Press release

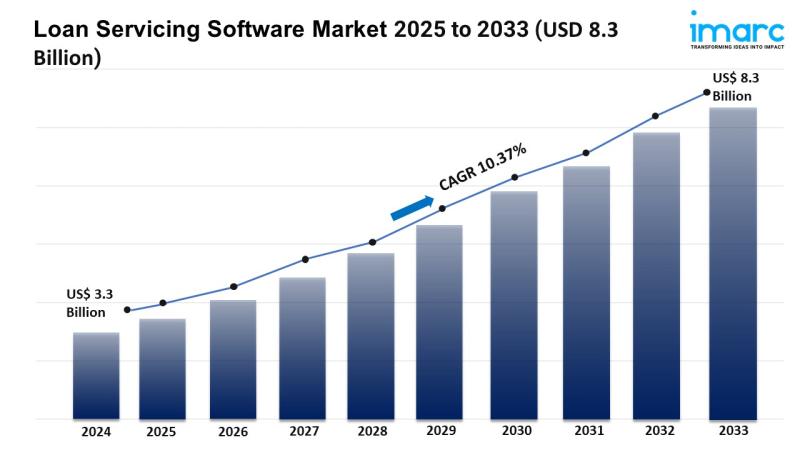

Loan Servicing Software Market to Hit USD 8.3 Billion at 10.37% CAGR by 2033

Market Overview:The loan servicing software market is experiencing rapid growth, driven by increasing demand for automation in loan processing, expansion of digital lending platforms, and regulatory compliance and risk management needs. According to IMARC Group's latest research publication, "Loan Servicing Software Market by Component (Software, Services), Deployment Mode (On-premises, Cloud-based), Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), End User (Banks, Credit Unions, Mortgage Lenders and Brokers, and Others), and Region 2025-2033", The global loan servicing software market size reached USD 3.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.3 Billion by 2033, exhibiting a growth rate (CAGR) of 10.37% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/loan-servicing-software-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends and Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the Loan Servicing Software Market

● Increasing Demand for Automation in Loan Processing

The loan servicing software will experience remarkable growth, attributed to the large demand for automation of loan processing. Financial institutions are focused on making operations more efficient to reduce manual errors, lower processing time, and reduce costs. Loan servicing software automates transactional tasks that are repetitive in nature, such as payment processing. With automations in place, lenders are able to manage larger loan portfolios with fewer human resources, and have a greater ability to perform additional transactional duties. Companies such as Black Knight have developed software platforms such as MSP that have the ability to automate the entire end-to-end loan servicing process, resulting in reduced operational costs, while providing a reduced risk of human error in the loan servicing process. The demand for automation will continue to rise as more institutions look to invest in improving customer satisfaction, and one way to achieve this is automating an institution's capabilities to conduct reliable, efficient, and cost-effective services in the loan servicing process.

● Expansion of Digital Lending Platforms

The increasingly prevalence of digital lending platforms is a major factor currently driving the loan servicing software market. Digital lending platforms like Upstart are integrated with loan servicing software that allows functions to loan borrowers from application to repayment. Borrowers are defining their experiences with lenders. They want to apply for their loans and manage those loans online, with integrated real-time updates, self-serve portals for borrowers, and mobile access. In fact, most of the rapid growth is coming from fintech companies and nontraditional lenders who are trying to distinguish themselves from traditional lenders by providing a user-friendly experience that is driven by technology, which is contributing to the need for robust loan servicing software.

● Regulatory Compliance and Risk Management Needs

Strict regulatory mandates and the need for a sound risk management strategy are driving the growth of loan servicing software. Financial institutions are faced with a multitude of regulatory requirements, such as Dodd-Frank regulations and GDPR, all of which may call for accurate reporting as well as data security. Loan servicing software provides tracking tools on compliance, audit trails, and tools for assessing risk, which assists lenders with compliance and helps to avoid penalties. By utilizing a case study on Fiserv's LoanServ platform, we can further understand how loan servicing solutions provide lenders with compliance tools that automate compliance functions and generate real-time compliance reports to prove compliance with regulations. This case also underscores the need for software as regulations continue to change and compliance changes with the regulations. Therefore, compliance is a key area of growth in the loan servicing market for financial institutions.

Key Trends in the Loan Servicing Software Market

● Adoption of Cloud-Based Solutions

The trend of cloud-based loan servicing software is becoming increasingly prevalent, and for good reason: it's cost effective, scalable and accessible. Unlike an on-premises system, lenders can access their data, in real-time, on a cloud solution while also incorporating other platforms, reducing costs and expanding lender capabilities beyond the confines of their infrastructure, as long as connectivity and the amount of data within an acceptable size constraint are sufficient. For example, Ellie Mae's Encompass allowed lenders to deliver loan servicing capabilities across their entire footprint, regardless of location, at cloud speed. Although not every lender is able to take advantage of the growing cloud capabilities, many small to medium lenders are taking advantage of this as a viable, economical and flexible solution. In addition, as many concerns around cybersecurity are improved upon and cloud technology continues to evolve, institutions and lenders are on a path of embracing and transitioning to a cloud-based system which introduces added innovation and competition in the market for loan servicing software.

● Integration of Artificial Intelligence and Machine Learning

The use of artificial intelligence (AI) and machine learning (ML) is impacting the loan servicing software industry in powerful ways, building on existing technologies to insert predictive analytics and individual customer experiences. AI offers tools that are capable of analyzing hundreds of variables and borrower data, which is then used to predict payment behaviors, conditions that may lead to default, and offer various repayment options for borrowers. One example of leveraging AI to enhance loan servicing is nCino's Bank Operating System, which provides AI-based capabilities for risk analytics, supports decision-making, and can automate assessments. The inclusion of AI and ML will also allow lenders to offer more efficient customer support and communication via chatbots or automated systems and messaging, thus lowering operational costs. As AI and ML will be, systems, capabilities, and features will come to define the future of loan servicing software, and therefore having AI-based systems will offer lenders a competitive advantage in a congested industry.

● Focus on Customer-Centric Features

The loan servicing software market is perceived to be moving away from traditional methods and towards customer-friendly features, motivated by a desire to increase satisfaction for borrowers and in turn, borrower retention. Modern software tends to have self-service portals, mobile apps and customer-friendly communication methods so the borrower can manage their loans efficiently and easily. For example, Blend's borrower portal is a place for users to follow payments, access documents and communicate with lenders, all from one platform. This change is part of the greater financial market's aim to enhance the customer experience in order to promote loyalty. Moving forward, loan servicing software providers are making a conscious effort to put borrowers at the forefront. They have noticed that user-friendly interfaces, accessible in real-time, are addressing borrower expectations, making customer-centricity a key trend in the loan servicing software market moving forward.

Buy Full Report: https://www.imarcgroup.com/checkout?id=6773&method=1670

Leading Companies Operating in the Loan Servicing Software Industry:

● Altisource

● Applied Business Software

● Bryt Software LCC

● C-Loans Inc.

● Emphasys Software (Constellation Software)

● Financial Industry Computer Systems Inc.

● Fiserv Inc.

● GOLDPoint Systems Inc.

● Graveco Software Inc.

● LoanPro

● Nortridge Software LLC

● Q2 Software Inc. (Q2 Holdings Inc.)

● Shaw Systems Associates LLC.

Loan Servicing Software Market Report Segmentation:

By Component :

● Software

● Services

The loan servicing software market is primarily composed of software and services, with software being the largest segment.

By Deployment Mode:

● On-premises

● Cloud-based

The market analysis reveals that cloud-based deployment holds the largest market share compared to on-premises solutions.

By Enterprise Size:

● Large Enterprises

● Small and Medium-sized Enterprises

Large enterprises dominate the loan servicing software market, as highlighted in the analysis of enterprise size.

By End User:

● Banks

● Credit Unions

● Mortgage Lenders and Brokers

● Others

Banks represent the largest segment among end users in the loan servicing software market, followed by credit unions and mortgage lenders.

Regional Insights:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America, driven by growth in the BFSI sector and technology integration, is the largest market for loan servicing software, encompassing the United States and Canada, along with other global regions.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=6773&flag=C

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Loan Servicing Software Market to Hit USD 8.3 Billion at 10.37% CAGR by 2033 here

News-ID: 4071631 • Views: …

More Releases from IMARC Group

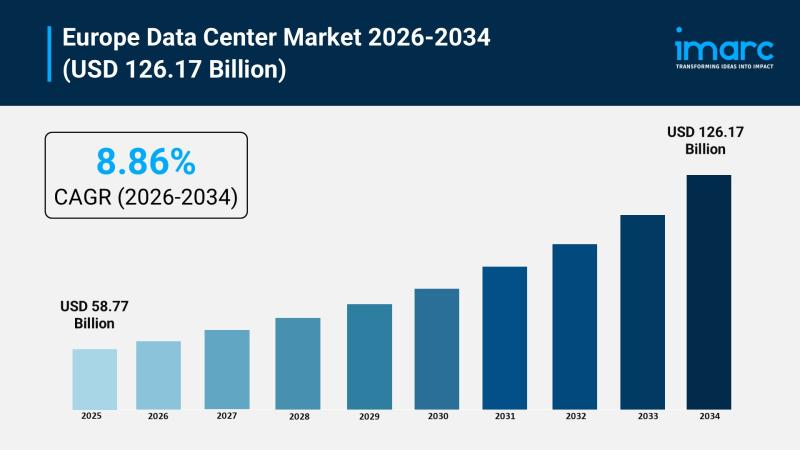

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

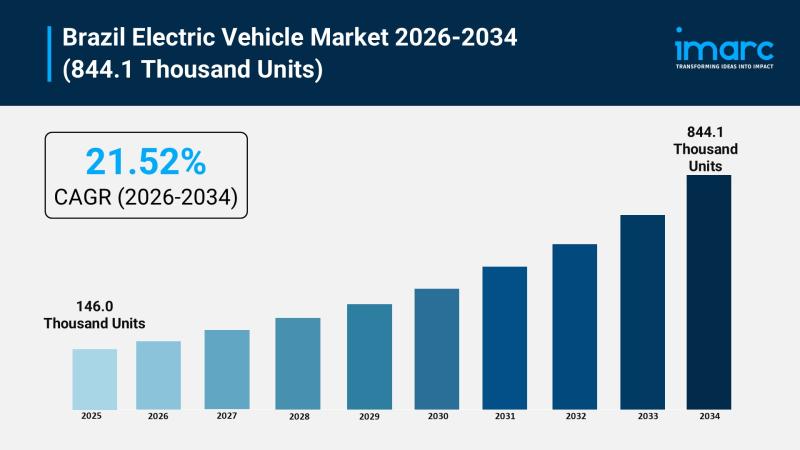

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Software

Takeoff Software Market May See a Big Move | Sage Software, Bluebeam Software, Q …

Latest Study on Industrial Growth of Takeoff Software Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Takeoff Software market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments…

Robot Software Market Analysis by Software Types: Recognition Software, Simulati …

The Insight Partners provides you global research analysis on “Robot Software Market” and forecast to 2028. The research report provides deep insights into the global market revenue, parent market trends, macro-economic indicators, and governing factors, along with market attractiveness per market segment. The report provides an overview of the growth rate of the Robot Software market during the forecast period, i.e., 2021–2028.

Download Sample Pages of this research study at: https://www.theinsightpartners.com/sample/TIPRE00007689/?utm_source=OpenPR&utm_medium=10452…

HR Software Market Analysis by Top Key Players Zenefits Software, Kronos Softwar …

HR software automates how companies conduct business with relation to employee management, training and e-learning, performance management, and recruiting and on-boarding. HR professionals benefit from HR software systems by providing a more structured and process oriented approach to completing administrative tasks in a repeatable and scalable manner. Every employee that is added to an organization requires management of information, analysis of data, and ongoing updates as progression throughout the company…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market Analysis by Top Key Players – Zenefits Software, Kronos Sof …

HR software helps HR personnel automate many necessary tasks, such as maintaining employee records, time tracking, and benefits, which allows HR professionals to focus on recruiting efforts, employee performance and engagement, corporate wellness, company culture, and so on. These human management tools can be purchased and implemented as on premise or cloud-based software.

This market studies report on the Global HR Software Market is an all-inclusive study of the enterprise sectors…