Press release

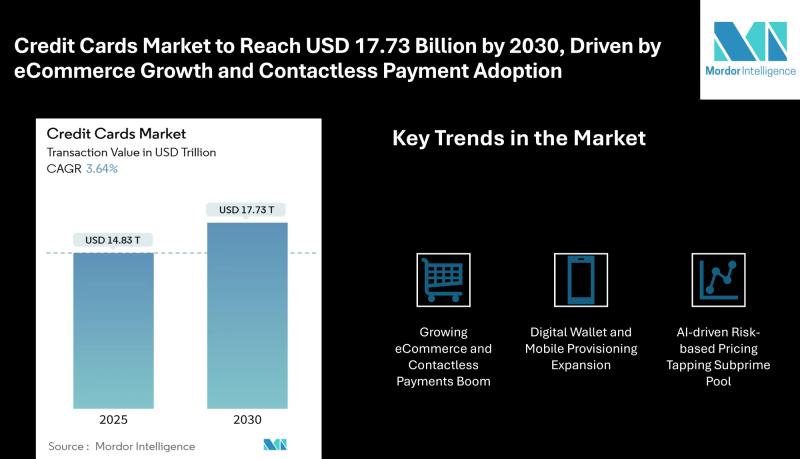

Credit Cards Market to Reach USD 17.73 Billion by 2030, Driven by eCommerce Growth and Contactless Payment Adoption

Mordor Intelligence has published a new report on the "Credit Cards Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction

The credit cards market reached USD 14.83 trillion in 2025 and is on course to touch USD 17.73 trillion by 2030, registering a 3.64% CAGR. The market growth is driven by rising eCommerce transactions, contactless payment adoption, and digital wallet integrations. Asia-Pacific continues to lead in adoption rates, while North America and Europe remain strong markets for credit card spending.

Credit cards remain a widely used payment instrument for food, groceries, travel, healthcare, and online purchases. Increasing financial inclusion initiatives, combined with digital provisioning and embedded card services, are expanding credit card usage among new customer segments globally.

Report Overview: https://www.mordorintelligence.com/industry-reports/global-credit-cards-market?utm_source=openpr

Key Trends

Growing eCommerce and Contactless Payments Boom

The surge in online shopping and the need for convenient payment options are boosting credit card usage. This trend is expected to grow at +0.8% globally, with Asia-Pacific leading adoption. Contactless cards are becoming mainstream due to their ease of use and faster transaction time, especially for everyday purchases such as food, groceries, and pharmacy items. The contactless payment boom is expected to continue in the medium term (2-4 years) as consumers shift towards touch-free payment modes.

Digital Wallet and Mobile Provisioning Expansion

Credit cards linked to digital wallets are gaining popularity for online and in-store transactions. This trend shows a +0.6% growth rate and is core to Asia-Pacific markets, with spill-over effects into North America and Europe. The ease of adding credit cards to smartphone wallets, combined with growing mobile commerce, is expected to drive this trend in the short term (≤ 2 years).

Rewards War Among Issuers

Credit card issuers are intensifying their acquisition strategies by offering attractive rewards, cashback offers, and loyalty programs to gain new customers. This trend is growing at +0.4% and is particularly strong in North America and Europe. In the medium term (2-4 years), consumers are expected to choose cards offering better rewards structures, influencing issuer market shares.

Virtual and Crypto Cards Enable Cross-Border Spend Efficiency

Virtual and crypto-backed credit cards are emerging as tools to facilitate efficient cross-border transactions, especially in business segments. This trend, with a +0.3% growth rate, has a long-term impact (≥ 4 years) and is driven by global businesses looking for lower transaction costs and operational efficiencies when dealing with international payments.

Embedded Credit-Card-as-a-Service for Niche Brands

Credit-Card-as-a-Service (CCaaS) is gaining traction among niche brands to offer embedded credit solutions to their customers. This trend is growing at +0.2%, with strong adoption in North America and Europe, and gradual expansion globally. Over the long term (≥ 4 years), CCaaS is expected to help brands build customer loyalty and capture additional revenue streams through embedded financial services.

AI-driven Risk-based Pricing Tapping Subprime Pool

The use of AI to drive risk-based pricing models is enabling issuers to tap into profitable subprime customer pools. This trend, with a +0.5% growth rate, is global but subject to regulatory variations. It is expected to impact the market in the medium term (2-4 years), allowing banks to expand credit offerings to underserved segments while managing risks effectively.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/global-credit-cards-market?utm_source=openpr

Market Segmentation

The credit cards market is segmented by:

Application

Food and Groceries

Health and Pharmacy

Travel and Hospitality

E-commerce

Other Applications

Food and groceries remain the largest spending category, followed by health and pharmacy due to everyday consumer needs. E-commerce continues to grow as consumers increasingly shop online for various products and services.

Card Type

General Purpose Credit Cards

Specialty and Other Credit Cards

General purpose cards dominate due to their acceptance across all spending categories, while specialty cards cater to co-branded programs and specific merchant tie-ups.

Card Format

Physical

Digital

While physical cards remain common, digital cards are seeing faster adoption due to integration with digital wallets and virtual payment platforms, particularly for online transactions and mobile payments.

Provider

Visa

Mastercard

Other Providers

Visa and Mastercard maintain market leadership due to their global acceptance networks, while other providers include American Express, Discover, JCB, and regional networks with market shares in specific geographies.

Geography

North America

Europe

Asia-Pacific

Middle East and Africa

Latin America

Asia-Pacific leads the market growth with strong digital payment adoption, while North America remains the largest market driven by high card penetration and consumer spending. Europe maintains a mature market with increasing contactless and virtual card usage.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players

Major companies operating in the global credit cards market include:

JPMorgan Chase & Co.

Offers a wide range of general-purpose and co-branded credit cards, focusing on rewards, travel benefits, and premium services.

Citigroup Inc. (Citi)

Provides credit cards targeting different customer segments, including cashback, rewards, and travel categories, with strong international acceptance.

American Express Co.

Known for its premium offerings, American Express focuses on business and affluent consumer segments with tailored benefits and strong customer service.

Wells Fargo & Co.

Offers credit cards across general-purpose and specialty segments, targeting existing banking customers with competitive rates and reward structures.

Bank of America Corp.

Provides a broad portfolio of credit cards with cashback and travel benefits, leveraging its large banking customer base for cross-selling.

These players compete on rewards programs, merchant partnerships, interest rates, security features, and digital integration to strengthen market position and drive cardholder acquisition.

Explore more details about Credit Cards Market Competitive Landscape: https://www.mordorintelligence.com/industry-reports/global-credit-cards-market/companies?utm_source=openpr

Conclusion

The global credit cards market is set to grow steadily over the next five years, driven by the expansion of eCommerce, contactless transactions, and financial inclusion initiatives. While general-purpose credit cards continue to lead the market, digital card formats and embedded credit solutions are gaining momentum. Key players such as JPMorgan Chase, Citi, American Express, Wells Fargo, and Bank of America are focusing on rewards-based acquisition strategies, digital wallet integrations, and AI-driven risk models to strengthen their market share.

As consumers increasingly adopt cashless and contactless payments for daily needs and online purchases, the credit cards market will remain integral to the global payments ecosystem, supporting personal finance management, consumer convenience, and business efficiency worldwide.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/global-credit-cards-market?utm_source=openpr

Industry Related Reports

Canada Credit Cards Market: The Canada Credit Cards Market report segments the industry into By Card Type (General Purpose Credit Cards, Specialty & Other Credit Cards), By Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism, Other Applications), and By Provider (Visa, MasterCard, Other Providers).

Get more insights: https://www.mordorintelligence.com/industry-reports/canada-credit-cards-market?utm_source=openpr

Europe Credit Cards Market: The Europe Credit Cards Market report segments the industry into By Card Type (General Purpose Credit Cards, Specialty & Other Credit Cards), By Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism, Other Applications), By Provider (Visa, MasterCard, Other Providers), and By Country (UK, Germany, France, Italy, Spain, Rest of Europe).

Get more insights: https://www.mordorintelligence.com/industry-reports/europe-credit-cards-market?utm_source=openpr

Japan Credit Cards Market: The Japan Credit Cards Market report segments the industry into By Card Type (General Purpose Credit Cards, Specialty & Other Credit Cards), By Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism, Other Applications), and By Provider (Visa, MasterCard, Other Providers).

Get more insights: https://www.mordorintelligence.com/industry-reports/japan-credit-cards-market?utm_source=openpr

Israel Credit Cards Market: The Israel Credit Cards Market report segments the industry into By Card Type (General Purpose Credit Cards, Specialty & Other Credit Cards), By Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism, Other Applications), and By Provider (Visa, MasterCard, Other Providers).

Get more insights: https://www.mordorintelligence.com/industry-reports/israel-credit-cards-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Cards Market to Reach USD 17.73 Billion by 2030, Driven by eCommerce Growth and Contactless Payment Adoption here

News-ID: 4087180 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

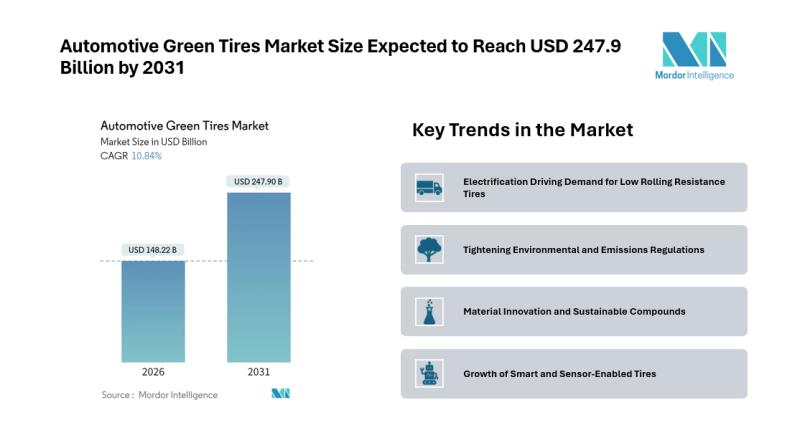

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…