Press release

Saudi Arabia Used Car Market Size to Worth USD 16.80 Billion by 2033 | With a 6.43% CAGR

Saudi Arabia Used Car Market OverviewMarket Size in 2024: USD 9.60 Billion

Market Size in 2033: USD 16.80 Billion

Market Growth Rate 2025-2033: 6.43%

According to IMARC Group's latest research publication, "Saudi Arabia Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Sales Channel, Vendor Type, and Region, 2025-2033", the Saudi Arabia used car market size was valued at USD 9.60 billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.80 billion by 2033, exhibiting a CAGR of 6.43% from 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-used-car-market/requestsample

Growth Factors in the Saudi Arabia Used Car Market

● Economic Diversification and Rising Disposable Income

Saudi Arabia's Vision 2030 initiative aims to diversify the economy. This plan cuts down on oil use. It also helps grow sectors like retail, tourism, and construction. As the economy shifts, more disposable income is available. This allows consumers to buy vehicles, especially affordable used cars. In cities like Riyadh and Jeddah, the growing middle class prefers pre-owned vehicles. They want to avoid the steep depreciation of new cars. Dealerships such as Aljomaih Automotive report increased sales of certified pre-owned vehicles. Buyers want affordable mobility that doesn't sacrifice quality. This reflects how economic growth drives demand for used cars among various demographics.

● Expanding Youth Population and New Drivers

Saudi Arabia's young population, with a median age of about 31, drives the used car market. Young professionals and first-time buyers prefer affordable used cars. This includes women who have been able to drive since 2018. Platforms like Syarah see more people wanting budget-friendly sedans and hatchbacks. The Toyota Yaris and Hyundai Accent are popular choices. Dealerships must focus on younger buyers. This shift is due to changing demographics and the need for better urban mobility. They offer flexible financing options, making used cars appealing to this growing market.

● Growth of Online Sales Platforms

Online platforms have changed the used car market. They make buying easier and more convenient. Sites like YallaMotor and Carswitch offer virtual tours, vehicle histories, and great prices. This attracts tech-savvy buyers. Syarah's vehicle restoration center in Jeddah helps with online sales. They offer quality pre-purchase inspections. These platforms give consumers what they want: transparency and ease. This helps the market grow by making purchases simpler. Digital sales have pushed traditional dealerships online to reach more customers.

Key Trends in the Saudi Arabia Used Car Market

● Rise of Certified Pre-Owned (CPO) Programs

Certified pre-owned (CPO) programs are becoming popular. Buyers now focus on reliability and transparency. Dealerships like Al-Futtaim Automotive's AutoTrust offer CPO vehicles. These come with verified service histories and limited warranties. They charge more for this assured quality. For example, a certified pre-owned Toyota Camry usually comes with a one-year warranty. This appeals to buyers who worry about unexpected repairs. This trend shows that consumers want trust in used car purchases. Organized dealerships put money into detailed inspections and reconditioning. This helps them stand out from the messy peer-to-peer market.

● Increasing Demand for SUVs and Practical Vehicles

SUVs are becoming more popular in the used car market in Saudi Arabia. Their versatility and cultural appeal attract many buyers. The Toyota Hilux and Hyundai Tucson are well-liked for their toughness. They can tackle various terrains easily. Corporate fleet renewals in Riyadh often put well-kept SUVs on the market. This helps meet the demand for spacious and reliable vehicles. Urban expansion and family-oriented lifestyles drive this trend. Dealerships are stocking more SUVs to meet this growing preference.

● Shift Toward Organized Dealerships

The used car market is shifting from unorganized peer-to-peer sales to organized dealerships. Consumer demand for convenience and added services drives this change. Organized vendors, such as Aljomaih Automotive, offer warranties, financing, and post-purchase maintenance. These benefits are not available in informal sales. Lumi Rental Company's used car outlet in Jeddah offers complete service packages. This attracts buyers who want a smooth experience. Government regulations also support this trend by promoting transparency. They urge consumers to pick organized channels. This leads to better quality and a more professional buying experience.

Buy Full Report: https://www.imarcgroup.com/checkout?id=14018&method=1315

Saudi Arabia Used Car Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Vehicle Type:

● Hatchback

● Sedan

● MUV and SUV

Analysis by Sales Channel:

● Online

● Offline

Analysis by Vendor Type:

● Organized

● Unorganized

Regional Analysis:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Future Outlook

The used car market in Saudi Arabia is set to grow. This growth stems from economic diversification, urbanization, and tech advancements. Projects like Vision 2030, NEOM, and the Red Sea Project will increase the need for affordable transport in new cities. Online platforms are making buying easier. Companies like Carswitch use AI to enhance user experience. The rise of electric vehicles (EVs) may also increase the supply of used EVs due to new charging stations. Challenges, like counterfeit vehicles, still exist. But stricter regulations and certified pre-owned programs will help build trust with consumers. These factors will create a strong and active market through 2030.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=14018&flag=C

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Used Car Market Size to Worth USD 16.80 Billion by 2033 | With a 6.43% CAGR here

News-ID: 4087847 • Views: …

More Releases from IMARC Group

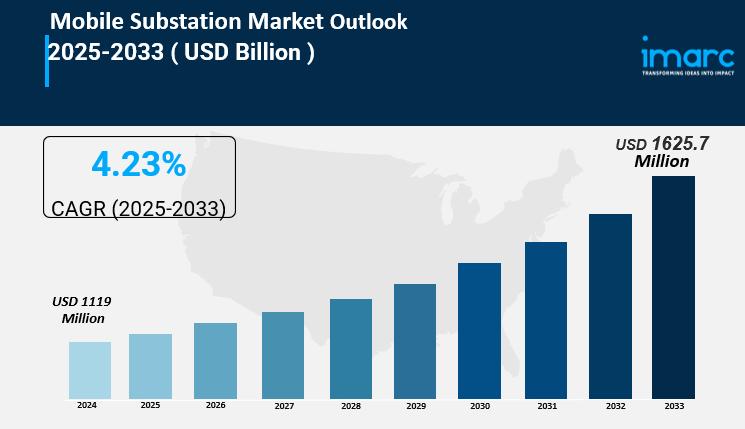

Mobile Substation Market is Expected to Grow USD 1,625.7 Million by 2033 | At CA …

IMARC Group, a leading market research company, has recently released a report titled " Mobile Substation Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the Mobile Substation Market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Mobile Substation Market…

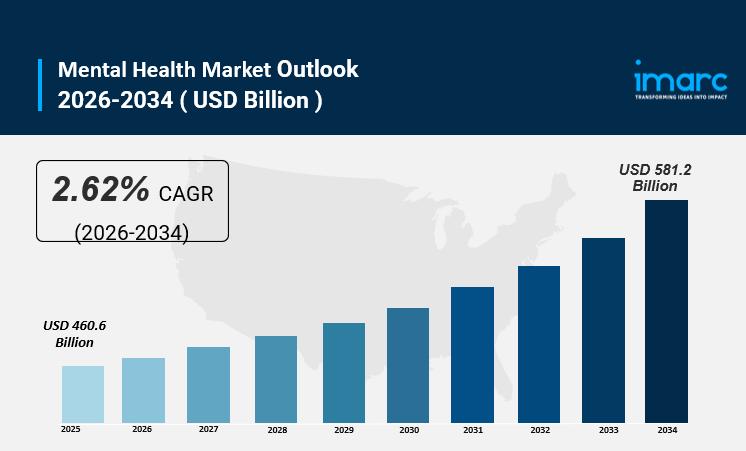

Mental Health Market Size, Share, Trends, and Forecast by Disorder, Service, Age …

IMARC Group, a leading market research company, has recently released a report titled " Mental Health Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2026-2034."The study provides a detailed analysis of the industry, including the Mental Health Market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Mental Health Market Overview

The…

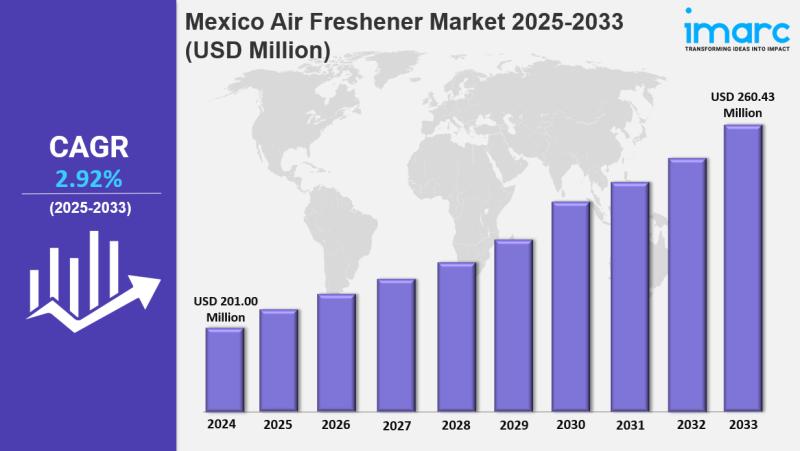

Mexico Air Freshener Market Size, Share, Latest Insights and Forecast to 2033

IMARC Group has recently released a new research study titled "Mexico Air Freshener Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico air freshener market reached USD 201.00 Million in 2024 and is projected to grow to USD…

Global Video Conferencing Market Report 2026-2034: Size, Share, Trends & Strateg …

The global video conferencing market size was valued at USD 13.8 Billion in 2025 and is forecasted to reach USD 31.4 Billion by 2034, exhibiting a CAGR of 9.60% during the forecast period of 2026-2034. The market growth is driven by increased reliance on high-speed internet, mobile devices, and the adoption of advanced features that enhance virtual communication. North America leads the market with a share of over 39.8% in…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…