Press release

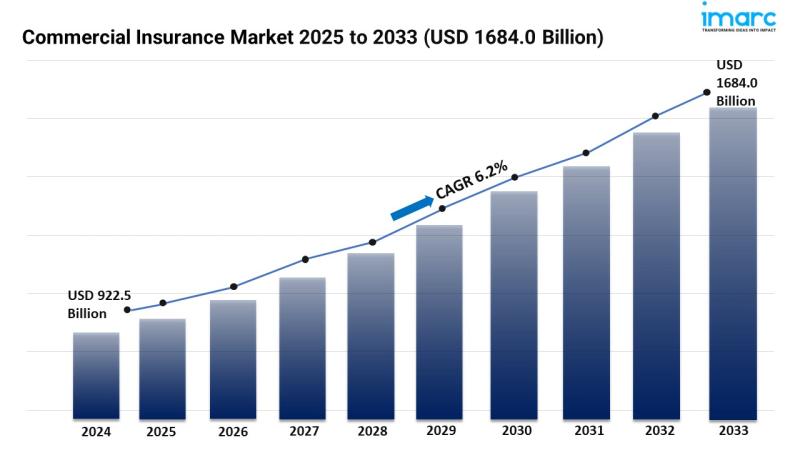

Commercial Insurance Market to Grow Worth USD 1,684.0 Billion by 2033 | Exhibiting CAGR of 6.2%

Market Overview:The commercial insurance market is experiencing rapid growth, driven by Rising Business Risk Exposure, Regulatory Compliance Requirements and Growth of SMEs and Startups. According to IMARC Group's latest research publication, "Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033", The global commercial insurance market size was valued at USD 922.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,684.0 Billion by 2033, exhibiting a CAGR of 6.2% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/commercial-insurance-market/requestsample

Our report includes:

●Market Dynamics

●Market Trends And Market Outlook

●Competitive Analysis

●Industry Segmentation

●Strategic Recommendations

Growth Factors in the Commercial Insurance Market:

●Rising Business Risk Exposure

Modern businesses face many risks. These include cyberattacks, data breaches, supply chain issues, and natural disasters. These complex threats have pushed companies of all sizes to reassess their risk management strategies. As a result, demand for comprehensive commercial insurance products has surged. Companies, such as manufacturing firms concerned about risks or e-commerce businesses facing cyber threats, need customized insurance plans. Ransomware attacks on big companies have shown how vital financial safeguards are. This need has boosted market growth.

●Regulatory Compliance Requirements

Governments and regulators worldwide are tightening rules. They focus on workplace safety, data protection, and operational transparency. Businesses must often have certain insurance types to meet regulations. This includes workers' compensation, general liability, and cyber insurance. Data protection laws, like GDPR in Europe and CCPA in California, require stricter accountability. This makes cyber insurance a must for many businesses. Additionally, construction and healthcare sectors often face mandatory insurance requirements. This regulatory environment has made more businesses adopt commercial insurance. They do this to comply with rules, reduce legal risks, and avoid big penalties.

●Growth of SMEs and Startups

The quick growth of small and medium-sized enterprises (SMEs) and startups in both emerging and developed economies has opened new opportunities for commercial insurance providers. As these businesses scale their operations, their exposure to financial, legal, and operational risks grows. Insurance helps these firms guard against surprises that could hurt growth or lead to money problems. Many insurance companies now provide flexible and affordable solutions for small businesses. This makes it easier for them to get the protection they need. The increasing entrepreneurial culture globally is thus a key growth driver for the commercial insurance sector.

Key Trends in the Commercial Insurance Market:

●Adoption of Digital Platforms

Digital transformation is reshaping how commercial insurance is delivered, purchased, and managed. Insurtech innovations are enabling automation in underwriting, claims processing, and customer service. AI and machine learning platforms provide quicker and more precise risk assessments. For instance, businesses can now get insured online within minutes, thanks to digital platforms offering instant quotes and policy comparisons. Mobile apps and self-service portals are improving the customer experience, especially for SMEs. Relying more on digital channels helps insurers work better. It also makes insurance easier to access and understand for businesses.

●Customization and Usage-Based Policies

Traditional, one-size-fits-all insurance models are being replaced by highly customized and usage-based policies. Companies now want insurance plans that fit their risk profiles and operations. A tech startup might focus on cyber liability and protecting intellectual property. In contrast, a logistics firm may prioritize fleet insurance and goods-in-transit coverage. Usage-based models, where premiums are calculated based on actual usage or behavior, are gaining popularity-particularly in commercial auto and equipment insurance. This trend shows a move toward flexible, data-driven insurance options. They fit better with today's business operations.

●Focus on ESG and Sustainability

Environmental, Social, and Governance (ESG) considerations are increasingly influencing commercial insurance offerings. Companies feel pressure from investors, customers, and regulators. They must adopt sustainable and ethical practices. Insurers are creating products to support ESG goals. This includes coverage for green buildings, renewable energy projects, and social impact enterprises. Additionally, insurers themselves are incorporating ESG metrics into their underwriting processes and risk evaluations. Businesses committed to sustainability may benefit from more favorable premiums or coverage terms. This trend shows how the commercial insurance market is changing. It aims to support a more responsible and sustainable business environment.

Buy Full Report: https://www.imarcgroup.com/checkout?id=5295&method=1670

Leading Companies Operating in the Global Commercial Insurance Industry:

●Allianz SE

●American International Group Inc.

●Aon plc

●Aviva plc

●Axa S.A.

●Chubb Limited

●Direct Line Insurance Group plc

●Marsh & McLennan Companies Inc.

●Willis Towers Watson Public Limited Company

●Zurich Insurance Group Ltd.

Commercial Insurance Market Report Segmentation:

Breakup By Type:

●Liability Insurance

●Commercial Motor Insurance

●Commercial Property Insurance

●Marine Insurance

●Others

Liability insurance represents the largest segment because businesses face various risks related to third-party injuries, damages, or legal claims, making liability coverage essential for protecting operations.

Breakup By Enterprise Size:

●Large Enterprises

●Small and Medium-sized Enterprises

Large enterprises account for the majority of the market share as they typically require more extensive coverage for their complex operations, higher assets, and greater exposure to risks.

Breakup By Distribution Channel:

●Agents and Brokers

●Direct Response

●Others

Agents and brokers exhibit a clear dominance in the market owing to their personalized services, expert advice, and businesses navigation insurance products.

Breakup By Industry Vertical:

●Transportation and Logistics

●Manufacturing

●Construction

●IT and Telecom

●Healthcare

●Energy and Utilities

●Others

Transportation and logistics hold the biggest market share due to the significant risks associated with the movement of goods, including accidents, delays, and cargo loss.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America enjoys the leading position in the commercial insurance market on account of its established insurance infrastructure, rising demand from diverse industries, and a robust regulatory framework.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=5295&flag=C

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Insurance Market to Grow Worth USD 1,684.0 Billion by 2033 | Exhibiting CAGR of 6.2% here

News-ID: 4086790 • Views: …

More Releases from IMARC Group

Supercapacitor Market Size to Reach $31.07B by 2033: Trends & Opportunities

Market Overview:

The supercapacitor market is experiencing rapid growth, driven by electrification of automotive systems, renewable energy and grid stabilization, and expansion of industrial automation and robotics. According to IMARC Group's latest research publication, "Supercapacitor Market Size, Share, Trends and Forecast by Product Type, Module Type, Material Type, End Use Industry, and Region, 2025-2033", the global supercapacitor market size was valued at USD 6.41 Billion in 2024. Looking forward, IMARC Group…

Bicycle Market Size to Surpass $102.05B by 2033: Growth & Insights

Market Overview:

The bicycle market is experiencing rapid growth, driven by global expansion of cycling infrastructure, rising health consciousness and preventative wellness, and technological advancements in e-bike propulsion. According to IMARC Group's latest research publication, "Bicycle Market Size, Share, Trends and Forecast by Type, Technology, Price, Distribution Channel, End User, and Region, 2025-2033", The global bicycle market size was valued at USD 67.42 Billion in 2024. Looking forward, IMARC Group estimates…

Baby Food and Infant Formula Market to Reach USD 84.06 Billion by 2033, Growing …

Market Overview:

The Baby Food and Infant Formula Market is experiencing steady expansion, driven by Increasing Awareness of Nutritional Needs for Infants, Rising Number of Working Women, and Technological Advancements and Product Innovation. According to IMARC Group's latest research publication, "Baby Food and Infant Formula Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global baby food and infant formula market size reached USD 53.73 Billion in 2024.…

Breakfast Cereals Market to Reach USD 149.07 Billion by 2033, Growing at a CAGR …

Market Overview:

The Breakfast Cereals Market is experiencing rapid growth, driven by Health and Wellness Awareness, Busy Lifestyles and On-the-Go Demand and Rising Disposable Incomes and Global Market Expansion . According to IMARC Group's latest research publication, "Breakfast Cereals Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global breakfast cereals market size was valued at USD 108.89 Billion in 2024. Looking forward, IMARC Group estimates…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…