Press release

Europe Equine Insurance Market to Reach USD 2223.3 Mn by 2035, Riding on Robust Growth and Strategic Partnerships - Analysis by TMR

The Europe Equine Insurance Market, valued at US$ 915.9 million in 2024, is set to experience significant growth, with projections indicating a compound annual growth rate (CAGR) of 8.5% from 2025 to 2035. By the end of the forecast period, the market is anticipated to reach US$ 2223.3 million, driven by evolving consumer needs, growing awareness of equine welfare, and strategic expansions by key industry players.Market participants including Agria Pet Insurance Ltd, AXA XL (Axa S.A.), C. Jarvis Insurance, Canopius, E&L Insurance, KBIS British Equestrian Insurance, Markel, NFU Mutual, Petplan Equine, and Taylor, Harris Insurance Services are adopting strategic partnerships to strengthen their portfolios and expand their reach across Europe.

Access key findings and insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86180

Market Overview

The Europe Equine Insurance Market is undergoing a pivotal transformation as both individual horse owners and commercial equine operators increasingly recognize the need for comprehensive insurance coverage. Horses are high-value assets that demand protection against a wide spectrum of risks including mortality, illness, theft, surgical costs, and liability claims. The rising number of recreational riders, competitive equestrians, and stud farms has contributed to the growing demand for equine insurance products. Insurers are responding with more customizable and flexible policies that reflect the diverse needs of the equestrian ecosystem.

Market Size and Growth

In 2024, the Europe Equine Insurance Market was valued at US$ 915.9 Mn. Forecasts project the market will expand at a CAGR of 8.5% between 2025 and 2035, culminating in a valuation of US$ 2223.3 Mn by 2035. This substantial growth can be attributed to a confluence of factors such as the rising cost of veterinary care, increasing participation in equestrian sports, and a cultural emphasis on animal welfare. The post-pandemic resurgence of outdoor sports and leisure activities has also played a significant role in reviving the equine sector, consequently boosting insurance uptake.

Market Segmentation

The Europe Equine Insurance Market can be segmented by type of insurance, coverage type, and end users. Types of insurance commonly offered include mortality insurance, medical/surgical insurance, loss of use, and liability insurance. Within coverage types, comprehensive and custom-built policies are gaining traction over basic policies, offering tailored benefits such as international transport coverage, foal insurance, and infertility protection. End users span from individual horse owners and breeders to professional equestrian athletes, riding schools, and commercial stables. Each group presents distinct needs, encouraging insurers to develop highly targeted products.

Regional Analysis

Within Europe, Western Europe-particularly the UK, Germany, France, and the Netherlands-dominates the equine insurance landscape. The United Kingdom, with its long-standing equestrian heritage and robust insurance sector, represents a particularly mature market. Northern Europe also shows considerable growth, thanks to rising horse ownership and state support for animal welfare initiatives. Meanwhile, Eastern and Southern Europe are emerging markets with potential for rapid adoption as equestrian sports and recreational riding gain popularity. Regional disparities in equine culture and income levels have led to varying penetration rates, creating opportunities for localized policy development.

Explore our report to uncover in-depth insights - https://www.transparencymarketresearch.com/europe-equine-insurance-market.html

Market Drivers and Challenges

Several key drivers are propelling market growth. The increasing value of individual horses, often reaching six-figure sums, has made insurance a financial necessity. Rising awareness of equine health and wellness, coupled with technological advancements in veterinary science, has led to higher treatment costs-further fueling the demand for insurance. Additionally, climate change and extreme weather events have introduced new risk factors that equine owners are seeking to mitigate through comprehensive policies.

On the flip side, limited awareness in certain regions, lack of standardization in policy offerings, and complexity in claims processing remain significant challenges. Regulatory fragmentation across EU member states also poses hurdles for insurers operating in multiple countries. Overcoming these barriers will require concerted efforts in customer education, digitization of services, and policy harmonization.

Competitive Landscape

The competitive dynamics in the Europe Equine Insurance Market are shaped by both established players and emerging niche providers. Leading firms such as Agria Pet Insurance Ltd, AXA XL, and Markel dominate market share due to their wide distribution networks, long-standing reputations, and extensive coverage options. Meanwhile, specialists like KBIS British Equestrian Insurance and Taylor, Harris Insurance Services continue to focus on bespoke, high-touch customer service and tailored products for elite clients.

Mergers, acquisitions, and strategic partnerships are central to market consolidation. Many companies are collaborating with veterinary networks, equestrian associations, and sports bodies to strengthen their brand presence and build trust. Investment in customer education and loyalty programs is another tactic being used to retain and grow customer bases.

Future Outlook

The future of the Europe Equine Insurance Market is promising, with technological innovation, increased awareness, and policy evolution set to redefine the landscape. The market is projected to double in size by 2035, driven by ongoing efforts to simplify the insurance process and integrate holistic wellness into policy frameworks. Strategic expansions by key players and increased penetration in underinsured regions will also contribute to market maturity.

Policy development is expected to move beyond traditional parameters, incorporating behavioral analytics, wearable tech, and AI-based risk profiling to deliver more accurate underwriting and real-time policy adjustments. This transformation will make equine insurance not only more accessible but also more adaptive to the changing needs of modern horse ownership.

Want to know more? Get in touch now. - https://www.transparencymarketresearch.com/contact-us.html

More Trending Reports by Transparency Market Research -

Livestream E-Commerce Market - https://www.transparencymarketresearch.com/livestream-e-commerce-market.html

Spiritual and Wellness Products Market - https://www.transparencymarketresearch.com/spiritual-and-wellness-products-market.html

Outdoor Furniture Market - https://www.transparencymarketresearch.com/outdoor-furniture-market.html

Online Home Decor Market - https://www.transparencymarketresearch.com/online-home-decor-market.html

Connected Apparel Market - https://www.transparencymarketresearch.com/connected-apparel-market.html

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Europe Equine Insurance Market to Reach USD 2223.3 Mn by 2035, Riding on Robust Growth and Strategic Partnerships - Analysis by TMR here

News-ID: 4088852 • Views: …

More Releases from Transparency Market Research

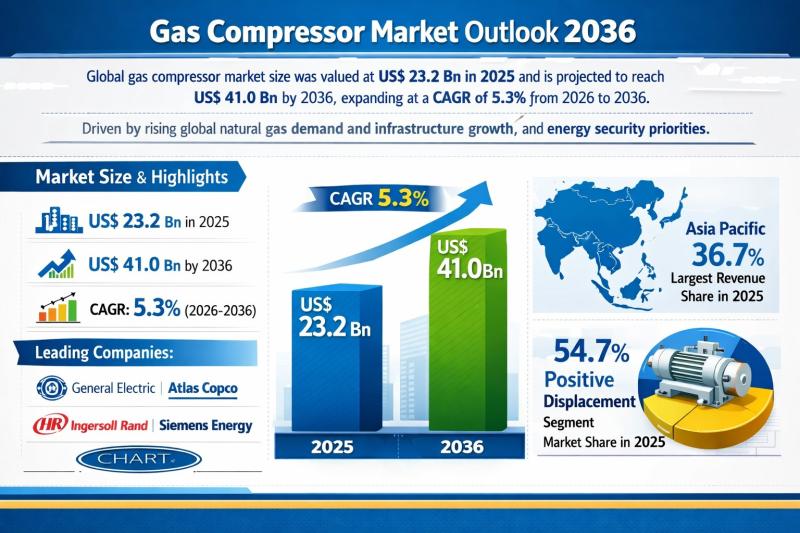

Gas Compressor Market Outlook 2036: Global Industry Expected to Reach US$ 41.0 B …

The global gas compressor market was valued at US$ 23.2 Bn in 2025 and is projected to reach US$ 41.0 Bn by 2036, expanding at a compound annual growth rate (CAGR) of 5.3% from 2026 to 2036. This steady growth trajectory reflects the structural importance of gas compression systems across upstream, midstream, and downstream gas value chains. Rising natural gas consumption, expansion of pipeline and LNG infrastructure, and national energy…

Anesthesia Drugs Market to be Worth USD 12.6 Bn by 2036 - By Drug / By Applicati …

The global anesthesia drugs market was valued at US$ 7.6 billion in 2025 and is projected to reach US$ 12.6 billion by 2036, expanding at a compound annual growth rate (CAGR) of 4.7% from 2026 to 2036. This steady growth trajectory reflects the essential and non-substitutable role of anesthesia drugs in modern healthcare systems. As surgical interventions continue to rise globally-across both elective and emergency procedures-the demand for safe, effective,…

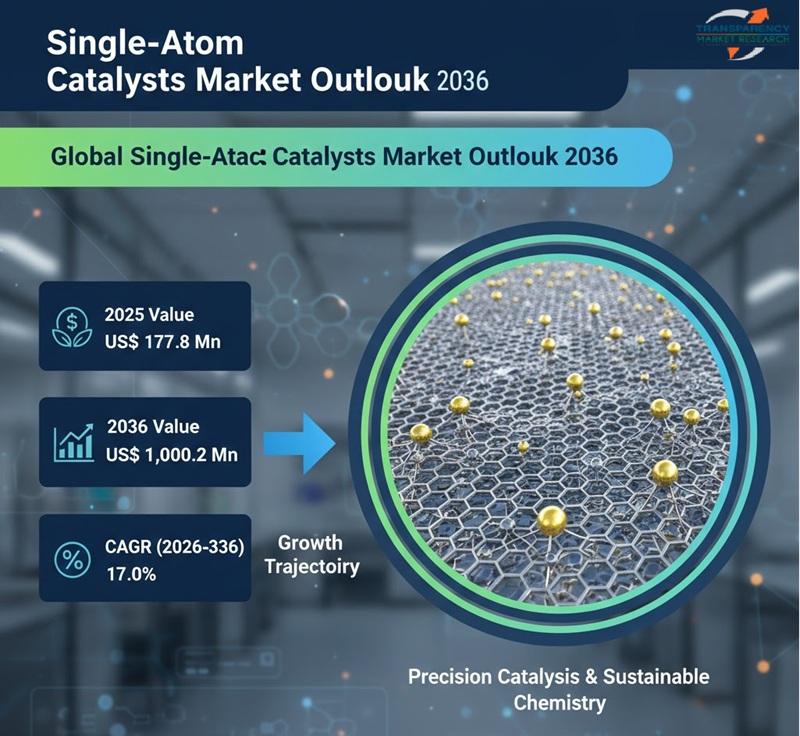

Single-Atom Catalysts Market Size is Expected to Expand from US$ 177.8 Million t …

The global single-atom catalysts (SACs) market is poised for remarkable growth as industries seek highly efficient, cost-effective, and sustainable catalytic solutions. Valued at US$ 177.8 million in 2025, the market is projected to reach US$ 1,000.2 million by 2036, expanding at a robust compound annual growth rate (CAGR) of 17.0% from 2026 to 2036. This rapid expansion reflects the growing importance of advanced catalysis in energy, chemicals, environmental protection, and…

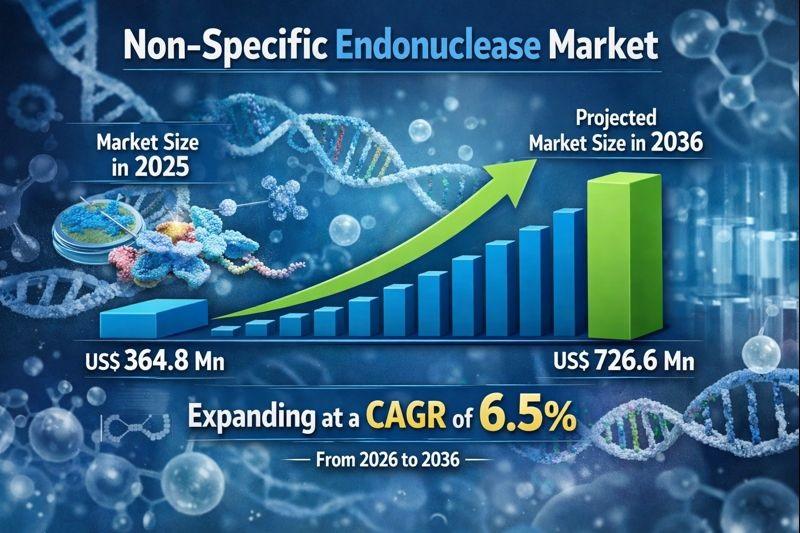

Non-specific Endonuclease Market to Reach USD 726.6 Million by 2036, Supported b …

The non-specific endonuclease market is witnessing steady growth, driven by the expanding use of molecular biology tools across biotechnology, pharmaceuticals, diagnostics, and academic research. Non-specific endonucleases are enzymes that cleave nucleic acids without requiring a specific recognition sequence, making them highly valuable for applications such as DNA/RNA degradation, sample preparation, viscosity reduction, and contamination control. Their broad activity profile differentiates them from restriction enzymes and enables versatile usage across multiple…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…