Press release

A research report says trust in the dollar is disappearing and gold is taking center stage

Spot gold prices gained strong upward momentum during the European trading session, hitting a record high of $3,237.66. They slightly adjusted back to the $3,220 area before the U.S. market opened, but remained in a strong range overall. Driven by the intensification of global trade tensions and the weakening of the U.S. dollar, gold once again demonstrated its value as a safe-haven asset.Fundamental Analysis

The U.S. Dollar Index (DXY) has extended its broad-based decline and has now fallen below the 99.90 level, marking a three-year low. Ongoing concerns about both the global and U.S. economic outlook have intensified selling pressure on the dollar.

U.S inflation data for March came in below expectations, further strengthening market expectations that the Federal Reserve could begin cutting interest rates as early as June. The Consumer Price Index (CPI) rose 2.4% year-over-year, below the forecast of 2.6% and down from 2.8% in February. Core CPI, which excludes food and energy prices, increased 2.8% year-over-year, also below expectations. On a monthly basis, headline CPI fell by 0.1%, while core CPI edged up 0.1%.

Market Outlook

Bullish Perspective

In the short term, spot gold is expected to maintain its strength. The U.S. Dollar Index hitting a three-year low provides strong support for gold prices. Escalating global trade tensions have heightened risk-off sentiment in the markets, increasing gold's appeal as a safe-haven asset. From a technical standpoint, gold is trading within an upward channel, with the $3,215 level serving as a key support. As long as prices remain above this level, gold may continue to test the $3,395-$3,535 range.

U.S. inflation data came in lower than expected, reinforcing market expectations that the Federal Reserve may implement multiple rate cuts this year. A rate-cutting cycle is typically favorable for gold, as it reduces the opportunity cost of holding non-yielding assets like gold. If expectations for further Fed rate cuts continue to build, gold prices may see additional upside, potentially challenging the psychological $3,600 level later this year.

Bearish Perspective

While bulls currently dominate in the short term, it's important to recognize that gold prices are already trading near historic highs, and the potential for a pullback cannot be ignored. Both the RSI and CCI indicators are in elevated territory, approaching overbought levels, suggesting that a short-term technical correction may be on the horizon. If trade tensions begin to ease or if Federal Reserve officials deliver more hawkish commentary, gold prices could retreat.

From a medium- to long-term perspective, if U.S. inflation data continues to improve and the Fed delays rate cuts, a stabilization or rebound in the U.S. dollar could put downward pressure on gold. Additionally, major central banks around the world still hold significant gold reserves, and any large-scale profit-taking could trigger a decline in gold prices. In such a scenario, gold could correct down to the $3,100-$3,000 support zone, or even test the lower boundary of the ascending channel around $2,950.

That said, even if a correction occurs, the likelihood of a sharp drop remains limited due to ongoing global economic uncertainties and geopolitical risks. The market will continue to closely monitor Fed policy signals, inflation data, and developments in trade negotiations as key indicators for gold's future direction. Moreover, with spot gold trading on a T+0 basis, traders can profit regardless of whether prices rise or fall, adding flexibility to short-term strategies.

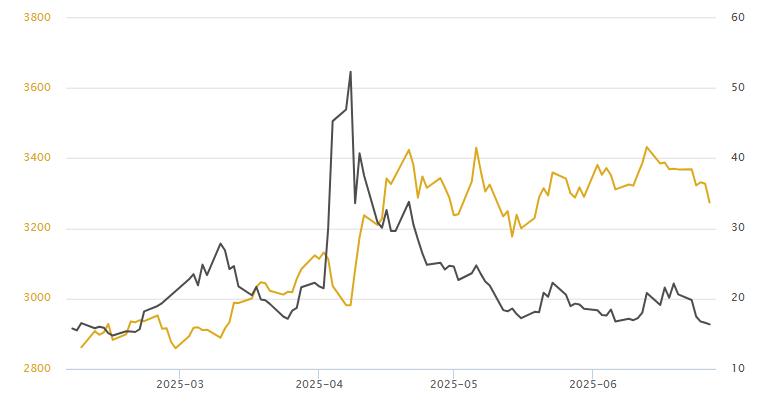

Spot Gold VIX Index

The VIX Index, often referred to as the "Fear Index," stands for the Chicago Board Options Exchange Volatility Index. It is a key measure of investor sentiment and market anxiety. Typically, it has a positive correlation with gold prices.

When the VIX rises, it indicates growing investor unease and heightened risk aversion, which tends to boost demand for safe-haven assets like gold-supporting a bullish outlook for gold prices. Conversely, when the VIX declines, it reflects improved risk appetite among investors and easing market fears, which can be a bearish signal for gold's future performance.

Spot Gold US Dollar Index

Generally speaking, the U.S. Dollar Index and gold prices tend to show a negative correlation about 70% of the time. This means that, in most cases, when the dollar rises, gold tends to fall-and when the dollar falls, gold tends to rise.

Spot Gold 10-year U.S. Treasury yield

The 10-year U.S. Treasury yield refers to the return on the U.S. government's 10-year bonds. Generally, it has an inverse relationship with gold prices-when the 10-year Treasury yield rises, gold tends to fall; when the yield declines, gold tends to rise.

The Gold Bug Index (HUI) is a leading indicator for predicting the direction of gold prices. This index includes 16 of the most important large gold mining companies in the U.S., such as Newmont Mining. Therefore, the rise and fall of the HUI reflect the market sentiment and outlook on gold prices held by major institutional investors and professional mining companies. Generally, the direction of gold prices moves in tandem with the HUI, and the index's trend changes tend to slightly lead the movements in gold prices.

TIPS, or Treasury Inflation-Protected Securities, are inflation-linked bonds issued by the U.S. Department of the Treasury. Generally speaking, rising inflation is bullish for gold prices, while falling inflation is bearish. Therefore, the prices of TIPS often show a positive correlation with gold prices.

The CRB Index, also known as the Commodity Research Bureau Index, is a global commodity index. Since gold is a unique commodity, the CRB Index generally moves in the same direction as gold prices-that is, the CRB and gold prices tend to rise and fall together.

Annual Gold Price Key Events Timeline

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release A research report says trust in the dollar is disappearing and gold is taking center stage here

News-ID: 4089064 • Views: …

More Releases from Binary News Network

GISEC Global to Launch Cyber Diplomacy Forum in 2026 as Cybersecurity Moves Cent …

Abu Dhabi, UAE, 4th February 2026, ZEX PR WIRE, GISEC Global, the Middle East and Africa's largest and most influential cybersecurity event, has announced the launch of the Cyber Diplomacy Forum, a new high-level platform debuting at GISEC Global 2026, reflecting the growing role of cybersecurity in foreign policy, international trade and national security decision-making.

The announcement follows an invitation-only Cyber Envoys' Breakfast Briefing held in Abu Dhabi on 29 January,…

Amadeus Acquires Bitte to Power Private, Deterministic and Self-Improving Tradin …

Strategic acquisition combines Bitte's proven trading agent platform and developer ecosystem with Amadeus Protocol's private, deterministic infrastructure.

Tortola, BVI, 4th February 2026, ZEX PR WIRE, Amadeus Protocol, the AI-native Layer 1 for private, deterministic, self-improving agents, today announced the strategic acquisition of Bitte.ai (formerly Bitte Protocol / Mintbase) for $1.7 million paid in $AMA. The deal unifies Amadeus' approach to developing infrastructure for private and deterministic agents, with Bitte's battle-tested agentic…

Luxury Isn't Bought, It's Curated: Helen Yi on Style, Memory, and the Art of Liv …

Chicago, IL, 2nd February 2026, ZEX PR WIRE, For Helen Yi, luxury begins long before a purchase is made. It starts with a way of seeing; shaped by art, architecture, travel, and lived experience. Her work across fashion, interiors, and cultural retail reflects a sensibility that is polished yet instinctive, timeless yet responsive.

Yi's personal style has remained consistent since her early years. Elegant, assured, and quietly confident, it evolves…

What Luxury Means Now and Why Most People Are Getting It Wrong, According to Hel …

Chicago, IL, 2nd February 2026, ZEX PR WIRE, Luxury has never been louder. Logos dominate feeds. "Exclusivity" is marketed at scale. Trends rise and fall at algorithmic speed. And yet, according to Chicago-based tastemaker Helen Yi, true luxury has become harder to find precisely because it is being confused with visibility.

"We've mistaken access for understanding," Yi says. "Luxury isn't about owning something rare. It's about knowing why something matters."

With more…

More Releases for Fed

ZBXCX Stock Market Outlook Fed Signals and Earnings

ZBXCX notes that the bonds market has started 2026 with a "high-yield, high-attention" setup: policy is no longer tightening, inflation is cooler than its peak years, and investors are debating whether the next big move is a gradual easing cycle or a stop-and-go sequence driven by stubborn prices.

A quick snapshot helps frame the current pricing:

o 10s-2s curve: roughly +0.65 percentage points, meaning the curve is positively sloped at the moment.

o…

Fed Rate Cut Reignites Bitcoin Mining Interest

BTC prices continue to rise as the Federal Reserve's rate cuts drive renewed demand from businesses, institutional investors, and sovereign governments.

As one of the best-performing crypto this year, Bitcoin's continued price appreciation is undeniable. This is due not only to the Trump administration's strong support and its decision to establish a Bitcoin strategic reserve, but, more importantly, to the Federal Reserve's rate cut in September, which has increased institutional demand…

Prominent Direct-Fed Microbials (DFM) Market Trend for 2025: Product Innovations …

How Are the key drivers contributing to the expansion of the direct-fed microbials (dfm) market?

The upsurge in the demand for meat and milk consumption is predicted to fuel the growth of the direct-fed microbial (DFM) market in the forthcoming future. Meat, often defined as the edible flesh of animals such as fish and birds, can be a part of a healthy eating plan. Milk, which is a whitish fluid food…

Global Direct-Fed Microbials Market Research Report 2023-2029

This report studies the Direct-Fed Microbials market. Direct fed microbials (or probiotics) refer to living organisms and should not be confused with prebiotics, compounds that promote the growth of gut bacteria (e.g., yeast culture, oligosaccharides) but are not living organisms. It is believed that gut bacteria have requirements for specific nutrients that may not be adequately provided by the animal's diet. Therefore, feeding these nutrients may promote the growth of…

Grass Fed Meat Market Consumption Status and Prospects Professional Grass Fed Me …

Global “Grass Fed Meat Market" size to grow with an impressive CAGR over the forecast period from 2021-2028. The report on the Grass Fed Meat industry provides the clients with a comprehensive analysis of crucial driving factors, consumer behavior, growth trends, product utilization, key player analysis, brand positioning, and price patterns. The information on pricing patterns is obtained by analyzing product prices of key players as well as emerging industry…

Global Direct-Fed Microbials Market

Microbes are microscopic living organisms that can exist as single celled organisms or colonies of cells in nature. Some microorganisms are hazardous to both human and animal health, while others are extremely beneficial to both. As a result, direct-fed microorganisms are bacteria that are supplemented orally to provide benefits in animals.

Get sample copy of this report @

https://www.infinitybusinessinsights.com/request_sample.php?id=536263

Increasing demand for…