Press release

India Unified Payments Interface (UPI) Market to Reach USD 478.9 Billion by 2033 - Growing at a CAGR of 45%

India Unified Payments Interface (UPI) Market 2025-2033According to IMARC Group's report titled "India Unified Payments Interface (UPI) Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033", The report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

How Big is the India Unified Payments Interface (UPI) Industry ?

The India unified payments interface (UPI) market size was valued at USD 16.9 Billion in 2024 and is expected to reach USD 478.9 Billion by 2033, exhibiting a growth rate (CAGR) of 45% during 2025-2033.

India Unified Payments Interface (UPI) Market Trends:

The Indian UPI ecosystem is seeing numerous innovations that are setting new antecedents for the digital payments world. An emerging trend is the rise of UPI credit lines, wherein banks and fintech firms disburse instant working capital or micro credit to merchants at the store checkout. Conversational AI is driving payment frontiers-aided by increasing voice-based UPI transactions among rural and elder users. Also, cross-border linkages of UPI with countries like Singapore and UAE are paving ways for frictionless remittance at a lesser cost against the traditional forex channels.

Then, offline UPI payments via NFC and sound technology are filling connectivity gaps in semi-urban areas. In essence, UPI 2.0 features, including signed intent and invoice in the inbox, are bringing in a new dimension for security and transparency in B2B payments. Notably, embedded finance solutions are increasingly being developed where UPI IDs serve as a replacement for bank details used in mutual fund investments, insurance premium payments, and even stock trading. Also, standardization of QR codes across kirana outlets and street vendors is helping in minimizing fraud risks for recurring payments. The market is also seeing hyper-personalized rewards, where UPI apps analyze spending patterns to offer targeted cashbacks and merchant discounts.

Request for a sample copy of this report: https://www.imarcgroup.com/india-unified-payments-interface-market/requestsample

India Unified Payments Interface (UPI) Market Scope and Growth Analysis:

India's UPI (Unified Payments Interface) market is set to grow exponentially with government initiatives and an ever-increasing penetration of digital access. The untapped potential for the Tier 3-6 towns presents a massive opportunity with vernacular language UPI applications and assisted payment models to bridge the adoption gap. Formalization of the gig economy in India is creating an augmented usage of UPI, with freelancers and delivery partners being paid instantaneously via UPI. And, the coming together of UPI with ONDC would be a game-changer in terms of e-commerce payments enabling interoperable transactions across platforms.

Essentially, the gradual spread of UPI Lite for small-value transactions is decongesting the banking infrastructure and enhancing financial inclusion. API-driven banking-as-a-service models contribute to the ecosystem, whereby neobanks and startups can embed UPI into their offerings. With higher adoption of UPI for payments to public transport and utility bills, the platform has become indispensable for everyday flows of money. A strategic focus on fraud prevention framework, merchant training programs, and interoperable credit products will become imperative for sustaining the growth. Overall, UPI's evolution into a multi-functional financial infrastructure positions India as a global leader in digital payment innovation.

India Unified Payments Interface (UPI) Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

• P2P

• P2M

Application Insights:

• Money Transfers

• Bill Payments

• Point of Sale

• Others

Regional Insights:

• North India

• South India

• East India

• West India

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Other key areas covered in the report:

• COVID-19 Impact on the Market

• Porter's Five Forces Analysis

• Strategic Recommendations

• Market Dynamics

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

• Top Winning Strategies

• Recent Industry News

• Key Technological Trends & Development

Ask an analyst: https://www.imarcgroup.com/request?type=report&id=31732&flag=C

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Explore More Research Reports & Get Your Free Sample Now:

• India B2C E-commerce Market: https://www.imarcgroup.com/india-b2c-e-commerce-market/requestsample

• India Debt Collection Software Market: https://www.imarcgroup.com/india-debt-collection-software-market/requestsample

• India Hybrid Cloud Market: https://www.imarcgroup.com/india-hybrid-cloud-market/requestsample

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Unified Payments Interface (UPI) Market to Reach USD 478.9 Billion by 2033 - Growing at a CAGR of 45% here

News-ID: 4071351 • Views: …

More Releases from IMARC Group

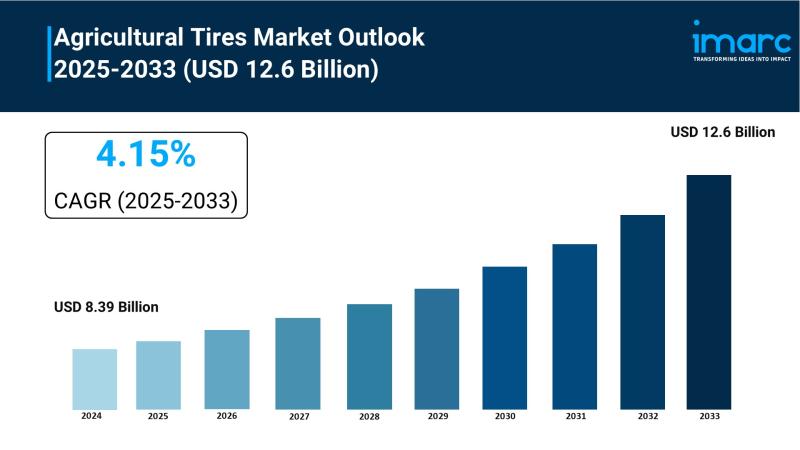

Agricultural Tires Market Set to Surge to USD 12.6 Billion by 2033 at a 4.15% CA …

Market Overview:

According to IMARC Group's latest research publication, "Agricultural Tires Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global agricultural tires market size reached USD 8.39 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.15% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and…

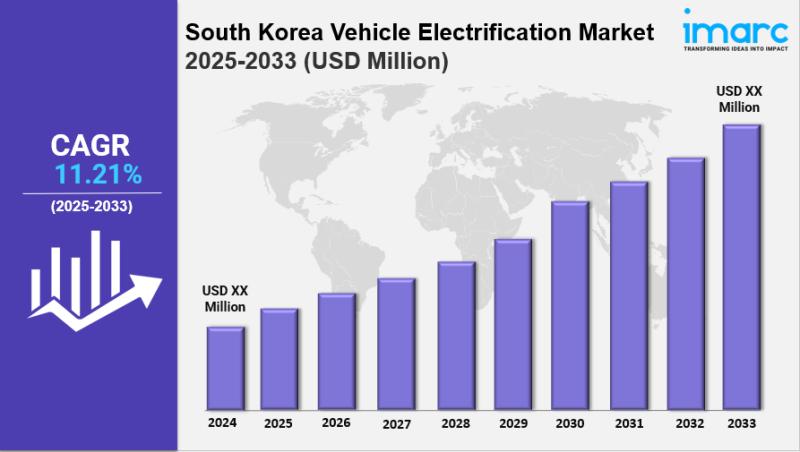

South Korea Vehicle Electrification Market Size, Growth, Key Players, Latest Tre …

IMARC Group has recently released a new research study titled "South Korea Vehicle Electrification Market Report by Product Type (Starter Motor, Alternator, Electric Car Motors, Electric Water Pump, Electric Oil Pump, Electric Vacuum Pump, Electric Fuel Pump, Electric Power Steering, Actuators, Start/Stop System), Vehicle Type (Internal Combustion Engine (ICE) and Micro-Hybrid Vehicle, Plug-in Hybrid Electric Vehicle (PHEV) and Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV)), Sales Channel (Original Equipment…

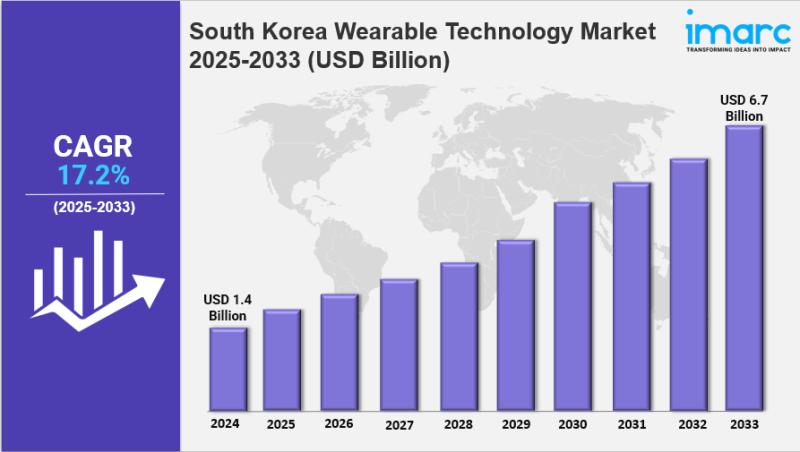

South Korea Wearable Technology Market Size, Share, Industry Overview, Trends an …

IMARC Group has recently released a new research study titled "South Korea Wearable Technology Market Report by Product (Wrist-Wear, Eye-Wear and Head-Wear, Foot-Wear, Neck-Wear, Body-Wear, and Others), Application (Consumer Electronics, Healthcare, Enterprise and Industrial Application, and Others), and Region 2025-2033" This report offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wearable Technology Market Overview

The…

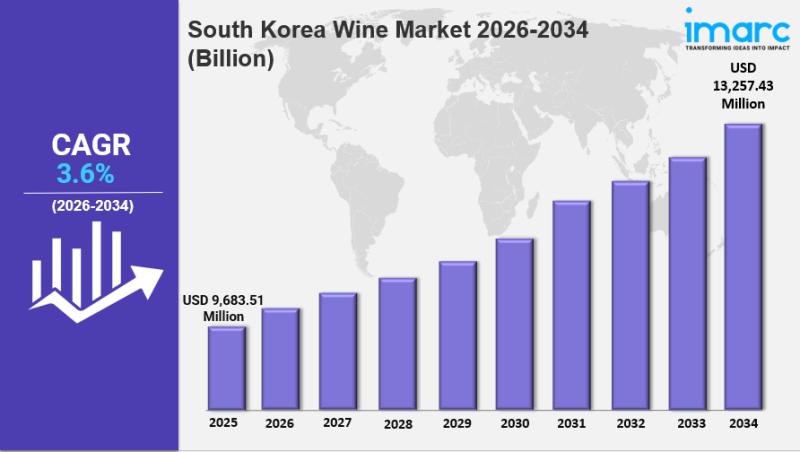

South Korea Wine Market Size, Share, Industry Overview, Trends and Forecast 2026 …

IMARC Group has recently released a new research study titled "South Korea Wine Market Size, Share, Trends and Forecast by Product Type, Color, Distribution Channel, and Region, 2026-2034", which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wine Market Report Overview

The South Korea wine market size was valued at USD 9,683.51 Million in 2025.…

More Releases for UPI

What is UPI Payment and How Does it Work?

In today's fast-paced digital world, convenience and speed are everything-especially when it comes to money. Whether you're paying your local grocery store or transferring funds to a friend instantly, UPI is revolutionizing the way we handle everyday transactions. But what exactly is UPI, and how does it work?

At ZingPay Technologies, we believe in empowering users with knowledge that helps them navigate the digital economy with confidence. Let's break it down.

What…

UPI Atm Machine Market Comprehensive Analysis for 2025

The UPI ATM Machine market is witnessing a transformative phase, characterized by rapid technological advancements and a shift in consumer preferences towards digital payment methods. Unified Payments Interface (UPI) technology has revolutionized the way financial transactions are conducted, making cash withdrawals, fund transfers, and bill payments seamless. This press release delves into the market's current landscape, highlighting key developments, growth drivers, competitive dynamics, and the opportunities that lie ahead.

You can…

GoKiwi.in Introduces Rupay Credit Card on UPI: A Revolutionary Payment Experienc …

[Karnataka, 20-10-2024] - GoKiwi.in, a leading player in digital payment solutions, is excited to announce the launch of its innovative Rupay Credit Card on UPI, revolutionizing the way users make payments. This latest offering merges the flexibility of credit card benefits with the ease and accessibility of UPI payments, offering a seamless, secure, and rewarding payment experience.

With the GoKiwi Rupay Credit Card, users can now enjoy the advantages of a…

Redefines Cash Withdrawals with Revolutionary UPI API Provider

Discover how PaySprint, a leading UPI API Provider, is transforming cash withdrawal experiences with its innovative UPI API solutions, offering unparalleled convenience and security.

In today's rapidly evolving digital landscape, the way we handle financial transactions is undergoing a significant transformation. Gone are the days of waiting in long queues at ATMs or worrying about carrying physical cards. Thanks to groundbreaking advancements in financial technology, cash withdrawals have become simpler, faster,…

India and Singapore driving digital innovation with UPI-PayNow-linkage

Until a decade ago paying without cash was a foreign idea. Digitisation changed this notion and made cashless transactions ubiquitous in every other country. In addition, smartphones, 4G, and booming 5G connectivity boosted this revolutionary change and led to the digital transformation of the fintech and banking industries. India geared up and embraced this change, surpassing the number of cash transactions with easy and secure digital payment methods.

India constantly…

Unified Payments Interface (UPI) Market is Booming Worldwide | Google Pay, Phone …

The latest released on Global Unified Payments Interface (UPI) Market delivers comprehensive data ecosystem with 360 view of customer activities, segment-based analytics-and-data to drive opportunities of evolving Unified Payments Interface (UPI) marketplace and future outlook to 2028. It includes integrated insights of surveys conducted with executives and experts from leading institutions across various countries. Some of the listed companies profiled in the report are Google Pay (United States), PhonePe…