Press release

Micro-Investing Platforms Market to Hit USD 36.1 Billion by 2030 | Persistence Market Research

Micro-Investing Platforms Market: Growth, Trends, and Future OutlookThe global micro-investing platforms market is witnessing rapid growth, driven by the rising interest in personal finance and the democratization of investment opportunities. With an estimated market value of US$19 billion in 2023, this market is projected to reach US$36.1 billion by 2030, growing at a compound annual growth rate (CAGR) of 9.6%. As investing becomes more accessible to the general public, the demand for low-cost, user-friendly platforms has soared. This article explores the various factors driving this growth, market segmentation, and the regional trends shaping the micro-investing landscape.

Overview of the Micro-Investing Platforms Market

Micro-investing platforms provide individuals with an easy and low-barrier entry into the world of investing. These platforms typically allow users to invest small amounts of money, starting with as little as a few dollars, into diversified portfolios. Leveraging technological advancements such as automated algorithms, fractional shares, and mobile applications, these platforms have made it easier for users, particularly younger generations, to begin their investing journey. The market for these platforms is projected to experience robust growth, driven by the increasing interest in personal finance, the rise of the digital economy, and advancements in financial technology.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/33656

Market Statistics & Key Growth Drivers

The micro-investing platforms market is expected to grow at a significant pace, expanding from US$19 billion in 2023 to US$36.1 billion by 2030, with a CAGR of 9.6%. Key growth drivers include increased awareness about personal finance management, the growing popularity of passive investing strategies, and the ease of using mobile-based platforms. Furthermore, a shift in consumer behavior toward self-directed investment choices, facilitated by technological advancements, is contributing to the expansion of the market. Younger generations, including Millennials and Gen Z, are increasingly becoming active investors, which is helping to drive market growth.

Leading Segment and Geographical Region

The leading segment in the micro-investing platforms market is currently driven by mobile-based investing applications, as they offer convenience and accessibility to users. Geographically, North America, particularly the United States, holds the largest market share due to the high adoption of mobile technology and strong consumer demand for personalized financial services. The U.S. is home to some of the largest and most influential micro-investing platforms, which have contributed to the country's dominance in the market.

Key Highlights from the Report

• The global micro-investing platforms market is projected to grow at a CAGR of 9.6% from 2023 to 2030.

• The market size is expected to increase from US$19 billion in 2023 to US$36.1 billion by 2030.

• Mobile-based investing applications lead the market segment, offering ease of access and user-friendly interfaces.

• Young investors, particularly Millennials and Gen Z, are driving the market's growth.

• North America holds the largest market share, with the U.S. being a key player.

• The market is witnessing continuous innovation and the emergence of new features and partnerships to meet evolving user needs.

Market Segmentation

Product Type Segmentation

The micro-investing platforms market can be segmented based on product type into two key categories: mobile applications and online platforms. Mobile applications dominate the market, thanks to their accessibility, ease of use, and the increasing trend of smartphone usage across various demographics. These mobile-based platforms are optimized for on-the-go investing, enabling users to monitor and manage their investments at their convenience. On the other hand, online platforms also contribute significantly to market growth, particularly in markets where desktop-based trading is still prevalent.

End-User Segmentation

Micro-investing platforms cater to a broad range of end-users, including individual investors, financial institutions, and wealth management firms. The primary end-users are individual investors, particularly younger demographics looking for low-cost and flexible investing options. Financial institutions are also increasingly leveraging micro-investing platforms to offer investment services to a broader audience, capitalizing on the growing demand for financial inclusivity. Wealth management firms are utilizing these platforms to integrate automated investment solutions into their portfolios, thus reaching smaller investors.

Regional Insights

North America

North America remains the dominant region in the micro-investing platforms market. The United States, in particular, leads the market due to high mobile penetration rates, a favorable regulatory environment, and a strong culture of personal finance management. Additionally, many prominent micro-investing platforms, such as Acorns, Robinhood, and Stash, are based in the U.S. These platforms have significantly contributed to the growth of the market by offering easy-to-use solutions for small investors. The increasing adoption of financial technology (FinTech) is expected to further enhance the region's market position.

Europe & Asia-Pacific

Europe and Asia-Pacific are expected to show strong growth in the micro-investing platforms market. In Europe, the rise in personal finance awareness, particularly in countries like the UK and Germany, has driven the adoption of micro-investing platforms. Meanwhile, in Asia-Pacific, countries like India and China are witnessing a growing interest in financial inclusion, which is expected to boost the market. The adoption of mobile applications and growing smartphone usage in these regions are significant factors contributing to the expected surge in market growth.

Market Drivers

The market for micro-investing platforms is being driven by several key factors:

1. Increased Financial Awareness: Younger generations are increasingly aware of the importance of personal finance management, which has fueled the demand for micro-investing platforms. This awareness is supported by educational initiatives and social media discussions about the importance of saving and investing.

2. Technological Advancements: Innovations in financial technology, such as fractional shares, robo-advisors, and automated investment strategies, have made investing more accessible and efficient for novice investors. The use of artificial intelligence (AI) to create personalized portfolios is also gaining popularity.

3. Demand for Low-Cost Investment Options: Traditional investment platforms often require large initial investments and high management fees. Micro-investing platforms, with their low-cost entry points and low or no fees, offer a compelling alternative, particularly for individuals with limited capital.

Market Restraints

Despite its promising growth, the micro-investing platforms market faces several challenges:

1. Regulatory Hurdles: The regulatory environment surrounding micro-investing platforms is still evolving. In some regions, stricter financial regulations could restrict platform offerings, limit user participation, or increase operational costs.

2. Market Volatility: Given that micro-investing platforms often cater to novice investors, their exposure to volatile markets could result in poor investment returns, discouraging long-term engagement from users.

3. Data Privacy Concerns: The collection and storage of personal and financial data by micro-investing platforms pose security and privacy risks. Regulatory bodies are increasingly focusing on data protection, and any failure to comply with data protection laws could lead to reputational damage and legal ramifications.

Market Opportunities

The micro-investing platforms market offers several growth opportunities:

1. Expanding into Emerging Markets: Many emerging markets have a young population that is increasingly interested in investing. As smartphone penetration rises in countries like India, Brazil, and Southeast Asia, these markets present untapped opportunities for micro-investing platforms.

2. Partnerships with Financial Institutions: Collaborations between micro-investing platforms and established financial institutions can help enhance credibility and increase customer trust, leading to market expansion.

3. Integration of ESG Investments: With growing interest in Environmental, Social, and Governance (ESG) investing, micro-investing platforms have an opportunity to integrate ESG factors into their portfolios, attracting socially conscious investors.

Reasons to Buy the Report

✔ Gain in-depth insights into the key trends and growth drivers of the micro-investing platforms market.

✔ Understand the regional dynamics and competitive landscape of the market.

✔ Identify the opportunities for market expansion, particularly in emerging markets.

✔ Stay updated on the latest technological advancements in the micro-investing space.

✔ Learn about the regulatory landscape and potential challenges affecting the market.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/33656

Frequently Asked Questions (FAQs)

How Big is the Micro-Investing Platforms Market?

Who are the Key Players in the Global Market for Micro-Investing Platforms?

What is the Projected Growth Rate of the Micro-Investing Platforms Market?

What is the Market Forecast for the Micro-Investing Platforms Market in 2032?

Which Region is Estimated to Dominate the Micro-Investing Platforms Industry through the Forecast Period?

Company Insights

Key Players

• Acorns

• Robinhood

• Stash

• Betterment

• Wealthfront

• SoFi Invest

• Public

Recent Developments

1. Acorns announced a partnership with major banks to offer users more investment options, including retirement plans and college savings accounts.

2. Robinhood launched a new feature allowing users to automatically round up their purchases and invest the spare change in diversified portfolios.

In conclusion, the micro-investing platforms market is experiencing significant growth due to the increased financial awareness among younger generations, advancements in technology, and the demand for low-cost investment solutions. With expanding opportunities in emerging markets and technological innovations, the future of the micro-investing market looks promising.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Micro-Investing Platforms Market to Hit USD 36.1 Billion by 2030 | Persistence Market Research here

News-ID: 4071381 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

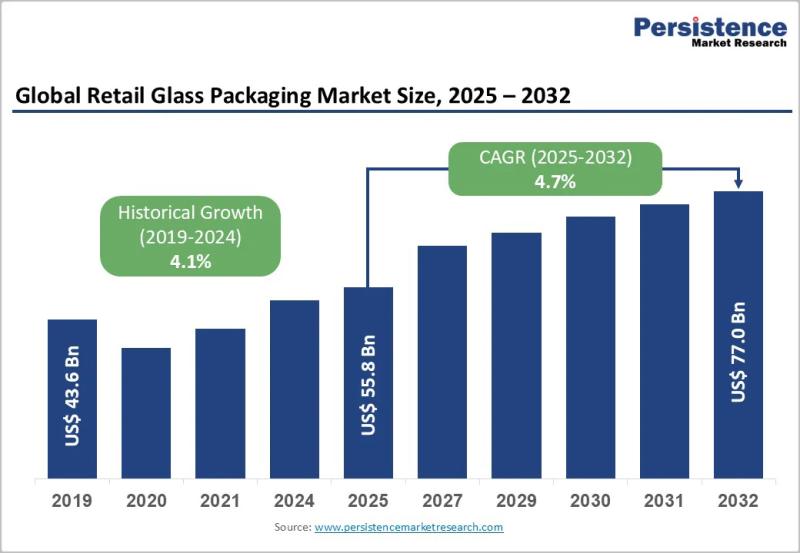

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for Invest

Robo-advisory Market Is Dazzling Worldwide with Major Giants TD Ameritrade, SoFi …

Latest Study on Industrial Growth of Robo-advisory Market 2024-2030. A detailed study accumulated to offer the Latest insights about acute features of the Robo-advisory market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments of…

How to invest in rental properties?

Investing in rental properties can be an excellent source of income. Do you know what to do to make this investment? Check out!

The real estate market is seen as an excellent opportunity for those who want to have a little more security in their financial life since it is an extremely safe and stable area over the years. However, do you know for sure what you need to invest in…

Robo-advisory Market to Witness Huge Growth by 2028 | Axos Invest, SoFi Invest, …

Global Robo-advisory Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Robo-advisory Market. Some of…

Warner Goodman invest in Linetime

Leading south coast law firm Warner Goodman LLP has signed up for the full Liberate software suite from Linetime. The fully integrated accounts, case and matter management system is to be rolled out to over 150 users across three branch offices in Southampton, Portsmouth and Fareham.

Andy Munden, partner at Warner Goodman said, “We are looking forward to working with Linetime to implement state of the art systems and processes that…

How would you Invest €100,000?

How would you Invest €100,000?

The big question is nowadays….what should I invest in and what will be safe enough to not lose money on? Imagine you have €100,000 to invest…. how should you invest it now? “Scan through your portfolio to see if there are any of your assets that you should now buy more of at lower prices or venture outside the box and look at the metal…

Diversified Portfolio Management Invest – Structured Finance

DPM Invest structured finance practice is interdisciplinary, drawing on the expertise of lawyers in the areas of banking, corporate finance and securities law, secured transactions, tax, bankruptcy and banking regulation. The partners who practice in this area have available to them partners specializing in tax, bankruptcy, bank regulatory and intellectual property practice areas to assist in the structuring and execution of complex structured transactions.

DPM Invest has been…