Press release

Global Payment Gateway Market Size Expected to Reach $56.92 Billion by 2030, Fueled by 12.09% CAGR: Markntel Advisors (PayPal, Stripe, Adyen, Amazon Pay)

Global Payment Gateway Market OverviewThe Global Payment Gateway Market is undergoing significant transformation, poised to reach approximately USD 56.92 billion by 2030 from USD 28.7 billion in 2024, growing at a robust CAGR of 12.09% during the forecast period. This unprecedented growth is primarily driven by the increasing demand for secure online transactions in the booming e-commerce industry and the proliferation of digital payment solutions across various sectors.

Payment Gateway Market Size, Revenue, and Key Statistics:

✔️ Market Value in 2024: USD 28.7 Billion

✔️ Market Value by 2030: USD 56.92 Billion

✔️ CAGR (2025-30): 12.09%

✔️ Leading Region: Asia-Pacific

@Get No Cost Report free Sample PDF Copy - https://www.marknteladvisors.com/query/request-sample/global-payment-gateway-market.html

- Market Trend: Embracing Digital Transformation in Payment Solutions

The rapid digitalization of business operations is reshaping the payment gateway market and driving new trends in online commerce. With the advent of advanced digital marketing strategies, businesses are increasingly focusing on maintaining a robust online presence, resulting in a remarkable surge in online transactions. This trend reflects a fundamental shift in consumer behavior, as more individuals opt for e-commerce over traditional shopping methods.

Technological advancements have enabled companies to introduce innovative digital services, effectively broadening the range of online payment solutions available to consumers. The growing acceptance of various payment methods-such as credit and debit cards, digital wallets, and net banking-enhances the overall shopping experience and encourages higher transaction volumes. As consumers demand more flexible payment solutions, businesses are adapting their payment gateways to meet these expectations.

Furthermore, consumers are increasingly relying on online platforms for services such as ticket booking and e-commerce transactions, moving away from conventional methods. In response to this shift, banks are forging partnerships with various enterprises to deliver attractive customer offers, aiming to enhance user engagement and drive loyalty. Collectively, these trends indicate that the global payment gateway industry is well-positioned for significant expansion in the coming years, driven by the ongoing digital transformation and the increasing importance of convenient payment solutions in today's market.

- Opportunity Ahead: Intensifying Financial Inclusion Worldwide

A considerable rural and pastoral population is yet to benefit from online transactions or even traditional banking. Citing this, developmental sectors and the government has recognized the need to provide financial services to the people living in rural and remote locations. Since the lack of digital literacy is a barrier to providing connectivity and promoting financial inclusion, various governments are aiding in digitalizing and bringing resources and services to the rural sector. Here, digital payments are essential as people can open a bank account and transact through their smartphones. The introduction of digital wallets also allures people to turn towards digital banking. This increasing adoption of banking accounts and digital wallets provides a growth opportunity for the industry.

- Upcoming Challenge: Lack of Standardized regulations for International Transactions

Businesses continuously purchase goods and services from around the world and across countries. However, due to the lack of standardized global regulations and varying government restrictions, digital payment and transaction providers fail to make the most out of the such opportunity. Payment and data storage requirements varying from country to country are becoming obstacles to efficient cross-border payments. Moreover, the local payment infrastructure of many countries needs to be at par to handle international transactions. Given the independent development of payment systems, the need for standardized regulation and automation across inter-bank and intra-bank networks is rising to prevent cyber-attacks, thereby impeding industry growth.

@View Full Research Report - https://www.marknteladvisors.com/research-library/global-payment-gateway-market.html

Key Player: Top Payment Gateway Companies Worldwide

• PayPal Holdings

• Stripe, Inc.

• Adyen NV., Inc

• Amazon Pay

• Square, Inc

• Skrill limited

• PayU group

• Ingenico Group

• Alipaycom Co Ltd

• Paytm Mobile Solutions Pvt. Ltd

• Others

Payment Gateway market Segmentation

• By Type (Hosted, Self-hosted & Bank Integrated)

• By Enterprise Size (SME and Large Enterprise)

• By End-User (Retail, Travel & Hospitality, Healthcare, Education, Government, Utilities & Others)

- The report indicates that Hosted Type Acquired a Larger Payment Gateway Market Share due to its ease of use, enhanced security, and compliance with PCI DSS. By minimizing merchant liability and reducing fraud, it offers a reliable solution for online billing and payments, ensuring continued growth in the coming years.

Regional Insights

• North America

• South America

• Europe

• Middle East and Africa

• Asia-Pacific

- The report indicates that Asia-Pacific is poised to emerge as the fastest-growing region in the Payment Gateway Market, driven by significant government initiatives towards digital banking and financial inclusion. Countries like China and India are leading the charge in digital payment adoption, while markets in the Middle East and Africa are following suit with a rising demand for efficient mobile payment solutions.

Industry Recent Development:

✔️ 2024: Adyen and Billie partner up to bring Buy Now, Pay Later to business across Europe. This includes managing cash flow for buyers and sellers, eliminating payment defaults and fraud risks, and simplifying dunning and collection processes. Billie's BNPL solution therefore offers a cost-efficient alternative to corporate credit cards.

Payment Gateway Market Report: List of Tables

• Table 1: Global Payment Gateway Market Outlook (2020-2030F)

• Table 2: Market Segmentation by Type

• Table 3: Market Segmentation by Enterprise Size

• Table 4: Market Segmentation by End-Users

• Table 5: Revenue Shares by Company

• Table 6: North America Payment Gateway Market Outlook (2020-2028)

• Table 7: US Payment Gateway Market Outlook (2020-2030F)

• Table 8: Brazil Payment Gateway Market Outlook (2020-2030F)

• Table 9: Payment Gateway Market Outlook by Country in Europe

• Table 10: Asia-Pacific Payment Gateway Market Outlook (2020-2030)

• Table 11: Middle East Payment Gateway Market Outlook (2020-2030)

• Table 12: Africa Payment Gateway Market Outlook (2020-2030)

• Table 13: Global Payment Gateway Market Trends & Insights

• Table 14: Competition Matrix

Looking for Regional or country-specific reports on this Market? Visit our website - https://www.marknteladvisors.com/query/request-customization/global-payment-gateway-market.html

Payment Gateway Market Report: List of Figures

• Figure 1: Global Payment Gateway Market Dynamics

• Figure 2: Growth Drivers of the Payment Gateway Market

• Figure 3: Market Challenges and Impact Analysis

• Figure 4: Payment Gateway Market Hotspot and Opportunities

• Figure 5: Key Strategic Imperatives for Success and Growth

• Figure 6: Product Portfolio Overview

• Figure 7: Brand Specialization in the Payment Gateway Market

• Figure 8: Target Markets for Payment Gateway Providers

• Figure 9: Target End Users Overview

• Figure 10: Strategic Alliances in the Payment Gateway Industry

Similar Report Topic -

✔️ Global Open Banking Market - https://www.prnewswire.com/news-releases/global-open-banking-market-size-to-reach-usd-136-13-billion-by-2030--growing-at-a-27-60-cagr-markntel-advisors-capgemini-oracle-global-payments-tata-consultancy-finastra--others-302479936.html

✔️ Europe Cards and Payments Market - https://www.marknteladvisors.com/research-library/europe-cards-payments-market.html

Contact:

MarkNtel Advisors

Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

Contact No: +91 8719999009

Email: sales@marknteladvisors.com

About Us -

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Payment Gateway Market Size Expected to Reach $56.92 Billion by 2030, Fueled by 12.09% CAGR: Markntel Advisors (PayPal, Stripe, Adyen, Amazon Pay) here

News-ID: 4071400 • Views: …

More Releases from MarkNtel Advisors LLP

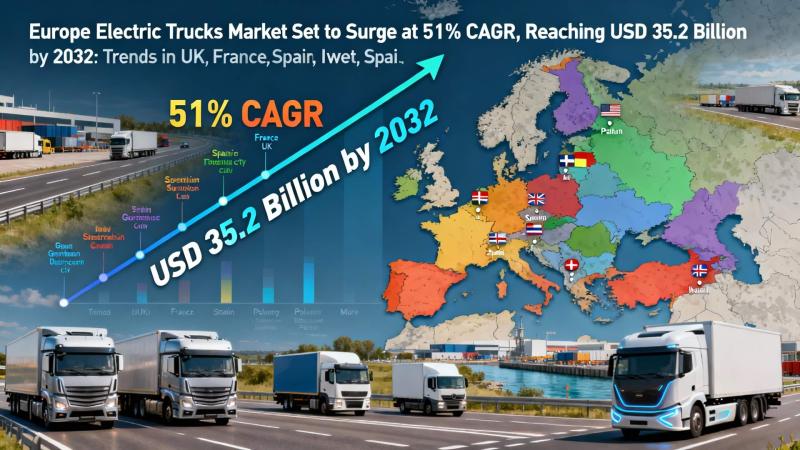

Europe Electric Trucks Market Set to Surge at 51% CAGR, Reaching USD 35.2 Billio …

Latest Research Report of European Electric Trucks Market Size and CAGR

According to MarkNtel Advisors latest market research report data, the Europe Electric Trucks Market is projected to grow from USD 1.96 billion in 2025 to USD 35.2 billion by 2032, registering a remarkable CAGR of 51.07%. Growth is primarily driven by stringent EU emission standards, expansion of high-capacity charging networks, and fleet electrification by major OEMs like Volvo Trucks and…

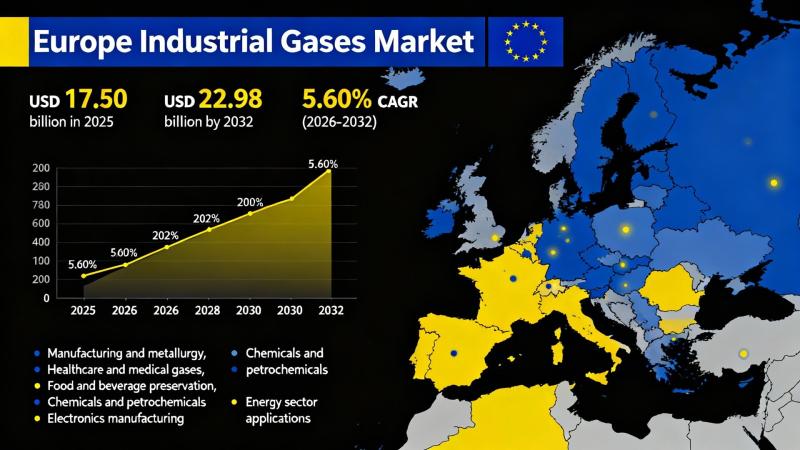

Europe Industrial Gases Market Expected to Reach Nearly $22.98 Billion by 2032: …

Europe Industrial Gases Market: Trends, Insights, and Future Outlook

The Europe Industrial Gases Market is seeing robust growth, driven by increasing demand across key sectors such as petrochemicals, healthcare, and steelmaking. Innovations in hydrogen production and carbon capture technologies are prominent factors influencing market dynamics. A shift towards renewable and low-carbon sources presents significant opportunities amid growing environmental regulations. Additionally, the rise in energy costs is reshaping the landscape for industrial…

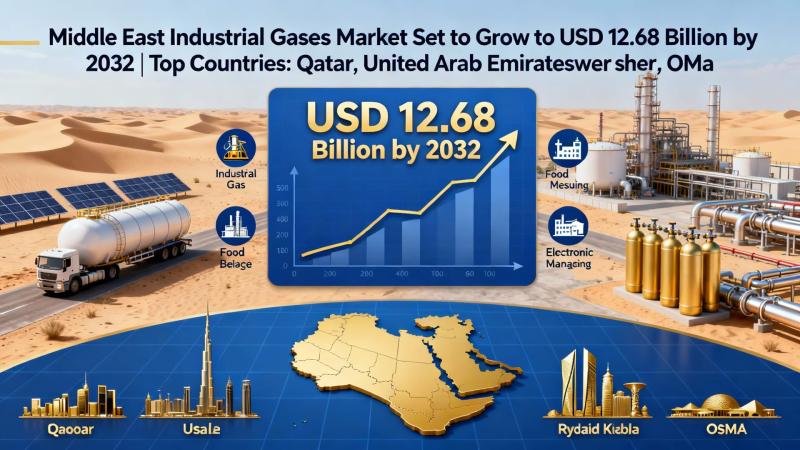

Middle East Industrial Gases Market Set to Grow to USD 12.68 Billion by 2032 | T …

The Middle East Industrial Gases Market is forecasted to expand from USD 10.06 billion in 2025 to USD 12.68 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.72% during the period of 2026 to 2032. The primary drivers fueling this growth are the increasing demand for hydrogen and the robust expansion of the petrochemical industry, which necessitates high-purity gases for various applications such as chemical synthesis and…

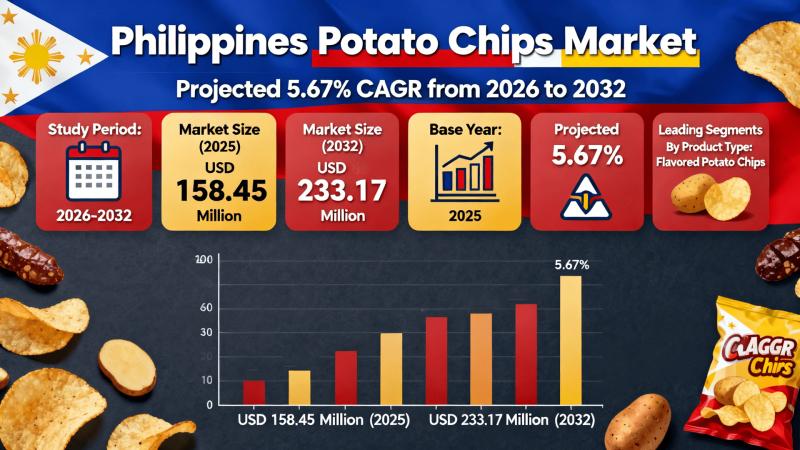

Potato Chips Market in Philippines Set to Grow to USD 233.17 Million by 2032 as …

The Philippines Potato Chips Market is entering a significant growth phase, projected to expand from USD 158.45 million in 2025 to USD 233.17 million by 2032, with a robust compound annual growth rate (CAGR) of 5.67%. Key growth drivers include government initiatives aimed at bolstering local potato production and the rising popularity of flavored varieties among consumers.

Philippines Potato Chips Market Growth Outlook:

As snack food preferences evolve, the Philippines Potato Chips…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…