Press release

United Kingdom Hedge Funds Market to Reach USD 680.19 Billion by 2030, Driven by Strategic Shifts and Technological Advancements

Mordor Intelligence has published a new report on the United Kingdom Hedge Funds Market, offering a comprehensive analysis of trends, growth drivers, and future projections.United Kingdom Hedge Funds Market Overview

The United Kingdom's hedge fund sector is poised for continued growth, with projections indicating an increase from USD 531.22 billion in 2025 to USD 680.19 billion by 2030, reflecting a compound annual growth rate (CAGR) of 4.21%. This upward trajectory is underpinned by several key factors, including London's resilience post-Brexit, strategic shifts in institutional investment behaviors, and advancements in technology that enhance operational efficiencies.

Report Overview: https://www.mordorintelligence.com/industry-reports/uk-hedge-funds-market?utm_source=openPR

Key Trends

1. Post-Brexit Resilience and Regulatory Harmonization

London's financial services industry has demonstrated adaptability in the post-Brexit landscape. Efforts to harmonize regulations and maintain access to global markets have bolstered investor confidence, contributing to the sustained growth of the hedge fund market.

2. Shift from Leveraged Liability-Driven Investments (LDI)

Institutional investors, particularly pension funds, are reallocating assets away from leveraged LDI strategies. This shift is driven by the need for more flexible and transparent investment approaches, favoring hedge funds that offer systematic and ESG-compliant strategies.

3. Emphasis on Systematic and ESG Strategies

There is a growing preference among institutions for hedge funds that incorporate systematic trading models and adhere to Environmental, Social, and Governance (ESG) criteria. These strategies are increasingly seen as aligned with long-term investment goals and risk management frameworks.

4. Expansion of UCITS-Compliant Hedge Funds

The rise of UCITS-compliant hedge funds has broadened the investor base, particularly among European investors seeking daily liquidity and regulatory transparency. This expansion is facilitating greater participation in the UK hedge fund market.

5. Technological Advancements in Hedge Fund Operations

Investments in technology, such as alternative data analytics, cloud-native execution platforms, and low-latency connectivity, are redefining competitive advantages in the hedge fund industry. These advancements enable managers to navigate volatile macroeconomic conditions more effectively.

Market Segmentation

The UK hedge fund market is characterized by diverse strategies and investor preferences:

Investment Strategies: Equity long/short strategies led the market with a 34.5% share in 2024. However, global macro strategies are projected to experience the fastest growth, with a CAGR of 6.53% through 2030.

Investor Types: Pension funds held 56.8% of the market share in 2024. Family offices are expected to grow at a CAGR of 7.21% through 2030, indicating a shift towards more personalized investment approaches.

Distribution Channels: Direct sales accounted for 70.2% of the market in 2024. Digital and online platforms are anticipated to grow at a CAGR of 5.43%, reflecting the increasing trend towards digitalization in investment processes.

Fund Domicile & Structure: UK-onshore funds represented 45.7% of the market share in 2024. UCITS-compliant hedge funds are forecasted to expand at a CAGR of 4.74%, highlighting the demand for regulated investment vehicles.

Geographical Distribution: London captured 37.6% of the market share in 2024 and is projected to be the fastest-growing center, with a CAGR of 5.43% through 2030, reinforcing its status as a global financial hub.

英国のヘッジファンド市場について詳しく知る - https://www.mordorintelligence.com/ja/industry-reports/uk-hedge-funds-market?utm_source=openPR

Key Players

Several prominent hedge fund managers are shaping the UK market landscape:

Man Group: As the world's largest publicly traded hedge fund company, Man Group manages assets totaling USD 178.2 billion as of 2024. The firm offers a range of investment strategies, including quantitative and discretionary approaches.

Marshall Wace: With assets under management (AUM) of USD 82.1 billion, Marshall Wace is recognized for its long/short equity strategies and innovative investment solutions.

Capula Investment Management: Specializing in fixed income and macro strategies, Capula manages approximately USD 30 billion in assets, focusing on delivering absolute returns.

Eisler Capital: Founded by former Goldman Sachs partner Edward Eisler, Eisler Capital manages USD 4 billion in assets, employing a multi-strategy investment approach.

Qube Research & Technologies: A quantitative investment firm with AUM of USD 28 billion, Qube Research & Technologies leverages advanced data analytics and systematic trading models.

These firms exemplify the diverse strategies and expertise present in the UK's hedge fund sector.

Conclusion

The United Kingdom's hedge fund industry is on a steady growth path, driven by strategic shifts in institutional investment behaviors, regulatory adaptations, and technological advancements. As the market evolves, hedge funds that embrace systematic and ESG-compliant strategies, leverage technological innovations, and adapt to changing investor preferences are well-positioned to capitalize on emerging opportunities. The continued development of the hedge fund sector will play a crucial role in shaping the broader financial landscape in the coming years.

Industry Related Report

Global Hedge Fund Market: The Market is divided by strategy, including Long/Short Equity, Event-Driven, Global Macro, and others. It is further segmented by investor type (Institutional Investors, High-Net-Worth Individuals & Family Offices, and more), fund structure (Onshore and Offshore), distribution channel (Direct Institutional Mandates, Fund of Funds, and more), and geography (North America, South America, and other regions).

To know more visit this link: https://www.mordorintelligence.com/industry-reports/global-hedge-fund-industry?utm_source=openPR

United States Hedge Fund Market: The market is segmented based on core investment strategies, including Equity, Macro, Event-driven, Credit, Relative Value, Niche, Multi-strategy, and others.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/us-hedge-fund-market?utm_source=openPR

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United Kingdom Hedge Funds Market to Reach USD 680.19 Billion by 2030, Driven by Strategic Shifts and Technological Advancements here

News-ID: 4082908 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

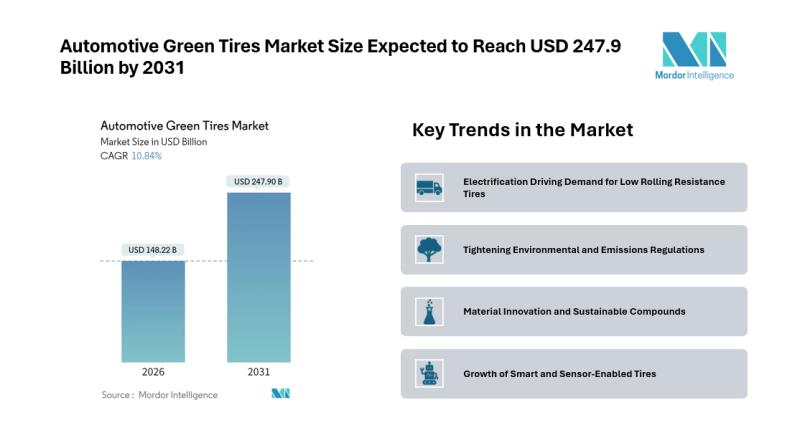

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for Fund

Broad-Based Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong F …

The Broad-Based Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Broad-Based Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E Fund, …

The Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Exchange-Traded Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fun …

The Exchange-Traded Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Exchange-Traded Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Equity Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Equity Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Equity Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Bond Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E …

The Bond Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Bond Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Money Market Funds Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Money Market Funds research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Money Market Funds market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…