Press release

China Commercial Real Estate Market to Reach USD 1.16 Trillion by 2030, Driven by Urbanization and Evolving Business Needs

Mordor Intelligence has published a new report on the China Commercial Real Estate Market, offering a comprehensive analysis of trends, growth drivers, and future projections.China Commercial Real Estate Market Overview

China's commercial real estate sector is projected to grow from USD 0.86 trillion in 2025 to USD 1.16 trillion by 2030, reflecting a compound annual growth rate (CAGR) of 6.31%. This growth is underpinned by significant public investments, evolving occupier demands, and a shift towards asset-light business models. However, challenges such as oversupply in certain segments and high borrowing costs for developers continue to impact the market.

Report Overview: https://www.mordorintelligence.com/industry-reports/china-commercial-real-estate-market?utm_source=openPR

Key Trends

1. Urbanization and Infrastructure Development

China's ongoing urbanization, supported by a USD 563.4 billion public-funding initiative for housing and urban projects, is driving demand for commercial real estate. This investment is facilitating the development of modern logistics facilities, Grade-A office spaces, and data-driven campuses, particularly in tier-1 cities like Shanghai, Beijing, and Shenzhen.

2. Rise of Logistics Properties

Logistics properties are experiencing the fastest growth within the commercial real estate sector, with a projected CAGR of 7.72% through 2030. This surge is attributed to the booming e-commerce sector and the government's dual-circulation policy, which emphasizes domestic consumption and trade. High warehouse occupancy rates and increased demand for automated distribution centers are indicative of this trend.

3. Shift Towards Rental Business Models

While sales dominated the market with a 62% share in 2024, rental operations are expected to grow at a CAGR of 6.98% through 2030. This shift reflects a broader trend towards stable income streams and long-term investment horizons, appealing to institutional investors seeking predictable returns.

4. Changing Occupier Preferences

Corporate tenants and small to medium-sized enterprises (SMEs) accounted for 66.1% of the market share in 2024. There's a growing preference for high-quality office spaces that offer flexibility and align with sustainability goals. This demand is influencing developers to focus on upgrading existing assets rather than pursuing new developments.

5. Policy Support and Regulatory Adjustments

The Chinese government's policy tilt favors asset upgrades over new developments, promoting urban renewal and the repurposing of existing structures. Additionally, the introduction of infrastructure real estate investment trusts (C-REITs) is unlocking institutional capital, providing developers with alternative financing options and enhancing market liquidity.

Market Segmentation

By Property Type

Office Spaces: Held a 34% share of the market in 2024. Grade-A offices are experiencing steady demand, driven by corporate tenants seeking modern amenities and flexible workspaces.

Logistics Properties: Projected to register the fastest growth with a 7.72% CAGR through 2030. The rise of e-commerce and the need for efficient supply chains are fueling this demand.

Retail and Hospitality: While facing challenges due to changing consumer behaviors, these sectors are adapting by focusing on experience-based offerings and repurposing spaces to meet new demands.

By Business Model

Sales: Dominated the market with a 62% share in 2024. Developers continue to pursue sales as a primary revenue model, although the focus is shifting towards more sustainable approaches.

Rental Operations: Expected to grow at a CAGR of 6.98% through 2030. This model is gaining traction among institutional investors seeking stable income streams and long-term capital appreciation.

By End-User

Corporate and SMEs: Accounted for 66.1% of the market share in 2024. These entities are increasingly prioritizing high-quality office spaces that offer flexibility and align with sustainability goals.

Individual Investors: Representing the fastest-growing cohort with a 6.73% CAGR through 2030. Individual investors are showing increased interest in commercial real estate as a means of diversifying their investment portfolios.

By City

Shanghai: Captured a 22% share of the market in 2024. The city continues to be a major hub for commercial real estate, attracting both domestic and international investors.

Chengdu: On track for the highest growth with a 7.24% CAGR by 2030. The city's development as a technology and innovation center is driving demand for commercial spaces.

中国の商業不動産市場について詳しく知る

- https://www.mordorintelligence.com/ja/industry-reports/china-commercial-real-estate-market?utm_source=openPR

Key Players

Several prominent developers and investors are shaping the landscape of China's commercial real estate market:

Wanda Group: A leading developer with a diverse portfolio spanning retail, office, and mixed-use properties.

Greenland Holdings: Known for its large-scale developments and focus on urban renewal projects.

Longfor Group: Emphasizes asset management and investment properties, particularly shopping malls, to secure stable income streams.wsj.com

China Resources Land: A state-owned enterprise transitioning towards a "build to hold" strategy, focusing on long-term rental income.en.wikipedia.org

GLP: Specializes in logistics properties and has been expanding its presence in China's e-commerce-driven real estate sector.

These companies are adapting to market dynamics by focusing on asset management, urban renewal, and catering to evolving occupier preferences.

Conclusion

China's commercial real estate market is poised for steady growth, driven by urbanization, evolving business needs, and supportive government policies. While challenges such as oversupply in certain segments and high borrowing costs for developers persist, the shift towards rental business models, asset upgrades, and logistics properties presents opportunities for investors and developers. Adapting to these trends and focusing on sustainability and flexibility will be key to success in this evolving market.

Industry Related Reports

Commercial Real Estate Market: The market is segmented by property type, including Offices, Retail, Logistics, and others. It is further divided by business model (Sales, Rental), end-user (Individuals/Households, Corporates & SMEs, and others), and region (North America, South America, Europe, Asia-Pacific, and the Middle East & Africa).

To know more visit this link: https://www.mordorintelligence.com/industry-reports/commercial-real-estate-market?utm_source=openPR

Turkey Commercial Real Estate Market: The market is segmented by property type, including Office, Retail, Industrial, Logistics, Hospitality, and Multi-family. It is also analyzed by key cities, such as Istanbul, Bursa, and Antalya.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/commercial-real-estate-market-in-turkey?utm_source=openPR

Saudi Arabia Commercial Real Estate Market: The market is segmented by property type, including Office, Retail, Logistics, and more. It is further categorized by business model (Sales and Rental), end user (Individuals/Households, Corporates and SMEs, and more), and region (Riyadh, Jeddah, Makkah, and the Rest of Saudi Arabia).

To know more visit this link: https://www.mordorintelligence.com/industry-reports/commercial-real-estate-market-in-saudi-arabia?utm_source=openPR

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release China Commercial Real Estate Market to Reach USD 1.16 Trillion by 2030, Driven by Urbanization and Evolving Business Needs here

News-ID: 4082914 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

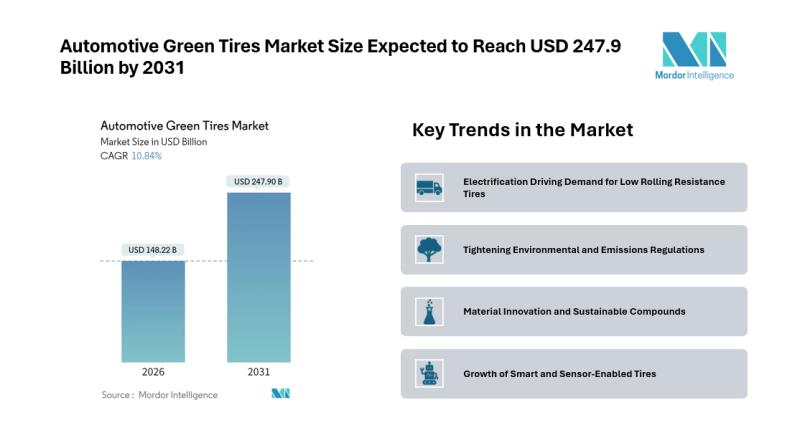

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for China

China fund establishment, China fund management,china investment management

Pandacu China is a leading financial institution that specializes in providing fund establishment and management services for domestic and international investors looking to invest in China. The company was founded in 2015 by a team of experienced finance professionals with a deep understanding of the Chinese market and a strong network of contacts in the investment industry.

https://boomingfaucet.com/

China Fund Establishment Consultation

E-mail:nolan@pandacuads.com

Investing in China can be a complex and challenging process, and…

China Finance Advisor, China Debt Finance Corporation,China Investment Corporati …

Investment bank is a financial institution that helps companies and governments raise capital by underwriting and issuing securities, and also provides advice on mergers and acquisitions, strategic investments, and other financial matters. Investment banks typically have a team of professionals with expertise in various areas such as corporate finance, securities underwriting, sales and trading, and market research.

http://pandacuads.com/

China Investment Corporation

Email:nolan@pandacuads.com

Some of the main services provided by investment banks include:

Underwriting: Investment banks…

China Investment Bank, China Investment Consultant, China Investment Corporation …

Pandacu is a company that specializes in cross-border investment in China. The company was founded in china and has since grown to become one of the leading cross-border investment firms in China. Pandacu offers a wide range of services to its clients, including investment advisory, market research, due diligence, and post-investment support.

http://pandacuads.com/

Investment banking consultant

Email:nolan@pandacuads.com

Cross-border investment in China can be a complex and challenging process, as the country has a unique…

china construction company,china engineering company,china major bridge engineer …

List of Top 500 Chinese Construction Enterprises

ranking

https://gzwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Company Name

province

1

China State Construction Corporation Limited

Beijing

2

China Railway Corporation Limited

Beijing

3

China Railway Construction Corporation Limited

Beijing

4

Shanghai Weimengsi Construction Engineering Co., Ltd.

Shanghai

5

China Communications Construction Group Co., Ltd.

Beijing

6

China Power Construction Corporation Limited

Beijing

7

China Energy Construction Group Co., Ltd.

Beijing

8

Shanghai Construction Engineering Group Co., Ltd.

Shanghai

9

Jiangsu Zhongnan Construction Industry Group Co., Ltd.

Jiangsu

10

China Gezhouba Group Co., Ltd.

Hubei

11

China National Chemical Engineering Co., Ltd.

Beijing

12

Sinoma Group Co., Ltd.

Beijing

13

Guangxi Construction Engineering Group Co., Ltd.

Guangxi

14

Shanghai Urban…

Forehead Thermometer Market Analysis (2019- 2025)| Microlife (China), Radiant (C …

This research study is one of the most detailed and accurate ones that solely focus on the global Forehead Thermometer market. It sheds light on critical factors that impact the growth of the global Forehead Thermometer market on several fronts. Market participants can use the report to gain a sound understanding of the competitive landscape and strategies adopted by leading players of the global Forehead Thermometer market. The authors of…

Global Color Steel Tile Market 2017 - South China, East China, Southwest China, …

Color Steel Tile Market Research Report

A market study based on the " Color Steel Tile Market " across the globe, recently added to the repository of Market Research, is titled ‘Global Color Steel Tile Market 2017’. The research report analyses the historical as well as present performance of the worldwide Color Steel Tile industry, and makes predictions on the future status of Color Steel Tile market on the basis…