Press release

Blockchain in Energy Market Set to Hit USD 37.4 Billion by 2032 with 25.6% CAGR

Blockchain in the Energy Market: A Transformative Force in the IndustryThe blockchain technology, renowned for its role in cryptocurrencies like Bitcoin, is making its way into various industries, with the energy sector being one of the key areas where its impact is poised to be transformative. In essence, blockchain in energy refers to the application of decentralized, tamper-proof ledger systems to manage transactions, data, and assets within the energy industry. As the global energy market shifts towards greater decentralization, sustainability, and efficiency, blockchain technology is positioned to support these changes, providing solutions to long-standing challenges such as security, transparency, and operational inefficiencies.

With its potential to revolutionize the way energy is traded, managed, and consumed, blockchain technology is becoming an essential part of the energy market landscape. The technology is expected to play a significant role in various areas such as peer-to-peer (P2P) energy trading, smart contracts for energy transactions, renewable energy tracking, and the management of decentralized grid systems. As such, the blockchain in the energy market is expected to grow significantly in the coming years, fueled by increasing demand for decentralized energy solutions and greater transparency in the sector.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/33754

Market Overview and Growth Trends

The global blockchain in energy market is forecast to experience substantial growth, with a compound annual growth rate (CAGR) of 25.6% from 2025 to 2032. This growth trajectory is expected to propel the market from a value of USD 7.6 billion in 2025 to USD 37.4 billion by 2032. This explosive growth is driven by a variety of factors, including the increasing need for transparency in energy transactions, a rising emphasis on renewable energy, and the move towards decentralized energy solutions. Moreover, blockchain's ability to provide a secure, immutable record of energy transactions positions it as a powerful tool for enhancing trust and efficiency in an industry that traditionally lacks these qualities.

In terms of key market segments, blockchain's application in peer-to-peer energy trading has emerged as a leading area of growth. Additionally, blockchain's role in automating transactions through smart contracts is gaining traction, particularly in decentralized energy trading platforms and renewable energy certification systems. Geographically, the market for blockchain in energy is expected to be led by North America, particularly the United States, due to its well-established technological infrastructure and strong commitment to the adoption of blockchain for energy solutions.

Key Highlights from the Report

• The global blockchain in energy market is forecast to reach USD 37.4 billion by 2032.

• A remarkable CAGR of 25.6% is projected from 2025 to 2032.

• Blockchain solutions are increasingly adopted in peer-to-peer energy trading systems.

• Smart contracts are driving operational efficiency and reducing transaction errors.

• The United States is the leading region in blockchain adoption for the energy sector.

• Blockchain is transforming the renewable energy sector by enabling transparent certification and tracking.

Market Segmentation

The blockchain in the energy market is segmented in various ways, with product type and end-user applications being the primary categories. On the product side, the market is divided into blockchain-based solutions for energy trading, smart contracts, and decentralized grid management. Among these, the energy trading segment has shown the most promise, as blockchain can directly address inefficiencies in traditional energy markets. Peer-to-peer energy trading platforms, where consumers can directly buy and sell energy from one another, are gaining in popularity, driven by blockchain's ability to provide a transparent, secure framework for transactions.

In terms of end-users, the market is segmented into utilities, government bodies, independent power producers, and consumers. Utilities are expected to be the largest adopters of blockchain solutions, driven by the need to streamline their operations, ensure regulatory compliance, and improve the efficiency of energy transactions. On the other hand, independent power producers and consumers are driving demand for blockchain-based platforms that allow for more control and transparency over energy usage and trading.

Regional Insights

Regionally, North America is expected to lead the blockchain in energy market, driven by high levels of technological adoption and robust energy infrastructure. The United States, in particular, has become a hub for blockchain-related energy innovations, with several projects exploring decentralized energy grids and smart contract applications. Europe is also expected to see significant growth, especially in countries such as Germany and the Netherlands, which are known for their commitment to renewable energy and sustainability.

In contrast, the Asia-Pacific region, particularly China and India, is rapidly increasing its focus on blockchain in energy due to the growing demand for energy and the need for smarter energy grids. These regions are also interested in blockchain's potential to enhance the traceability of renewable energy and improve the efficiency of large-scale energy systems.

Market Drivers

Several factors are driving the growth of blockchain in the energy market. One of the primary drivers is the increasing demand for decentralized energy systems. As more consumers and businesses seek control over their energy consumption, blockchain's ability to enable peer-to-peer energy trading is becoming increasingly valuable. Additionally, the transition towards renewable energy sources, such as solar and wind, requires more efficient and transparent management systems, and blockchain provides a robust solution for tracking renewable energy certificates and ensuring supply chain transparency.

Another significant driver is the increasing focus on operational efficiency and cost reduction. Blockchain technology reduces the need for intermediaries, thus lowering transaction costs and enhancing efficiency in energy markets. Moreover, blockchain can streamline the process of grid management, from energy production to consumption, which reduces the risk of errors and inefficiencies in the system.

Market Restraints

Despite the promising growth prospects, there are several challenges that may hinder the widespread adoption of blockchain in the energy market. One of the key restraints is the lack of standardization across blockchain platforms. In the absence of a universally accepted framework for blockchain applications, energy companies may be hesitant to invest in the technology. Additionally, the energy sector is heavily regulated, and the integration of blockchain solutions into existing regulatory frameworks could be a complex and time-consuming process.

Another challenge is the high initial investment required for blockchain implementation. While blockchain offers long-term cost savings, the upfront costs associated with developing and deploying blockchain solutions can be prohibitively high for smaller energy companies, particularly in developing regions.

Market Opportunities

There are several opportunities for growth in the blockchain in the energy market. The increasing interest in renewable energy sources presents a huge opportunity for blockchain to provide transparency and traceability, ensuring that consumers and producers can accurately verify the origin of renewable energy. Furthermore, the growing trend of energy decentralization, such as the rise of microgrids and distributed energy resources, creates an opportunity for blockchain to facilitate secure, peer-to-peer transactions.

In addition, the integration of blockchain with other emerging technologies, such as the Internet of Things (IoT) and Artificial Intelligence (AI), presents a significant opportunity for the development of smarter and more efficient energy systems. Blockchain can enhance the ability of IoT devices to interact in a decentralized manner, improving the overall efficiency and reliability of energy networks.

Reasons to Buy the Report

✔ Comprehensive insights into the blockchain in energy market, including growth projections and trends.

✔ Detailed segmentation analysis by product type, end-user, and geographical region.

✔ In-depth exploration of market drivers, restraints, and opportunities.

✔ Regional insights with a focus on North America, Europe, and the Asia-Pacific region.

✔ Analysis of leading players in the market, including key recent developments.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/33754

Frequently Asked Questions (FAQs)

How Big is the Blockchain in Energy Market?

Who are the Key Players in the Blockchain in Energy Market?

What is the Projected Growth Rate of the Blockchain in Energy Market?

What is the Blockchain in Energy Market Forecast for 2032?

Which Region is Estimated to Dominate the Blockchain in Energy Industry through the Forecast Period?

Company Insights

The blockchain in energy market includes several key players, including:

• IBM

• Microsoft Corporation

• R3 CEV

• Power Ledger

• Concord Blockchain Technologies

Recent Developments:

1. IBM has partnered with several utilities to develop blockchain-based energy trading platforms, enhancing the efficiency of energy transactions and reducing operational costs.

2. Power Ledger has expanded its blockchain solutions for peer-to-peer energy trading in Australia and New Zealand, allowing consumers to buy and sell energy directly.

Blockchain is positioning itself as a game-changer in the energy sector, with its ability to create more transparent, efficient, and decentralized systems. With the rising demand for renewable energy and decentralized grids, blockchain is set to become a cornerstone technology for the future of the energy market.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Blockchain in Energy Market Set to Hit USD 37.4 Billion by 2032 with 25.6% CAGR here

News-ID: 4071365 • Views: …

More Releases from Persistence Market Research

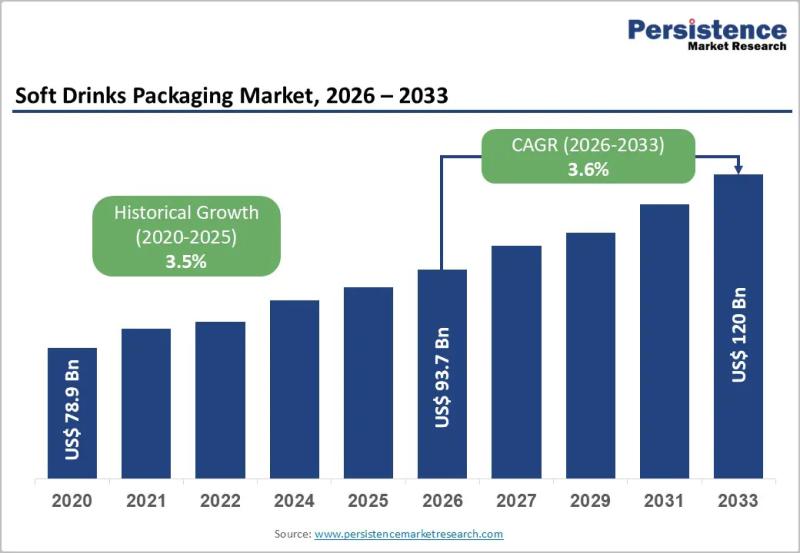

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

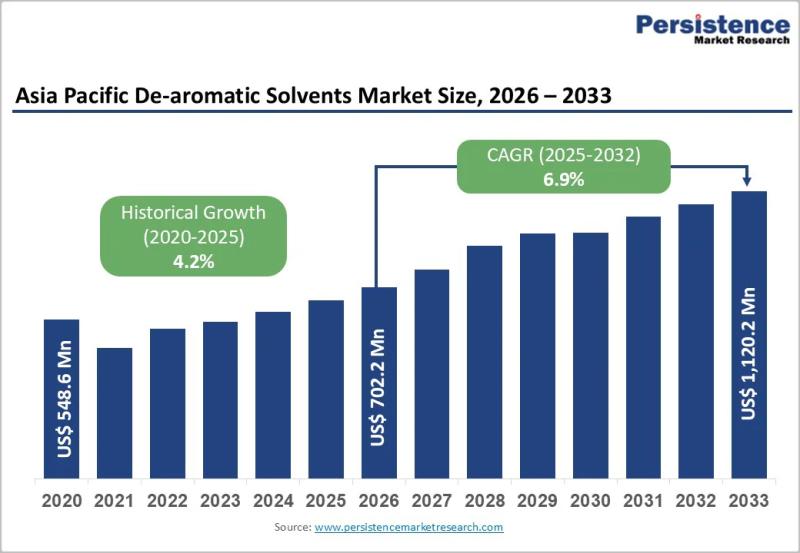

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Blockchain

Blockchain-Enabled Logistics Platforms Market Is Booming So Rapidly | Major Gian …

HTF MI recently introduced Global Blockchain-Enabled Logistics Platforms Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2033). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence.

Major companies in Blockchain-Enabled Logistics Platforms Market are:

IBM Blockchain, Oracle Blockchain, SAP Blockchain, VeChain, Modum, ShipChain, OriginTrail, Waltonchain, CargoX, Ambrosus,…

Pharmaceutical Blockchain Market to Witness Impressive Growth by 2030: IBM Block …

According to HTF Market Intelligence, the Pharmaceutical Blockchain market to witness a CAGR of 55% during the forecast period (2024-2030).The Latest published a market study on Global Pharmaceutical Blockchain Market provides an overview of the current market dynamics in the Global Pharmaceutical Blockchain space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2030. The study breaks the market by revenue and…

FinTech Blockchain Market Is Booming Worldwide | Ripple, Guardtime, Cambridge Bl …

FinTech Blockchain Market: The extensive research on FinTech Blockchain Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on FinTech Blockchain Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as market rate, estimated…

Blockchain Security Market Set for Explosive Growth | DMG Blockchain Solutions, …

Global Blockchain Security Market Growth (Status and Outlook) 2021-2026 is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Blockchain Security Market. Some of the key players profiled in the study are Oracle, IBM, Kaspersky, Gemalto,…

Impact of Outbreak of Coronavirus (Covid-19) on Blockchain in IOT Market by 2027 …

The Blockchain in IOT market is expected to garner $6000 million and rise at a CAGR of 70% during the forecast period from 2019 to 2027.

A new market report titled “Blockchain in IOT Market” has been added to the repository of Research N Reports. This report provides comprehensive assessment of the current trends, restrains and futuristic opportunities, which are anticipated to provide lucrative avenues for market proliferation. An in-depth description…

Oodles Blockchain Uses Top Blockchain Platforms To Expedite Blockchain Adoption

With an aim to leverage the blockchain technology to change the centralized system and make it decentralized, Oodles Blockchain has decided to use top blockchain platforms to develop consumer-based blockchain applications.

Oodles Blockchain, a micro-website of Oodles Technologies, developed mainly to focus on blockchain technology, is delighted to announce that it will be expanding its horizon of blockchain development services by using a few latest open source blockchain platforms like…