Press release

Strategic Analysis of Open Banking System Market: Trends, Size, Share, and Forecast by 2032

"The Open Banking System Market is experiencing a period of robust expansion, driven by the confluence of technological advancements, evolving regulatory landscapes, and increasing consumer demand for personalized and seamless financial services. The core concept of open banking, which facilitates secure data sharing between financial institutions and third-party providers through APIs, is revolutionizing traditional banking models. This shift enables the development of innovative solutions, such as enhanced payment systems, personalized financial advice, and streamlined lending processes. Technological advancements like cloud computing, artificial intelligence, and blockchain are pivotal in enhancing the security, scalability, and efficiency of open banking platforms. Furthermore, the market plays a critical role in addressing global challenges by fostering financial inclusion, promoting competition, and empowering consumers with greater control over their financial data. As the financial services sector becomes increasingly digital and interconnected, open banking emerges as a cornerstone for building a more inclusive, efficient, and customer-centric financial ecosystem.

Get the full PDF sample copy of the report: (TOC, Tables and figures, and Graphs) https://www.consegicbusinessintelligence.com/request-sample/2710

Market Size:

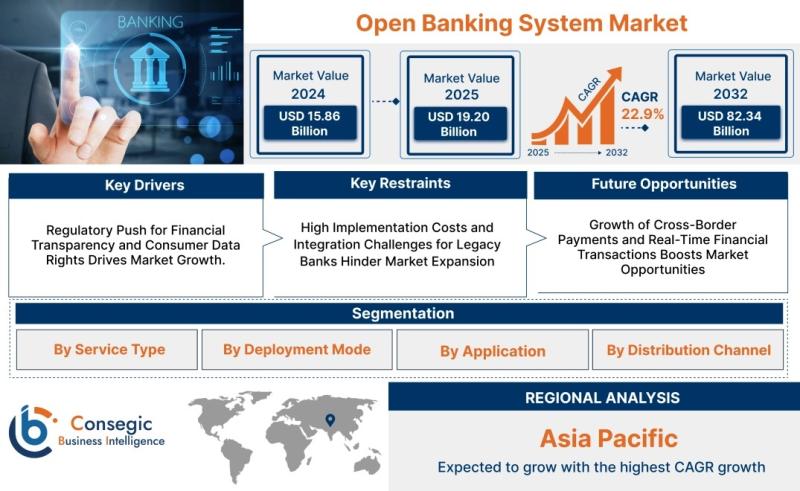

The open banking system market size is estimated to reach over USD 82.34 Billion by 2032 from a value of USD 15.86 Billion in 2024. It is projected to grow by USD 19.20 Billion in 2025, exhibiting a CAGR of 22.9% from 2025 to 2032.

Definition of Market:

The Open Banking System Market encompasses the ecosystem of technologies, regulations, and services that enable third-party developers to access banking information and functionality through APIs. It's fundamentally about allowing secure and standardized data sharing between banks, financial institutions, and authorized third-party providers. This data sharing facilitates the creation of innovative financial products and services that cater to the evolving needs of consumers and businesses.

Key terms associated with this market include:

Application Programming Interface (API): A set of protocols and tools that allows different software applications to communicate with each other. In open banking, APIs are used to securely share financial data.

Third-Party Provider (TPP): An organization, other than a bank, that offers financial services based on access to customer banking data through APIs. TPPs can include fintech companies, retailers, and other financial institutions.

Account Information Service Provider (AISP): A type of TPP that provides consolidated views of a customer's accounts across multiple banks.

Payment Initiation Service Provider (PISP): A type of TPP that initiates payment transactions on behalf of a customer.

PSD2 (Payment Services Directive 2): A European regulation that mandates banks to provide access to customer account information to TPPs with the customer's consent.

Data Aggregation: The process of collecting financial data from multiple sources into a single, unified view.

Consent Management: The process of obtaining and managing customer consent for data sharing with TPPs.

Get Discount On Report @ https://www.consegicbusinessintelligence.com/request-discount/2710

Market Scope and Overview:

The scope of the Open Banking System Market is vast and encompasses a wide range of technologies, applications, and industries. It includes the underlying infrastructure for API development and management, security protocols for data sharing, and the diverse range of financial services that are built upon open banking principles. These services span across payment solutions, lending platforms, wealth management tools, and personalized financial advisory services. The applications of open banking are not limited to traditional banking; they extend to e-commerce, insurance, and various other sectors where financial data and transactions play a crucial role.

The importance of the Open Banking System Market lies in its potential to transform the financial landscape. In the context of global trends, it aligns perfectly with the increasing demand for digital financial services, the growing importance of data-driven decision-making, and the regulatory push for greater competition and transparency in the financial sector. Open banking is driving the evolution of the financial services industry towards a more open, interconnected, and customer-centric model, empowering individuals and businesses with greater control over their financial data and fostering innovation in financial products and services. It addresses the needs of a digitally savvy population, drives financial inclusion by enabling access to tailored financial solutions, and supports economic growth by facilitating more efficient and transparent financial transactions. Open banking's role is increasingly significant in the broader global trend towards digital transformation and the creation of data-driven economies.

Top Key Players in this Market

Plaid (USA) Tink (Sweden) TrueLayer (UK) Token.io (UK) Bud Financial (UK) Salt Edge (Canada) Yapily (UK) Basiq (Australia) Finicity (USA) Bunq (Netherlands)

Market Segmentation:

The Open Banking System Market can be segmented based on several key factors:

By Service Type: This includes Banking & Capital Markets, Payments, Digital Lending, Insurance, and Wealth Management. Each segment benefits from open banking by enabling personalized services, streamlined processes, and improved efficiency.

By Deployment Mode: This includes On-Premise and Cloud-Based deployments. Cloud-based solutions are gaining popularity due to their scalability and cost-effectiveness, while on-premise deployments offer greater control over data security.

By Application: This includes Payment, Banking, Wealth Management, and Digital Lending. Open banking enhances each of these applications by providing seamless data sharing, improved customer experiences, and innovative solutions.

By Distribution Channel: This includes Bank Channel, App Market, Distributors, and Aggregators. Each channel plays a role in delivering open banking services to customers, with app markets and aggregators offering diverse platforms for accessing these services.

Market Drivers:

Technological Advancements: Advancements in API technology, cloud computing, and cybersecurity are enabling the development of secure and scalable open banking platforms.

Government Policies and Regulations: Regulations like PSD2 in Europe are mandating banks to provide access to customer data, driving the adoption of open banking.

Increasing Demand for Personalized Financial Services: Consumers are increasingly demanding personalized and convenient financial services, which open banking can provide through data-driven insights.

Growing Fintech Ecosystem: The rise of fintech companies is fostering innovation and competition in the financial sector, driving the adoption of open banking.

Enhanced Customer Experience: Open banking enables seamless integration of financial services into various platforms, improving the overall customer experience.

Market Key Trends:

Increased API Adoption: The number of banks and fintech companies adopting open banking APIs is rapidly increasing, leading to greater interoperability and innovation.

Growing Focus on Security: With increased data sharing, security is becoming a paramount concern, leading to the development of advanced security protocols and technologies.

Rise of Embedded Finance: Open banking is enabling the integration of financial services into non-financial platforms, creating new opportunities for businesses.

Expansion into New Sectors: Open banking is expanding beyond traditional banking to sectors such as insurance, retail, and healthcare, unlocking new use cases and applications.

AI and Machine Learning Integration: The use of AI and machine learning is enhancing the capabilities of open banking platforms, enabling personalized insights and automated decision-making.

Market Opportunities:

Development of Innovative Financial Products: Open banking enables the creation of new financial products and services tailored to specific customer needs.

Expansion into Emerging Markets: Emerging markets offer significant growth opportunities for open banking due to the lack of established financial infrastructure and the high adoption of mobile technology.

Partnerships between Banks and Fintech Companies: Collaborations between banks and fintech companies can leverage the strengths of both parties to deliver innovative open banking solutions.

Increased Focus on Data Analytics: Open banking generates vast amounts of data, creating opportunities for data analytics companies to provide insights and solutions to financial institutions.

Enhanced Security Solutions: The growing concern over security is creating opportunities for cybersecurity companies to develop advanced solutions for protecting open banking platforms.

Market Restraints:

Security and Privacy Concerns: Concerns over data security and privacy can hinder the adoption of open banking.

Lack of Standardization: The lack of standardized APIs can create interoperability issues and increase the complexity of open banking implementations.

Regulatory Uncertainty: Uncertain or inconsistent regulations can create challenges for businesses operating in the open banking market.

Legacy Infrastructure: Banks with legacy IT systems may face challenges in implementing open banking solutions.

Customer Awareness and Trust: Lack of awareness and trust in open banking can limit adoption among consumers.

Market Challenges:

The Open Banking System Market, despite its promising growth trajectory, faces several significant challenges that need to be addressed for its sustained success. One of the primary challenges is security and data privacy. The increased sharing of financial data through APIs raises concerns about the potential for data breaches, fraud, and misuse of customer information. Ensuring the security of APIs and the protection of sensitive data is crucial for building trust among consumers and financial institutions. This requires the implementation of robust authentication mechanisms, encryption protocols, and continuous monitoring for vulnerabilities.

Another challenge is the lack of standardization across different banks and financial institutions. The absence of common API standards can create interoperability issues, making it difficult for third-party providers to integrate with multiple banks. This can limit the scalability and efficiency of open banking solutions, as developers need to build custom integrations for each bank. Promoting standardization and collaboration among industry stakeholders is essential for overcoming this challenge and fostering a more open and interconnected financial ecosystem. Furthermore, regulatory uncertainty poses a significant challenge to the growth of the open banking market. The regulatory landscape is still evolving in many regions, and inconsistent or unclear regulations can create confusion and uncertainty for businesses operating in this space. Harmonizing regulations across different jurisdictions and providing clear guidelines for data sharing, consent management, and liability are crucial for fostering innovation and investment in open banking. Additionally, banks need to overcome the challenge of legacy infrastructure. Many banks still rely on outdated IT systems that are not easily compatible with open banking APIs. Modernizing legacy infrastructure and adopting cloud-based solutions are essential for enabling seamless data sharing and integration with third-party providers.

Finally, consumer awareness and trust remain key challenges for the open banking market. Many consumers are still unaware of the benefits of open banking and may be hesitant to share their financial data with third-party providers. Building trust among consumers requires educating them about the security measures in place and demonstrating the value of open banking solutions. This can be achieved through transparent communication, user-friendly interfaces, and partnerships with trusted brands. Addressing these challenges effectively is crucial for unlocking the full potential of the Open Banking System Market and creating a more open, innovative, and customer-centric financial ecosystem.

Market Regional Analysis:

The Open Banking System Market exhibits varying dynamics across different regions, influenced by factors such as regulatory frameworks, technological adoption, and market maturity. In Europe, the implementation of PSD2 has been a significant driver for open banking adoption, mandating banks to provide access to customer data. The UK has emerged as a leader in open banking, with a well-established ecosystem of fintech companies and supportive regulatory policies. In North America, the market is driven by increasing consumer demand for personalized financial services and the growing adoption of fintech solutions. The US market is characterized by a fragmented regulatory landscape, with different states having varying approaches to open banking. In the Asia-Pacific region, countries like Australia and Singapore are actively promoting open banking through regulatory initiatives and government support. The region's large and tech-savvy population presents significant growth opportunities for open banking solutions. In Latin America, the market is driven by the need for financial inclusion and the increasing adoption of mobile banking. The region's large unbanked population and the growing fintech ecosystem are creating opportunities for open banking to address financial challenges. Each region presents unique opportunities and challenges for the Open Banking System Market, requiring businesses to adapt their strategies to local market conditions.

Frequently Asked Questions:

What is the projected growth rate of the Open Banking System Market?

The Open Banking System Market is projected to grow at a CAGR of 22.9% from 2025 to 2032.

What are the key trends driving the market?

Key trends include increased API adoption, a growing focus on security, the rise of embedded finance, expansion into new sectors, and AI/ML integration.

What are the most popular Market types?

The most popular Market types include services focused on banking & capital markets, payments, digital lending, insurance, and wealth management.

"

Contact Us:

Consegic Business intelligence Pvt Ltd

Baner Road, Baner, Pune, Maharashtra - 411045

(US) (505) 715-4344

info@consegicbusinessintelligence.com

sales@consegicbusinessintelligence.com

Web - https://www.consegicbusinessintelligence.com/

About Us:

Consegic Business Intelligence is a data measurement and analytics service provider that gives the most exhaustive and reliable analysis available of global consumers and markets. Our research and competitive landscape allow organizations to record competing evolutions and apply strategies accordingly to set up a rewarding benchmark in the market. We are an intellectual team of experts working together with the winning inspirations to create and validate actionable insights that ensure business growth and profitable outcomes.

We provide an exact data interpretation and sources to help clients around the world understand current market scenarios and how to best act on these learnings. Our team provides on-the-ground data analysis, Portfolio Expansion, Quantitative and qualitative analysis, Telephone Surveys, Online Surveys, and Ethnographic studies. Moreover, our research reports provide market entry plans, market feasibility and opportunities, economic models, analysis, and an advanced plan of action with consulting solutions. Our consumerization gives all-inclusive end-to-end customer insights for agile, smarter, and better decisions to help business expansion.

Connect with us on:

LinkedIn - https://www.linkedin.com/company/consegic-business-intelligence/

YouTube - https://www.youtube.com/@ConsegicBusinessIntelligence22

Facebook - https://www.facebook.com/profile.php?id=61575657487319

X - https://x.com/Consegic_BI

Instagram - https://www.instagram.com/cbi._insights/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Strategic Analysis of Open Banking System Market: Trends, Size, Share, and Forecast by 2032 here

News-ID: 4066495 • Views: …

More Releases from Consegic Business Intelligence Pvt. Ltd

Europe Pharmaceutical Manufacturing Equipment Market 2025 Industry Updates, Futu …

Introduction:

The Pharmaceutical Manufacturing Equipment Market is experiencing robust growth, driven by a confluence of factors reshaping the landscape of pharmaceutical production. Increasing global demand for pharmaceuticals, fueled by an aging population and the rise of chronic diseases, necessitates advanced and efficient manufacturing processes. Technological advancements, such as continuous manufacturing, automation, and digitalization, are revolutionizing traditional methods, improving production efficiency, reducing costs, and enhancing product quality. Stringent regulatory requirements and the…

Europe Vibration Damping Materials Market Size 2025 Overview, Manufacturers, Typ …

Introduction:

The Vibration Damping Materials market is experiencing significant growth, driven by the increasing demand for noise and vibration reduction across various industries. Key drivers include stringent environmental regulations, the growing automotive industry, particularly the electric vehicle (EV) sector, and the need for enhanced comfort and safety in residential and commercial buildings. Technological advancements in materials science are also playing a pivotal role, with the development of more efficient and durable…

Europe Lightweight Aggregates Market Size 2025 Emerging Technologies, Opportunit …

Introduction:

The Lightweight Aggregates Market is experiencing substantial growth driven by several key factors. Primarily, the increasing demand for sustainable and eco-friendly construction materials is fueling the adoption of lightweight aggregates. These materials offer superior insulation properties, reduced transportation costs, and contribute to the overall reduction of the carbon footprint of construction projects. Technological advancements in the production and application of lightweight aggregates are also playing a crucial role, enhancing their…

Europe Visible Light Communication Market Share, Growth, Size, Industry Trends, …

Introduction:

The Visible Light Communication (VLC) market is experiencing significant growth, driven by the increasing demand for faster, more secure, and energy-efficient communication technologies. VLC leverages light waves for data transmission, offering a complementary solution to traditional radio frequency (RF) based wireless communication. Key drivers include the proliferation of LED lighting, growing concerns about RF spectrum congestion, and the need for secure communication in sensitive environments. Technological advancements, such as improved…

More Releases for Open

Open to Submissions

Do you have an inspiring story to tell? To celebrate the launch of CozyBookShoppe.com, we are hosting a writing contest! We are looking for the most inspirational essay of 2000 words or less to be the winner of $250. It can be a personal experience or a fictional story, but the result needs to be inspiring - to make the reader feel full of hope or encouraged.

CozyBookShoppe.com was born out…

Open Source Camp on Bareos: Call for Papers open

The organizer NETWAYS GmbH opens the Call for Papers for the Open Source Camp (OSCamp) on Bareos. Presentations can be submitted until March 30, 2020.

Nuremberg, January 23, 2020

Let's talk about backups! This is the title of this year's Open Source Camp (OSCamp) on Bareos, which takes place on June 19, 2020 in Berlin. The Call for Papers for the event is open: The organizer is looking for case studies, reports…

Open API (Application Programming Interface) Market : Key Vendors : Open Banking …

An open API is a publicly available interface which is developed to be easily accessible by the wider population of Web and mobile developers. An open API can be used both by developers inside the organization that published the API as well as by developers outside the organization who wish to register for access to the interface.

Three main characteristics of open APIs are – freely available to use by all…

Open Source Intelligence Market, Open Source Intelligence Market Analysis, Open …

Open-source intelligence is data collected from publicly available sources to be used in an intelligence context. Open-source intelligence collects data from publicly available sources such as television, radio, newspapers, commercial databases, internet, media, and others. The open source intelligence solutions are being adopted by many enterprises. The open source intelligence tools enable in collecting a wide range of information which are publicly available.

Get Sample Copy of this Report: https://www.qyreports.com/request-sample?report-id=79500…

ICORE Meets to Bridge Open Education and Open Research

ICORE members have begun a series of meetings to develop the association’s defining connection between open research and open education, as well as methods of promotion for these fields. All interested organizations and experts are invited to join one of the next open online meetings on Wednesday, 23 October 2013. The first session will start at 8:00 am UTC and the second at 4:00 pm UTC, in order to allow…

Kaplan Open Learning launches incentives for new open degree course students

Anyone who is considering taking a degree course is advised to do so this January before the large-scale changes to education funding take effect. In the light of these changes, Kaplan Open Learning, who provide online degree courses in partnership with the University of Essex, announce a new “Refer a Friend” incentive scheme for new students.

Major changes to education funding which are due to take effect in September 2012…