurance Group, Tokio Mariane

The Global Agricultural Insurance Market size reached USD 3214.7 million in 2022 and is projected to witness lucrative growth by reaching up to USD 5,482.2 million by 2030. The market is growing at a CAGR of 6.9% during the forecast period 2024-2031.The latest Agricultural Insurance market research report from DataM Intelligence delivers a comprehensive analysis of the global Agricultural Insurance Market landscape, highlighting emerging trends, market size, competitive dynamics, and key growth drivers. By leveraging advanced analytics, technology trend mapping, and regulatory assessment, the report highlights emerging growth drivers, evolving care models, and investment opportunities. It equips stakeholders with strategic intelligence essential for navigating the complex healthcare ecosystem from clinical innovation to operational efficiency across the forecast period 2024-2031.

Download exclusive insights with our detailed sample report (Corporate Email ID gets priority access):

https://www.datamintelligence.com/download-sample/agricultural-insurance-market?ophp

Agricultural insurance protects farmers and agribusinesses from losses caused by natural disasters or market fluctuations. With increasing climate unpredictability, the market is expanding rapidly, supported by government subsidies and advancements in technology like AI and satellite-based risk assessment, making coverage more efficient and accessible worldwide.

Comprehensive Insight into Agricultural Insurance Market Competitor Landscape:

Insurance Company of India, Prudentisl and XL Callin, China United Property Insurance, American Insurance Group, Tokio Mariane, New India Assurance, Farmers Mutual Hail, Everest Re Group, ICICI Lombard and Chubb.

Important Mergers, Acquisitions, and Market Shifts:

In March 2025 NFU Mutual now covers roughly 65-75% of UK farm insurance backed by a return to profitability in 2024.

Market Drivers:

The agricultural insurance market is driven by increasing climate-related risks, government subsidies and policy support, rising awareness among farmers, and technological advancements in risk modeling and crop monitoring.

Agricultural Insurance Market Segments

By Product (Managed Crop Hail Insurance, Multi-Peril Crop Insurance, Greenhouse Insurance, Aquaculture Insurance, Others)

By Organization (Government, Private)

By Distribution Channel (Digital & Direct Channel, Broker, Agency, Others)

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/agricultural-insurance-market?ophp

Methodology and Scope:

This Agricultural Insurance Market report is developed using a robust research methodology that combines primary interviews, insights from industry experts, and verified secondary sources such as company filings, trade journals, and trusted databases. It follows a bottom-up and top-down approach to ensure data accuracy through triangulation. The scope of the report covers current market trends, growth potential, and strategic developments across global and regional markets.

Regional Overview for Agricultural Insurance Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

The Report Includes:

➡ A descriptive analysis of demand-supply gap, market size estimation, SWOT analysis, PESTEL Analysis and forecast in the global market.

➡ Go-to-market Strategy.

➡ Neutral perspective on the market performance.

➡ Customized regional/country reports as per request and country level analysis.

➡ Potential & niche segments and regions exhibiting promising growth covered.

People Also Ask:

➠ What are the global sales, production, consumption, imports, and exports in the Agricultural Insurance market?

➠ Who are the top manufacturers, and what are their capacity, production, sales, pricing, and revenue stats?

➠ What key opportunities and challenges do vendors face in the Agricultural Insurance industry?

➠ Which product types, applications, or end-users are driving market growth, and what is their market share?

➠ What are the major growth drivers and restraints of the Agricultural Insurance market?

Looking For Exclusive Full Report? Get it here: https://www.datamintelligence.com/buy-now-page?report=agricultural-insurance-market?ophp

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Agricultural Insurance Market Advances Due to Increased Agri-Risk Awareness During Forecast Period | Prudentisl and XL Callin, China United Property Insurance, American Insurance Group, Tokio Mariane here

News-ID: 4090409 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Regenerative Agriculture Market to Reach USD 48.14 Billion by 2032 | Cover Cropp …

The Global Regenerative Agriculture Market USD 12,634.54 million in 2024 and is projected to witness lucrative growth by reaching up to USD 48,139.24 million by 2032. The market is growing at a CAGR of 18.20% during the forecast period 2025-2032.

The Regenerative Agriculture Market is rapidly gaining traction as farmers, agribusinesses, and policymakers focus on sustainable practices that restore soil health, enhance biodiversity, and mitigate climate change. Driven by increasing consumer…

United States Neonatal Intensive Care Unit Market 2026 | Growth Drivers, Trends …

Market Size and Growth

Neonatal intensive care unit market is estimated to reach at a CAGR of 4.19% during the forecast period (2024-2031).

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/neonatal-intensive-care-unit-market?sb

Key Development:

United States: Recent Industry Developments

✅ In February 2026, VirtuAlly became one of the first in the nation to integrate experienced virtual registered nurses into a Level IV Neonatal Intensive Care Unit care team,…

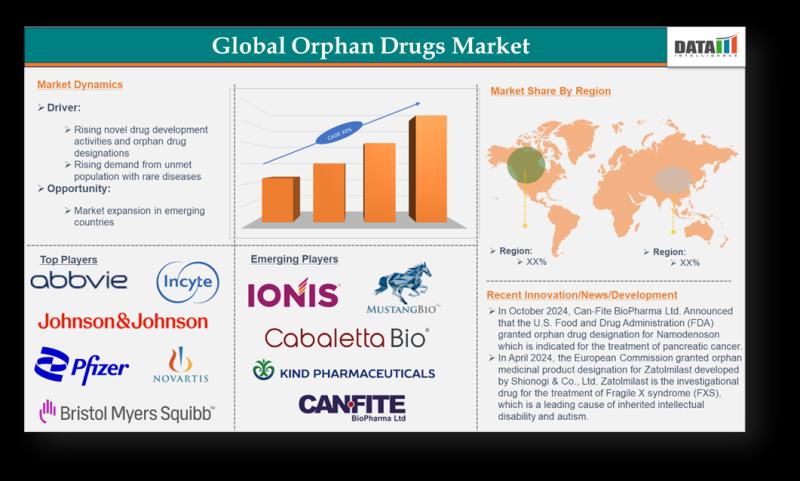

Orphan Drugs Market to Surge Beyond USD 350 Billion by 2033 | Biologics, Gene & …

The Global Orphan Drugs Market reached US$ 223.76billion in 2023 and is expected to reach US$ 486.51 billion by 2032, growing at a CAGR of 9.1% during the forecast period 2024-2032.

The Orphan Drugs Market is witnessing rapid growth as pharmaceutical companies and healthcare systems focus on developing treatments for rare and life-threatening diseases that affect small patient populations. Driven by increasing regulatory support, such as orphan drug designations, tax incentives,…

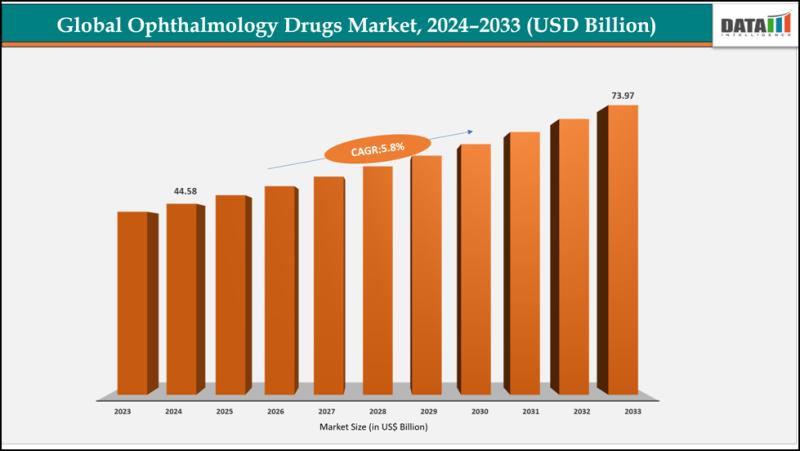

Ophthalmology Drugs Market to Reach USD 73.97 Billion by 2033 | Biologics, Anti- …

The global ophthalmology drugs market reached US$ 42.30 Billion with a rise of US$ 44.58 Billion in 2024 and is expected to reach US$ 73.97 Billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025-2033.

The Ophthalmology Drugs Market is experiencing steady expansion driven by the rising prevalence of vision-related disorders such as glaucoma, dry eye syndrome, retinal diseases, and age-related macular degeneration. Increasing screen exposure, aging…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…