Press release

Personal Gadget Insurance Market to Reach US$ 79.2 Bn by 2034, Fueled by Digital Transformation and Rising Consumer Tech Adoption - Analysis by TMR

The global Personal Gadget Insurance Market is witnessing a significant transformation driven by digital innovation and the growing reliance on high-value personal electronics. Valued at US$ 25.4 billion in 2023, the industry is forecast to grow at a robust CAGR of 10.9% from 2024 to 2034, ultimately reaching a market size of US$ 79.2 billion by 2034. With increasing consumer demand for comprehensive and seamless protection plans, key industry players are leveraging digital platforms to offer fast, paperless, and secure insurance solutions tailored to modern lifestyles.Access key findings and insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86081

Market Overview

As the global consumer electronics ecosystem expands, so does the dependency on personal gadgets such as smartphones, tablets, laptops, smartwatches, and wireless earbuds. These devices are no longer luxury items but essential tools for daily communication, work, entertainment, and even healthcare. As a result, the personal gadget insurance market has evolved from a niche service to a critical value proposition. Consumers are actively seeking reliable protection plans to safeguard their expensive gadgets from theft, accidental damage, breakdowns, and even cyber threats. Digital transformation across the insurance sector is further accelerating market maturity, enabling insurers to provide real-time claims processing, seamless policy management, and personalized coverage options.

Market Size and Growth

With the market valued at US$ 25.4 billion in 2023, the industry has already shown strong momentum due to the proliferation of personal devices and rising repair and replacement costs. The projected compound annual growth rate (CAGR) of 10.9% from 2024 through 2034 signifies not only increased consumer awareness but also insurer innovation. The anticipated market size of US$ 79.2 billion by 2034 reflects a potent mix of high device penetration, integration of insurtech solutions, and evolving consumer expectations for real-time service delivery. This exponential growth suggests that personal gadget insurance is set to become a mainstream element of the consumer electronics value chain.

Market Segmentation

The personal gadget insurance market is segmented by device type, coverage type, distribution channel, and end user.

By Device Type, smartphones dominate the market, accounting for the largest share, followed by laptops, tablets, and wearable devices. The increasing cost of flagship smartphones and fragility of foldable phones have driven demand for tailored protection.

By Coverage Type, accidental damage protection leads the segment, with growing interest in theft, extended warranty, and cybersecurity insurance.

By Distribution Channel, digital platforms including mobile apps and e-commerce sites are outperforming traditional brokers and agents, as consumers increasingly demand quick and convenient access to insurance.

By End User, individual consumers represent the core segment, though small businesses are emerging as new customers, particularly for fleet coverage of work-related gadgets.

Regional Analysis

Geographically, North America holds the largest market share, driven by high device ownership rates and early adoption of insurtech platforms. Europe follows closely, supported by a well-established regulatory framework and consumer rights laws that favor comprehensive insurance policies.

Asia Pacific is the fastest-growing region, particularly due to rapid smartphone penetration, rising disposable incomes, and initiatives from OEMs and telcos offering bundled insurance. Countries like India and China are hotspots for market expansion. Latin America and the Middle East & Africa are gradually entering the fray, with insurance providers tapping into urban youth demographics and digitally-savvy consumers in tier-1 and tier-2 cities.

Explore our report to uncover in-depth insights - https://www.transparencymarketresearch.com/personal-gadget-insurance-market.html

Market Drivers and Challenges

Market Drivers include the rising cost and complexity of personal devices, increasing consumer dependence on gadgets, and the digitalization of insurance services. The integration of artificial intelligence (AI) and machine learning (ML) in claims assessment, chatbot assistance, and policy personalization is a game-changer.

Market Trends

Key market trends include the rise of embedded insurance models, where gadget protection is integrated at the point of sale or via manufacturer partnerships. For instance, Samsung now offers complete protection for accidental breakage and breakdown for up to two years under its device care plans.

Additionally, subscription-based insurance models are gaining traction, allowing users to pay monthly or annually for comprehensive, cancel-anytime coverage. Another emerging trend is eco-friendly insurance, where providers offer repair-first solutions to minimize e-waste. There is also a growing emphasis on cyber protection add-ons, particularly for smartwatches and connected health devices.

Competitive Landscape

The personal gadget insurance market is characterized by a mix of traditional insurers, tech-driven insurtech firms, and OEM-affiliated providers. Major players include Progressive Casualty Insurance Company, Bolttech, Asurion, Bajaj Allianz General Insurance, OneAssist Consumer Solutions, AT&T Inc., SquareTrade Inc., and Worth Ave. Group.

These companies are differentiating themselves through customer-centric models, offering instant policy issuance, online claims processing, and value-added services like device pick-up and drop-off for repairs. Strategic partnerships with device manufacturers and mobile carriers are also central to their growth strategies.

Future Outlook

Looking ahead, the market is poised for sustained double-digit growth as the convergence of insurtech and personal electronics accelerates. Innovations in blockchain for claims transparency, AI for fraud detection, and IoT for proactive damage alerts will further enhance the insurance experience. Emerging device categories-such as AR/VR headsets, drone cameras, and smart glasses-will unlock new avenues for protection services.

By 2034, the personal gadget insurance sector will likely be a core component of consumer digital ecosystems, seamlessly integrated into device purchase flows and digital wallets. A focus on affordability, transparency, and accessibility will remain critical for unlocking the next phase of global market adoption.

Want to know more? Get in touch now. - https://www.transparencymarketresearch.com/contact-us.html

More Trending Reports by Transparency Market Research -

Modular Furniture Market - https://www.transparencymarketresearch.com/modular-furniture-market.html

Smart Faucets Market - https://www.transparencymarketresearch.com/smart-faucets-market.html

Waterproof Makeup Market - https://www.transparencymarketresearch.com/waterproof-makeup-market.html

Ceramic Tableware Market - https://www.transparencymarketresearch.com/ceramic-tableware-market.html

Corporate Travel Security Market - https://www.transparencymarketresearch.com/corporate-travel-security-market.html

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Personal Gadget Insurance Market to Reach US$ 79.2 Bn by 2034, Fueled by Digital Transformation and Rising Consumer Tech Adoption - Analysis by TMR here

News-ID: 4071490 • Views: …

More Releases from Transparency Market Research

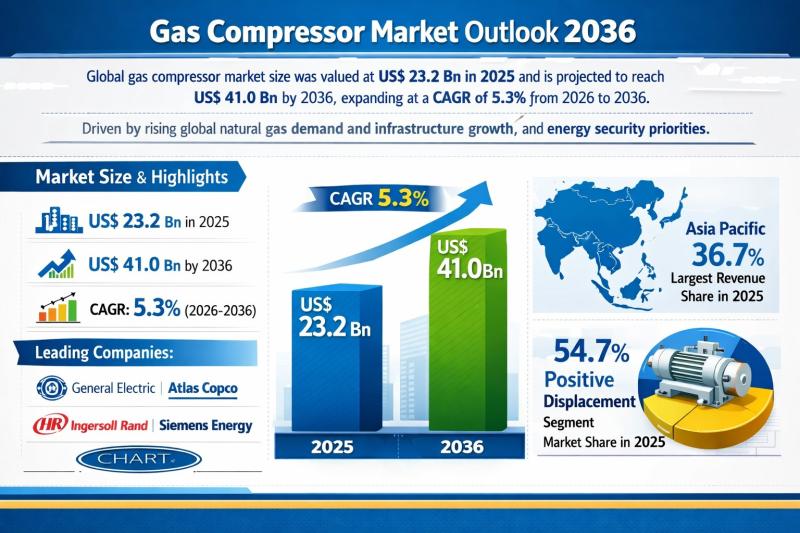

Gas Compressor Market Outlook 2036: Global Industry Expected to Reach US$ 41.0 B …

The global gas compressor market was valued at US$ 23.2 Bn in 2025 and is projected to reach US$ 41.0 Bn by 2036, expanding at a compound annual growth rate (CAGR) of 5.3% from 2026 to 2036. This steady growth trajectory reflects the structural importance of gas compression systems across upstream, midstream, and downstream gas value chains. Rising natural gas consumption, expansion of pipeline and LNG infrastructure, and national energy…

Anesthesia Drugs Market to be Worth USD 12.6 Bn by 2036 - By Drug / By Applicati …

The global anesthesia drugs market was valued at US$ 7.6 billion in 2025 and is projected to reach US$ 12.6 billion by 2036, expanding at a compound annual growth rate (CAGR) of 4.7% from 2026 to 2036. This steady growth trajectory reflects the essential and non-substitutable role of anesthesia drugs in modern healthcare systems. As surgical interventions continue to rise globally-across both elective and emergency procedures-the demand for safe, effective,…

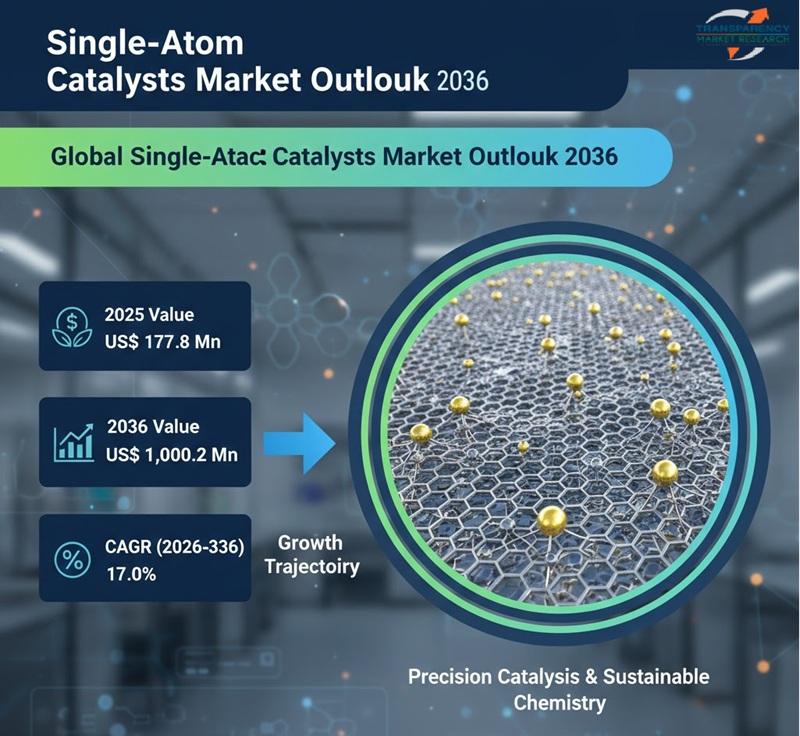

Single-Atom Catalysts Market Size is Expected to Expand from US$ 177.8 Million t …

The global single-atom catalysts (SACs) market is poised for remarkable growth as industries seek highly efficient, cost-effective, and sustainable catalytic solutions. Valued at US$ 177.8 million in 2025, the market is projected to reach US$ 1,000.2 million by 2036, expanding at a robust compound annual growth rate (CAGR) of 17.0% from 2026 to 2036. This rapid expansion reflects the growing importance of advanced catalysis in energy, chemicals, environmental protection, and…

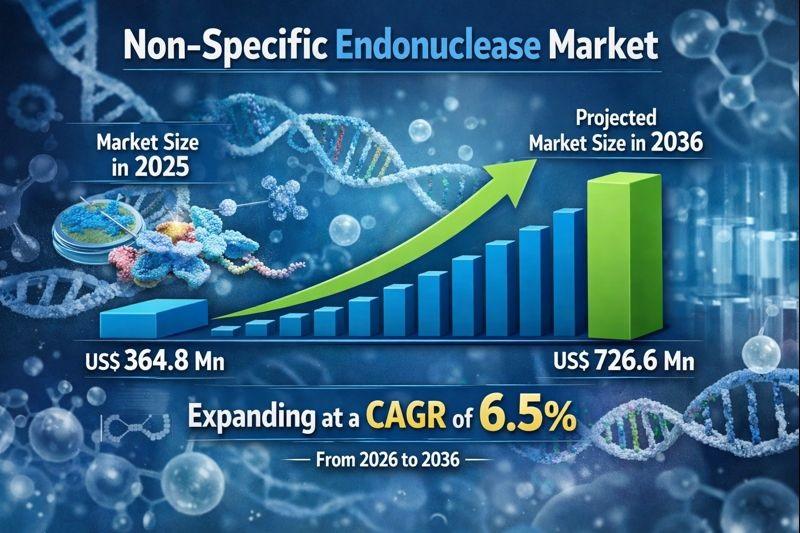

Non-specific Endonuclease Market to Reach USD 726.6 Million by 2036, Supported b …

The non-specific endonuclease market is witnessing steady growth, driven by the expanding use of molecular biology tools across biotechnology, pharmaceuticals, diagnostics, and academic research. Non-specific endonucleases are enzymes that cleave nucleic acids without requiring a specific recognition sequence, making them highly valuable for applications such as DNA/RNA degradation, sample preparation, viscosity reduction, and contamination control. Their broad activity profile differentiates them from restriction enzymes and enables versatile usage across multiple…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…