Press release

Neobanking Market is Booming and Expected to Hit USD 5,510.18 Billion by 2033 | IMARC Group

IMARC Group, a leading market research company, has recently released a report titled "Neobanking Market Report by Account Type (Business Account, Savings Account), Application (Enterprises, Personal, and Others), and Region 2025-2033". The study provides a detailed analysis of the industry, including the neobanking market share, trends, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.Report Highlights:

How Big Is the Neobanking Market?

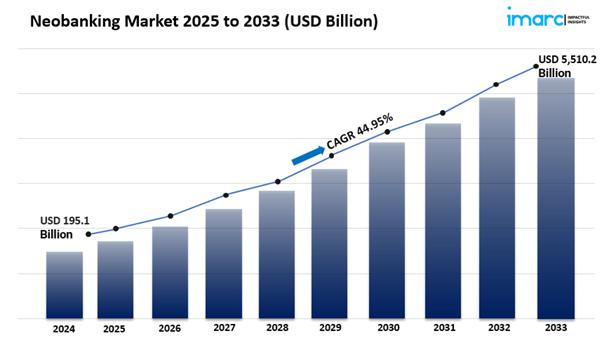

The global neobanking market size was valued at USD 195.11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5,510.18 Billion by 2033, exhibiting a CAGR of 44.95% from 2025-2033. Europe currently dominates the market, holding a market share of over 31.5% in 2024. The neobanking market share is expanding, driven by the increasing consumer preference for digital and mobile-first banking solutions, favorable regulatory changes facilitating the growth of neobanks, and continuous technological advancements, particularly in artificial intelligence (AI), blockchain, and machine learning (ML).

Neobanking Market Insights:

• Technological advancements are at the core of neobanks' ability to streamline operations and enhance service delivery.

• A growing consumer preference for mobile-first, digital banking solutions is driving adoption across various demographic segments.

• Regulatory reforms worldwide are fostering the growth of a more agile and competitive digital banking ecosystem.

• Neobanks catering to businesses are gaining traction by providing customized financial tools and services for SMEs and enterprises.

• The integration of artificial intelligence (AI), machine learning (ML), and blockchain is improving personalization, security, and transaction efficiency.

Request to Get the Sample Report:

https://www.imarcgroup.com/neobanking-market/requestsample

Neobanking Market Trends

The global neobanking market is experiencing robust growth, driven by evolving consumer preferences and rapid technological advancements. As of 2023, digital banking continues to reshape the financial services landscape, with more individuals turning to neobanks for their affordability, innovation, and customer-centric services.

Heading into 2024, regulatory developments are expected to further propel the market forward. The rise of open banking is increasing competition and expanding consumer choice by enabling data-sharing between financial institutions. Additionally, the growing emphasis on financial inclusion and education is fueling demand for neobanks, which are well-positioned to serve underserved populations with accessible, user-friendly financial tools. This ongoing transformation highlights the importance of innovation, security, and inclusivity in the banking sector. Companies that deliver secure, intuitive, and educational experiences are set to lead the market.

Market Dynamics

• Growing Adoption of Digital-First Banking Platforms

The accelerating shift toward digital-first financial services is a major catalyst driving the growth of the neobanking market. Consumers-particularly younger, tech-savvy generations-are increasingly seeking seamless and mobile-centric ways to manage their finances. Unlike traditional banks, neobanks deliver agile, user-friendly, and cost-effective digital solutions that align with modern expectations for convenience and speed.

By 2024, demand for highly personalized and frictionless digital banking experiences is expected to intensify. Neobanks are gaining customer loyalty through services such as instant account setup, real-time transaction alerts, and AI-driven financial tools. These features enhance usability and empower customers with greater financial control. Moreover, with significantly lower operating costs than traditional banks, neobanks can offer more attractive interest rates and minimal fees-making them especially appealing to digital-native users. As these digital challengers continue refining their offerings, they are positioned to capture a larger share of the market and compel legacy institutions to innovate.

• Supportive Regulation and the Rise of Open Banking

The neobanking sector is also being propelled by favorable regulatory developments and the global expansion of open banking frameworks. Governments and financial regulators are increasingly embracing innovation in financial services, aiming to promote competition, consumer choice, and data-driven solutions. These regulatory shifts are creating an environment where neobanks can thrive while maintaining customer protections.

By 2024, open banking regulations will enable neobanks to securely access customer data from traditional financial institutions-upon user consent. This will allow them to deliver more personalized, real-time financial services tailored to individual needs. At the same time, enhanced regulations focusing on data privacy, security, and transparency are building trust in digital-only banking platforms. With these safeguards in place, consumers are becoming more comfortable with digital banking, and neobanks are gaining legitimacy as trustworthy financial service providers. The convergence of open banking and progressive regulation is fostering a more competitive and collaborative financial ecosystem.

• Expanding Financial Inclusion and Consumer Empowerment

Financial inclusion and literacy are emerging as powerful drivers of neobank adoption, particularly among underserved and unbanked populations. Many individuals around the world face barriers to accessing traditional banking services, whether due to location, income level, or lack of credit history. Neobanks are helping to bridge this gap by offering user-friendly, low-barrier financial platforms that promote accessibility and inclusion.

By 2024, the demand for inclusive banking solutions is set to grow further, as neobanks increasingly focus on tools that enhance financial understanding and stability. Features such as automated budgeting, savings tracking, credit-building programs, and integrated financial education modules are helping users make informed decisions and achieve financial wellness. Moreover, neobanks often provide accounts with minimal eligibility requirements, making them accessible to a broader demographic, including first-time bank users and those with limited financial backgrounds. As these solutions become more widespread, neobanks are not only expanding their customer base but also playing a vital role in promoting economic empowerment on a global scale.

Checkout Now: https://www.imarcgroup.com/checkout?id=3488&method=1670

Neobanking Market Report Segmentation:

By Account Type:

• Business Account

• Savings Account

Business account accounted for the largest market share due to the growing demand from small and medium-sized enterprises for digital banking solutions that offer better financial management tools and lower fees compared to traditional banks.

By Application:

• Enterprises

• Personal

• Others

Enterprises represented the largest segment as large organizations seek comprehensive and scalable financial solutions that can integrate seamlessly with their existing systems and support global operations.

Regional Insights:

• North America

• Asia-Pacific

• Europe

• Latin America

• Middle East and Africa

Europe's dominance in the neobanking market is attributed to the advanced technological infrastructure, supportive regulatory environment, and high adoption rate of digital banking services among consumers and businesses.

Competitive Landscape with Key Players:

The competitive landscape of the digital payment market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

• Agricultural Bank of China Limited

• Atom Bank PLC

• Citigroup Inc.

• Deutsche Bank AG

• Fidor Solutions AG (Groupe BPCE)

• HSBC Holdings Plc

• Malayan Banking Berhad

• Monzo Bank Limited

• Movencorp Inc.

• N26 GmbH

• Simple Finance Technology Corporation (BBVA USA)

• Ubank Limited

• Webank Co. Ltd.

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=3488&flag=C

Key Highlights of the Report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Market Trends

• Market Drivers and Success Factors

• Impact of COVID-19

• Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neobanking Market is Booming and Expected to Hit USD 5,510.18 Billion by 2033 | IMARC Group here

News-ID: 4086694 • Views: …

More Releases from IMARC Group

Supercapacitor Market Size to Reach $31.07B by 2033: Trends & Opportunities

Market Overview:

The supercapacitor market is experiencing rapid growth, driven by electrification of automotive systems, renewable energy and grid stabilization, and expansion of industrial automation and robotics. According to IMARC Group's latest research publication, "Supercapacitor Market Size, Share, Trends and Forecast by Product Type, Module Type, Material Type, End Use Industry, and Region, 2025-2033", the global supercapacitor market size was valued at USD 6.41 Billion in 2024. Looking forward, IMARC Group…

Bicycle Market Size to Surpass $102.05B by 2033: Growth & Insights

Market Overview:

The bicycle market is experiencing rapid growth, driven by global expansion of cycling infrastructure, rising health consciousness and preventative wellness, and technological advancements in e-bike propulsion. According to IMARC Group's latest research publication, "Bicycle Market Size, Share, Trends and Forecast by Type, Technology, Price, Distribution Channel, End User, and Region, 2025-2033", The global bicycle market size was valued at USD 67.42 Billion in 2024. Looking forward, IMARC Group estimates…

Baby Food and Infant Formula Market to Reach USD 84.06 Billion by 2033, Growing …

Market Overview:

The Baby Food and Infant Formula Market is experiencing steady expansion, driven by Increasing Awareness of Nutritional Needs for Infants, Rising Number of Working Women, and Technological Advancements and Product Innovation. According to IMARC Group's latest research publication, "Baby Food and Infant Formula Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global baby food and infant formula market size reached USD 53.73 Billion in 2024.…

Breakfast Cereals Market to Reach USD 149.07 Billion by 2033, Growing at a CAGR …

Market Overview:

The Breakfast Cereals Market is experiencing rapid growth, driven by Health and Wellness Awareness, Busy Lifestyles and On-the-Go Demand and Rising Disposable Incomes and Global Market Expansion . According to IMARC Group's latest research publication, "Breakfast Cereals Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global breakfast cereals market size was valued at USD 108.89 Billion in 2024. Looking forward, IMARC Group estimates…

More Releases for Neobanking

Neobanking Market Trends That Will Shape the Next Decade: Insights from Neobanki …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

How Large Will the Neobanking Market Size By 2025?

The scale of the neobanking market has seen remarkable expansion in the past few years. It is expected to surge from $176.05 billion in 2024 up to $261.4 billion in 2025, reflecting a compound annual growth rate (CAGR) of 48.5%.…

Primary Catalyst Driving Neobanking Market Evolution in 2025: Rapid Digitalizati …

How Are the key drivers contributing to the expansion of the neobanking market?

The burgeoning need for digital transformation in banking agencies worldwide is fuelling the neobanking market's expansion. Digital banking involves the complete digitization of banking operations, replacing the physical branches with a constant online presence, thereby eliminating the requirement for customers to visit a physical office. Traditional banking services are getting streamlined through digital means. With digital banking, bank…

Neobanking Market Size & Trends To 2030

The Neobanking Market 2024 Report makes available the current and forthcoming technical and financial details of the industry. It is one of the most comprehensive and important additions to the Prudent Markets archive of market research studies. It offers detailed research and analysis of key aspects of the global Neobanking market. This report explores all the key factors affecting the growth of the global Neobanking market, including demand-supply scenario, pricing…

Neobanking Market Potential and Growth Opportunities 2024-2031

The Neobanking Market is a rapidly evolving sector, driven by advancements in hardware, software, and digital infrastructure. It encompasses a wide range of services, including cloud computing, cybersecurity, data analytics, and artificial intelligence. The increasing demand for digital transformation across industries is fueling growth. Emerging technologies like 5G, blockchain, and IoT are further expanding its potential. With continuous innovation, the IT market is expected to see robust growth in the…

Neobanking Market Key Trends, Analysis, Forecast To 2033

"The Business Research Company has recently revised its global market reports, now incorporating the most current data for 2024 along with projections extending up to 2033.

Neobanking Global Market Report 2024 by The Business Research Company offers comprehensive market insights, empowering businesses with a competitive edge. It includes detailed estimates for numerous segments and sub-segments, providing valuable strategic guidance.

The Market Size Is Expected To Reach $836.11 billion In 2028 At A…

Neobanking Market Size, Share, Industry, Forecast to 2030

The Neobanking Market 2023 Report makes available the current and forthcoming technical and financial details of the industry. It is one of the most comprehensive and important additions to the Prudent Markets archive of market research studies. It offers detailed research and analysis of key aspects of the global Neobanking market. This report explores all the key factors affecting the growth of the global Neobanking market, including demand-supply scenario, pricing…