Press release

Africa Insurance Market Size to Surpass USD 160.9 Billion by 2033 at a CAGR of 6.03%

Africa Insurance Market OverviewMarket Size in 2024:USD 92.9 Billion

Market Size in 2033: USD 160.9 Billion

Market Growth Rate 2025-2033: 6.03%

According to IMARC Group's latest research publication, "Africa Insurance Market Report by Type (Life Insurance, Non-Life Insurance), and Country 2025-2033", The Africa insurance market size reached USD 92.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 160.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.03% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/africa-insurance-market/requestsample

Growth Factors in the Africa Insurance Market

● Rising Middle-Class Population

The growing middle class in Africa, particularly in countries like Nigeria, Kenya, and South Africa, is a key growth driver for the insurance market. As disposable incomes increase, more people are searching for financial security through types of insurance like health, life and property coverage. For example, Sanlam, one of the insurers in South Africa, has developed affordable life insurance plans for middle income families, that increased uptake by middle income families looking for affordable insurance. Urbanization and improvement in education levels are further prompting consumers to put risk management first, signalling to the insurance market potential demand for a diverse range of products. There is an important demographic change occurring in Africa that is good for the insurance market, and this demographic change will support growth in the insurance market by fostering a culture to think about financial protection and planning for the future.

● Digitalization and Mobile Penetration

In many regions of Africa, particularly Sub-Saharan Africa, levels of mobile penetration are remarkably high, with millions of people owning mobile phones. This provides insurers with a unique opportunity to use mobile technology to reach previously underserved populations with various forms of insurance and related products, microinsurance or otherwise. One example of this in practice is BIMA. BIMA sells affordable health and accident insurance products in Ghana and Tanzania via mobile apps that the company has designed and developed, allowing customers to pay through mobile financial service offerings. The use of mobile financial services allows BIMA to decrease its cost to serve while improving access and reach (especially in rural markets). Various government initiatives promoting mobile and digital inclusion, such as Kenya's Digital Economy Blueprint, support and promote the trend towards digitization of the insurance distribution process. The combination of offerings from insurance companies via various digital selling platforms enables millions of people to access insurance products in a way that is convenient and affordable.

● Regulatory Reforms and Financial Inclusion

Countries in Africa are introducing progressive regulatory reforms that spur growth in the insurance sector by promoting financial inclusion. Rwanda and Morocco have implemented a succession of policies that stipulate mandatory types of insurance, such as motor and health insurance, which has stimulated more people entering the insurance market. In Nigeria, the National Insurance Commission (NAICOM) has issued microinsurance guidelines leading insurers such as Leadway Assurance to develop inexpensive insurance coverage products that target workers in the informal sector. Following the progressive regulatory changes in these countries, insurers will be establishing better trust with customers and market stability to allow foreign insurers to invest in local insurance markets, such as Allianz. Regulatory reform in action, with the expansion of financial insurance inclusion, allows regulators to create additional customers in the insurance market, which results in insurance sector growth.

Key Trends in the Africa Insurance Market

● Growth of Microinsurance

Microinsurance is a growing trend in Africa, helping to serve the needs of informal sector and low-income individuals who have traditionally been excluded from insurance. Many of the products being offered today include crop insurance, health insurance, and funeral insurance, at a low premium and in partnership with mobile operators. For example, Econet in Zimbabwe works with insurers to provide weather-indexed crop insurance to smallholder farmers, helping to mitigate climate-related risks. This trend is a response to the need for low-cost risk protection in vulnerable communities and insurers are leveraging data analytics to create bespoke products, to strengthen financial resilience, and to extend their market coverage into remote rural and urban areas.

● Adoption of Insurtech Solutions

Insurtech is revolutionizing African insurance by automating paper processes and improving customer experiences. For example, South Africa's Naked Insurance is an insuretech startup that uses artificial intelligence (AI) to provide on-demand car insurance, allowing customers to activate and deactivate insurance via mobile applications. Similarly, Kenya's Pula utilizes satellite data to provide parametric insurance for farmers to automate payouts to a drought or loss of revenue. These are very positive innovations that reduce administrative costs and improve overall efficiency, which resonates with tech-savvy consumers. Insurtech also presents insurers and their partners with data extraction ownership and analytics to learn about their customers and develop increased personalization of their value propositions. The overall outcomes of facilitating increased competition--as well as increased innovation of existing products and services--encourages established, traditional insurers like Old Mutual to invest in digital channel development and practice innovation to adapt to competition in the overall basket of industry impacts.

● Focus on Climate-Resilient Insurance

With increasing climate risks in the form of droughts and floods across Africa, there is a recognition of the need for climate resilient insurance products. Products like parametric insurance are growing in popularity because they make payout decisions based on the occurrence of certain weather events. For example, the African Risk Capacity (ARC) partners with insurance entities in countries such Malawi to provide drought insurance products for governments to protect the economic livelihoods of farmers. Insurers are also creating products supporting renewable energy projects, addressing Africa's green transition. Overall, it is evident that mitigation of environmental vulnerabilities is needed, and insurers are working with non-governmental organizations (NGOs) and governments to create sustainable solutions, making them more relevant in the market.

Buy Full Report: https://www.imarcgroup.com/checkout?id=1827&method=1645

Africa Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Type:

● Life Insurance

● Non-life Insurance

● Automobile Insurance

● Fire Insurance

● Liability Insurance

● Other Insurances

Breakup by Country:

● South Africa

● Morocco

● Nigeria

● Egypt

● Kenya

● Algeria

● Angola

● Namibia

● Tunisia

● Mauritius

● Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Future Outlook

The Africa insurance market is on a path to robust growth, propelled by digital innovation, regulatory encouragement and a growing middle class. Insurtech will continue to democratize access to insurance, mobile-based microinsurance expanding coverage in hard to reach communities and rural areas. Climate resilient products will be in higher demand as environmental challenges grow, with the backing of partnerships like the ARC's initiatives. Regulatory changes that promote trust will usher in global providers, while rising incomes will drive demand different types of insurance. Events like the African Insurance Organisation Conference will strengthen collaboration and signal to the rest of the world that Africa is emerging as a vibrant insurance market base with a purpose to include, sustainabilise and digitize.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=1827&flag=C

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Africa Insurance Market Size to Surpass USD 160.9 Billion by 2033 at a CAGR of 6.03% here

News-ID: 4077585 • Views: …

More Releases from IMARC Group

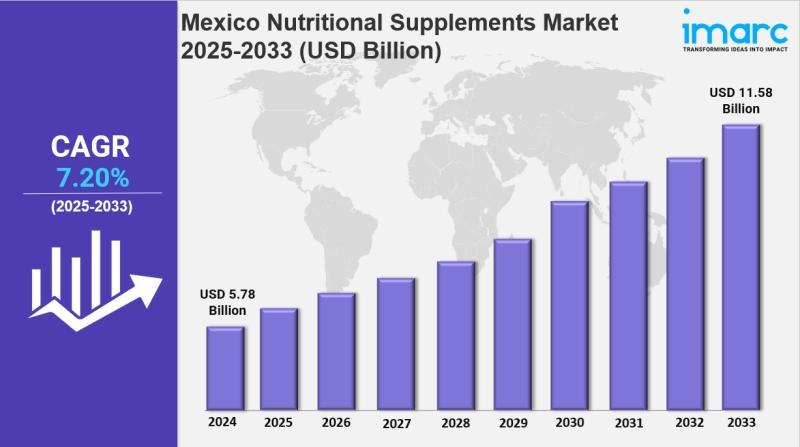

Mexico Nutritional Supplements Market Size, Growth, Latest Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Mexico Nutritional Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, Consumer Group, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico nutritional supplements market size was valued at USD 5.78 Billion in 2024. It is…

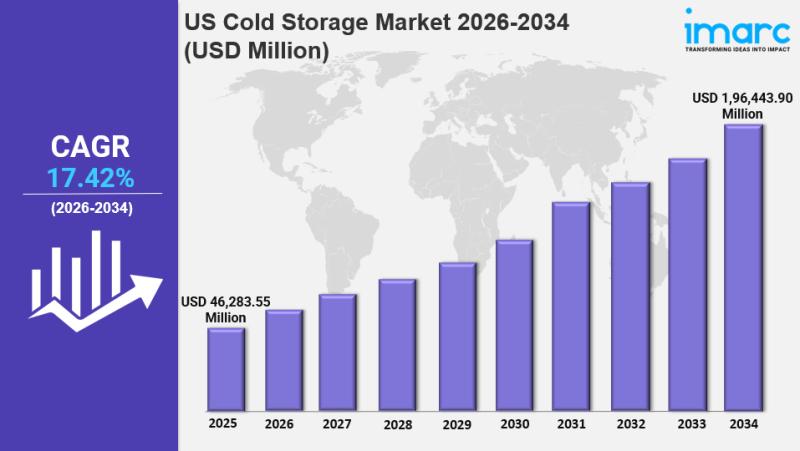

US Cold Storage Market Size, Trends, Growth and Forecast 2026-2034

IMARC Group has recently released a new research study titled "US Cold Storage Market Size, Share, Trends and Forecast by Warehouse Type, Construction Type, Temperature Type, Application, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The US cold storage market size reached USD 46,283.55 Million in 2025 and is projected to grow…

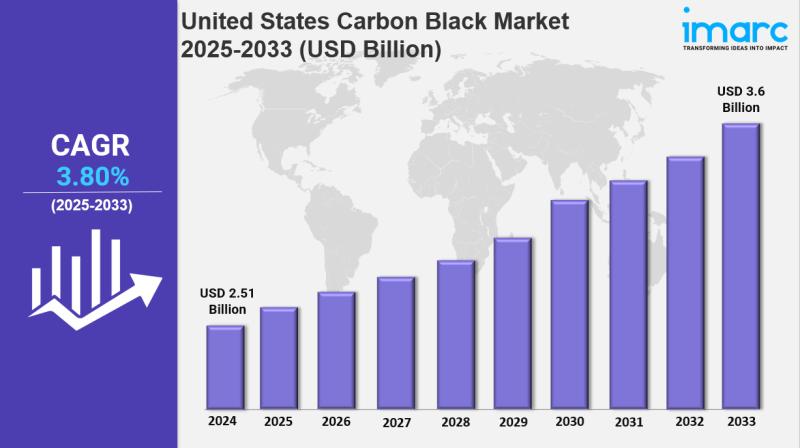

United States Carbon Black Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "United States Carbon Black Market Size, Share, Trends and Forecast by Type, Grade, Application, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States carbon black market size was valued at USD 2.51 Billion in 2024 and is projected to…

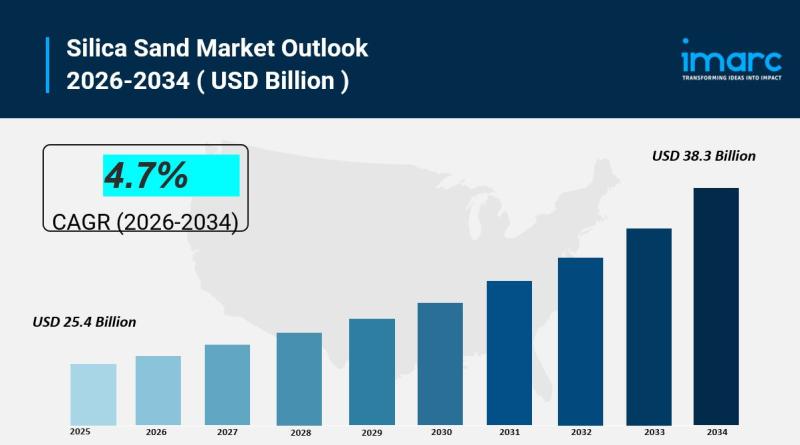

Silica Sand Market is Projected to Reach USD 38.3 Billion by 2034 | At CAGR 4.7%

Silica Sand Market Overview:

The global Silica Sand Market was valued at USD 25.4 Billion in 2025 and is forecast to reach USD 38.3 Billion by 2034, growing at a CAGR of 4.7% during 2026-2034. This growth is driven by increasing demand from the construction and glass manufacturing industries, continual advancements in hydraulic fracturing technology in oil and gas extraction, and rapid changes in environmental and regulatory landscapes.

The silica sand market…

More Releases for Africa

ONShine Africa Awareness Expands Through ONSAFX and Develop Africa Partnership

ONSA FX, a forex broker licensed by South Africa's Financial Sector Conduct Authority (FSCA), is extending its social impact through a strategic partnership with Develop Africa, under the umbrella of its social responsibility platform, ONShine Africa. This collaboration focuses on delivering critical educational support to children across Africa and reinforcing ONSA FX's commitment to sustainable development through long-term, values-based initiatives.

Develop Africa is a respected nonprofit organization founded in 2006 with…

Zetu Africa: Designing a Sustainable Future for Education Across Africa

In the heart of Kampala, Uganda, lies a bustling hub of creativity and purpose: Zetu Africa [https://www.zetuafrica.org/]. This award-winning design company has garnered acclaim not only for its stunning products but also for its unwavering commitment to social and environmental impact. At the core of Zetu's ethos is the belief that design can be a powerful force for positive change, and this belief is reflected in everything they do.

Image: https://www.abnewswire.com/uploads/83a984ca8ea183848376ae0ab0fea376.jpg

The…

Buildexpo Africa – Largest building and construction exhibition returns to Eas …

Buildexpo Africa is the only show with the widest range of the latest technology in building material, mining machines, construction machinery and heavy equipment. At the latest edition of Buildexpo, East Africa's largest building and construction fair, we bring you exhibitors from over 40 countries who are the finest in infrastructure development.

Find what suits you best from about 14.3 million business prospects during the three-day event, with over 10,000 products,…

South Africa Agriculture Market, South Africa Agriculture Industry, South Africa …

The South Africa has a market-oriented agricultural economy, which is much diversified and includes the production of all the key grains (except rice), deciduous, oilseeds, and subtropical fruits, sugar, wine, citrus, and most vegetables. Livestock production includes sheep, cattle, dairy, and a well-developed poultry & egg industry. Value-added activities in the agriculture sector include processing & preserving of fruit and vegetables, crushing of oilseeds, chocolate, slaughtering, processing & preserving of…

Wellness Tourism Market 2019 Future Growth with Worldwide Players: Africawellnes …

Wellness Tourism Market 2019 Industry Research Report provides a detailed Global Wellness Tourism Industry overview along with the analysis of industry’s favorable growth opportunities, the advent of flexible packaging is likely to dampen the market’s growth to an extent. Nevertheless, the increasing number of manufacturers, high demand for management applications, growth of residential & commercial sector and superior strength & corrosion resistance property.

Get Sample Copy of this Report -https://www.orianresearch.com/request-sample/904685

Market Overview:…

Vizocom Selects iSAT Africa as Its Africa C-band Partner

Vizocom, a leading global provider of satellite services, announced today that it has signed a partnership agreement with iSAT Africa to cooperate in providing satellite services and solutions.

Sharjah, UAE, March 02, 2016 -- Vizocom, a leading global provider of satellite services, announced today that it has signed a partnership agreement with iSAT Africa to cooperate in providing satellite services and solutions such as data solutions including C-band VSAT services and…