Press release

Mortgage And Loans Software Industry Report 2025-2034: Market Dynamics, Trends, And Forecasts

We've updated all our reports with current data on tariff changes, trade developments, and supply chain shifts affecting key industries.What Is the Expected Mortgage And Loans Software Market Size During the Forecast Period?

In recent years, the mortgage and loans software market has seen a significant expansion. It is projected to increase from $16.08 billion in 2024 to $18.46 billion in 2025, reflecting a compound annual growth rate (CAGR) of 14.8%. The previous growth period's increase is linked to the escalation of digital transformation, enhanced smartphone utilization, the emergence of online lending platforms, an amplified need for customer-driven solutions, and the surge of open banking.Expectations for the mortgage and loans software market size are bullish, with rapid expansion predicted over the coming years. The market value is projected to reach $31.63 billion by 2029, growing at a compound annual growth rate (CAGR) of 14.4%. This growth projection can be attributed to multiple factors like growing demand for automated loan processing, increased digitization and automation, wider internet access, heightened consumer expectations and growing usage of digital tools. Notable trends for the forecast period include the integration of financial technology (fintech) platforms, more advanced automation that allows quicker loan processing, better tools for fraud prevention, cloud technology adoption and an overall digital makeover.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=21523

What Are the High-Growth Segments in the Mortgage And Loans Software Market?

The mortgage and loans software market covered in this report is segmented -

1) By Software Type: Loan Origination Software, Loan Servicing Software, Loan Management Software, Compliance Management Software, Other Software Type

2) By Deployment Mode: On-Premises, Cloud-Based

3) By Application: Residential Mortgage, Commercial Mortgage, Consumer Loans, Other Application

4) By End-User: Banks, Credit Unions, Mortgage Lenders, Non-Banking Financial Institutions, Other End Users

Subsegments:

1) By Loan Origination Software: Automated Underwriting Systems, Credit Decisioning Software, Loan Pricing Software, Document Management Solutions, eClosing And eSignature Software

2) By Loan Servicing Software: Payment Processing Software, Escrow And Tax Management Software, Delinquency And Default Management Software, Loan Modification Software, Customer Self-Service Portals

3) By Loan Management Software: Portfolio Management Software, Risk And Fraud Management Software, Collateral Management Software, Debt Collection Software, AI-Powered Loan Analytics

4) By Compliance Management Software: Regulatory Reporting Software, Anti-Money Laundering (AML) Software, Know Your Customer (KYC) Compliance Software, Fair Lending Compliance Software, Data Privacy And Security Compliance Software

5) By Other Software Type: Mortgage Broker Software, Reverse Mortgage Software, Construction Loan Management Software, Peer-to-Peer (P2P) Lending Software, Loan Marketplace Platforms

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=21523&type=smp

What Key Drivers Are Expected to Influence Future Mortgage And Loans Software Market Growth?

The mortgage and loans software market is projected to expand, propelled forward by the increasing prevalence of mobile banking. Mobile banking, a digital service enabling financial transactions via a mobile device, is growing due to factors such as higher smartphone use, improved web connectivity, growing consumer preference for online financial services, and advancements in secure mobile payment technologies. Mobile banking is greatly enhanced by mortgage and loan software, which allows users to apply for loans, keep track of repayments, calculate EMIs, and manage mortgages smoothly, thus increasing financial engagement and accessibility. For example, a UK Finance Limited report from July 2024 noted that in 2023, 42% of adults were registered for mobile payments, rising from 30% the previous year, with 34% of people using the feature each month. As a result, the growth of the mortgage and loans software market is being spurred on by the advent of mobile banking.

Which Companies Hold the Largest Share Across Different Mortgage And Loans Software Market Segments?

Major companies operating in the mortgage and loans software market are Fiserv Inc., First American Financial Corporation, Wolters Kluwer Financial Services Inc., Finastra Inc., Black Knight Inc., The Mortgage Office Inc., Blend Inc., PathSoftware Inc., Provenir Inc., MortgageCadence LLC, Financial Industry Computer Systems Inc., TruHome Solutions LLC, Turnkey Lender Inc., Calyx Software Inc., SimpleNexus LLC, LoanLogics Inc., LoanPro Inc., LendingQB LLC, Better Mortgage Corporation, Ellie Mae Inc.

What Trends Are Driving Growth in The Mortgage And Loans Software Market?

Key players in the mortgage and loans software market are prioritizing the creation of innovations such as voice-activated AI loan assistants. Their aim is to enrich customer experiences, optimize loan origination, and boost customization. Voice-activated AI loan assistants are virtual help features, powered by artificial intelligence, designed to aid customers in applying for, managing, and asking about loans through voice dialogue. These virtual assistants, often incorporated into banking apps, call centers, or intelligent devices, can provide data on loan eligibility, interest rates, and repayment plans. For example, Betsy, the first voice-activated AI loan assistant for the US mortgage sector, was introduced by Better Home & Finance Holding Company, a US-based finance service company, in October 2024. Betsy revolutionizes the mortgage process by automating mundane tasks and supplying real-time customer assistance. This breakthrough not only increases productivity and minimizes costs but also enhances the overall customer experience within the mortgage sector. Furthermore, it allows loan officers to concentrate on more intricate conversations about interest rates and other certified activities, thereby simplifying the entire mortgage procedure.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/mortgage-and-loans-software-global-market-report

What Are the Emerging Geographies for The Mortgage And Loans Software Market Growth?

North America was the largest region in the mortgage and loans software market in 2024. The regions covered in the mortgage and loans software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Mortgage And Loans Software Market?

2. What is the CAGR expected in the Mortgage And Loans Software Market?

3. What Are the Key Innovations Transforming the Mortgage And Loans Software Industry?

4. Which Region Is Leading the Mortgage And Loans Software Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mortgage And Loans Software Industry Report 2025-2034: Market Dynamics, Trends, And Forecasts here

News-ID: 4071845 • Views: …

More Releases from The Business Research Company

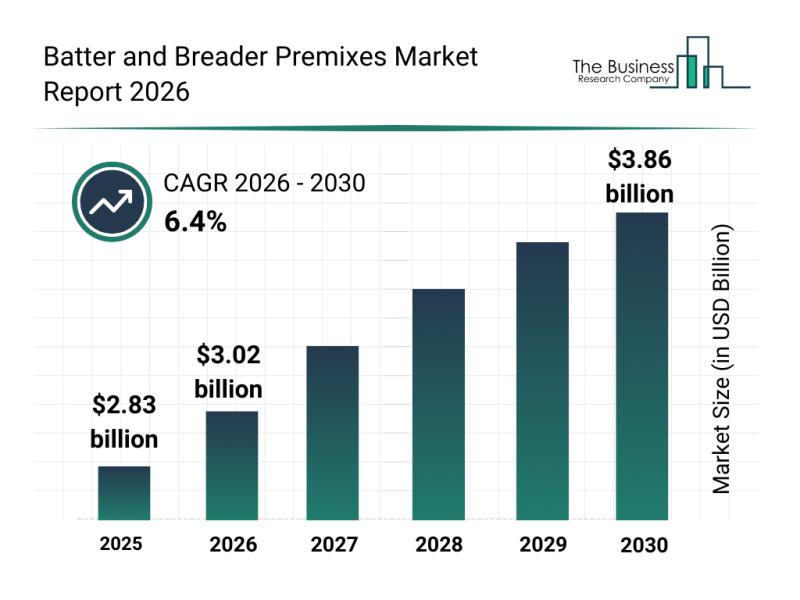

Analysis of Key Market Segments Influencing the Batter and Breader Premixes Indu …

The batter and breader premixes market is set for a promising future with significant growth expected over the coming years. Driven by evolving consumer preferences and innovations, this sector is capturing attention from food manufacturers and consumers alike. Let's explore the market's projected value, key players, trending innovations, and the main segments fueling its expansion.

Projected Market Value and Growth Outlook for Batter and Breader Premixes

The batter and breader…

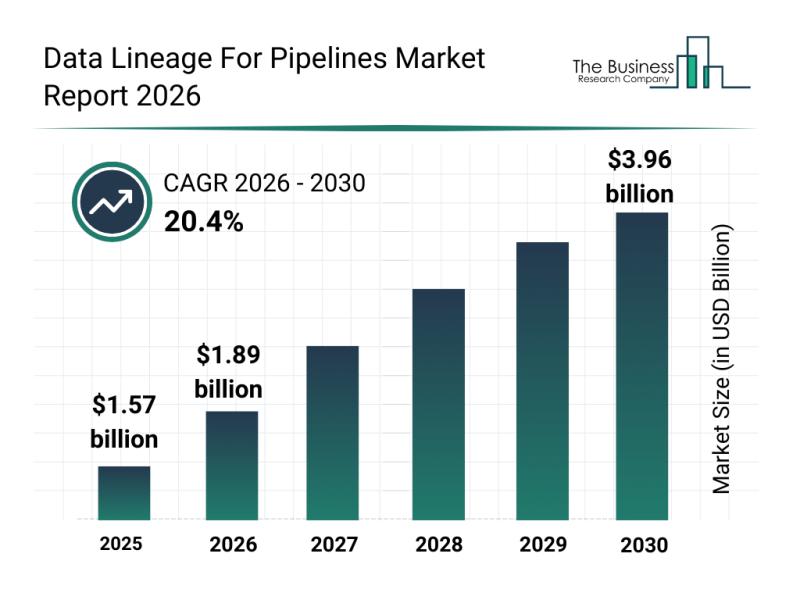

Emerging Growth Patterns Driving Expansion in the Data Lineage for Pipelines Mar …

The data lineage for pipelines market is positioned for remarkable expansion as organizations increasingly seek to enhance transparency and control over their data workflows. With advancing technologies and rising demand for robust data governance, this sector is set to witness significant growth and innovation in the coming years. Below is an overview of market size projections, leading players, trending advancements, and key segmentations shaping the future of this dynamic market.

Projected…

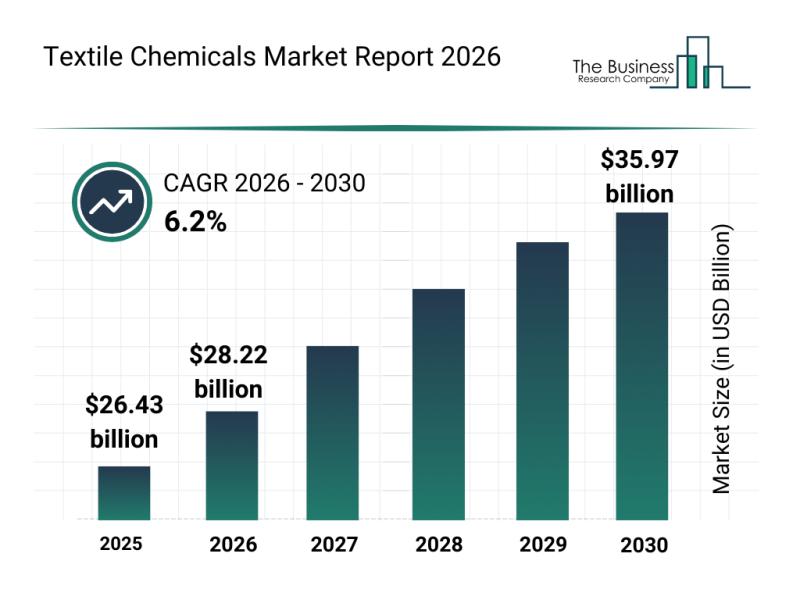

Emerging Growth Trends Driving Expansion in the Textile Chemicals Market

The textile chemicals industry is set to experience significant growth over the coming years, driven by advancements in fabric technologies and evolving market demands. This overview delves into the market's expansion prospects, key players shaping the landscape, emerging trends, and the main segments defining this sector's trajectory.

Textile Chemicals Market Size and Growth Outlook Through 2030

The market for textile chemicals is projected to expand steadily, reaching a valuation of…

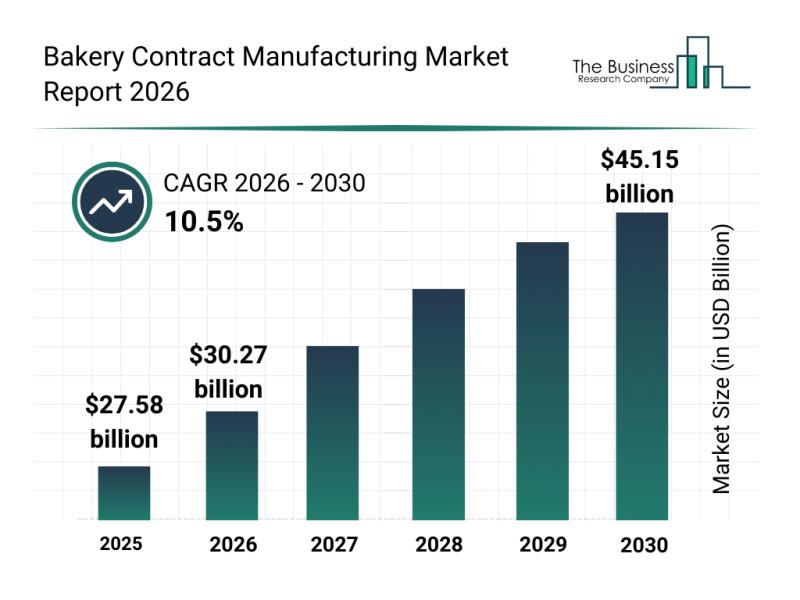

Market Trend Analysis: The Impact of Emerging Developments on the Bakery Contrac …

The bakery contract manufacturing sector is on the brink of significant expansion as consumer preferences and industry dynamics evolve. With rising health consciousness and the demand for innovative bakery items, this market is set to transform, presenting numerous opportunities for manufacturers and service providers alike. Let's explore the upcoming growth projections, key players, influential trends, and market segmentation shaping this industry.

Strong Growth Outlook for the Bakery Contract Manufacturing Market Size…

More Releases for Software

Takeoff Software Market May See a Big Move | Sage Software, Bluebeam Software, Q …

Latest Study on Industrial Growth of Takeoff Software Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Takeoff Software market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments…

Robot Software Market Analysis by Software Types: Recognition Software, Simulati …

The Insight Partners provides you global research analysis on “Robot Software Market” and forecast to 2028. The research report provides deep insights into the global market revenue, parent market trends, macro-economic indicators, and governing factors, along with market attractiveness per market segment. The report provides an overview of the growth rate of the Robot Software market during the forecast period, i.e., 2021–2028.

Download Sample Pages of this research study at: https://www.theinsightpartners.com/sample/TIPRE00007689/?utm_source=OpenPR&utm_medium=10452…

HR Software Market Analysis by Top Key Players Zenefits Software, Kronos Softwar …

HR software automates how companies conduct business with relation to employee management, training and e-learning, performance management, and recruiting and on-boarding. HR professionals benefit from HR software systems by providing a more structured and process oriented approach to completing administrative tasks in a repeatable and scalable manner. Every employee that is added to an organization requires management of information, analysis of data, and ongoing updates as progression throughout the company…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market Analysis by Top Key Players – Zenefits Software, Kronos Sof …

HR software helps HR personnel automate many necessary tasks, such as maintaining employee records, time tracking, and benefits, which allows HR professionals to focus on recruiting efforts, employee performance and engagement, corporate wellness, company culture, and so on. These human management tools can be purchased and implemented as on premise or cloud-based software.

This market studies report on the Global HR Software Market is an all-inclusive study of the enterprise sectors…