Press release

B2B Payments Market Expands with Growing Digital Transformation and Cross-Border Transactions

Market OverviewThe global B2B payments market is witnessing robust growth, propelled by the widespread adoption of digital payment solutions, the rapid expansion of e-commerce, and the increasing need for efficient cross-border transactions. Valued at USD 1,189.6 billion in 2024, the market is projected to reach USD 2,189.0 billion by 2033, exhibiting a CAGR of 7% during the forecast period. Key drivers include the integration of advanced technologies like blockchain and AI, enhancing transaction security and efficiency, and the growing demand for real-time payment processing systems.

________________________________________

Study Assumption Years

• Base Year: 2024

• Historical Years: 2019-2024

• Forecast Years: 2025-2033

________________________________________

B2B Payments Market Key Takeaways

• Market Size and Growth: The B2B payments market was valued at USD 1,189.6 billion in 2024 and is expected to reach USD 2,189.0 billion by 2033, growing at a CAGR of 7% from 2025 to 2033.

• Regional Dominance: Asia-Pacific leads the market, holding a 36.7% share in 2024, driven by rapid digitalization and a burgeoning e-commerce sector.

• Technological Integration: Businesses are increasingly adopting electronic invoicing, digital payment platforms, and real-time transaction tracking to enhance efficiency and reduce operational costs.

• Security Enhancements: Advancements in technology have led to the development of innovative payment solutions that offer enhanced security and reporting capabilities.

• Real-Time Processing Demand: The growing need for faster, more secure, and cost-effective payment options is driving the adoption of real-time payment processing systems.

Request for a sample copy of this report: https://www.imarcgroup.com/b2b-payments-market/requestsample

________________________________________

Market Growth Factors

1. E-commerce growth and digital transformation

The rise in digital transformation initiatives across several industries has profoundly altered the B2B payments landscape. Looking for cost-effectiveness and efficiency, businesses are switching from old paper-based methods to digital ones. The rapid growth of e-commerce platforms demands easy, safe, and fast payment solutions to handle large amounts of transactions. Matching the dynamic requirements of contemporary firms, digital payment solutions offer real-time processing, reduced mistakes, and improved cash flow management. Providing faster and more reliable payment experiences not only streamlines processes but also raises customer satisfaction by means of this change.

2. Technical Progress Improving Security and Efficiency

Including advanced technologies like blockchain and artificial intelligence (AI) is changing the B2B payments market. Openness is improved and fraud risk is reduced by blockchain's guaranteed safe and permanent transaction records. Real-time fraud detection, predictive analytics, and automated processes are all made possible by artificial intelligence, hence greatly increasing operational efficiency. These techniques enable businesses to more accurately, swiftly, and safely process payments, hence fostering stakeholder trust and therefore supporting wider acceptance of digital payment options.

3. Real-Time Payment Processing Demand

In the fast corporate environment of today, real-time payment processing is increasingly vital. Companies seek payment solutions that offer immediate fund transfers, real-time monitoring, and quick confirmations to preserve liquidity and respond rapidly to market changes. By ensuring prompt payments, real-time payments help to speed settlement times, lower credit risk, and improve supplier relationships. Adopting such systems is today a competitive requirement driving real-time payment infrastructure growth and investment all around.

________________________________________

Market Segmentation

Breakup by Payment Type:

• Domestic Payments: Transactions conducted within a single country's borders, offering faster processing times and lower fees.

• Cross-Border Payments: International transactions involving currency exchanges and compliance with multiple regulatory standards.

Breakup by Payment Mode:

• Traditional: Conventional methods like checks and bank transfers, still prevalent in certain regions and industries.

• Digital: Modern electronic methods, including online banking and mobile payments, offering enhanced speed and convenience.

Breakup by Enterprise Size:

• Large Enterprises: Organizations with substantial transaction volumes, requiring robust and scalable payment solutions.

• Small and Medium-sized Enterprises: Businesses seeking cost-effective and flexible payment systems to support growth.

Breakup by Industry Vertical:

• BFSI: Banking, Financial Services, and Insurance sectors utilizing advanced payment technologies for secure transactions.

• Manufacturing: Industries focusing on efficient supply chain payments and vendor management.

• IT and Telecom: Companies requiring rapid and secure payment solutions to support technological services.

• Metals and Mining: Sectors dealing with high-value transactions necessitating reliable payment systems.

• Energy and Utilities: Industries managing recurring payments and large-scale billing operations.

• Others: Various sectors adopting B2B payment solutions tailored to specific operational needs.

Breakup by Region:

• North America: United States, Canada

• Asia Pacific: China, Japan, India, South Korea, Australia, Indonesia, Others

• Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Others

• Latin America: Brazil, Mexico, Others

• Middle East and Africa

________________________________________

Regional Insights

Asia Pacific dominates the B2B payments market, holding a 36.7% share in 2024. This leadership is attributed to rapid digitalization, a booming e-commerce sector, and the widespread adoption of electronic payment methods across countries like China, Japan, and India. The region's emphasis on technological innovation and supportive regulatory frameworks further bolster its market position.

________________________________________

Recent Developments & News

The B2B payments landscape is undergoing significant transformations:

• Technological Integration: Companies are increasingly adopting AI and blockchain technologies to enhance transaction security, streamline processes, and reduce operational costs.

• Growth of Digital Payment Methods: The use of virtual cards and other digital payment solutions is surging, with projections indicating a growth of over 250% by 2028.

• Strategic Partnerships: Financial institutions are forming alliances to expand their payment services. For instance, Credem, an Italian lender, partnered with Worldline to manage merchant payment activities in Italy, aiming to enhance digital payment offerings for retailers.

________________________________________

Key Players

• American Express Company

• Bank of America Corporation

• Capital One

• Citigroup Inc.

• JPMorgan Chase & Co.

• Mastercard Inc.

• Payoneer Inc.

• PayPal Holdings Inc.

• Paystand Inc.

• Stripe Inc.

• Visa Inc.

• Wise Payments Limited

________________________________________

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5143&flag=C

________________________________________

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC's offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release B2B Payments Market Expands with Growing Digital Transformation and Cross-Border Transactions here

News-ID: 4088102 • Views: …

More Releases from IMARC Group

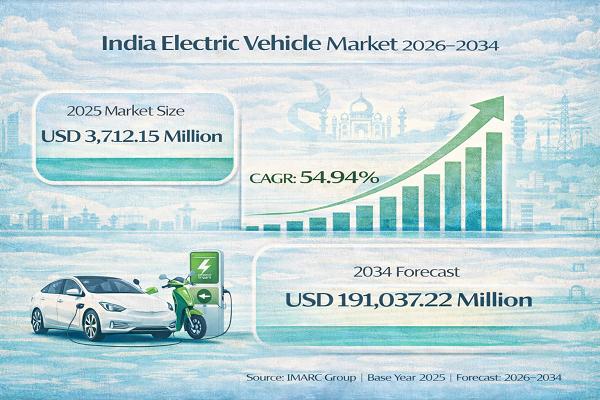

India Electric Vehicle Market Set to Reach USD 191,037.22 Million by 2034, Expan …

India Electric Vehicle Market : Report Introduction

According to IMARC Group's report titled "India Electric Vehicle Market Size, Share, Trends and Forecast by Vehicle Type, Price Category, Propulsion Type, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Free Sample Download PDF (Exclusive Offer on Corporate Email) : https://www.imarcgroup.com/india-electric-vehicle-market/requestsample

India Electric Vehicle Market Overview

The India electric vehicle market size was valued at…

United States Revenue Cycle Management Market Size, Trends, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Revenue Cycle Management Market Size, Share, Trends and Forecast by Type, Component, Deployment, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Connect with a Research Analyst Now:

https://www.imarcgroup.com/united-states-revenue-cycle-management-market/requestsample

United States Revenue Cycle Management Market Summary:

The United States revenue cycle…

LED Chip Manufacturing Plant Cost Report 2026: Demand Analysis, CapEx/OpEx & ROI …

Setting up an LED chip manufacturing plant involves strategic planning, substantial capital investment, and comprehensive understanding of semiconductor fabrication technologies. These high-performance components power everything from general illumination and displays to automotive lighting and consumer electronics. Success requires careful site selection, advanced epitaxial growth processes, sophisticated cleanroom facilities, reliable raw material sourcing, and compliance with stringent quality and environmental regulations to ensure profitable and sustainable operations.

IMARC Group's report, "LED Chip…

Eyewear Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, …

Setting up an eyewear manufacturing plant positions investors within a strategically important segment of the global optical and fashion accessories industry, driven by increasing demand for vision correction solutions, rising awareness of eye health, and growing fashion consciousness. As modern lifestyles advance, digital device usage expands, and the need for protective and corrective eyewear grows, eyewear continues to gain traction across prescription glasses, sunglasses, safety eyewear, and fashion accessories worldwide.…

More Releases for B2B

B2B Telecommunication Market Report 2024 - B2B Telecommunication Market Size, Tr …

"The Business Research Company recently released a comprehensive report on the Global B2B Telecommunication Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Global B2B Emails: Premier Destination for Verified B2B Emails and Lead Generati …

Discover how GlobalB2BEmails.com is revolutionizing B2B email acquisition for modern businesses. With a focus on simplicity, affordability, and user satisfaction, GlobalB2BEmails.com empowers businesses to reach their target audience effectively. Experience seamless access to verified B2B emails and unlock new opportunities for growth and success with GlobalB2BEmails.com.

In the digital age, where marketing plays a pivotal role in driving business growth, access to verified B2B emails is essential for success. Amidst the…

B2B Marketplace

All set to redefine India's growing e-commerce sector, DIAL42 is making its way into the B2B marketplace by providing services in four major domains: Transport and Logistics, B2B e-commerce and services, Medical services, and Foods & Beverages. We provide a highly integrated platform which brings together the country's leading manufacturers, suppliers, wholesalers, dealers and retailers for SMEs, MSMEs, and large-scale businesses.

Based in Gurugram, Haryana, DIAL42 is dedicated to simplifying…

Best B2B Service Providers in United States | United States B2B Market Research …

The market research is a proficient process of gathering information linked to the industry, market trends, customer behaviour, demographics and numerous other relevant information of the marketer’s product and services. Market research is an essential for the important of any business: new and existing. Through the market research you get a thorough understanding of your competition and industry. That’s the reason Ken Research convey you with an extreme market research…

Best B2B Service Providers in Thailand, Thailand B2B Market Research Reports - K …

Thailand has made the remarkable progress in the social and economic improvement, shifting from a low-income to an upper middle-income region in less than a generation. As such, Thailand has been a broadly cited improvement accomplish story, with sustained robust growth and impressive poverty deduction.

In addition, Thailand is renowned for its universal health care program (UHC) and accomplishment in the child nutrition, but quality of education remains a feeble…

B2B Data Exchange Market Is Booming Worldwide | Informatica, EIX Systems, Adepti …

HTF MI recently introduced Global B2B Data Exchange Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Informatica, EIX Systems, Adeptia, Inc., B2B Commerce (M) Sdn. Bhd.…