Press release

Insurance Brokerage Market to Reach USD 395.41 Billion by 2030, Driven by Digital Transformation and Rising Insurance Demand

Mordor Intelligence has published a new report on the "Insurance Brokerage Market" offering a comprehensive analysis of trends, growth drivers, and future projections.Introduction

The global insurance brokerage market is poised for significant growth, with projections indicating a rise from USD 331.96 billion in 2025 to USD 395.41 billion by 2030, reflecting a compound annual growth rate (CAGR) of 3.56%. This expansion is attributed to several key factors, including the increasing demand for various insurance policies, advancements in digital technologies, and a surge in mergers and acquisitions within the industry. As the insurance landscape becomes more complex, insurance brokers are positioned as essential intermediaries between insurance companies and consumers, offering expert guidance and tailored insurance solutions. This press release explores the key trends, market segmentation, and the leading players contributing to the growth of the insurance brokerage market.

Report Overview: https://www.mordorintelligence.com/industry-reports/insurance-brokerage-market?utm_source=openpr

Key Trends Shaping the Market

1. Digitalization of Insurance Services

One of the most significant trends driving the growth of the insurance brokerage market is the digital transformation of the sector. Traditionally, insurance services were primarily delivered through face-to-face interactions, but with the rapid development of technology, digital platforms have become increasingly integral. Brokers are adopting digital tools and platforms to improve customer engagement, enhance operational efficiency, and streamline the process of purchasing and managing insurance policies.

The rise of online insurance marketplaces and digital brokers is making insurance more accessible to a wider audience. Customers now have the ability to compare policies, get quotes, and even purchase insurance through mobile apps and websites. The shift to digital is also facilitating the automation of back-end processes, reducing the operational burden on brokers, and allowing them to focus on providing personalized services to clients. Moreover, advanced data analytics and artificial intelligence (AI) are helping brokers better understand consumer needs and offer customized solutions.

2. Rising Consumer Awareness and Demand

There is a growing awareness among consumers regarding the importance of insurance in protecting their financial well-being. This heightened awareness is fueled by increasing media coverage of insurance-related topics, as well as the rising frequency of natural disasters, health crises, and economic uncertainties. As consumers become more informed, they are actively seeking insurance products to safeguard themselves, their families, and their assets.

Insurance brokers play a crucial role in educating consumers about the different types of insurance available and helping them navigate the complexities of policy terms, coverage options, and premiums. This is particularly important in markets where insurance penetration has traditionally been low. As consumer demand for insurance grows, brokers are playing an even more pivotal role in facilitating access to suitable policies that meet the specific needs of individuals and businesses.

3. Growth in Mergers and Acquisitions

The insurance brokerage sector is also witnessing a surge in mergers and acquisitions (M&A), as firms seek to consolidate their position in a highly competitive market. M&A activity enables insurance brokers to expand their geographic reach, diversify their service offerings, and achieve economies of scale. This trend is particularly prevalent among larger firms that are seeking to increase their market share and leverage technological capabilities for better customer service.

In addition to enhancing competitive strength, mergers and acquisitions allow brokers to diversify into new market segments. This includes expanding their offerings in niche insurance products such as cyber insurance, environmental insurance, and specialty lines. The consolidation of firms is helping to streamline operations and enhance efficiency, ultimately benefiting both brokers and their customers.

Check out more details now and stay updated with the latest industry trends: https://www.mordorintelligence.com/ja/industry-reports/insurance-brokerage-market?utm_source=openpr

Market Segmentation

The insurance brokerage market is broadly segmented based on insurance type, brokerage type, and region. Each of these segments has distinct characteristics that contribute to the overall growth of the market.

By Insurance Type

Life Insurance: The life insurance segment is seeing a rapid rise, driven by increased consumer awareness about the importance of life coverage. As more people realize the financial benefits of securing life insurance, the demand for these policies is expected to grow significantly. Additionally, the availability of customized life insurance plans, such as term life, whole life, and universal life insurance, is making it easier for consumers to find the right policy to suit their needs.

Property & Casualty Insurance: This segment remains one of the largest in the insurance brokerage market. Property and casualty insurance covers a broad range of risks, including property damage, liability, and accidents. As natural disasters and other risks continue to rise, consumers and businesses are increasingly relying on brokers to find appropriate coverage to protect their assets.

By Brokerage Type

Retail Brokerage: Retail insurance brokers serve individual clients and families, providing personalized services to help them select the right insurance policies. Retail brokers are increasingly focusing on offering customized solutions to meet the specific needs of consumers. As the demand for personalized insurance experiences rises, retail brokers are expected to continue growing their market share.

Wholesale Brokerage: Wholesale brokers typically cater to businesses and commercial clients, offering specialized insurance solutions for a range of industries. This includes complex risk management services, such as directors and officers (D&O) liability insurance, commercial property insurance, and workers' compensation coverage. As the need for specialized insurance solutions grows, wholesale brokers are likely to see an increase in demand for their services.

By Region

North America: North America currently holds the largest market share in the global insurance brokerage market. The region benefits from a mature insurance industry, a high level of consumer awareness, and a well-established regulatory framework. In particular, the United States and Canada have a high penetration of both personal and commercial insurance policies, making North America a key player in the global market.

Asia-Pacific: The Asia-Pacific region is expected to be the fastest-growing market for insurance brokerage services. Countries such as China, India, and Japan are witnessing rapid economic growth, leading to an increase in disposable income and a growing middle class. This has resulted in a greater demand for insurance products, including health, life, and property insurance. Additionally, as the region experiences increasing urbanization, the need for insurance coverage is rising, particularly in emerging markets where insurance penetration remains relatively low.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players in the Market

The insurance brokerage market features a number of prominent players who are driving the growth and development of the sector. These key players include:

Acrisure LLC

Aon Plc

Arthur J. Gallagher & Co

Brown & Brown Inc

Marsh & McLennan Companies Inc

These companies have a significant presence in the global market, offering a wide range of services and solutions tailored to meet the needs of both individual and corporate clients. By leveraging their expertise and expanding their service offerings, these market leaders are contributing to the evolution of the insurance brokerage industry.

Explore the key companies and get to know the leaders of the insurance brokerage industry: https://www.mordorintelligence.com/industry-reports/insurance-brokerage-market/companies?utm_source=openpr

Conclusion

The global insurance brokerage market is on a steady upward trajectory, driven by key trends such as digital transformation, increased consumer awareness, and the consolidation of major industry players. With a projected market size of USD 331.96 billion in 2025, the sector is well-positioned for continued growth in the coming years. As consumer demand for insurance products rises and the need for specialized coverage increases, insurance brokers will continue to play a crucial role in connecting clients with the right insurance solutions. The industry's growth is further supported by the ongoing digitalization of services, which allows brokers to streamline operations and enhance customer experiences. As the market evolves, opportunities for innovation and expansion remain abundant, making the future of the insurance brokerage industry promising.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/insurance-brokerage-market?utm_source=openpr

Industry Related Reports

Europe Insurance Brokerage Market: Europe Insurance Brokerage Market is segmented by Segmented Based on the Type of Insurance (Life and Non-life) and by Geography (Germany, United Kingdom, France, Italy, Belgium, Spain, and Other Countries).

Get more insights: https://www.mordorintelligence.com/industry-reports/europe-insurance-brokerage-market?utm_source=openpr

China Online Insurance Market: China's Online Insurance Market Report is Segmented by Product Type (Life Insurance and Non-Life Insurance), and by Type of Provider (Insurance Companies, Third Party Administrators, and Brokers).

Get more insights: https://www.mordorintelligence.com/industry-reports/china-online-insurance-market?utm_source=openpr

Europe Online Insurance Market: Europe Online Insurance Market is Segmented by Type (life and non-life insurance), and Geography (Germany, France, United Kingdom, Italy, and the Rest of Europe).

Get more insights: https://www.mordorintelligence.com/industry-reports/europe-online-insurance-market?utm_source=openpr

India Health and Medical Insurance Market: The India Health and Medical Insurance Market is Segmented by Policy Type (Individual Health Insurance, Family Floater & Group Health, and More), Coverage Type (In-Patient Hospitalization, Out-Patient & Day-Care, and More), Demographic (0-18, 19-45 Years, and More), Provider Type (Public, Private Sector, and More), Distribution Channel (Agents & Brokers, and More), and Region

Get more insights: https://www.mordorintelligence.com/industry-reports/india-health-and-medical-insurance-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Brokerage Market to Reach USD 395.41 Billion by 2030, Driven by Digital Transformation and Rising Insurance Demand here

News-ID: 4081925 • Views: …

More Releases from Mordor Intelligence

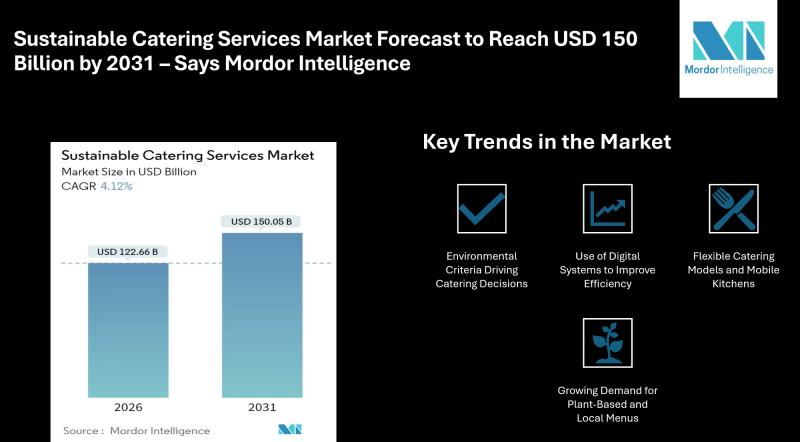

Sustainable Catering Services Market Forecast to Reach USD 150 Billion by 2031 - …

Mordor Intelligence has published a new report on the sustainable catering services market offering a comprehensive analysis of trends, growth drivers, and future projections.

Sustainable Catering Services Market Overview

According to Mordor Intelligence, the Sustainable Catering Services Market is witnessing steady expansion as organizations across industries adopt environmentally responsible foodservice models. The market is projected to increase from around USD 122.66 billion to nearly USD 150.05 billion by the year…

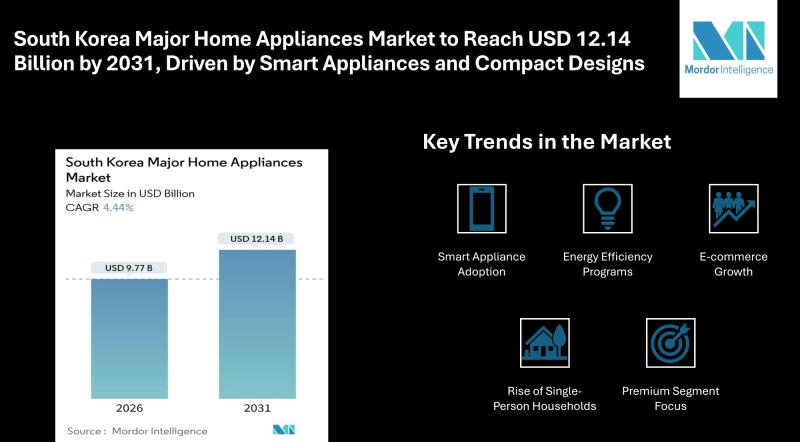

South Korea Major Home Appliances Market to Reach USD 12.14 Billion by 2031, Dri …

Mordor Intelligence has published a new report on the South Korea major home appliances market offering a comprehensive analysis of trends, growth drivers, and future projections.

South Korea Major Home Appliances Market Overview

According to Mordor Intelligence, the South Korea Major Home Appliances Market Size is poised for steady growth over the next few years, with the market size expected to rise from USD 9.77 billion in 2026 to USD…

Cake Mixes Market Size Forecast to Reach USD 2.09 Billion by 2030 as Home Baking …

Market Evolution Reflects Stable Demand and Lifestyle-Driven Consumption

The cake mixes market size is estimated at USD 1.78 billion in 2025 and is projected to reach USD 2.09 billion by 2030, registering a CAGR of 3.26% during the forecast period. This growth trajectory reflects a mature yet resilient market characterized by consistent consumer usage rather than rapid volume expansion.

The global cake mixes market growth is supported by evolving household…

Global Cakes Market Size to Reach USD 125.38 Billion by 2031 as Premiumization, …

Market Outlook Reflects Dual Role of Cakes as Daily Treats and Celebration Essentials

The cakes market size is projected to reach USD 102.36 billion by 2026 and is expected to expand to USD 125.38 billion by 2031, registering a CAGR of 4.14% during the forecast period.

Growth in the global cakes market is anchored in the product's unique positioning as both a routine indulgence and a symbolic centerpiece for social, cultural, and…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…