Press release

Soaring Demand Set to Propel Letter Of Credit Confirmation Market to $5.63 Billion by 2029

Stay ahead with our updated market reports featuring the latest on tariffs, trade flows, and supply chain transformations.What Is the Expected CAGR for the Letter Of Credit Confirmation Market Through 2025?

The market size for letter of credit confirmation has seen a consistent rise in the past few years. It is projected to expand from a value of $4.38 billion in 2024 to $4.6 billion in 2025, indicating a compound annual growth rate (CAGR) of 4.9%. Factors contributing to this growth in the historical period include the intricacies involved in international transactions, concerns regarding creditworthiness, regulatory compliance issues, risks associated with currency exchange, global political and economic stability, and the extension of global supply chains.

What's the Projected Size of the Global Letter Of Credit Confirmation Market by 2029?

The market size of the letter of credit confirmation is predicted to experience robust expansion in the coming years, reaching $5.63 billion by 2029 with a compound annual growth rate (CAGR) of 5.2%. The anticipated growth within the forecast period is largely due to factors like evolving regulatory conditions, modifications in trade policy, the rise of alternative financing methods, the initiation of supply chain resilience, worldwide occurrences, and economic upheavals. The forecast period also presents several major trends, including digital transformation, the use of blockchain technology, alternative solutions for trade finance, automation and artificial intelligence implementation, collaborations between banks and fintechs and the customization of confirmation services.

View the full report here:

https://www.thebusinessresearchcompany.com/report/letter-of-credit-confirmation-global-market-report

Top Growth Drivers in the Letter Of Credit Confirmation Industry: What's Accelerating the Market?

The global trade activities surge is anticipated to boost the market for letter of credit confirmations in the future. Here, trade activities involve the purchase and sale of commodities, products, and services among corporations, countries, or groups with the primary goal of earning profits. This process entails the exchange of goods and services from one business to another. When it comes to trade activities, a confirmed letter of credit, a common trade finance instrument, safeguards exporters and importers by assuring payments, thus a rise in trade activities augments the need for the letter of credit confirmation. For instance, as per the United Nations Conference on Trade and Development, a Swiss-based intergovernmental organization that encourages global trade, the world trade value experienced a 25% hike to touch $28.5 trillion in 2021, as of February 2022. Moreover, the World Trade Organization, an institution based in Switzerland that regulates and supports international trade, projects a 3.5% rise in global merchandise trade volumes in 2022. Hence, the escalation in global trade activities is fuelling the demand for credit confirmation letters.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9087&type=smp

What Trends Will Shape the Letter Of Credit Confirmation Market Through 2029 and Beyond?

Leading firms in the letter of credit confirmation market are turning to innovative technologies, such as blockchain-supported letter of credit (LC) transactions, to remain competitive. A blockchain-supported LC transaction is a financial operation that employs blockchain technology to simplify and fortify the execution of international trade transactions. For example, in April 2023, Citi India, an Indian bank functioning as a foreign investor, carried out its inaugural blockchain-supported LC transaction. This operation was facilitated via Contour, a blockchain-based network that allows banks, businesses, and logistics partners to jointly and securely work in real-time on one shared platform. Notably, this transaction was finalized within three hours, drastically cutting down the processing duration relative to the customary five to ten-day period required for a letter of credit (LC) document submission.

What Are the Main Segments in the Letter Of Credit Confirmation Market?

The letter of credit confirmation market covered in this report is segmented -

1) By L/C Type: Sight L/Cs, Usance L/Cs

2) By End User: Small Enterprises, Medium-Sized Enterprises, Large Enterprises

Subsegments:

1) By Sight L/Cs: Commercial Sight L/Cs, Standby Sight L/Cs

2) By Usance L/Cs: Commercial Usance L/Cs, Standby Usance L/Cs

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=9087&type=smp

Which Top Companies are Driving Growth in the Letter Of Credit Confirmation Market?

Major companies operating in the letter of credit confirmation market include Bank of America Corporation, Citigroup Inc., DBS Bank Ltd., JPMorgan Chase & Co., Mizuho Bank Ltd., MUFG Bank Ltd., Scotiabank, Standard Chartered PLC., Sumitomo Mitsui Banking Corporation, The PNC Financial Services Group Inc., CoBank, HSBC Holdings plc., ICICI Bank Group, State Bank of India. Group, Wells Fargo & Company, Barclays Bank PLC, BNP Paribas SA, Credit Agricole SA, Deutsche Bank AG, Industrial and Commercial Bank of China Limited, National Australia Bank Limited, Royal Bank of Canada, Societe Generale SA, The Bank of Tokyo-Mitsubishi UFJ Ltd., The Toronto-Dominion Bank, nion Bank of Switzerland Aktiengesellschaft AG, UniCredit S.p.A., Westpac Banking Corporation, China Construction Bank Corporation

Which Regions Will Dominate the Letter Of Credit Confirmation Market Through 2029?

Asia-Pacific was the largest region in the letter of credit confirmation market in 2024. The regions covered in the letter of credit confirmation market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=9087

This Report Supports:

1. Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2. Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3. Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4. Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Soaring Demand Set to Propel Letter Of Credit Confirmation Market to $5.63 Billion by 2029 here

News-ID: 4089852 • Views: …

More Releases from The Business Research Company

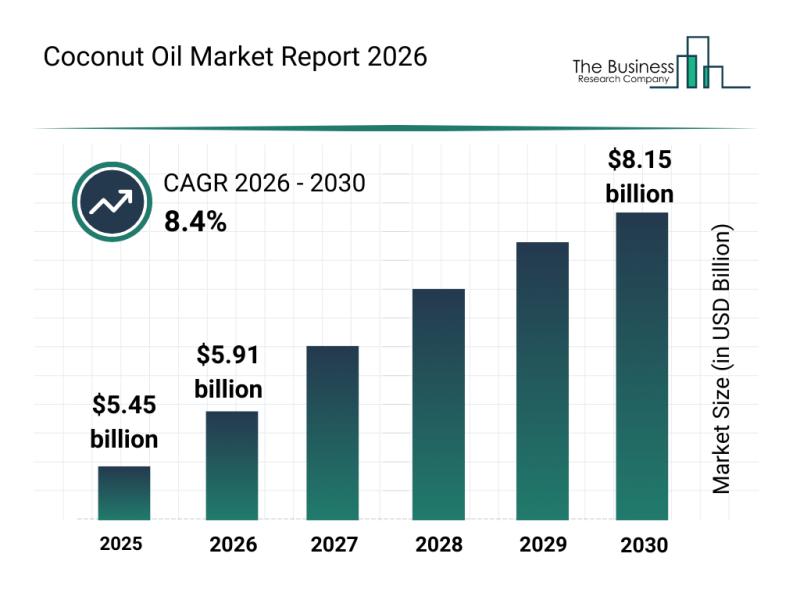

Trends in Growth, Market Segments, and Competitive Strategies Influencing the Co …

The coconut oil industry is poised for remarkable expansion in the coming years, driven by evolving consumer preferences and innovations across various sectors. As demand grows for healthier and sustainable products, the market is expected to witness significant developments that will shape its future trajectory. Let's explore the current market value, key players, trends, and segmentation of the coconut oil industry.

Projected Market Value and Growth Outlook for the Coconut Oil…

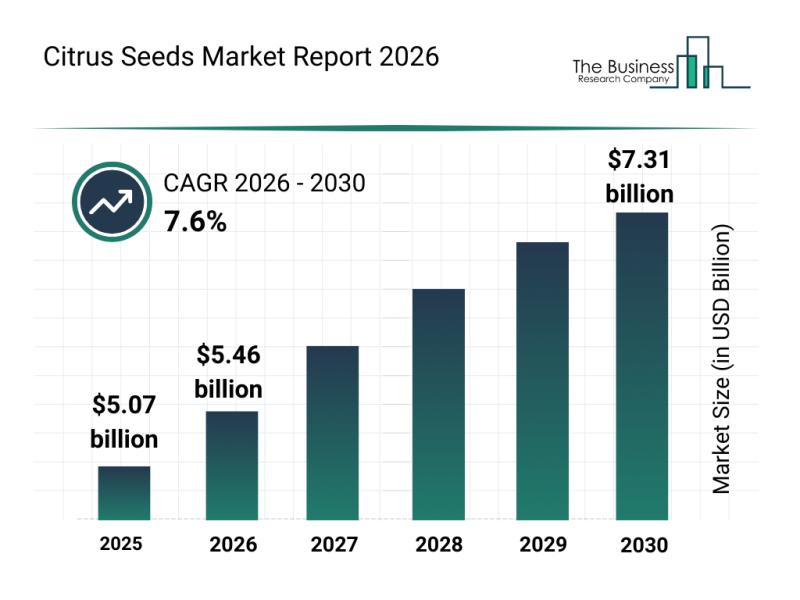

Analysis of Key Market Segments Driving the Citrus Seeds Market

The citrus seeds market is attracting significant attention due to its expanding role in agriculture, cosmetics, and food industries. With increasing emphasis on sustainability and innovative uses, this sector is set to experience notable growth in the coming years. Let's explore the current market size, influential trends, leading companies, and segmentation details shaping the future of the citrus seeds industry.

Citrus Seeds Market Size and Forecast Through 2030

The citrus…

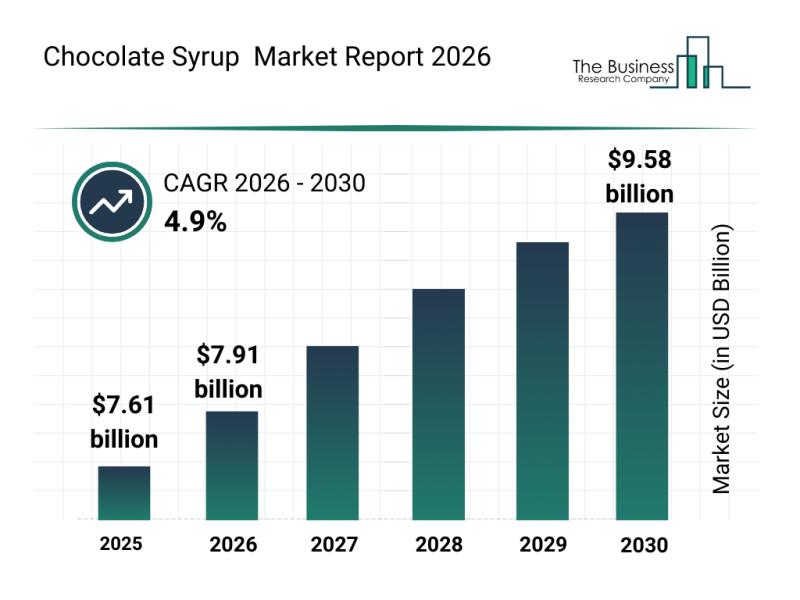

Market Trend Insights: The Impact of Recent Developments on the Chocolate Syrup …

The chocolate syrup market is on a steady growth path, driven by evolving consumer preferences and innovations in product offerings. As demand shifts toward healthier and more diverse options, the industry is poised for notable expansion in the coming years. Let's explore the market's projected valuation, key players, emerging trends, and segmentation in detail.

Projected Market Value and Growth Forecast of the Chocolate Syrup Market

The chocolate syrup market is…

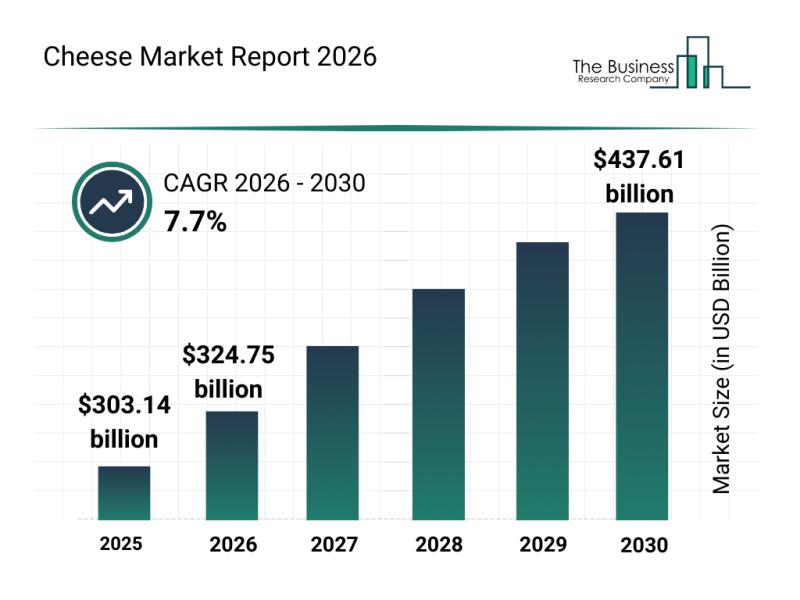

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the C …

The cheese market is on track for substantial growth as consumer preferences evolve and new product innovations emerge. With rising interest in premium, plant-based, and specialty cheese options, this industry is preparing for a significant expansion by 2030. Let's explore the market size projections, key players, emerging trends, and the main product segments shaping this dynamic market.

Projected Growth and Size of the Cheese Market by 2030

The cheese market…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…