Press release

Minimum Revenue for Business Credit Cards: A Barrier or Just a Number?

When you're a startup founder, freelancer, or small business owner in the U.S., a business credit card can be a powerful financial tool. It helps manage expenses, build business credit, earn rewards, and provide short-term financing. But when you're just starting out, one question often stands in your way: what is the minimum revenue for business credit cards?For many entrepreneurs, this requirement feels like a locked door. But is it really as restrictive as it seems? Or is the minimum revenue for business credit cards simply a flexible guideline rather than a hard barrier?

Let's break down the truth behind this key requirement and how you can work around it-even if your business is new or hasn't generated significant revenue yet.

• Why Revenue Matters for Business Credit Cards

Business credit card issuers evaluate risk when reviewing applications. Unlike personal credit cards, where your credit score and income are the main considerations, business cards involve additional factors, including:

1. Type of business

2. Time in operation

3. Personal and business credit

4. Estimated monthly spend

5. Annual business revenue

Revenue tells the issuer how much money your business earns and whether it can realistically repay the credit extended. For example, if your startup earns $100,000 a year, a $10,000 credit limit might make sense. But if your revenue is $2,000, they'll likely hesitate to offer much credit without other strong qualifications.

• Is There a Set Minimum Revenue?

Here's the good news: there is no universal minimum revenue requirement across all business credit card issuers in the U.S.

Each issuer sets its own criteria, and some are more flexible than others. In fact, many cards do not publish a specific minimum revenue at all. Instead, they ask for:

1. Estimated annual revenue

2. Estimated monthly spend

3. Time in business

If your business is new or has zero revenue, some applications even allow you to enter "$0" without automatically disqualifying you.

So while revenue is considered, it's often weighed alongside other factors-especially your personal credit.

• How Much Revenue Is Typically Expected?

While issuers rarely state a firm threshold, here are some general insights based on trends from major credit card providers:

1. $5,000 to $10,000+ annual revenue may be the starting point for basic business cards.

2. $50,000+ annual revenue is often expected for mid-tier cards with better rewards or higher limits.

3. $100,000+ is more likely needed for premium business credit cards with perks like travel rewards, insurance, or large credit lines.

However, these are not hard rules. You may still qualify with low or no revenue if you meet other requirements.

• Other Factors That Can Offset Low Revenue

If you're applying with low or zero revenue, here are some things that may help your approval odds:

1. Strong Personal Credit

Most issuers rely heavily on your personal credit score, especially for new businesses. A score of 680 or higher is often required for the best cards, but some issuers accept scores in the 640-670 range.

2. Personal Guarantee

Nearly all business credit cards require a personal guarantee, meaning you agree to pay back the debt personally if your business can't. This reduces the issuer's risk and can make them more willing to overlook low revenue.

3. Alternative Income

Even if your business is new, issuers often let you include other sources of personal income (e.g., salary from a job or spousal income). This shows you have the means to repay debt.

4. Type of Business

Some industries have seasonal or inconsistent revenue. For example, a freelance designer may have irregular income but still be a reliable borrower. Issuers consider your business model and expense needs.

5. Business Banking and Cash Flow

If you bank with the same institution you're applying to (like Chase or Bank of America), they can view your cash flow directly-which may help if your revenue doesn't look strong on paper.

• Best Business Credit Cards for Low Revenue Businesses

If you're worried about the minimum revenue for business credit cards (https://ramp.com/blog/how-to-apply-for-a-business-credit-card), consider these startup-friendly options:

1. Chase Ink Business Unlimited®

• No annual fee

• Earn 1.5% cashback on all purchases

• Often approves sole proprietors and side hustlers with low revenue

2. Capital One Spark 1.5% Cash Select - Good Credit

• No foreign transaction fees

• Straightforward cashback model

• Accepts personal credit history for new businesses

3. American Express Blue Business CashTM Card

• 2% cashback on first $50,000 spent per year

• No annual fee

• Ideal for startups and low-revenue companies with strong credit

4. Brex Card for Startups (No Personal Guarantee)

• No credit check required

• Available only to incorporated startups with bank balance or investor backing

• Great for early-stage companies with venture capital

• Can You Apply with $0 Revenue?

Yes! Many new founders apply with $0 in declared business revenue, especially if they're still pre-revenue but plan to start operations soon.

In this case, be honest about your status. Lying on your application can result in denial or even account closure. Instead, focus on:

• Strong credit

• Clear business intent

• Other income sources

Many issuers understand that early-stage businesses (https://www.svb.com/startup-insights/startup-growth/what-are-the-three-stages-of-a-startup/) are still ramping up and will review the entire picture before making a decision.

• Conclusion

So, is the minimum revenue for business credit cards truly a barrier? Not necessarily. It's one piece of a larger puzzle.

For many U.S.-based small business owners and startups, especially those with good personal credit and clear business plans, revenue isn't the gatekeeper it's often believed to be. It's more of a guideline used in conjunction with other metrics.

If your business is new or your revenue is low, don't let that stop you from applying. Choose cards that cater to entrepreneurs, be transparent in your application, and work on strengthening other aspects like credit score and personal income.

With the right preparation, that "barrier" becomes just another number-and one you can overcome.

https://theinfluencersgonewild.org/

Office 7602 182-184, High Street North, East Ham, London

Finixio Digital is a UK-based remote-first Marketing & SEO Agency helping clients worldwide. In only a few short years, we have grown to become a leading Marketing, SEO, and Content agency.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Minimum Revenue for Business Credit Cards: A Barrier or Just a Number? here

News-ID: 4077926 • Views: …

More Releases from Finixio Digital

How to Choose a Bucking Unit for Tubing & Casing Connections: A Practical Buyer' …

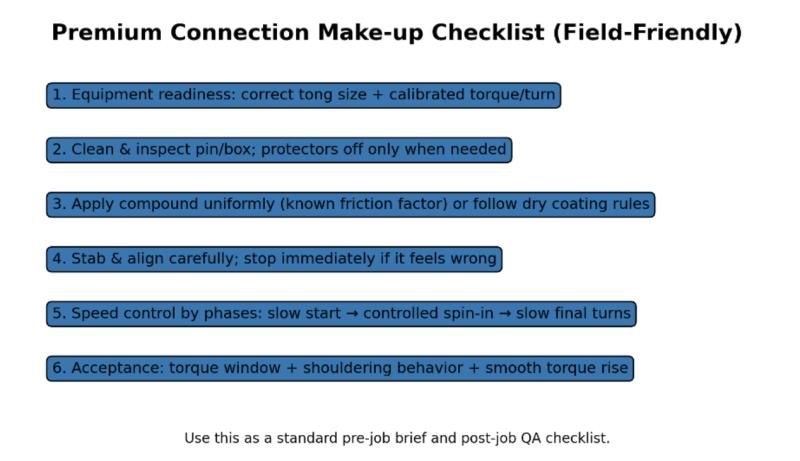

A field-ready checklist to improve repeatability, reduce rework, and support QA documentation.

When teams evaluate a https://galipequipment.com/bucking-unit/ the first comparison is usually torque range. That matters, but it is not the only factor that determines whether your connection work stays consistent over time. In real operations, the biggest costs often come from rework, inconsistent make-up behavior, damaged surfaces, and unclear documentation when customers request proof.

This guide breaks down what to evaluate…

Roller Shutters: The Ultimate Guide to Security, Energy Savings & Weather Protec …

Roller shutters are one of the smartest investments you can make for your home or business. These strong, versatile window and door coverings provide security, insulation, noise reduction, and weather protection all in one package. Whether you're looking to lower energy bills, keep intruders out, or protect your property from storms, roller shutters (https://qldshade.com.au/roller-shutters/) deliver real results.

● What Are Roller Shutters?

Roller shutters are protective coverings made from horizontal slats (called…

Online Blinds Australia: Buy Custom Blinds Online & Save 40-60%

Looking to buy blinds online in Australia? You're making a smart choice. Shopping for online blinds Australia (https://aussieonlineblinds.com.au/) saves you 40-60% compared to retail stores, and you get custom-made window coverings delivered straight to your door. This guide shows you everything you need to know to choose, order, and install the perfect blinds for your home.

● Why Buy Blinds Online in Australia?

When you buy blinds online in Australia, you skip…

Hiddence.net: Premium Anonymous VPS & VDS Hosting

In today's world of constant digital surveillance, finding a hosting provider that combines high-performance hardware with genuine privacy is rare. Hiddence.net (http://Hiddence.net) redefines hosting by offering powerful VPS and VDS solutions designed to keep your identity completely anonymous. Whether you're running privacy-focused projects, mission-critical applications, or specialized workloads, Hiddence ensures your digital footprint remains fully protected-without sacrificing speed or reliability.

● Privacy Meets Performance

Most hosting providers require personal information during…

More Releases for Business

Business-to-Business eCommerce Market is Going to Boom | Alibaba, Amazon Busines …

The Global Business-to-Business eCommerce Market report, spanning over 135+ pages, provides a comprehensive overview of the product/industry scope and outlines the market outlook and status from 2024 to 2032. The study is segmented by key regions driving market growth. Currently, the market is expanding its presence, with notable contributions from key players such as Alibaba, Amazon Business, eBay Business, IndiaMART, ThomasNet, Global Sources, SAP Ariba, Salesforce, Shopify Plus, BigCommerce, Oracle…

Factors Influencing Global Business Broker Service Market through 2023 and Beyon …

The worldwide "Business Broker Service Market" 2023 Research Report presents a professional and complete analysis of the Global Business Broker Service Market in the current situation. This report includes development plans and policies along with Business Broker Service manufacturing processes and price structures. the reports 2023 research report offers an analytical view of the industry by studying different factors like Business Broker Service Market growth, consumption volume, Market Size, Revenue,…

Business Consulting Company, Business Consulting Firm, Business Consulting Servi …

The market research is an essential portion of any business strategy and primarily comprises of the data collecting about the markets and consumers in those markets. In recent’s globalized business surroundings, effective market research is a critical portion of any business’s efforts to compete successfully.

At Ken Research, the market research services support businesses identify growth opportunities and form a competitive strategy reliant on the deep understanding of consumers and…

Business to Business Media Market 2019 Business Scenario – Bloomberg, IBM, Ora …

A new Profession Intelligence Report released by Stats and Reports with the title Global Business to Business Media Market "can grow into the most important market in the world that has played an important role in making progressive impacts on the global economy. Global Business to Business Media Market Report presents a dynamic vision to conclude and research market size, market hope and competitive environment. The study is derived from…

Business Alliance Market Growing Dynamically with Leading Top Key Players like B …

A business alliance is an agreement between businesses, usually motivated by cost reduction and improved service for the customer. Alliances are often bounded by a single agreement with equitable risk and opportunity share for all parties involved and are typically managed by an integrated project team. An example of this is code sharing in airline alliances.

The Global Business Alliance Market 2019 research provides a basic overview of the industry including…

Global Interferon Market Business Growth, Business Opportunities, Business Outlo …

Albany, NY, USA / 16 Oct 2018: - A New fresh research report presented by KD Market Insights provides a detailed analysis of “Global Interferon Market Size, Trends, Opportunity and Forecast to 2023” research report will include all the major trends and technologies that play an important role in market growth in the predicted span of 6 years. It also presents the overview of industry players, advantages, challenges the business…