Press release

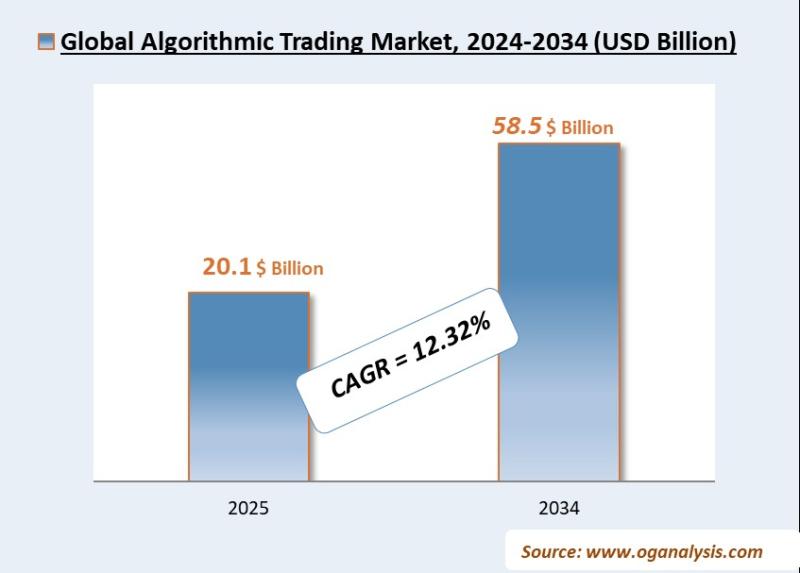

Global Algorithmic Trading Market Report Insights and Growth Outlook to 2034 - Strategic Trade Shifts, Tariff Impacts, and Supply Chain Reinvention Driving Competitive Advantage

Algorithmic Trading Market Analysis 2025-2034: Industry Size, Share, Growth Trends, Competition and Forecast Report

Get a Free Sample: https://www.oganalysis.com/industry-reports/algorithmic-trading-market

Algorithmic Trading Market Overview

The global Algorithmic Trading Market has emerged as a cornerstone of modern financial systems, automating the execution of trade orders at speeds and frequencies far beyond human capability. Leveraging advanced mathematical models, artificial intelligence, and machine learning, algorithmic trading enables market participants-including hedge funds, investment banks, proprietary trading firms, and retail investors-to analyze large datasets, identify optimal trading opportunities, and execute complex strategies across asset classes such as equities, derivatives, foreign exchange, and commodities. The market is experiencing rapid expansion due to the rise of electronic trading platforms, growth in high-frequency trading (HFT), and increasing regulatory mandates promoting transparency and best execution. Market infrastructure providers are integrating smart order routing, real-time analytics, and latency optimization tools to support dynamic trading strategies. Moreover, financial institutions are investing heavily in proprietary algorithms, low-latency networks, and co-location services to gain competitive advantages. The surge in cloud computing, edge computing, and data streaming technologies further strengthens the ecosystem, allowing traders to respond to microsecond-level market fluctuations with unprecedented precision.

In parallel, the democratization of algorithmic trading platforms is broadening participation beyond institutional players. Retail traders now access intuitive algo tools and APIs through brokers and fintech platforms, while open-source libraries and backtesting frameworks have lowered the entry barrier for independent developers. The market is also seeing convergence with artificial intelligence and natural language processing for sentiment-driven trading, news-based strategies, and predictive analytics. As environmental, social, and governance (ESG) data becomes increasingly integrated, ESG-aligned algorithmic strategies are gaining traction. However, the market faces challenges such as flash crashes, systemic risk, model overfitting, and evolving regulatory scrutiny across jurisdictions like the U.S., EU, and APAC. Despite these concerns, the continued evolution of quantum computing, deep reinforcement learning, and blockchain-based execution models is poised to redefine the next generation of algorithmic trading. With capital markets digitizing at scale and the global appetite for automation growing, algorithmic trading is expected to remain a pivotal driver of liquidity, efficiency, and innovation in global financial markets.

Access Full Report @ https://www.oganalysis.com/industry-reports/algorithmic-trading-market

Key Algorithmic Trading Market Companies Analysed in this Report include -

BNP Paribas Leasing Solutions

AlgoTrader

Argo Software Engineering

InfoReach, Inc.

Kuberre Systems, Inc.

MetaQuotes Ltd.

Symphony

Tata Consultancy Services Limited

VIRTU Finance Inc.

AlgoBulls Technologies Private Limited

Key Insights from the report -

1. Rise of AI and Machine Learning Integration

Algorithmic trading strategies are increasingly powered by machine learning and deep learning models. These enable adaptive strategies that evolve with market behavior and historical data patterns. AI-driven systems enhance prediction accuracy and dynamic portfolio rebalancing.

2. Surge in High-Frequency Trading (HFT)

The demand for ultra-low latency execution is fueling the growth of HFT strategies. Co-location services, FPGA hardware, and real-time data feeds are critical components. Speed has become a core differentiator in competitive trading environments.

3. Expansion of Retail Algo Trading Platforms

Retail traders are gaining access to user-friendly algorithmic tools through brokers and fintech apps. APIs, drag-and-drop strategy builders, and backtesting engines support DIY trading automation. This democratization is reshaping traditional trading boundaries.

4. Regulatory Focus and Compliance Automation

Global regulators are tightening controls around algorithmic trading to ensure market stability and transparency. Firms are adopting real-time surveillance and compliance algorithms to meet evolving rules. Automated audit trails and kill-switch mechanisms are becoming standard.

5. Integration of Alternative and ESG Data

Traders are increasingly incorporating alternative data sources like satellite imagery, social media, and ESG metrics into their models. These datasets offer non-traditional insights for alpha generation. ESG-focused algorithms are gaining adoption among sustainable investors.

6. Growth of Multi-Asset and Cross-Market Strategies

Algorithmic trading is expanding across asset classes including crypto, fixed income, and FX. Cross-market arbitrage and multi-venue execution strategies are on the rise. Unified trading platforms are enabling seamless execution across fragmented markets.

Tailor the Report to Your Specific Requirements @ https://www.oganalysis.com/industry-reports/algorithmic-trading-market

Get an In-Depth Analysis of the Algorithmic Trading Market Size and Market Share split -

Component

- Solution

- Service

Deployment

- Cloud

- On-premise

Type

- Foreign Exchange (FOREX)

- Stock Markets

- Exchange-Traded Fund (ETF)

- Bonds

- Cryptocurrencies

- Others

By Type Of Trader

- institutional Investors

- Long-term Traders

- Short-term Traders

- Retail Investors

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

DISCOVER MORE INSIGHTS: EXPLORE SIMILAR REPORTS!

https://www.oganalysis.com/industry-reports/selfcheckout-pos-terminal-market

https://www.oganalysis.com/industry-reports/selfservice-kiosks-for-healthcare-market

https://www.oganalysis.com/industry-reports/rf-picking-system-market

https://www.oganalysis.com/industry-reports/algorithmic-trading-market

Contact Us:

John Wilson

Phone: 88864 99099

Email: sales@oganalysis.com

Website: https://www.oganalysis.com

Follow Us on LinkedIn: linkedin.com/company/og-analysis/

OG Analysis

1500 Corporate Circle, Suite # 12, Southlake, TX-76177

About OG Analysis:

OG Analysis has been a trusted research partner for 14+ years delivering most reliable analysis, information and innovative solutions. OG Analysis is one of the leading players in market research industry serving 980+ companies across multiple industry verticals. Our core client centric approach comprehends client requirements and provides actionable insights that enable users to take informed decisions.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Algorithmic Trading Market Report Insights and Growth Outlook to 2034 - Strategic Trade Shifts, Tariff Impacts, and Supply Chain Reinvention Driving Competitive Advantage here

News-ID: 4065834 • Views: …

More Releases from OG Analysis

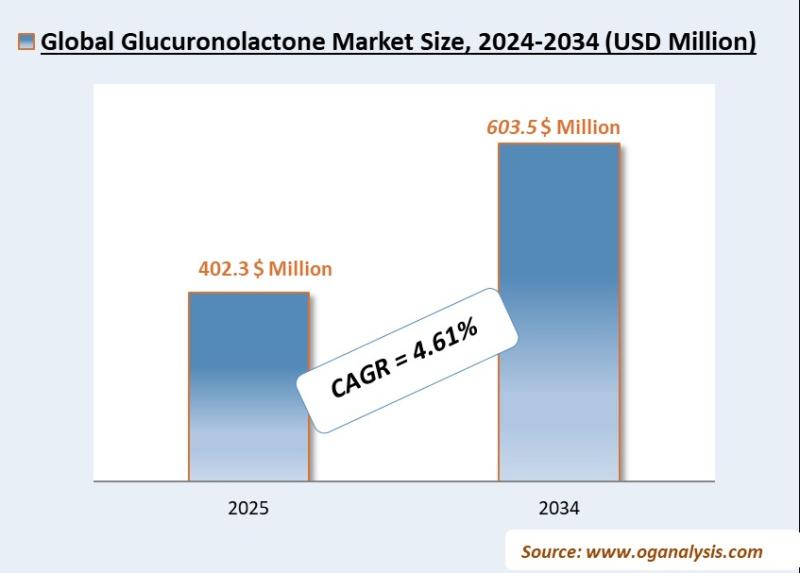

Global glucuronolactone-market Report Insights and Growth Outlook to 2034 - Stra …

According to OG Analysis, a renowned market research firm, the Global glucuronolactone-market was valued at USD 383.7 Million in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 4.61%, rising from USD 402.3 Million in 2025 to an estimated USD 603.5 Million by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/glucuronolactone-market

glucuronolactone-market Overview

The glucose market covers the production and use of glucose (dextrose) and glucose syrups derived primarily…

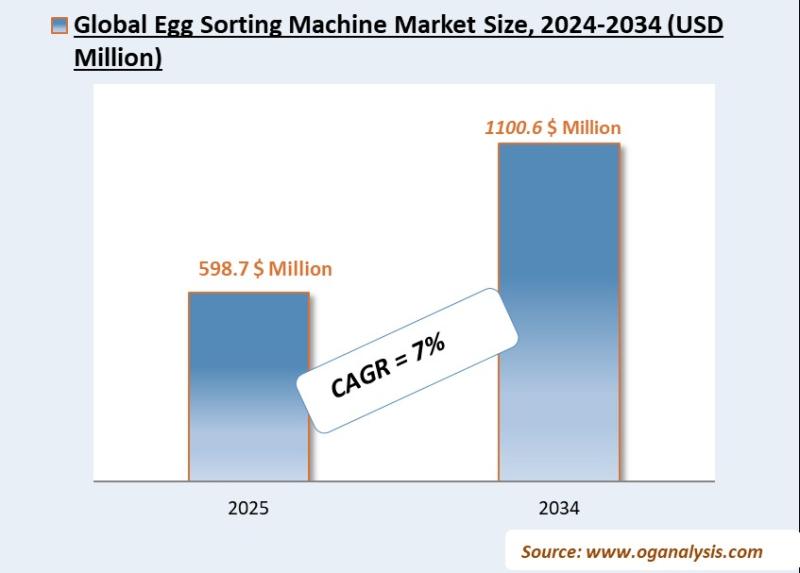

Global Egg Sorting Machine Market Report Insights and Growth Outlook to 2034 - S …

According to OG Analysis, a renowned market research firm, the Global Egg Sorting Machine Market was valued at USD 556.7 Million in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 7%, rising from USD 598.7 Million in 2025 to an estimated USD 1100.6 Million by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/egg-sorting-machine-market

Egg Sorting Machine Market Overview

The egg sorting machine market supports commercial egg processing by…

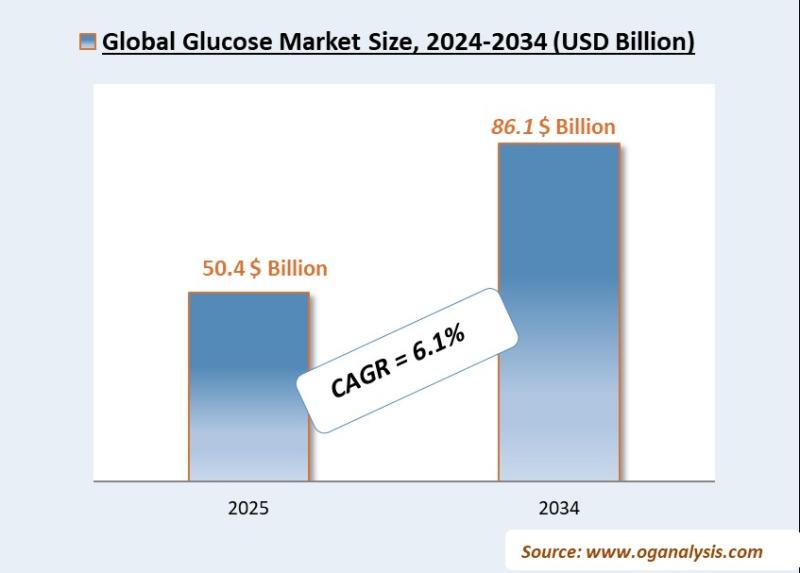

Global Glucose Market Report Insights and Growth Outlook to 2034 - Strategic Tra …

According to OG Analysis, a renowned market research firm, the Global Glucose Market was valued at USD 47.3 Billion in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 6.1%, rising from USD 50.4 Billion in 2025 to an estimated USD 86.1 Billion by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/glucose-market

Glucose Market Overview

The glucose market covers the production and use of glucose (dextrose) and glucose syrups…

Global Food Glazing Agents Market Report Insights and Growth Outlook to 2034 - S …

According to OG Analysis, a renowned market research firm, the Global Food Glazing Agents Market was valued at USD 5.7 Billion in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 6.8%, rising from USD 6.2 Billion in 2025 to an estimated USD 11.2 Billion by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/food-glazing-agents-market

Food Glazing Agents Market Overview

The food glazing agents market covers edible coatings applied to…

More Releases for Algo

Best Crypto To Explode : Algorand (ALGO) vs Pepeto

Algorand identifies itself as a scalable pure proof-of-stake blockchain with ALGO trading at $0.13 and market capitalization of $1B based on January 2026 CoinMarketCap data. Recently, the network declared to re-enter the U.S. market with a relocation of the headquarters to Delaware, which is an indication of fresh attention towards domestic institutional adoption in the use cases of payments and asset tokenization.

Technical analysts see the opportunity to rise to…

TrustStrategy Expands AI Capabilities to Strengthen Algo Crypto Trading Infrastr …

United States, 14th Oct 2025 - TrustStrategy, an AI-powered investment plan, has announced an infrastructure enhancement focused on improving its algo crypto performance and system precision. The update reflects the platform's continued focus on advancing automation, analytics, and scalability within the digital asset sector.

As trading volumes across global exchanges continue to grow, efficiency and data accuracy remain core challenges for institutional and individual participants. TrustStrategy's latest update integrates advanced AI…

Algo Trading Software Market Future Business Opportunities 2025-2032

The research report on the Algo Trading Software Market provides detailed statistics, trends, and analyses that clarify the current and future landscape of the industry. It identifies key growth drivers, constraints, trends, and opportunities, along with assessments of the competitive landscape and detailed company profiles. The report presents year-over-year growth rates along with the compound annual growth rate (CAGR), offering crucial insights for decision-makers through a detailed pricing analysis. Additionally,…

MasterQuant Introduces Next-Generation Automation in Algo Trading

The world is changing and so is the financial landscape as AI and automation reshape trading strategies. At the heart of this change, MasterQuant has released new updates to its trading technology to improve accuracy, flexibility, and speed in traditional and digital asset markets.

The latest system upgrade focuses on autotrade performance and algorithmic decision-making. By combining advanced analytics, deep learning, and real-time data modelling, MasterQuant wants to provide consistency across…

Momentum Algo Pro: Advancing Investment Strategies with Superior Client Engageme …

Momentum Algo Pro (MAP), a pioneer in algorithmic investing, is excited to unveil new client engagement initiatives that are set to redefine the investment experience. These initiatives reflect MAP's unwavering commitment to delivering exceptional service and personalized support to its esteemed clients.

Empowering Investors through Enhanced Interaction and Insight

Sal Habibi, the visionary lead advisor and investor at MAP, emphasizes the importance of a personalized investment journey. "We believe in fostering a…

At 10.1% CAGR Automated Algo Trading Market Expected to Reach $35 Billion by 203 …

According to the report published by Allied Market Research, the global automated algo trading market generated $13.5 billion in 2021, and is projected to reach $35 billion by 2031, growing at a CAGR of 10.1% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂

https://www.alliedmarketresearch.com/request-sample/A19438

The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities,…